The linked Canada headline supports one of the themes that we have been highlighting for a while, which is that certainty around carbon pricing is likely to drive investment rather than discourage it. Canada, and specifically Alberta, has seen several new investments announced over the last few months because manufacturers can now add some certainty around carbon values to other advantages offered by the province, including cheap natural gas and what appears to be low-cost CCS opportunities. We are also seeing investments shape up in Europe – also to produce low carbon materials and fuels – and this is also driven by greater certainty around carbon value. The lack of a carbon price in the US is becoming a competitive disadvantage for the country and those opposing it in government are, in our view, very misguided. If China can develop a credible and broad carbon pricing mechanism, it will also likely gain investment dollars, possibly at the expense of the US. Not having a sound climate change and carbon value framework in the US is a major threat to many of the reshoring initiatives that US retailers and manufacturers would like to see.

No Carbon Price In The US: A Competitive Disadvantage!

Jan 26, 2022 2:11:28 PM / by Graham Copley posted in Climate Change, Methane, CCS, Energy, Carbon, Emissions, Carbon Price, carbon value, natural gas, carbon values, low carbon, methane leakage, carbon pricing, fuels, reshoring, oil and gas, pipeline emissions, low carbon materials

Carbon Offset Values Rising But Still A Long Way To Go

Jan 7, 2022 1:13:51 PM / by Graham Copley posted in Carbon, carbon offsets, carbon trading, carbon cost

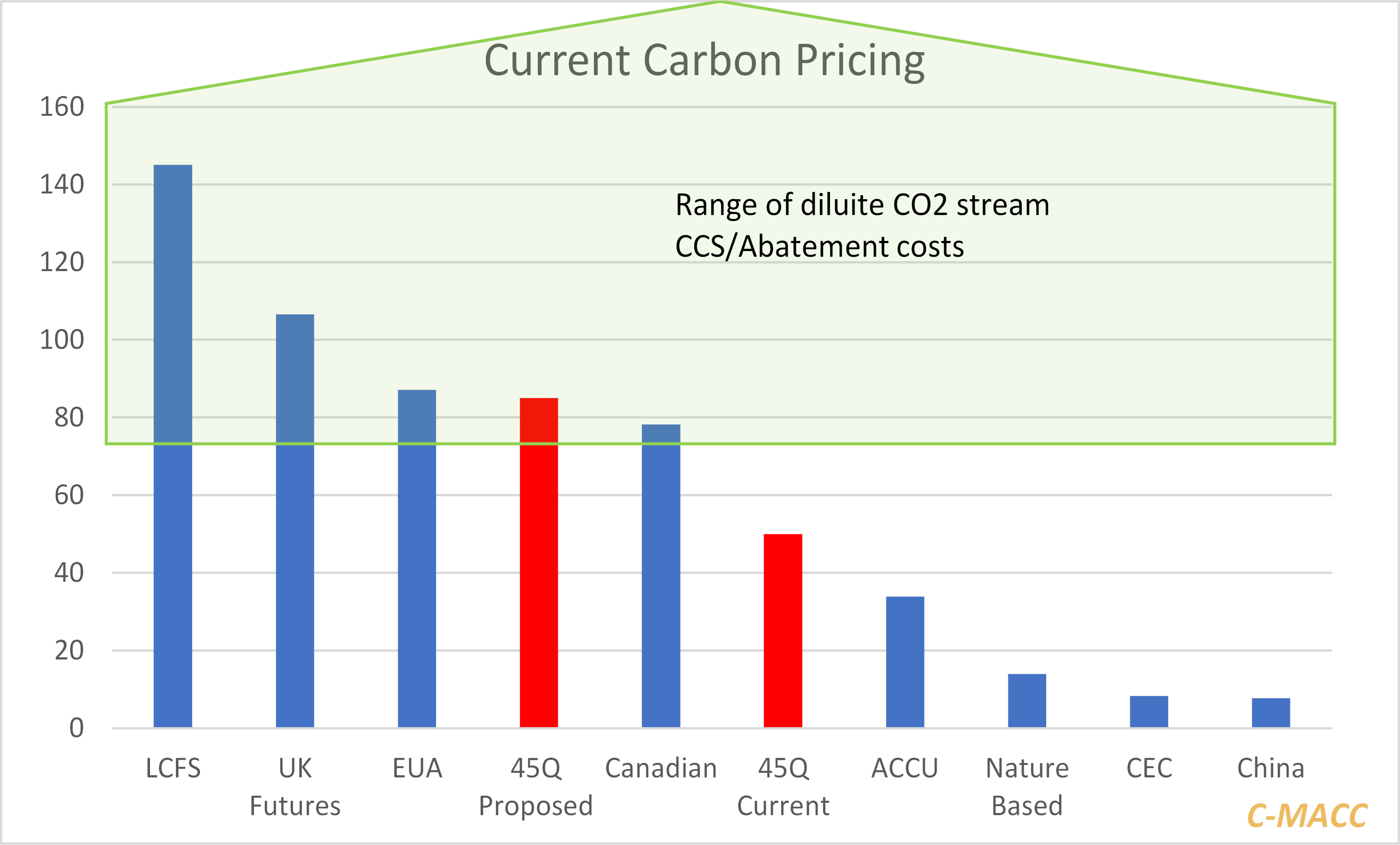

Despite the “soaring” carbon offset market in the FT article linked here, we would remind clients that this is something we have written about extensively and that while “nature-based” offset prices have jumped over the last year they remain very low compared to the physical cost of carbon abatement, whether through reforestation or physical abatement for CO2 emitting fuels and processes. The nature-based credits should at least rise to the physical cost of planting trees and maintaining forests (adjusting for the risk of fires etc). This is well above $50 per ton in our view and maybe as high as $100 per ton depending on how you define the costs. The very low price today, despite the recent rise, reflects an oversupply of credits perhaps, but it may also reflect buyers' unwillingness to pay more because of the uncertainties around accuracy and chain of custody of the credits. If the credit truly reflects the removal of 1 ton of CO2, at $14 per credit, someone is subsidizing the credit – maybe those planting the trees. The chart below shows carbon values at the end of December. See our ESG and Climate report No 57 for more.

Different Net Zero Target Dates Will Create Competitive Risks

Dec 9, 2021 2:07:56 PM / by Graham Copley posted in ESG, Sustainability, LNG, CCS, CO2, Carbon, Emissions, Carbon Price, Carbon Neutral, Net-Zero, China, climate, CO2 footprint, Climate Goals

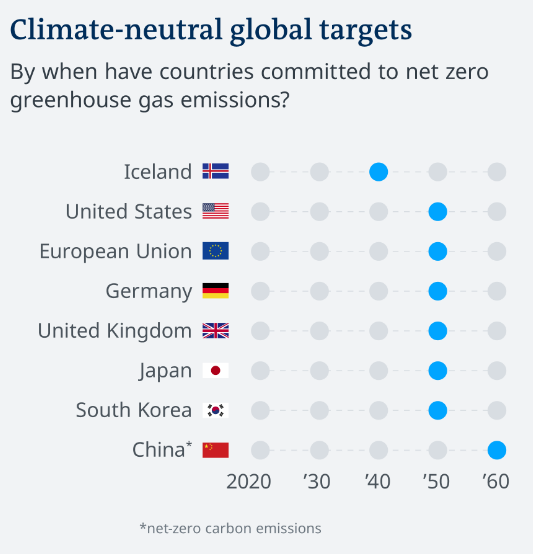

When China announced its 2060 net-zero goals we dedicated one of our ESG and Climate pieces to the topic - China: A Challenge With 2060 Goal But Also A Possible Edge - concluding that this would likely drive considerable competitive advantage for China assuming that others would bear the costs of new technology learning curves and China would get the solutions more cheaply. In interim China would have lower costs of manufacturing because of the delayed net-zero implementation. With the Biden administration now pushing for a coordinated 2050 commitment for the US, some of the burdens of early costs that China could benefit from also fall on the US. In one of the headlines (from today's report), there is criticism of the European CBAM and questions around whether it could work. The reality is that it, or something like it, has to work, otherwise asymmetric climate policies will create pockets of competitive advantage - potentially very damaging to those spending more.

Carbon Momentum Building

Dec 8, 2021 12:27:25 PM / by Graham Copley posted in ESG, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Carbon, IEA, climate, CCUS, carbon prices, solar capacity, wind capacity, hydrogen capacity

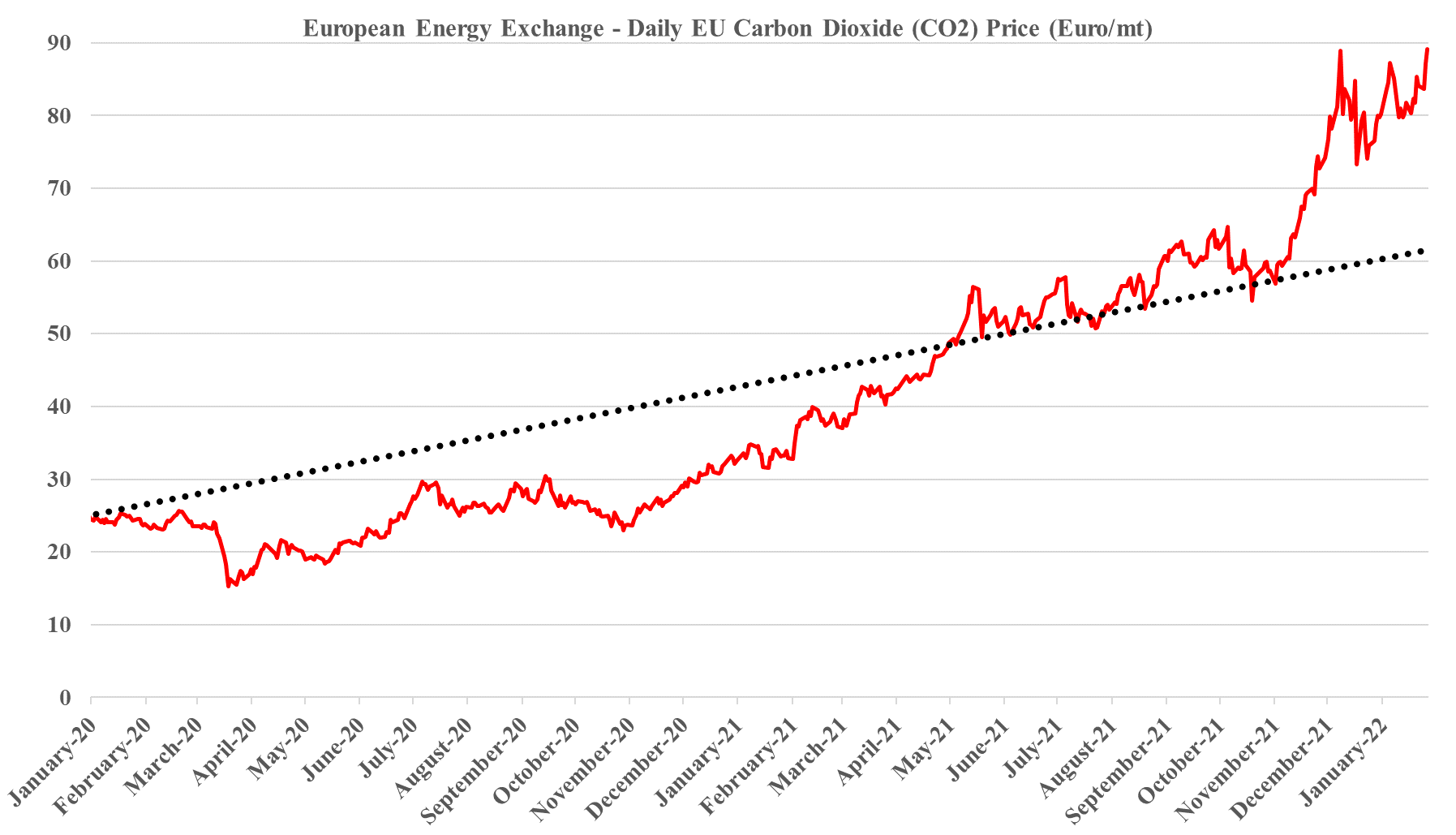

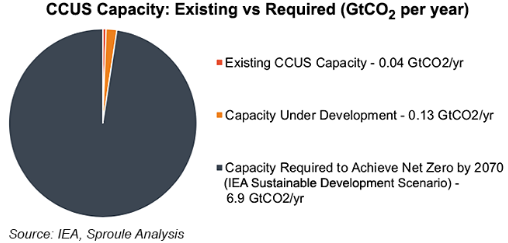

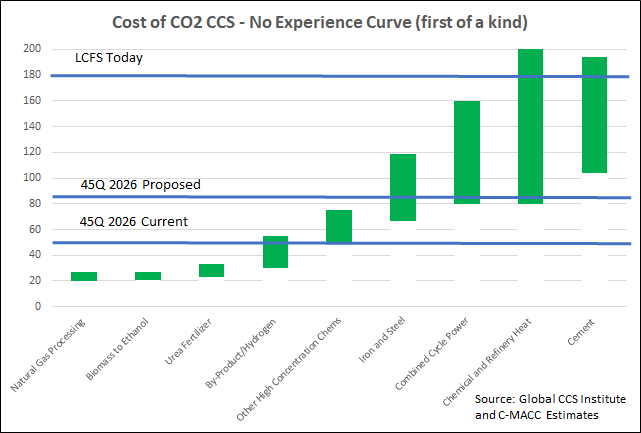

Most of the focus today is on carbon, in part because the CCS momentum is picking up, with more initiatives being announced daily all around the world, and partly because of the surge in European carbon prices as shown in Exhibit 1 from today's daily report. The IEA CCS projections in the Exhibit below, are likely low in our view, despite the significant investment needed to reach the target shown. In our ESG and climate report today we focus on many of the materials supply limitations that will likely emerge as the world tries to add wind and solar capacity at higher and higher rates. Our analysis of the IEA net-zero projections published earlier this year suggested that the IEA might be too ambitious on renewable power and that the balancing effect would likely be increased natural gas use versus its base case and more than forecast CCS. We have a long way to go to get there given the shortfall in the exhibit below, but at the same time, carbon prices are moving to make it happen. The European price has spiked again this week and is now slightly higher than $100 per ton of CO2, a level reached by the UK price late last week. At this level, we should see investments in Europe to abate carbon without additional local subsidies, or with minimal subsidies. The constraint in Europe will be finding inexpensive CCS locations. A $100 carbon price in the US would, in our opinion, drive a very significant investment in the US, not only in CCS capacity but also in new blue and green hydrogen capacity.

ExxonMobil: Going Heavy On CCS (The Right Move), But Pushing For Support

Nov 12, 2021 2:07:37 PM / by Graham Copley posted in Hydrogen, CCS, Carbon, Emissions, ExxonMobil, Emission Goals, carbon footprint, carbon abatement, biofuel, carbon offsets, carbon trading, greenwashing

ExxonMobil is seriously upping its lower-carbon game with the CCS announcements over the last few weeks and the release this week that states the company will spend $15 billion over the next 6 years on lower carbon initiatives. In this linked headline ExxonMobil states that it will meet its 2025 emission goals this year – we are assuming that this must be correct as the company would not want to risk the accusation of greenwashing. Either way, the critics will weigh in, either claiming “greenwashing” or suggesting that the targets were not high enough, to begin with. The ExxonMobil focus is very much on CCS, which makes sense for an oil and gas-centric company whose only real play right now is to lower the carbon footprint of its fuel portfolio. In the release linked above, ExxonMobil also talks about biofuel and hydrogen initiatives, but again calls for supportive policies from governments and we suspect that the underlying push here is towards the US government. ExxonMobil and others have indicated that $100 per ton is the right incentive to drive CCS and other carbon abatement strategies and we would agree with this estimate as it backs up much of the work that we have done over the last year. See - Carbon: Trading, Offsets, and CCS as a Service – It’s All Coming! and - Carbon Games – Appetite, But Not Enough Hunger Yet. The other reason why ExxonMobil and others would like to see the US act is because other jurisdictions in which they operate will likely take a lead from the US.

Gevo: Ticking All The Boxes To Be A Sustainable Fuel Provider

Oct 26, 2021 12:48:37 PM / by Graham Copley posted in ESG, Sustainability, CO2, Carbon, Gevo, Chevron, gasoline, sustainable aviation fuel, renewable fuels, Sustainable Fuel, Axens, ADM

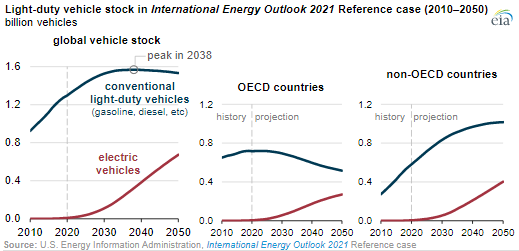

Gevo is racking up the agreements to produce sustainable fuels, announcing deals with Chevron, Axens, and now ADM since September. Our view on the need for sustainable aviation fuel is that everyone building will likely be capital constrained relative to the potential demand – this is also true for sustainable diesel and gasoline, which is relevant given that the EIA sees the conventional light vehicle stock peaking globally as late as 2038 (this is not inconsistent with other estimates we have seen) see chart below.

The COP26 Challenges Go Beyond Net-Zero

Oct 20, 2021 2:02:43 PM / by Graham Copley posted in ESG, Sustainability, CO2, Carbon, Emissions, Net-Zero, IEA, carbon value, COP26, Climate Goals, Paris Agreement

The Financial Times opinion piece linked in the bullet below and from which the chart is taken has used the IEA data that we have featured in recent work. The piece comprehensively walks through how the world is likely to come up short, and while it gives the measures that are needed and the money that likely needs to be spent, it is not an optimistic review of what will most likely occur. We remain firmly of the belief that much more progress could be made if there was a global agreement to make carbon very expensive – accompanied by an agreement on how to share the spoils of that expensive carbon such that the inflationary pressures are offset where they are most needed and that environmental injustices are minimized – this is idealistic are we recognize that.

Chevron Joins The Club, But The Focus On Cleaning Up Its Fossil Fuel Footprint Could Be Important

Oct 12, 2021 2:05:37 PM / by Graham Copley posted in ESG, Carbon Capture, Biofuels, Climate Change, Sustainability, LNG, Methane, CCS, Renewable Power, Carbon, Net-Zero, fossil fuel, carbon abatement, natural gas, carbon trading, offsets, EIA, Chevron, methane emissions, CO2 footprint, COP26, low carbon, methane leakage, carbon credits

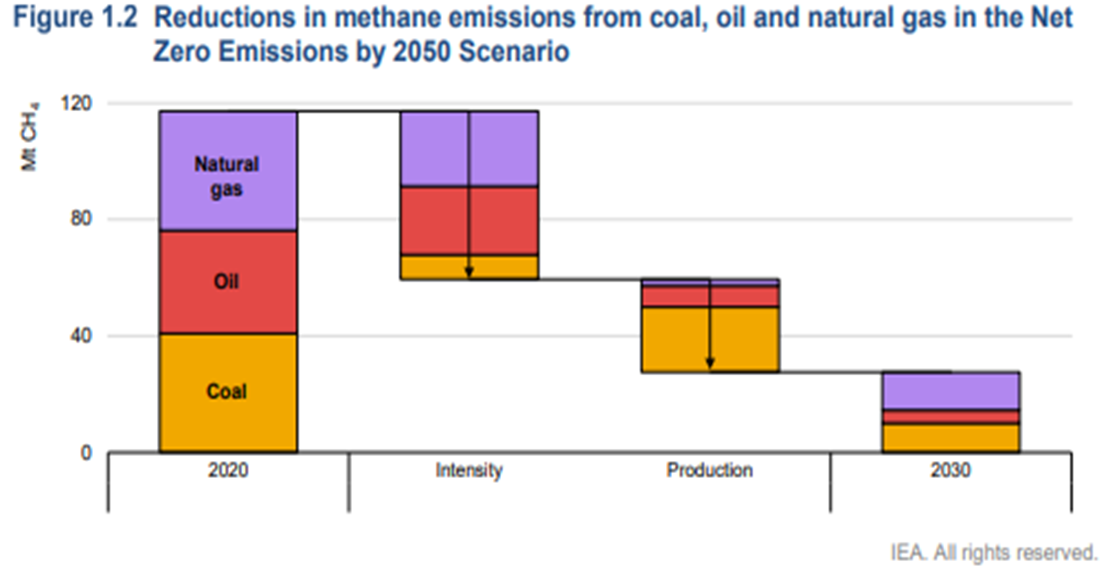

A couple of things worth highlighting in today's daily report – the first being Chevron’s move to join the net-zero club – focusing all eyes now on ExxonMobil in particular but also the rest of the US E&P crowd. Chevron will have some major challenges getting to net-zero and will likely face much of the same skepticism that bp, Shell, and TotalEnergies attracted in Europe initially and still face today. The Europeans have placed a lot of their bets on moving into renewable power – for the moment, Chevron is focused on moving to net zero in its own operations, which we read as biofuels and a lot of CCS. Given the acute shortage of international natural gas, it would make the most sense for the independent natural gas E&P companies and the LNG sellers to jump on the same boat. By promising low carbon natural gas and LNG, the industry is much more likely to gain support for the expansion that the world needs to counter some of the EIA assumptions around coal and petroleum product use from 2030 to 2050. Of course, it would be a whole lot easier for the US industry to do this if they had a value on carbon to work with! The chart below looks at one of the core clean-up issues, which is methane leakage. This is a subject we cover extensively in our ESG and Climate service linked here.

Existing Carbon Black Producers Should Look For Ways to Decarbonize

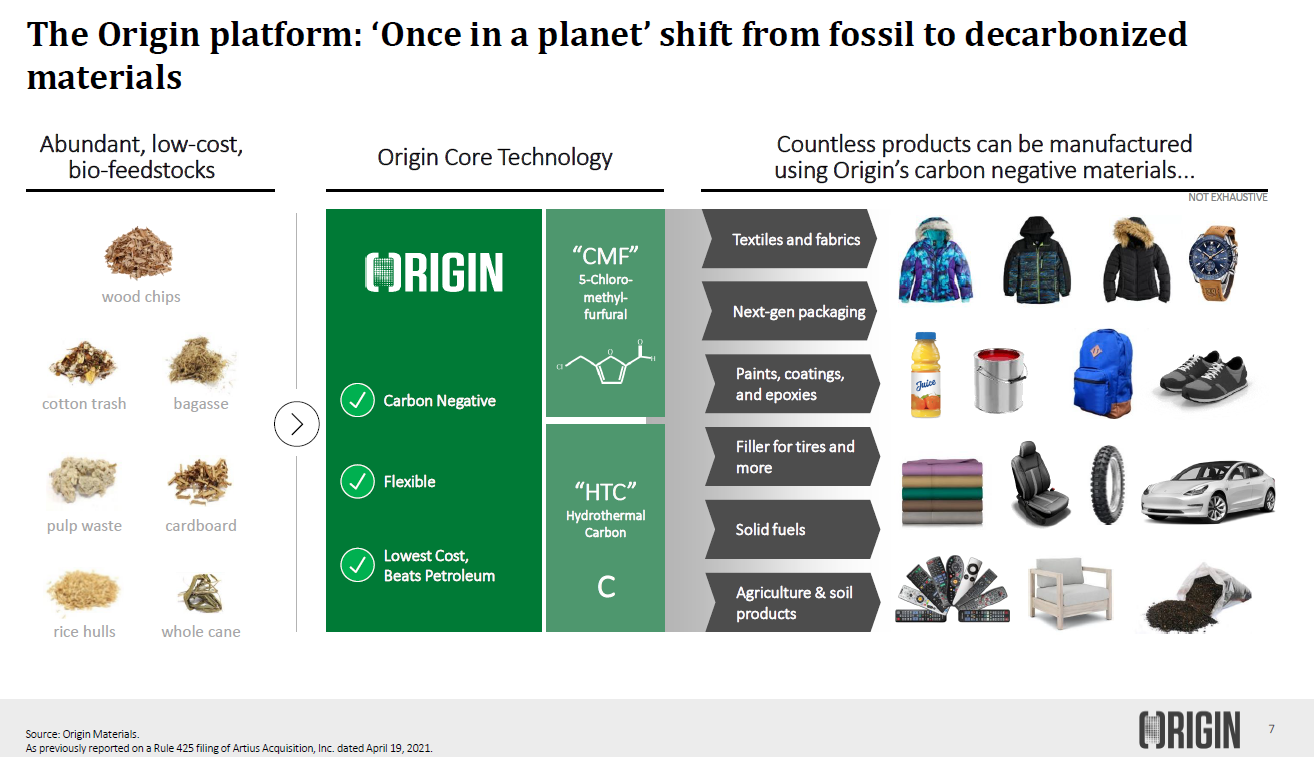

Oct 6, 2021 2:27:54 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CCS, CO2, Carbon Black, Carbon, Emissions, PET, decarbonization, Origin Materials

We think that Orion Engineered Polymers and its fellow traditional carbon black producers could be in for a rough ride.

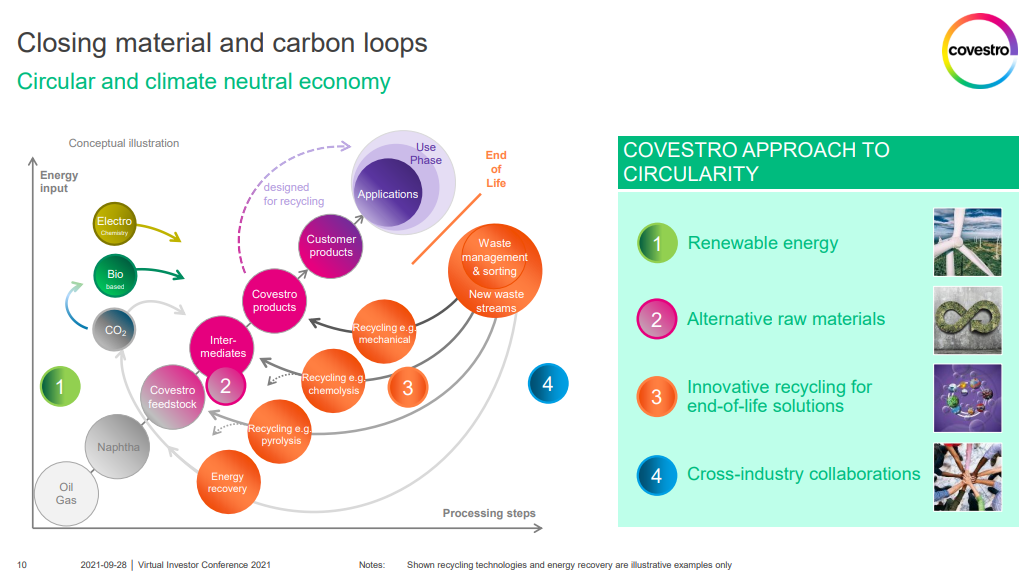

Pretty Charts Hide Very Complex ESG Problems

Sep 28, 2021 12:43:15 PM / by Graham Copley posted in ESG, Recycling, Climate Change, Sustainability, Carbon, Emissions, Mechanical Recycling, recycled polymer, Gevo, feedstock, chemical recycling, polymer, biodegradable plastics, Origin, polymer demand, Covestro

Companies are being encouraged/forced to produce climate plans by ever more focused shareholders many of whom only have a passing understanding of how some of the companies operate and how they might best set a course to lower emissions and otherwise be better stewards of the environment. The pretty graphic by Covestro below likely looks much better than the data and ambition behind it really are. This is not necessarily meant as a criticism of Covestro, but the company like many others is being challenged to explain a very complex, process, and engineering-heavy set of options to an audience not really qualified to understand them – pictures with circles are easier.