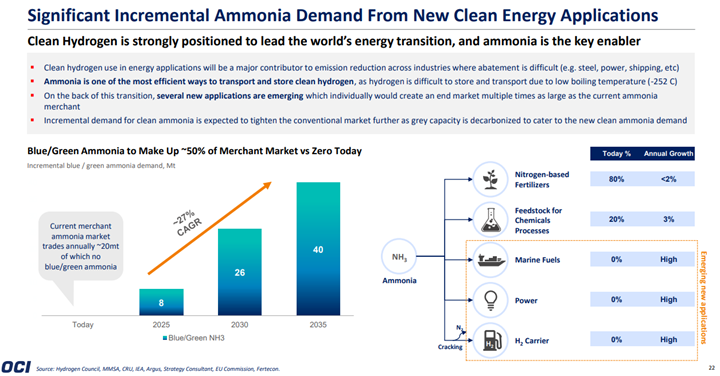

There is the potential for the ammonia thirst (please don’t drink it) to surpass opportunities to build cost-effective capacity for the medium term. Consequently, the shortages we see today could extend and become more severe. Co-firing coal-based power facilities in Asia is one of the more obvious ways to start decarbonizing a predominantly coal-based power region. The experiments in Japan, if successful, will drive a step-change in demand for blue or green ammonia, and this should drive much more new capacity than we have seen announced to date. The power-based demand comes on top of expected growth in fertilizer-driven demand and a possible rise as a shipping fuel. The issue for investors is that green ammonia at scale is economically challenging, especially with the recent shortfalls in renewable power generating plans and what now looks like rising power costs for a while. Blue ammonia is much easier to think about at scale, but we are still hamstrung by expensive carbon capture costs and a lack of incentives – either in terms of tax breaks or taxes or in terms of a customer willing to pay more, to get most ideas and plans past the “wouldn’t it be nice” phase. In the meantime, as indicated above, installed ammonia capacity is making abnormal returns.

Shortages: Ammonia, Affordable Ethanol, & Renewable Power In The Right Places

May 12, 2022 2:01:48 PM / by Graham Copley posted in Polyethylene, Ethylene, Renewable Power, Ammonia, ethanol, blue ammonia, Braskem, fertilizer, reshoring, green ammonia, sugar, green polyethelyne