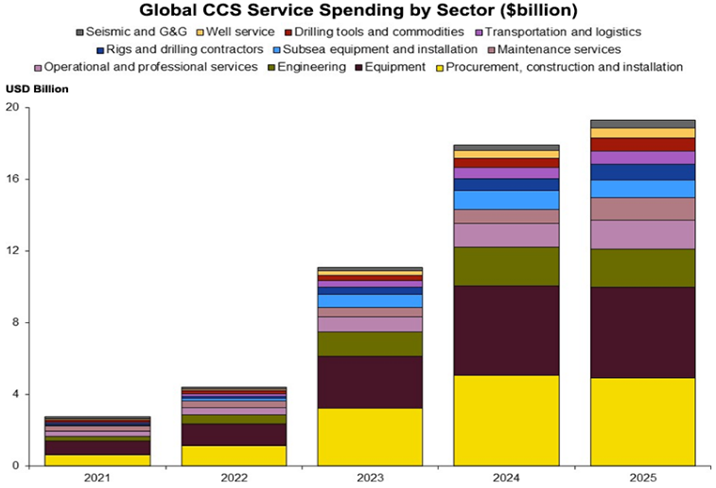

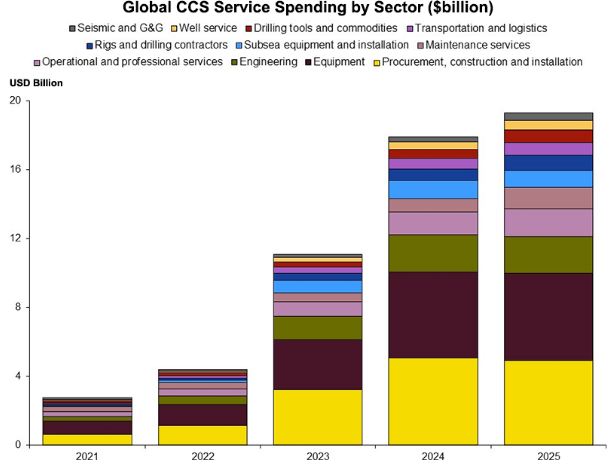

The CCS spending chart below is quite detailed, but shows the limited amount of spending in 2021 and 2022 and may underestimate the amount of seismic spending needed, especially in the US, as companies prepare permit applications. We do not expect to see much spending in the US before mid-decade beyond permit applications. However, as we discuss in today’s ESG and Climate report, should the API proposed carbon tax, or something similar, be additive to the 45Q tax credit, we could see a step-change in CCS when/if the tax is approved. The tax on its own is likely not enough to drive decarbonizing investment, but when added to 45Q it could be a specific trigger for CCS investment, and we could see a step-change in the second half of the decade. This might involve large-scale blue hydrogen production, especially on the Gulf Coast to decarbonize the refining and chemical industries.

A Boost For Carbon Capture: More Constrains For Renewable Power

Apr 27, 2022 12:25:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, Carbon Tax, CCS, Blue Hydrogen, Renewable Power, Chemical Industry, decarbonization, Aemetis, renewable energy, clean energy, SAF, 45Q tax credit, Fulcrum Bioenergy

Energy Transition Moving Forward; Commodity Availability To Support It In Question

Apr 12, 2022 12:06:03 PM / by Graham Copley posted in LNG, Renewable Power, Raw Materials, Supply Chain, hydrocarbons, Dow, Oil, natural gas, clean energy, Enterprise Products, materials, fossil fuels, material cost inflation, minerals, renewable targets

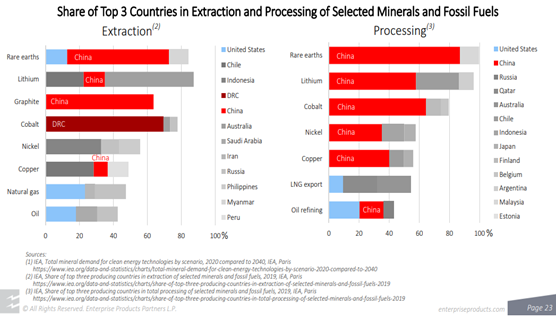

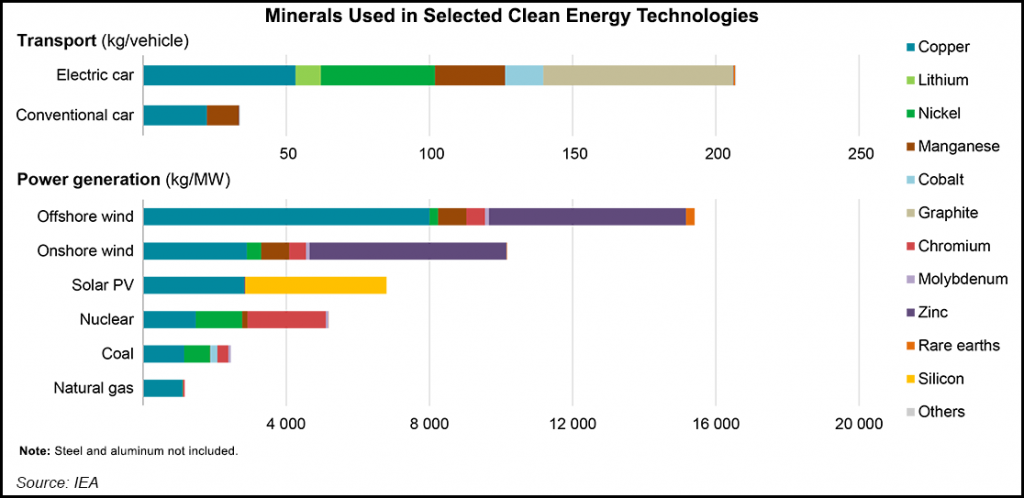

While longer-term use of oil and gas products is in Enterprise Products' best interest, it is nice to see someone else pushing the point that we have been making for more than a year – that there is not enough material out there, in the right locations, to meet the suggested clean energy goals. It is important that this becomes better understood and accepted by a broader group than just Enterprise and C-MACC, as we will not get the needed tack in strategy, priorities, and incentives if there is a broad reliance on renewable targets that will not be met – we focus on the IPCC report in tomorrow’s ESG and Climate report.

CCS Wont Work Without Policy And Neither Will Energy Conservation

Mar 22, 2022 12:48:43 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Energy, Emissions, IEA, Oil, natural gas, clean energy, renewable, fossil fuels, renewable capacity, EPA

One of the subjects that we will cover at length in the ESG and Climate report tomorrow (to be found here) is the significant need for CCS globally, but especially in the US, as we see more balanced forecasts of energy supply emerging which show more use of fossil fuels for longer – especially, but not limited to natural gas. These forecasts recognize the current energy momentum as well as some of the more practical realities around the rate of construction of renewable capacity relative to energy demand growth. The CCS plans that are appearing all over the place are nothing more than plans right now and if the EPA permit activity is a true barometer – not much has moved beyond planning. This needs to change and we likely need both an increase in CCS incentives – which could take many forms – as well as some streamlining around the permitting process. Simply waiting and hoping for a renewable miracle is not going to work – nor is some sort of CCS cost breakthrough.

Why A Hydrogen Credit Could Be Harmful & All Change At LyondellBasell

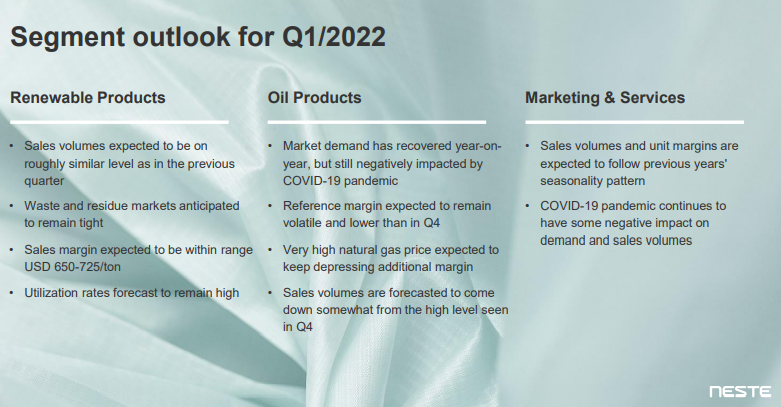

Feb 10, 2022 12:36:00 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Green Hydrogen, Blue Hydrogen, Energy, Emissions, LyondellBasell, decarbonization, renewable energy, tax credit, clean energy, renewable diesel, Neste, fuels, polymer recycling, energy companies

We view the hydrogen tax credit discussed in today's daily report as potentially very harmful, as it could give life to projects that will further increase demand on a renewable energy industry that has finite limits to its rate of growth. The credit could encourage inherently uneconomic projects – even with a longer-term “abundant power” view. If the incentives are used to back clean rather than green projects it would make more sense as blue hydrogen could be produced in very large quantities without breaking the bank and would allow constrained renewable power investments to focus on other harder to decarbonize power needs. If the hydrogen subsidy could be added to the 45Q sequestration credit we would likely see a wave of blue hydrogen investments in the US – primarily aimed at decarbonizing industrial applications and refining.

As Solar Installations Disappoint, Natural Gas Demand Rises

Jan 25, 2022 1:39:27 PM / by Graham Copley posted in Commodities, Renewable Power, Materials Inflation, natural gas, solar, clean energy, energy transition, commodity prices, US natural gas, supply shortages, solar capacity, natural gas demand, solar installations, commodity index, solar modules, power supply, material cost inflation, US natural gas prices, minerals

A couple of things worth noting today that reflects our commodity index in today's daily report but also looks at some of the results below. The linked solar headline is confirmation of one of the topics that we have probably worn out over the last few months, which is that renewable power ambitions have not taken into account real limitations in the rate of equipment supply, especially solar modules. New forecasts suggest that the US expected installations of solar capacity could come in 25% short in 2022, which has implications for energy transition ambition, but also overall power supply as the shortfall will have to be made up elsewhere. It is not just a function of solar module availability but also solar module costs, because of some of the material cost inflation illustrated in exhibit 1 (see today's daily report). These shortfalls will have implications for natural gas demand in the US if it needs to fill the gap, and we have already noted that we think US natural gas prices could spike in 2022, much higher than we saw in 2021.

Net-Zero Pledges Remain Well Below What Is Needed: 2030 Particularly Worrying

Oct 13, 2021 12:27:36 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Energy, Net-Zero, fossil fuel, IEA, clean energy, COP26, Climate Goals, energy technologies

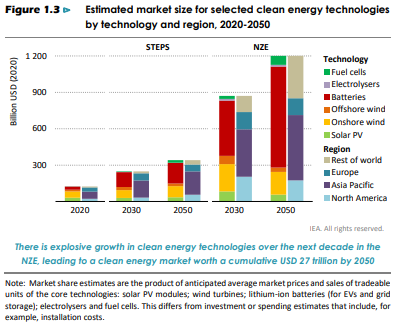

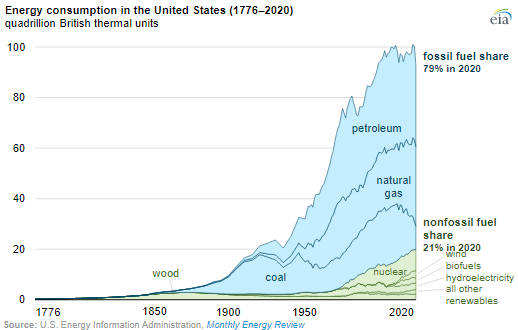

The IEA chart in the exhibit below is another stark reminder of how far away stated policies for clean energy are from what will be needed, and the 2030 gap is the most significant in our view as there is little time to correct it. The IEA has presented several studies over the last year that presents a series of “straw men” examples around how the World and, most recently China, might meet their respective net-zero targets, and the chart below is intended to show how far adrift we are, comparing what is needed to what has been stated. As we have mentioned a couple of times, it would be unusual for companies and countries to have firm plans for 2050 that sum to what the IEA is looking for as there are new technologies under development and the incentive/penalty landscape is still uncoordinated and very unclear. The latter is also a problem looking forward to 2030, but closing the gap between the STEPs scenario and the NZE scenario by 2030 looks almost insurmountable today, without a much tougher and more globally coordinated regulatory landscape, which looks unlikely given some of the low expectations for COP26 specifically. Note that how under the Net-Zero scenario discussed by the IEA, fossil fuel would peak by 2025 and compare this with the EIA analysis that we discuss in today's daily report – there is a huge disconnect.

If We Want Green Hydrogen, We Better Start Now

Sep 30, 2021 2:20:51 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Green Hydrogen, power, solar, batteries, wind, clean energy, battery storage, green investments

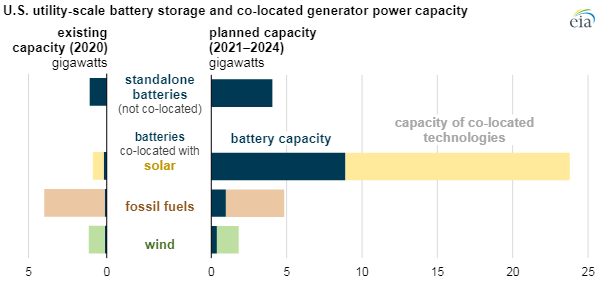

The battery storage investment chart below is interesting in that it shows significant pairing with Solar facilities and less with wind. If we are to meet the green hydrogen goals that many are optimistically predicting over the next 10 years, then the new wind and solar investments need to be paired with hydrogen and hydrogen-based swing power generation capacity. This is the only way that countries will develop effective hydrogen grids. Simply having one or two large hydrogen facilities and/or import facilities will result in very inefficient distribution models either for fuel cell vehicles or for heating and swing power generation. A distributed network for hydrogen makes much more sense and modular electrolyzers coupled with modular hydrogen power generators is a more holistic model, with much more flexibility than adding batteries. Granted, the battery technology is tested and available today, but the broader ambitions for hydrogen will not be met if we do not get out of the blocks soon.

A Climate Plan For China: Ambitious But Late

Sep 29, 2021 2:06:29 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Emissions, Net-Zero, power, clean energy, climate, chemical prices

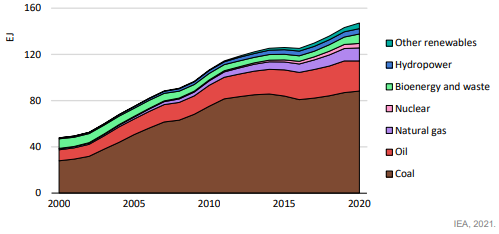

Overnight there has been a very good IEA report on how China could get to net-zero by 2060, and further news of more industries hit by power cuts because of power shortages, some of which are apparently due to tighter emissions standards. These are both important and far-reaching topics and will require some analysis to provide the kind of insight that we believe is necessary, and accordingly, we will push these to next week’s report (all input welcome). In the meantime, we have included a couple of charts that show the way up and the IEA view of the way down. The power outages are interesting as while they may cause some manufacturing cutbacks and we have seen recent news to that effect, China has overbuilt in the last couple of years relative to domestic demand growth, and with port and shipping congestion the country has surpluses of many products sitting around at very low values. The power moves may help correct some of these imbalances and we are already seeing some chemical prices bounce off recent lows because of production cutbacks. We discussed the acetic acid chain in one of our dailies last week – linked here.

Carbon Abatement – A Multi-client Analysis

Jul 7, 2021 1:01:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax, Carbon Fuels, CCS, CO2, Renewable Power, Carbon, Carbon Neutral, Emission Goals, Net-Zero, decarbonization, carbon footprint, ESG Fund, carbon dioxide, carbon credit, carbon value, carbon abatement, power, carbon cost, carbon offset, offsets, ESG investment, carbon emissions, clean energy, climate

A major initiative by C-MACC in collaboration with the Power Research Group

Unrealistic US Green Power Targets May Cause More Harm Than Good

Jul 1, 2021 2:16:28 PM / by Graham Copley posted in Hydrogen, Climate Change, Coal, CCS, raw materials inflation, fossil fuel, natural gas, renewables, batteries, US Green Power, power storage, clean energy, petroleum

One of the themes that we have focused on in our ESG and Climate work is the lack of realism in the Biden climate plan as it relates to power generation and the same with the plan in California. The more limited reliability factor in renewable power (because of its dependence on cooperation from the weather), means that you have to build a lot more new power capacity than you are replacing and you need to build a storage system for the power – batteries, hydrogen or hydraulic. This gets very expensive and will be more so if the push drives inflation in raw materials – which is already a factor YTD in 2021. Natural gas turbines are a cleaner and reliable source of power and cleaner still if combined with CCS. Politicians in the US are taking a considerable risk by promoting plans that could leave the power grid more vulnerable to some of the issues that we have already seen over the last 12 months (California and Texas). Of course, as the plans call for natural gas phase-outs in 10-12 years, none of those making the decisions today will be in the office to face the consequences!