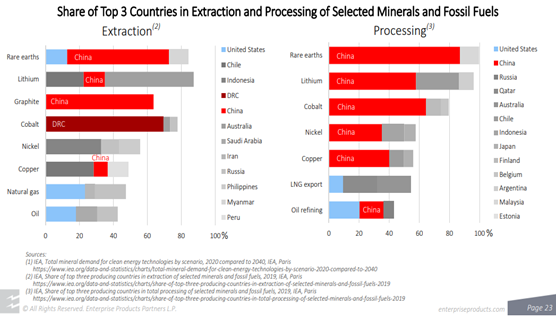

While longer-term use of oil and gas products is in Enterprise Products' best interest, it is nice to see someone else pushing the point that we have been making for more than a year – that there is not enough material out there, in the right locations, to meet the suggested clean energy goals. It is important that this becomes better understood and accepted by a broader group than just Enterprise and C-MACC, as we will not get the needed tack in strategy, priorities, and incentives if there is a broad reliance on renewable targets that will not be met – we focus on the IPCC report in tomorrow’s ESG and Climate report.

Energy Transition Moving Forward; Commodity Availability To Support It In Question

Apr 12, 2022 12:06:03 PM / by Graham Copley posted in LNG, Renewable Power, Raw Materials, Supply Chain, hydrocarbons, Dow, Oil, natural gas, clean energy, Enterprise Products, materials, fossil fuels, material cost inflation, minerals, renewable targets

Another Illustration Of How Important Metals Are To Energy Transition

Jan 21, 2022 1:07:16 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Renewable Power, Metals, Raw Materials, solar, renewable energy, wind, energy transition, Lithium, climate, advanced recycling, materials, low carbon, material shortages, low carbon economy, renewable power production

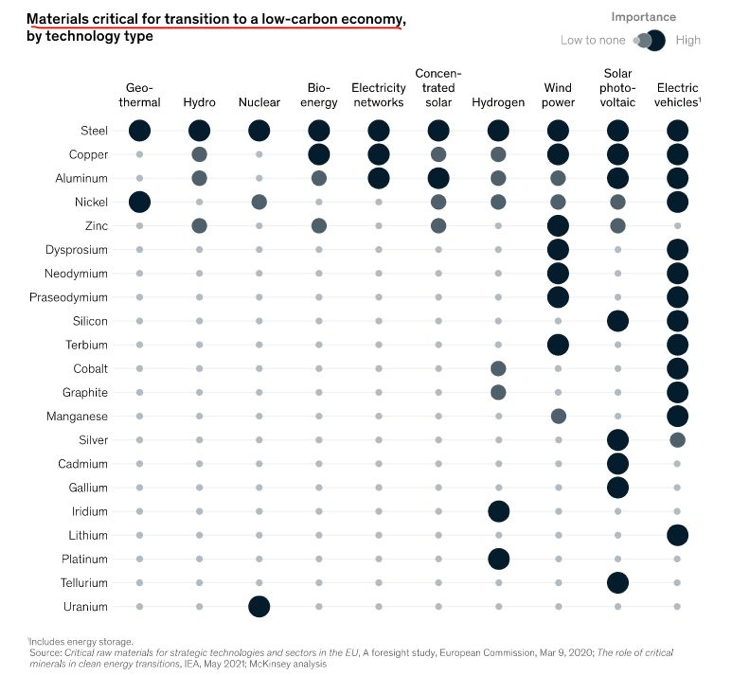

The materials chart in the exhibit below from today's daily report, is worth noting as it highlights all of the materials that are needed to advance the production of equipment required to drive renewable power production and demand. We would make one change to the chart in that lithium should also be added to the wind and solar categories to account for storage that needs to be built, although this could be done through hydrogen production or hydraulically, depending on location. One of our primary concerns concerning renewable power projections is the availability of some of these materials and we have written about the topic at length – most comprehensively in - 2022 – Policy Key, But Inflation Will Distract – Maybe Beneficially.

Materials Inflation Now A Concern Of The IEA

Dec 3, 2021 1:13:41 PM / by Graham Copley posted in ESG, Sustainability, Renewable Power, Materials Inflation, Raw Materials, renewable energy, manufacturing, climate, EVs, price index

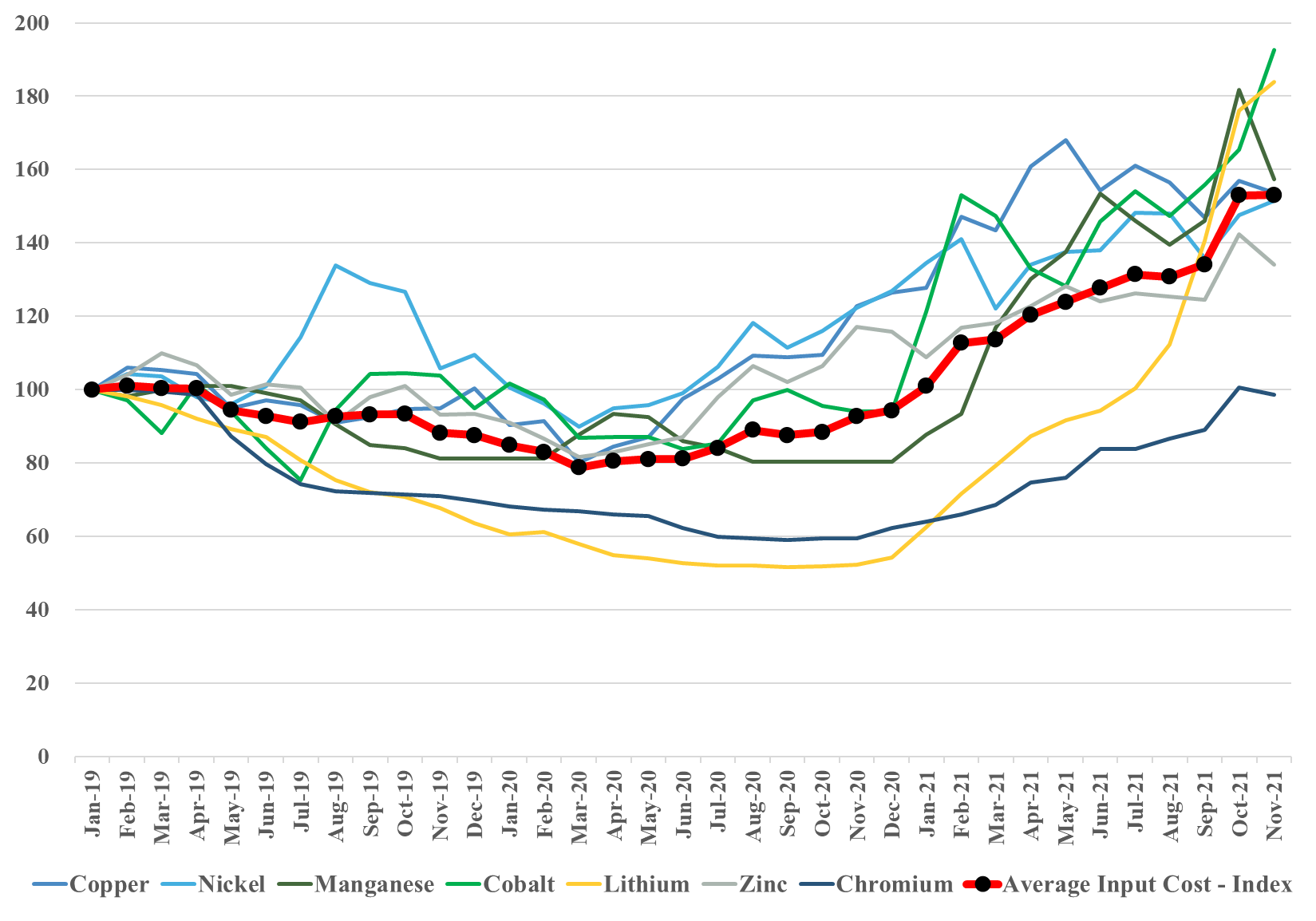

We focus today on raw material inflation and use the IEA analysis of materials demand (excluding steel and aluminum) in EVs and renewable power, creating a price index for the materials in question. This index is a straight average, but we will develop indices for specific sub-industries and include these in our next ESG and climate report. What is important is that the index below is up over 50% since the beginning of 2019 and this is before many of the EV plans and power plans move from planning to construction. We have highlighted inflation risk for more than a year now and remain very concerned that when many of the new auto plants start and many of the incremental renewable power facilities move from planning to equipment purchasing, we will see bottlenecks and faster price increases. See more in today's daily report.

Solar Module Raw Material Costs Reversing Long Term Price Declines

Sep 2, 2021 1:57:21 PM / by Graham Copley posted in ESG, Renewable Power, Energy, Raw Materials, raw materials inflation, solar, renewable energy, renewable investment, solar energy, solar module

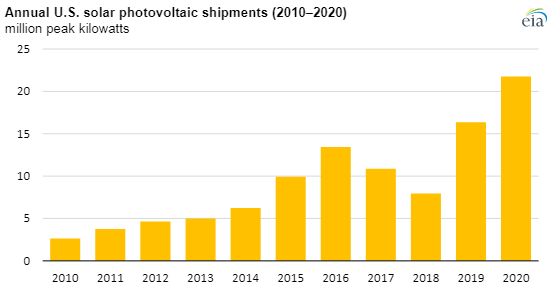

In our ESG and climate piece yesterday we discussed rising costs of climate-related actions, with a focus on some of the likely inflation in renewable power costs. The optimists are looking at the Exhibit below, and what were falling module costs through 2020, and concluding that solar installations can grow and that costs can still fall. While the module shipment growth in 2020 was impressive at 33%, some of the forecasts of what will be needed call for a much more dramatic rate of module growth than we saw in 2020.

Batteries Are Not The Only Way To Store Power

Aug 20, 2021 11:47:43 AM / by Graham Copley posted in ESG, Hydrogen, Raw Materials, raw materials inflation, power, EV, batteries, power storage

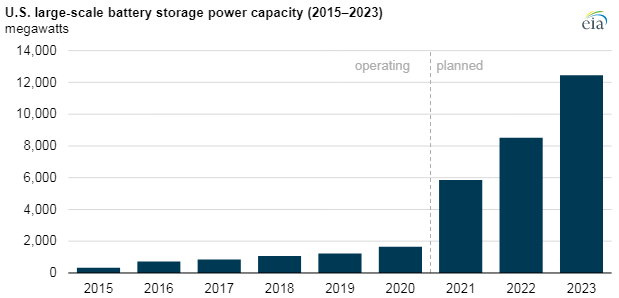

If we look at the battery storage projects highlighted in today's daily report and in the Exhibit below and then read some of the raw material inflationary concerns around batteries, we conclude that batteries will likely not end up dominating the power storage market. Both hydrogen and hydraulic-based storage are likely to be competitive if the battery costs do not come down. Note that storage batteries can afford to compromise on technology as they do not need leading-edge density – weight is not an issue for something that is not going to move. Even so, with battery demand expected to grow rapidly for EVs, it is not hard to see a scenario where other means of fixed location energy storage are more attractive.

It's Hard To Bet On Deflation When You Are Dependent On Commodity Pricing

Aug 19, 2021 11:57:02 AM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Renewable Power, Raw Materials, solar, copper, silver, wind, Lithium, solar energy, steel, basic polymers, semiconductors, renewable power goals, aluminum, EV batteries, rare earths

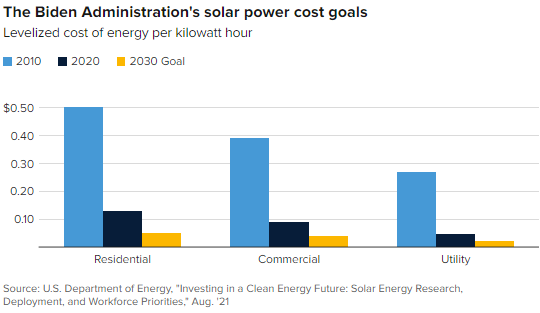

We are back on one of our pet topics today which is the reasonableness around some of the assumptions around the future cost of renewable power. We reference, work done by the US Department of Energy in the Exhibit below, and see two potential pitfalls with the assumptions around continuous improvement in solar, wind, and hydrogen costs, although there is a slight twist for hydrogen. The first is around the dynamics of learning curves. As the exhibit shows, in the early stages of any product development, there are huge leaps in cost improvements, driven by scale, better know-how, more efficient manufacturing, and in the case of solar power, both better processes for installation and some technology improvements. However, as you drive costs lower, the cost of raw materials becomes a much larger component of overall costs, and your ability to lower costs further can be overwhelmed by moves in material costs. Any inability to pass on the costs will result in economics that do not justify additional capital and you find yourselves in a commodity cycle. This is something that we have seen in basic polymers for decades, and no buyer of polyethylene today can claim that they are benefiting from a learning curve improvement. Closer to home for solar, we are seeing the same issue today in semiconductors – not enough margin to invest as everyone has been trying to push costs lower. The expectation in the DOE study and highlighted in the CNBC take on the study below is that annual solar installations in the US need to rise by 3-4X to meet some of the renewable power goals the Biden Administration is looking for by 2030, while similar growth is expected in other markets – the solar panel and other component makers have to be making good money to achieve this.

Here Comes The Sun... But Not Cheaply

Jul 16, 2021 1:50:56 PM / by Graham Copley posted in ESG, Hydrogen, Renewable Power, Raw Materials, carbon abatement, solar, solar energy

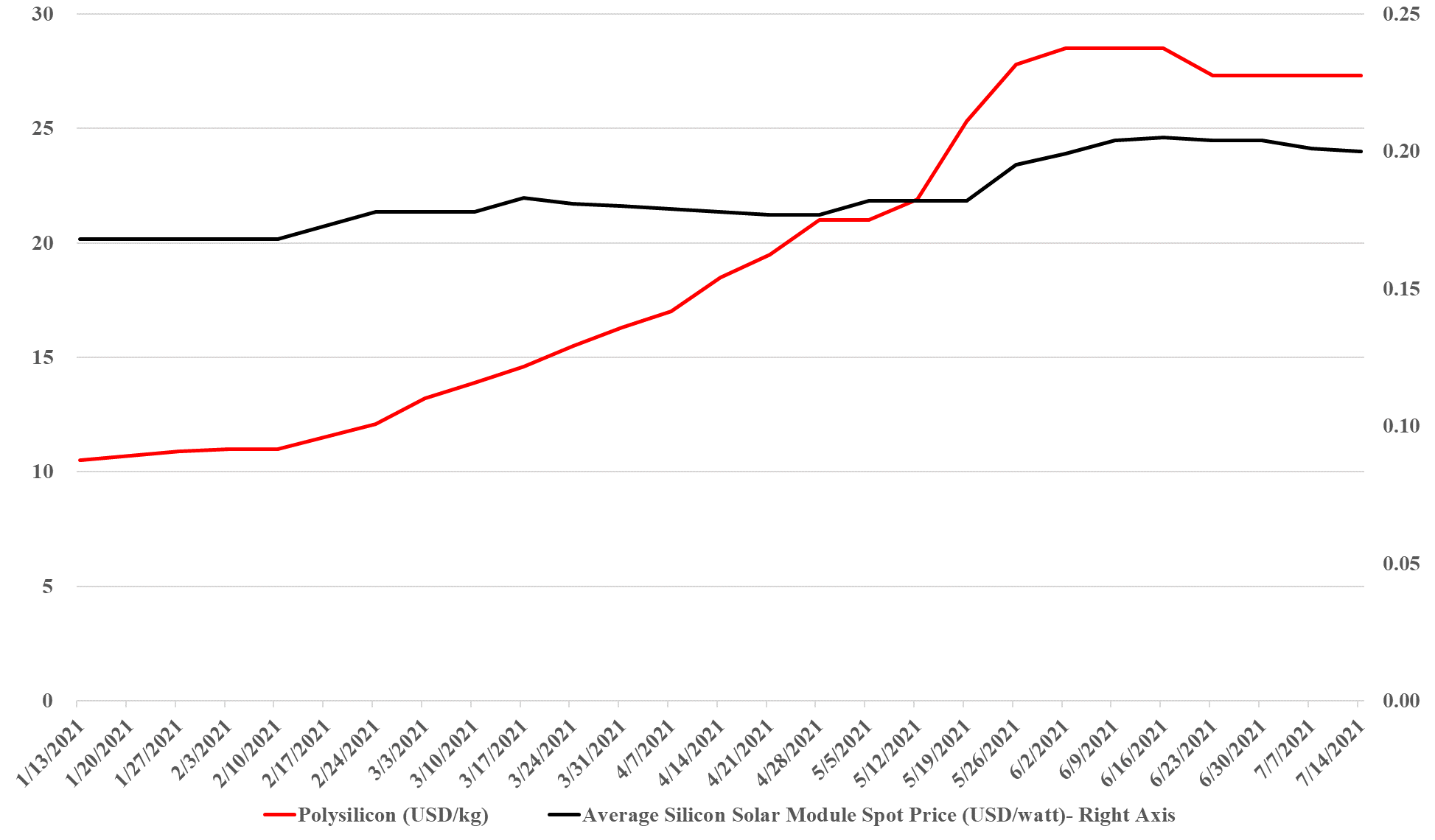

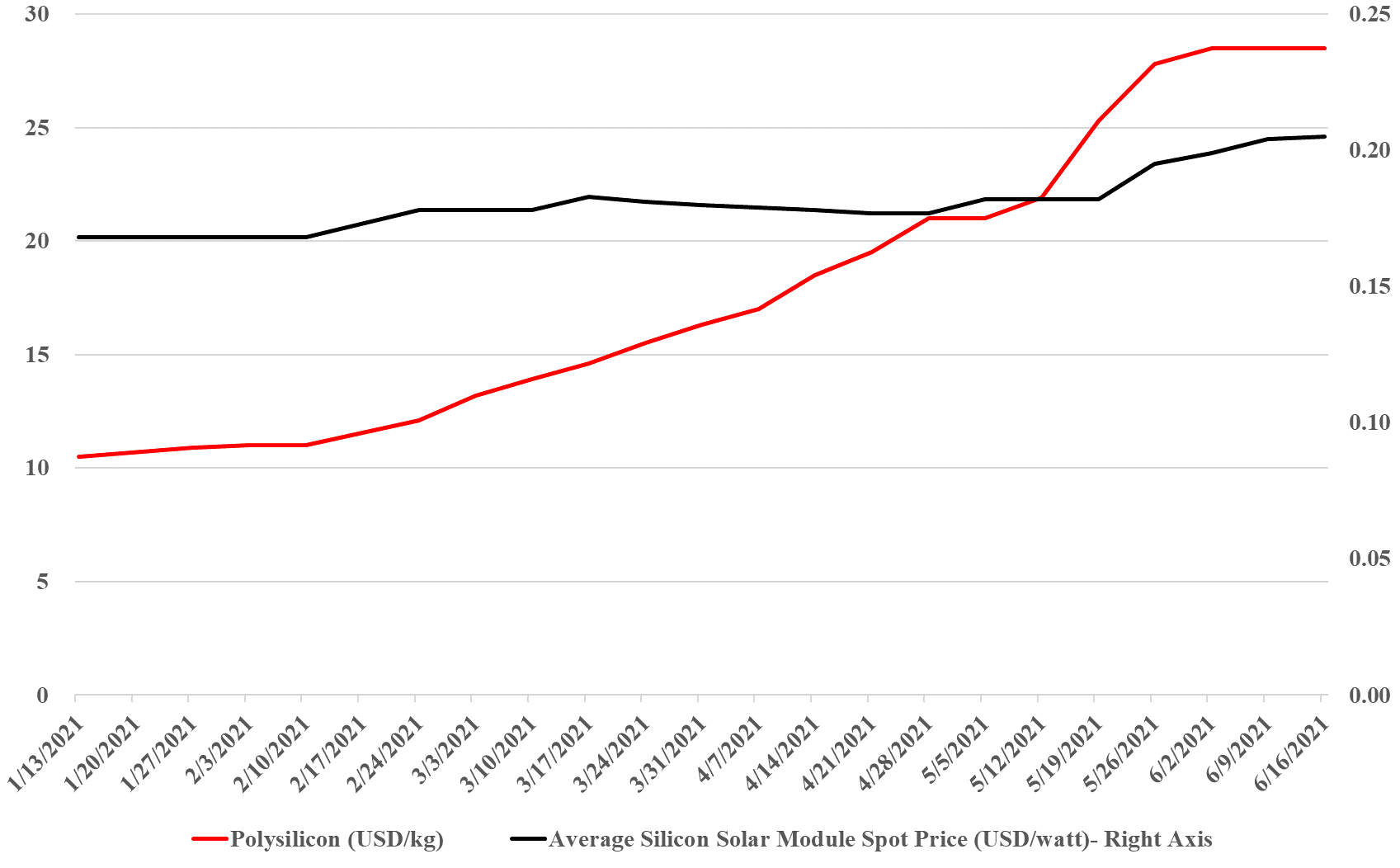

While the escalation in solar panel material costs has plateaued over the last couple of months, the increase has been enough already to reverse the decline in solar module pricing as we have noted previously (see charts below). While the increase in module pricing is not that significant there are three points to note:

Solar: A Clear Example Of Potential Renewable Energy Inflation

Jun 17, 2021 1:32:30 PM / by Graham Copley posted in ESG, Hydrogen, Biofuels, Polymers, ESG Investing, Electric Vehicles, Raw Materials, LyondellBasell, Inflation, Gevo, solar, polysilicon, Wacker, copper, silver, Aemetis, renewable energy

The exhibit below summarizes well one of the primary concerns that we have with some of the very ambitious goals for decarbonizing power grids, EV introduction, the further electrification of industry, and hydrogen. While the solar module price increase does not look that significant (yet), to put it in context, solar module prices have collapsed from over $1.80 per watt in 2010 to below $0.20 in 2020, and many of the expectations around cheap hydrogen require the cost to keep falling. The bigger concern is the polysilicon price, which is up 160% this year, good for the polysilicon producers like Wacker (see the headline here), but bad for the solar module producers, who are seeing major margin squeezes, especially given the rise in copper and silver as well this year. The raw material pressure should drive further increases in solar module pricing and while the higher margins for polysilicon will likely drive expansion investment, the metals are harder to call, given the ESG views on mining. We remain firmly of the view that raw material availability and price inflation, as well as module and wind turbine manufacturing capacity, will be the rate-determining constraint in terms of the growth in renewable power and this is why we question all of the near-term cheap power and cheap hydrogen goals that are being suggested by potential producers and government agencies.

Raw Materials Inflation Deserves Another Mention

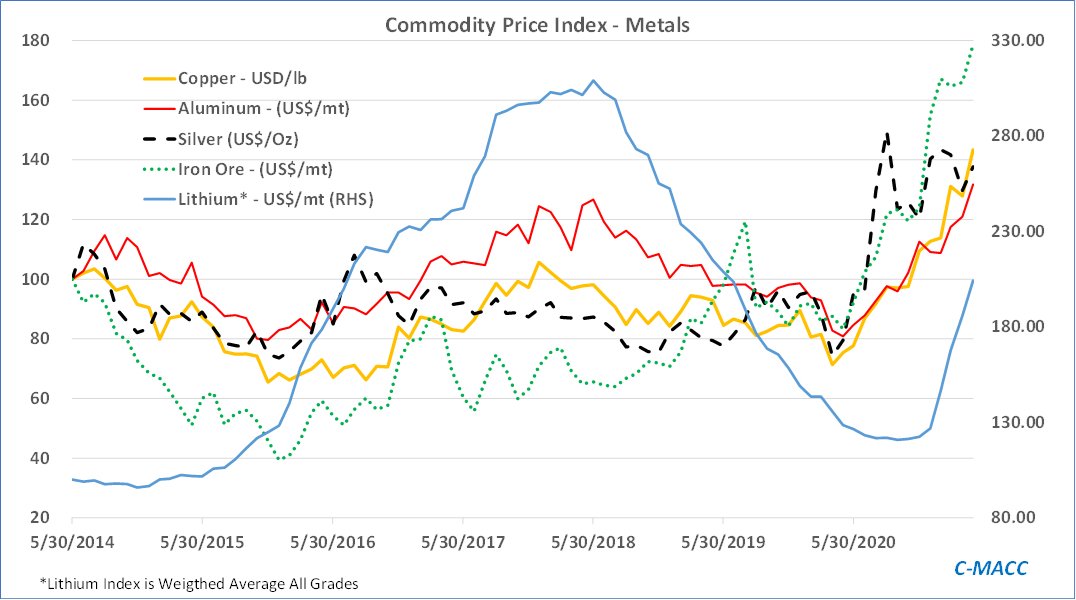

May 6, 2021 1:17:54 PM / by Graham Copley posted in ESG, Renewable Power, Metals, Materials Inflation, Raw Materials

Source: Bloomberg, C-MACC Analysis, May 2021