A couple of things worth noting today that reflects our commodity index in today's daily report but also looks at some of the results below. The linked solar headline is confirmation of one of the topics that we have probably worn out over the last few months, which is that renewable power ambitions have not taken into account real limitations in the rate of equipment supply, especially solar modules. New forecasts suggest that the US expected installations of solar capacity could come in 25% short in 2022, which has implications for energy transition ambition, but also overall power supply as the shortfall will have to be made up elsewhere. It is not just a function of solar module availability but also solar module costs, because of some of the material cost inflation illustrated in exhibit 1 (see today's daily report). These shortfalls will have implications for natural gas demand in the US if it needs to fill the gap, and we have already noted that we think US natural gas prices could spike in 2022, much higher than we saw in 2021.

As Solar Installations Disappoint, Natural Gas Demand Rises

Jan 25, 2022 1:39:27 PM / by Graham Copley posted in Commodities, Renewable Power, Materials Inflation, natural gas, solar, clean energy, energy transition, commodity prices, US natural gas, supply shortages, solar capacity, natural gas demand, solar installations, commodity index, solar modules, power supply, material cost inflation, US natural gas prices, minerals

Renewable Projects: The Constraints Of Material Shortages

Jan 20, 2022 11:58:06 AM / by Graham Copley posted in ESG, Sustainability, Renewable Power, solar, renewable energy, climate, EIA, US natural gas, materials, energy inflation, material shortages, solar capacity, US natural gas demand, renewable capacity

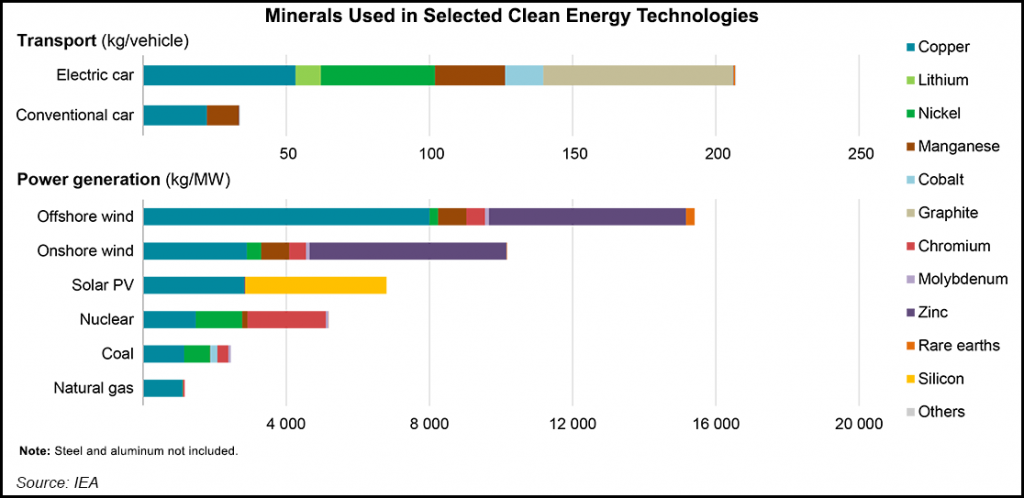

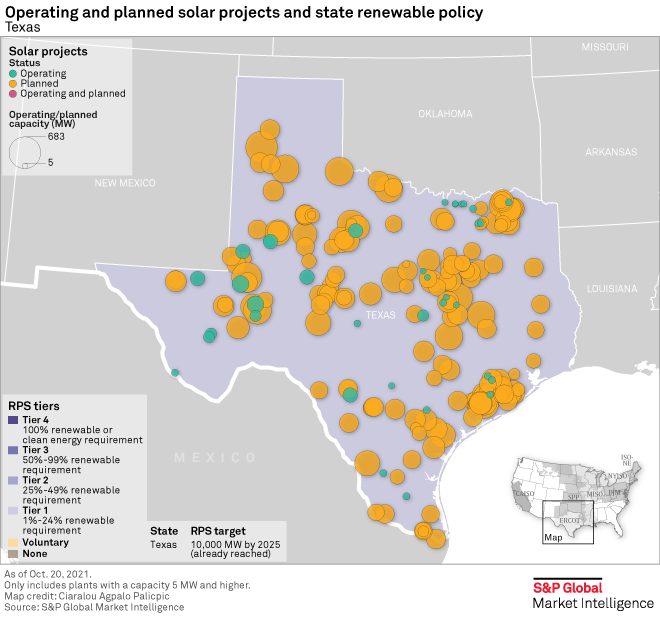

We struggle with both of the charts below, as we see the rate of potential renewable additions as far too optimistic, not because of a lack of capital, but because of a lack of materials and the knock on effect that this could have on capital if project costs increase meaningfully or if timelines extend. The solar expansions planned for Texas for example all require solar modules and there is simply not enough capacity to make these modules and in many cases not enough raw materials. All of these projects are not planned for the same year, but regardless, when you add the Texas plans to plans all over the World, you have an annual rate of addition that the equipment makers will not be able to meet. Today, many of the projects are in the planning and financing stage and the installers have yet to go looking for equipment – when they do, they may have to rethink.

Carbon Momentum Building

Dec 8, 2021 12:27:25 PM / by Graham Copley posted in ESG, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Carbon, IEA, climate, CCUS, carbon prices, solar capacity, wind capacity, hydrogen capacity

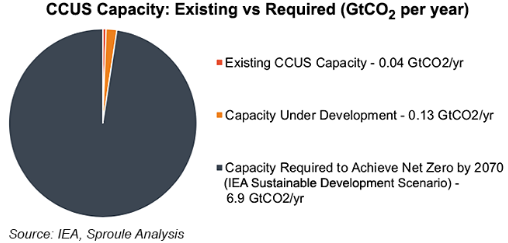

Most of the focus today is on carbon, in part because the CCS momentum is picking up, with more initiatives being announced daily all around the world, and partly because of the surge in European carbon prices as shown in Exhibit 1 from today's daily report. The IEA CCS projections in the Exhibit below, are likely low in our view, despite the significant investment needed to reach the target shown. In our ESG and climate report today we focus on many of the materials supply limitations that will likely emerge as the world tries to add wind and solar capacity at higher and higher rates. Our analysis of the IEA net-zero projections published earlier this year suggested that the IEA might be too ambitious on renewable power and that the balancing effect would likely be increased natural gas use versus its base case and more than forecast CCS. We have a long way to go to get there given the shortfall in the exhibit below, but at the same time, carbon prices are moving to make it happen. The European price has spiked again this week and is now slightly higher than $100 per ton of CO2, a level reached by the UK price late last week. At this level, we should see investments in Europe to abate carbon without additional local subsidies, or with minimal subsidies. The constraint in Europe will be finding inexpensive CCS locations. A $100 carbon price in the US would, in our opinion, drive a very significant investment in the US, not only in CCS capacity but also in new blue and green hydrogen capacity.