While we would generally avoid quoting work from a company that we might consider a peripheral competitor, we are happy to do so when it backs up one of our central themes – in this case, inflation in renewable power costs. The quote is taken from the Wood Mackenzie report flagged article linked here and discusses a view on how challenges that renewable power installers have faced in 2021 will extend into 2022. The quote talks about shortages of renewable power equipment, and the obvious consequence will be higher prices for that equipment, especially as raw material prices for components remain high and possibly move higher. In our ESG and Climate report today, we talk about the need for some commonsense oversight such that impractical ESG investing targets do not limit the ability of producers of critical fuels and materials to operate.

Renewable Power Bottlenecks = More Fossil Fuels

Dec 22, 2021 1:44:32 PM / by Graham Copley posted in ESG, Sustainability, LNG, Coal, Renewable Power, ESG Investing, raw materials inflation, solar, renewable energy, wind, climate, shortages, fuels, renewable power inflation, oil production, Permian basin, coal demand, electricity, LNG supply

European Natural Gas: The Price Of Impractical Energy Transition Policy

Dec 21, 2021 2:13:22 PM / by Graham Copley posted in ESG, Sustainability, LNG, PVC, Coal, Methanol, ESG Investing, Inflation, Ammonia, natural gas, natural gas prices, energy transition, climate, renewable power investments, Climate Goals, shortages, fossil fuels, Europe, low carbon LNG

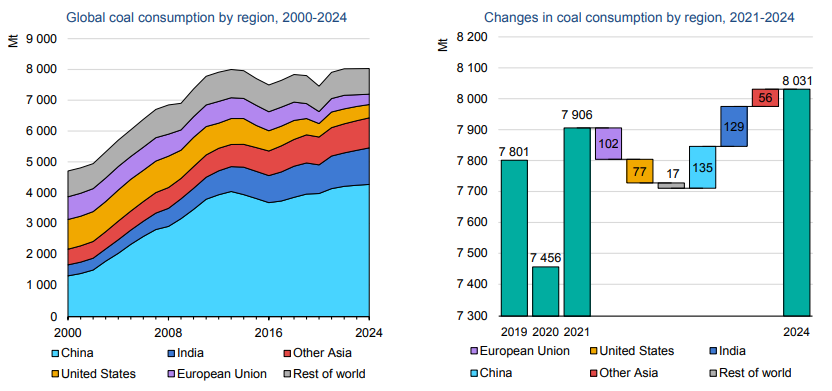

International natural gas prices are hitting new highs this week, both on an absolute basis and relative to the US - see both charts below. At the same time, we see new contracts being signed for US LNG to move to China and Europe, but mainly China. This is happening despite significant renewable power investments globally in 2021 and it would appear that many have underestimated energy demand growth in projections and policy. The other net effect of the supply/demand imbalance this winter and possibly through 2022 will be increased coal use in Europe and the US, with local governments unable to meet near-term climate goals, especially in Europe, but also in parts of Asia and, at the same time keep the people warm and the lights on. In our ESG and Climate piece tomorrow we will focus on one highly unpopular but likely very practical opportunity for coal as part of a planned energy transition program, and it is likely that, while climate goals may not need to change, some socially unpopular decisions around the use of fossil fuels will be needed to prevent even more socially unpopular inflation or absolute shortages.