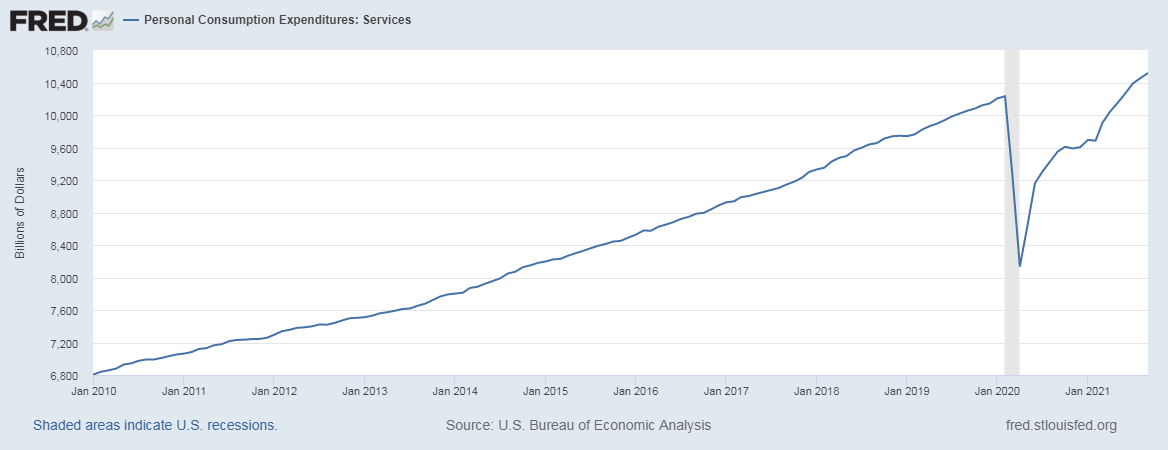

This is a topic for a more detailed report, but we question whether rising inflation, supply chain panics, and more drastic government action to try and tame labor shortages and price increases could bump into a step down in demand, exposing a significant inventory surplus – sitting between producers all over the world and consumers, mainly in the west. We are seeing travel restrictions lifted all over the world over the last couple of months as the vaccination program has brought COVID under more manageable control in many countries/regions and as leaders conclude that we just have to live with whatever residual there may be. Now, this could all change if COVID surges through the winter in the northern hemisphere, but if it does not, we could see that shift in consumer spending from goods to services that we were discussing a year ago. So far we have only seen a partial shift, and as the chart below shows we are not back to the pre-COVID trend yet. A swing would create different problems and likely not end the labor shortages based on recent experiences in restaurants that were not busy, but could not keep up, and based on some of the staff issues that the airlines are having because they are running too leanly to have the ability to pivot if weather throws them a curveball.

A Further Swing Towards Services Spending May Not Curb Wage Growth, But Could Hurt Materials Demand

Nov 2, 2021 3:53:11 PM / by Graham Copley posted in Chemicals, Inflation, Supply Chain, consumer spending, shortages, COVID, services, materials surplus, demand, inventory surplus, travel

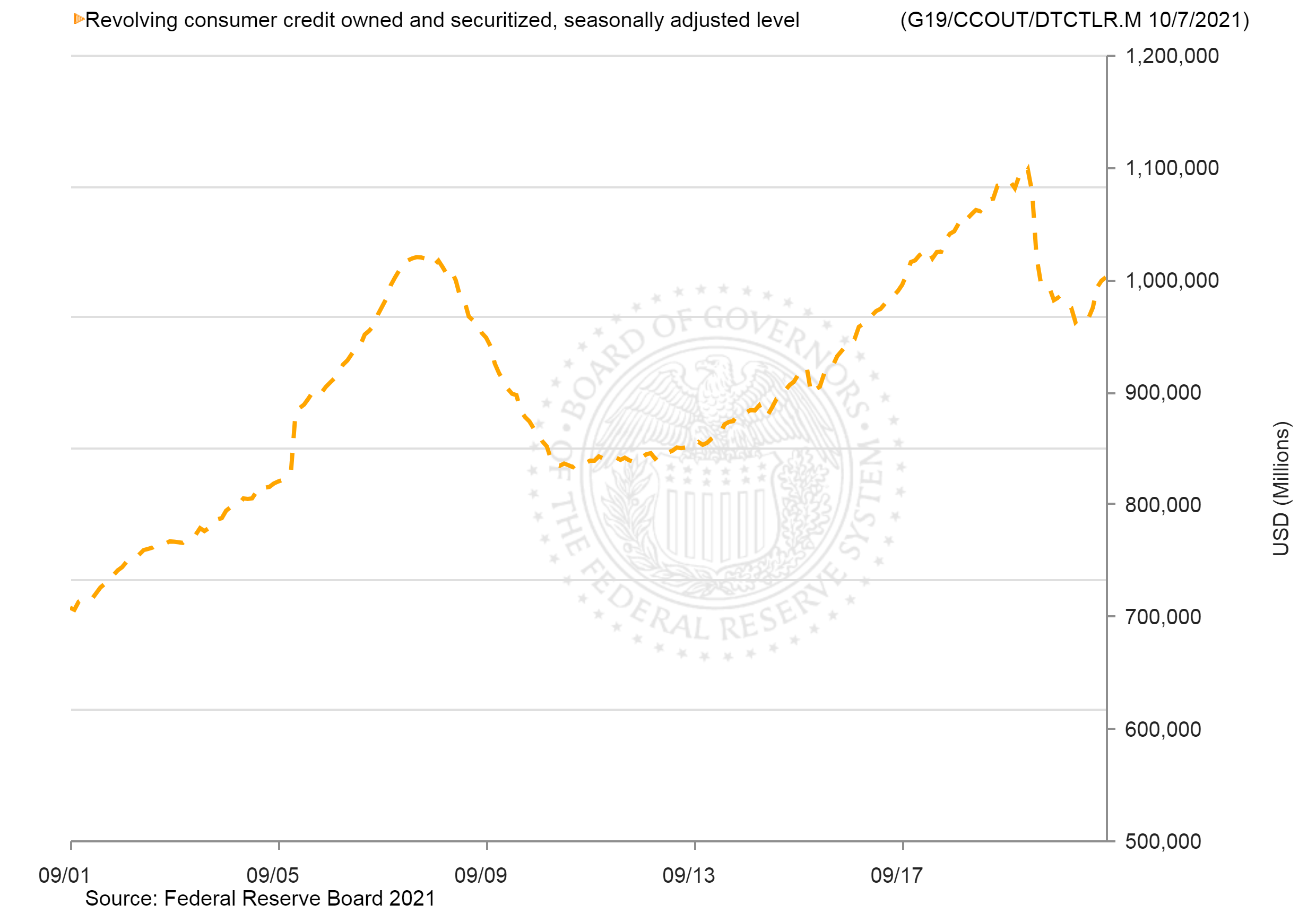

Will Panic Buying & Inflation Drive A US Credit Bubble Eventually?...

Oct 20, 2021 2:49:36 PM / by Graham Copley posted in Inflation, consumer spending, shortages, credit cards, COVID, US consumer, consumer credit, interest rates

We talk about inflation several times a week (and it features in many of the headlines in yesterday's daily report), but the effect that shortages, perceived or otherwise, are having on the US consumer, is significant, as buying remains high, fueled in part by rising consumer credit. COVID reduced consumer credit levels from a record high, just before COVID began, but it is climbing back again, and offers of low credit and new credit cards with new features appear every day. Inflation could have two effects – it could increase the cost of credit-based purchases, so increasing credit card debt, and it could eventually lead to a tightening of credit and higher rates, which might increase the credit default rate and exaggerate the negative economic impact of higher interest rates in general. In our attempts to combat the effects of COVID, overcome a constrained supply chain, and keep economies moving, we may be setting up a credit bubble (not this year and probably not in 2022) that comes back to bite us later.