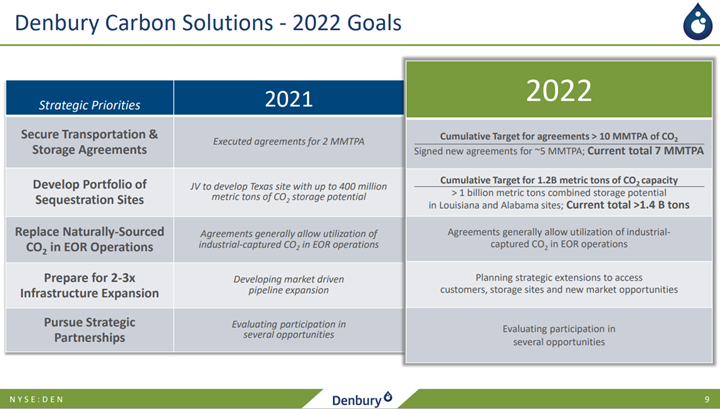

We are seeing a flood of CCUS announcements in the US in 2022, but they look like “gathering” exercises at this stage rather than projects that are ready for FID. Companies are chasing potential pore space and, like Talos, leasing onshore and offshore (mainly offshore) acreage, where they believe opportunities exist to sequester CO2. These announcements sometimes include firm commitments from companies that have CO2 surpluses and sometimes are more speculative. At this stage, it seems like a “land grab” and “customer grab”. There is wide agreement that the incentive structure in the US – centered around the 45Q tax credit scheme – is not enough to drive much real investment, unless it can be stacked with other credits like the LCFS structure, which only applies to fuels in California today. We see the land grab as relatively low-cost and low-risk positioning in the hope that incentives or economics change. There are some instances where investments will go ahead, and these will focus on processes that have a reasonably low cost of carbon capture – fermentation, urea, natural gas clean-up for LNG, and a handful of other processes. The LSB Industries announcement for Arkansas, highlighted this week, is likely an example of where the economics work even if LSB cannot get much of a premium for the low-carbon urea.

CCS And Plastic Recycling Ambitions Running High

May 5, 2022 12:31:00 PM / by Graham Copley posted in Carbon Capture, Recycling, LNG, CCS, CO2, natural gas, fermentation, Talos, urea, low carbon, CCUS, Denbury, Plastics recycling, LSB Industries, Berry Global