A major initiative by C-MACC in collaboration with the Power Research Group

Carbon Abatement – A Multi-client Analysis

Jul 7, 2021 1:01:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax, Carbon Fuels, CCS, CO2, Renewable Power, Carbon, Carbon Neutral, Emission Goals, Net-Zero, decarbonization, carbon footprint, ESG Fund, carbon dioxide, carbon credit, carbon value, carbon abatement, power, carbon cost, carbon offset, offsets, ESG investment, carbon emissions, clean energy, climate

Expected ESG Regulation Likely Good For Pure-Play Energy Transition Stocks

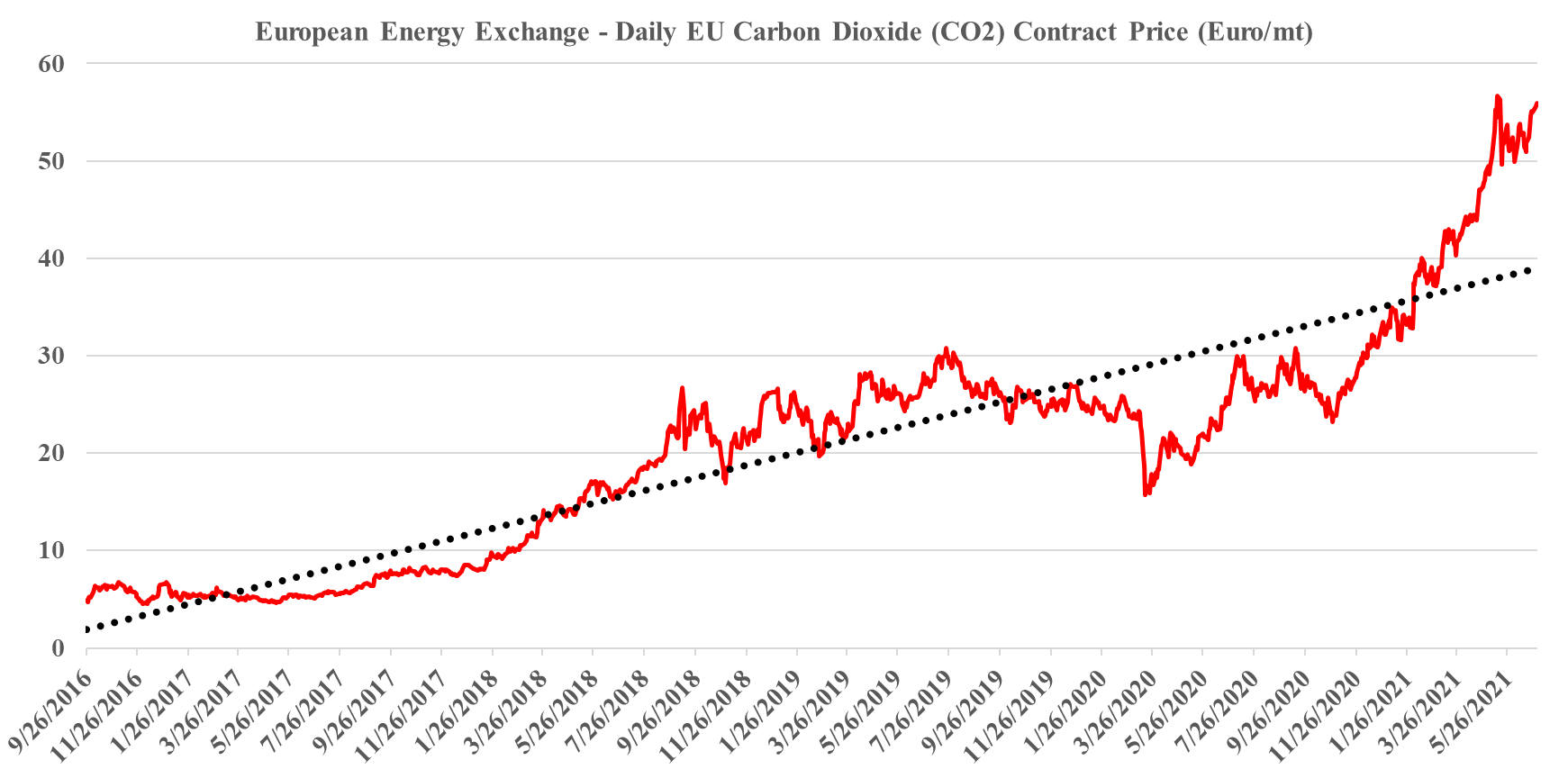

Jun 30, 2021 4:05:20 PM / by Graham Copley posted in ESG, Biofuels, Plastic Waste, CCS, Carbon, Dow, ESG Fund, solar, ESG investment, wind, European Carbon price, carbon emissions

The ESG investment shakeup could be one of the major events of this year, and as many of the headlines in our daily report suggest, there is a lot of work to be done, whether it is agreeing on a common set of measurement metrics – note the US and European differences discussed in one story – or the introduction of more empirical methods to judge whether what is labeled as an ESG investment fund is labeled correctly. There is also the issue of comparable disclosures, especially for companies in complex industries. It is interesting to note that in many analyses we see around carbon footprint or greenhouse gas emissions, and the potential routes to and cost of abatement, the chemical industry is omitted, except for ethanol and hydrogen. This is despite the industry accounting for 15% of the non-power emissions in the US industrial sector (similar in size to refineries). We believe that this is because the complexity of the industry makes it hard to model, and analysts choose to exclude it because they are not sure what they are doing.

Will ExxonMobil Activists Change Anything?

May 26, 2021 1:24:39 PM / by Graham Copley posted in ESG, Carbon Capture, Energy, ESG Investing, ExxonMobil, carbon footprint, ESG Fund, bp

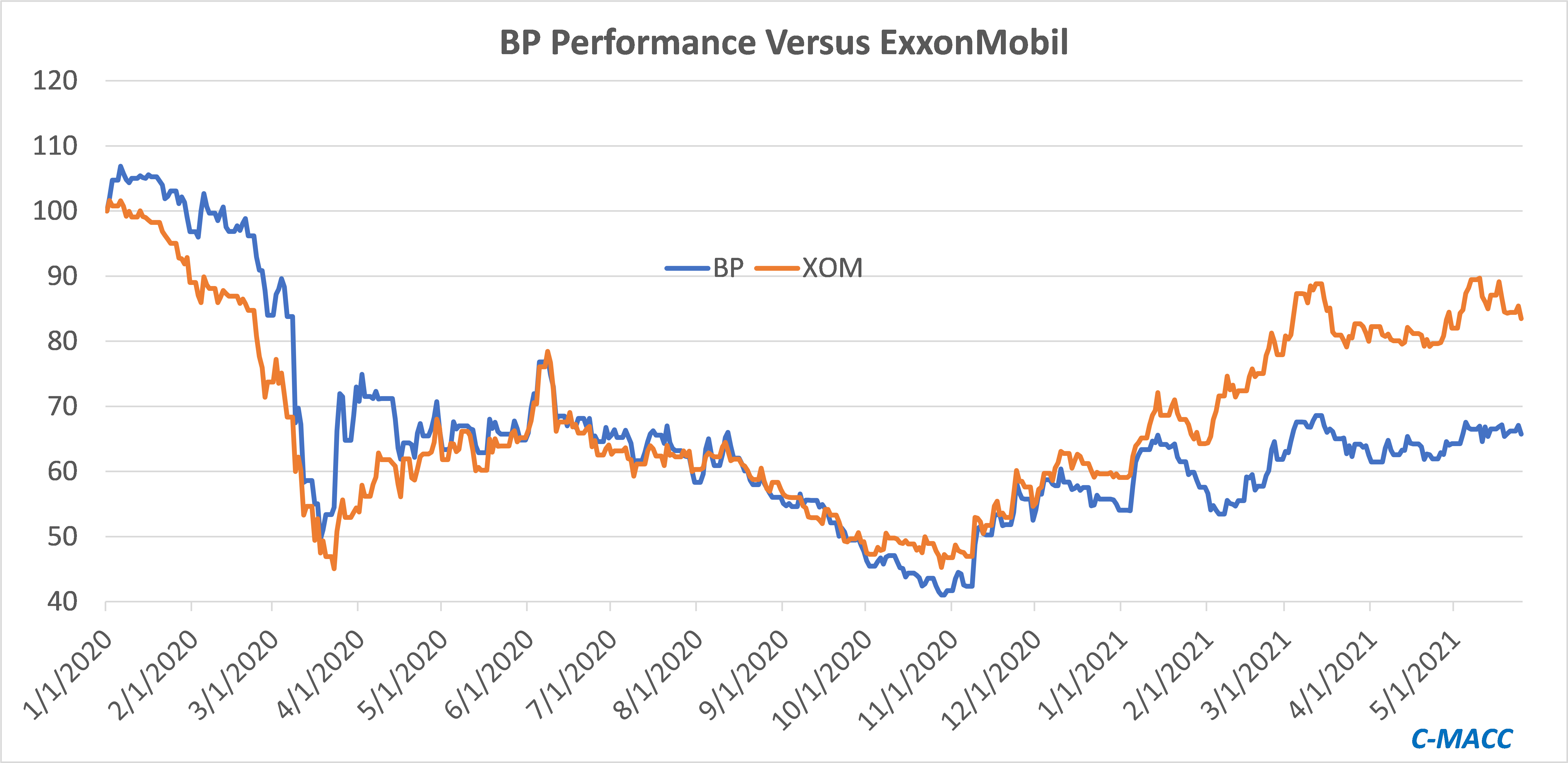

With little chemical corporate news of note, we will focus on ExxonMobil today. The shareholder activism may be high but it is unclear to us what the activists hope to achieve, even if they are successful at the annual meeting. The ESG investment group has largely given up on energy and even if ExxonMobil changes strategy and agrees to spend more on carbon abatement it is unlikely that new investors will show up, especially if the new strategy is more costly. Despite all of its directional change and rhetoric, bp has underperformed ExxonMobil since Mr. Looney took the helm in early 2020. If ExxonMobil were to follow the bp playbook, it is not clear that shareholders would benefit.