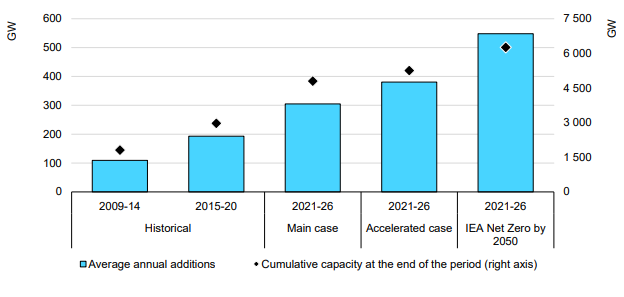

The core message of the IEA analysis published today is around how renewable power rates of investment remain far too low and need to more than double immediately to meet net-zero goals – see below. This analysis is very supportive of our renewable power inflation thesis, as none of the renewable power component manufacturers can double production either cheaply or quickly, and none of their suppliers has that much spare materials capacity. On the solar front, we may have the additional problem of regional production concentration. China has the largest share of capacity for solar module capacity and now has much more aggressive plans for solar power domestically. We could see China-based components stay in China, exaggerating shortages outside China. The IEA has an accompanying report today on the possible impact of commodity pricing on solar and wind pricing and it is also linked here – these reports were published this morning and we will cover them in more detail in next week's ESG and Climate report. More on this in today’s ESG and Climate report.

Are We Asking Too Much Of The Renewable Power Industry?

Dec 1, 2021 12:19:53 PM / by Graham Copley posted in ESG, Sustainability, Renewable Power, Emissions, Materials Inflation, Emission Goals, Inflation, Net-Zero, IEA, solar, wind, climate, renewable power inflation, commodity pricing