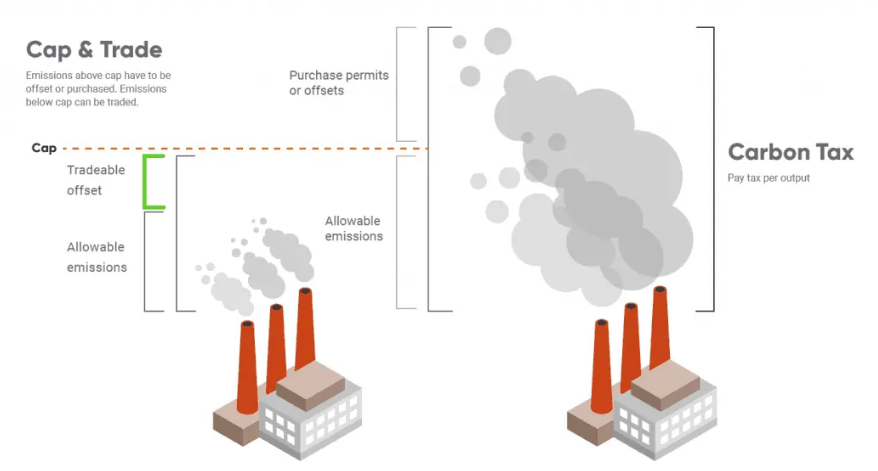

There was a very strong focus at the WPC on the need for carbon pricing in the US to facilitate investment decisions around many initiatives focused on carbon abatement. The consensus was very much that a carbon price – so a cap and trade system like they have in Europe – was the best mechanism, and far more likely to drive action and limit inflation than a carbon tax. This is something that we broadly agree with but the US is a bit late to the game and the right caps need to be set so that CO2 prices don’t languish at very low levels for years, as they did in Europe. Jim Fitterling of Dow was somewhat provocative in his comments around nuclear power, but we see this as part of a broader initiative aimed at getting a serious dialogue moving around how we make the practical steps needed to drive carbon lower. Nuclear power provides stable baseload and is carbon-free – a small modular nuclear reactor could generate enough steam and enough power to drive the decarbonization of major chemical complexes – one investment for example could transform one of the larger Dow sites. If we are going to get to net-zero targets without nuclear, we need much more progressive policies – especially around carbon pricing – which is likely the direction that Dow would like to take the discussion.

Everyone Is Pushing For A US Carbon Policy, Except Congress

Mar 24, 2022 2:54:22 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Carbon Tax, CO2, Carbon Price, Emission Goals, Inflation, Chemical Industry, Net-Zero, decarbonization, Dow, carbon abatement, carbon emissions, carbon pricing, nuclear power, WPC

bp Analysis Shows Steep Challenges Of Energy Transition

Mar 15, 2022 11:36:51 AM / by Graham Copley posted in ESG, Climate Change, Sustainability, Energy, Emission Goals, Net-Zero, bp, renewable energy, renewables, energy transition

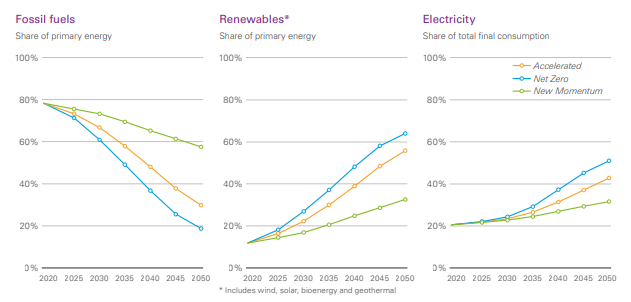

The annual review of World energy from bp shows a stark reversal of the company’s position only a short while ago. When the pandemic hit, bp went on record suggesting that we may have seen peak oil demand in 2019. It was an interesting theory and one that we discussed at the time, but it underestimated the impact that aggressive COVID-related stimulus would have on consumers globally and we suspect that bp, like many others, overestimated the rate at which renewables could be added. Now the company is exploring a very different scenario, one in which the current momentum in the energy market continues and the rate of renewable additions slows, either because of more limited capital or because of material constraints – or a combination of both.

Big Hydrogen Plans But Likely Not Yet...

Mar 9, 2022 12:28:34 PM / by Graham Copley posted in Hydrogen, Green Hydrogen, Blue Hydrogen, Renewable Power, Emission Goals, renewable energy, renewables, materials, material shortages, inflationary pressure, hydrogen economics, electrolyzer, Houston, renewable industry

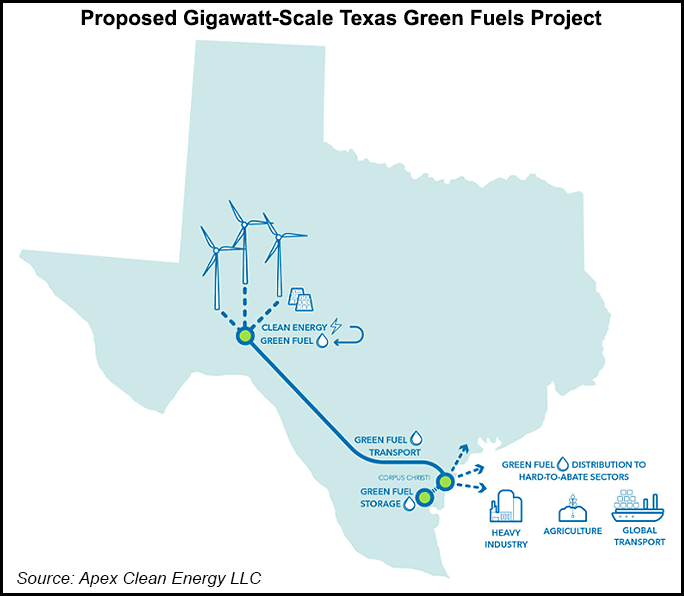

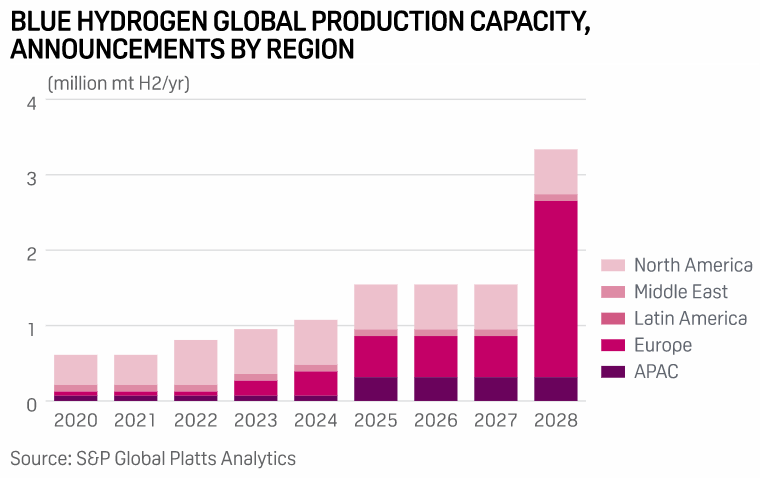

The Texas hydrogen hub is getting a lot of press and we also cover the idea in our ESG and Climate report today. We see this as not a lot more than intent today and would be surprised if any part of the project would be up and running, assuming it gets built at all, before the end of the decade. Green hydrogen economics do not (yet) make sense and some considerable efficiency learning curves need to emerge before any project could expect to make economic sense without significant subsidy. We have talked at length about the inflationary effects of material shortages and this is the core topic of our ESG report again today, where we suggest that a global recession may be the best thing for the renewable industry as it would slow other sectors' demand for critical materials. But the other wild card is renewable power demand, and how many industrial and materials companies along the Gulf Coast have their eyes on the same renewable power capacity to meet 2030 emission reduction goals. No one must buy renewable power today, because no one has 2022 emission goals. So, renewable power demand is likely understated and it is why the premium to buy renewable power in Texas today is quite low. Fast forward to 2030 – when promises have been made – and we will likely see demand spike and prices rise relative to conventionally generated power. This would materially impact the economics of the green hydrogen hub in Texas even if the electrolyzer costs could be reduced. Given the abundant pore space both onshore and offshore, blue hydrogen makes much more economic sense for Houston.

Emission Pledges Will Need To Become Emission Investments Soon

Jan 28, 2022 3:35:32 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Emission Goals, LyondellBasell, Chemical Industry, Dow, climate, materials, Investments, 2022

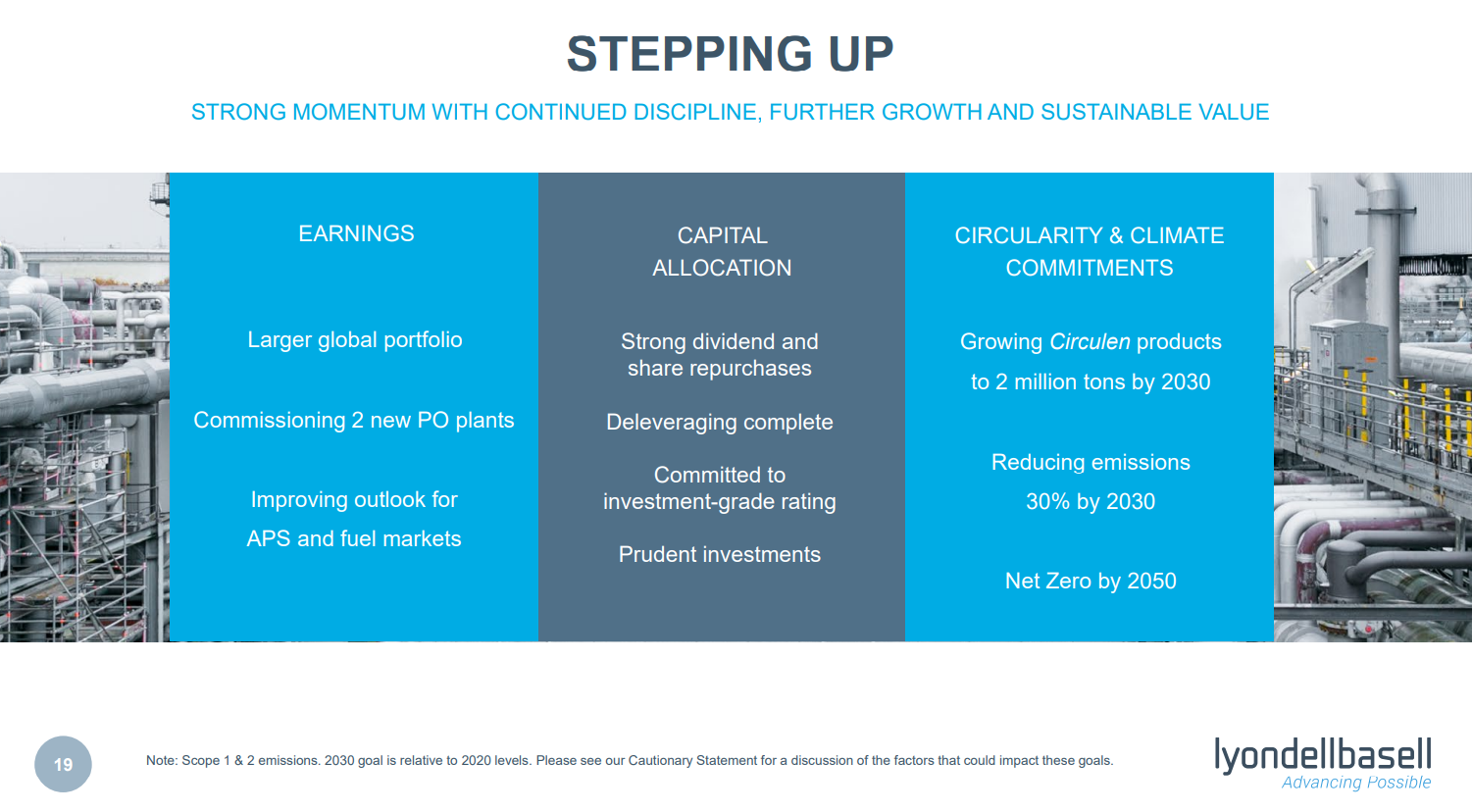

2022 is the year in which the rubber will need to meet the road for many of the chemical and other material and industrial companies who have made 2030 emission pledges. In the Dow release yesterday, the company used the call as an opportunity to remind investors about the Canada investment and tie that into the 2030 emission goals. We note LyondellBasell’s 30% emission reduction goal by 2030 and like others, LyondellBasell will not be able to get there without substantial investment. LyondellBasell and others do not necessarily have to spend in 2022 (neither does Dow), but unless there are some concrete plans by the end of the year stakeholders will likely start to question whether the emission goals are real. We suspect that most companies are trying to work out whether investments in hydrogen (likely blue hydrogen because of the volumes needed) are a better solution than trying to capture CO2 from a natural gas furnace. Any large hydrogen investment with associated CCS will take 5-6 years from concept to production. Like Dow, we would expect others to focus emission-reduction investments in countries/states that have a clear value on CO2. See today's daily report for more.

Are We Asking Too Much Of The Renewable Power Industry?

Dec 1, 2021 12:19:53 PM / by Graham Copley posted in ESG, Sustainability, Renewable Power, Emissions, Materials Inflation, Emission Goals, Inflation, Net-Zero, IEA, solar, wind, climate, renewable power inflation, commodity pricing

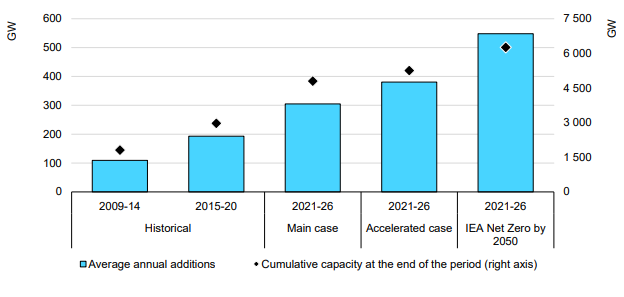

The core message of the IEA analysis published today is around how renewable power rates of investment remain far too low and need to more than double immediately to meet net-zero goals – see below. This analysis is very supportive of our renewable power inflation thesis, as none of the renewable power component manufacturers can double production either cheaply or quickly, and none of their suppliers has that much spare materials capacity. On the solar front, we may have the additional problem of regional production concentration. China has the largest share of capacity for solar module capacity and now has much more aggressive plans for solar power domestically. We could see China-based components stay in China, exaggerating shortages outside China. The IEA has an accompanying report today on the possible impact of commodity pricing on solar and wind pricing and it is also linked here – these reports were published this morning and we will cover them in more detail in next week's ESG and Climate report. More on this in today’s ESG and Climate report.

ExxonMobil: Going Heavy On CCS (The Right Move), But Pushing For Support

Nov 12, 2021 2:07:37 PM / by Graham Copley posted in Hydrogen, CCS, Carbon, Emissions, ExxonMobil, Emission Goals, carbon footprint, carbon abatement, biofuel, carbon offsets, carbon trading, greenwashing

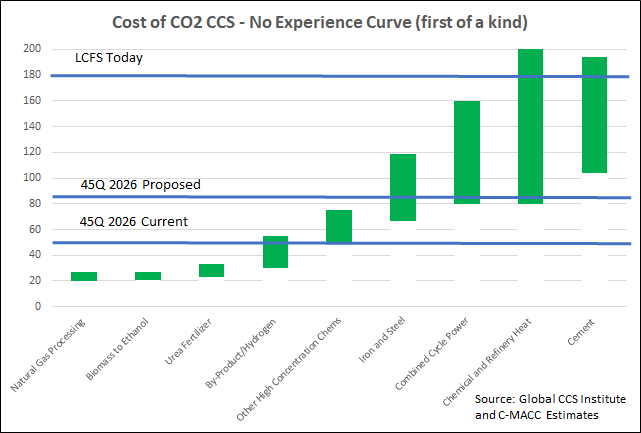

ExxonMobil is seriously upping its lower-carbon game with the CCS announcements over the last few weeks and the release this week that states the company will spend $15 billion over the next 6 years on lower carbon initiatives. In this linked headline ExxonMobil states that it will meet its 2025 emission goals this year – we are assuming that this must be correct as the company would not want to risk the accusation of greenwashing. Either way, the critics will weigh in, either claiming “greenwashing” or suggesting that the targets were not high enough, to begin with. The ExxonMobil focus is very much on CCS, which makes sense for an oil and gas-centric company whose only real play right now is to lower the carbon footprint of its fuel portfolio. In the release linked above, ExxonMobil also talks about biofuel and hydrogen initiatives, but again calls for supportive policies from governments and we suspect that the underlying push here is towards the US government. ExxonMobil and others have indicated that $100 per ton is the right incentive to drive CCS and other carbon abatement strategies and we would agree with this estimate as it backs up much of the work that we have done over the last year. See - Carbon: Trading, Offsets, and CCS as a Service – It’s All Coming! and - Carbon Games – Appetite, But Not Enough Hunger Yet. The other reason why ExxonMobil and others would like to see the US act is because other jurisdictions in which they operate will likely take a lead from the US.

US CCS Clusters Gaining Momentum, As They Should

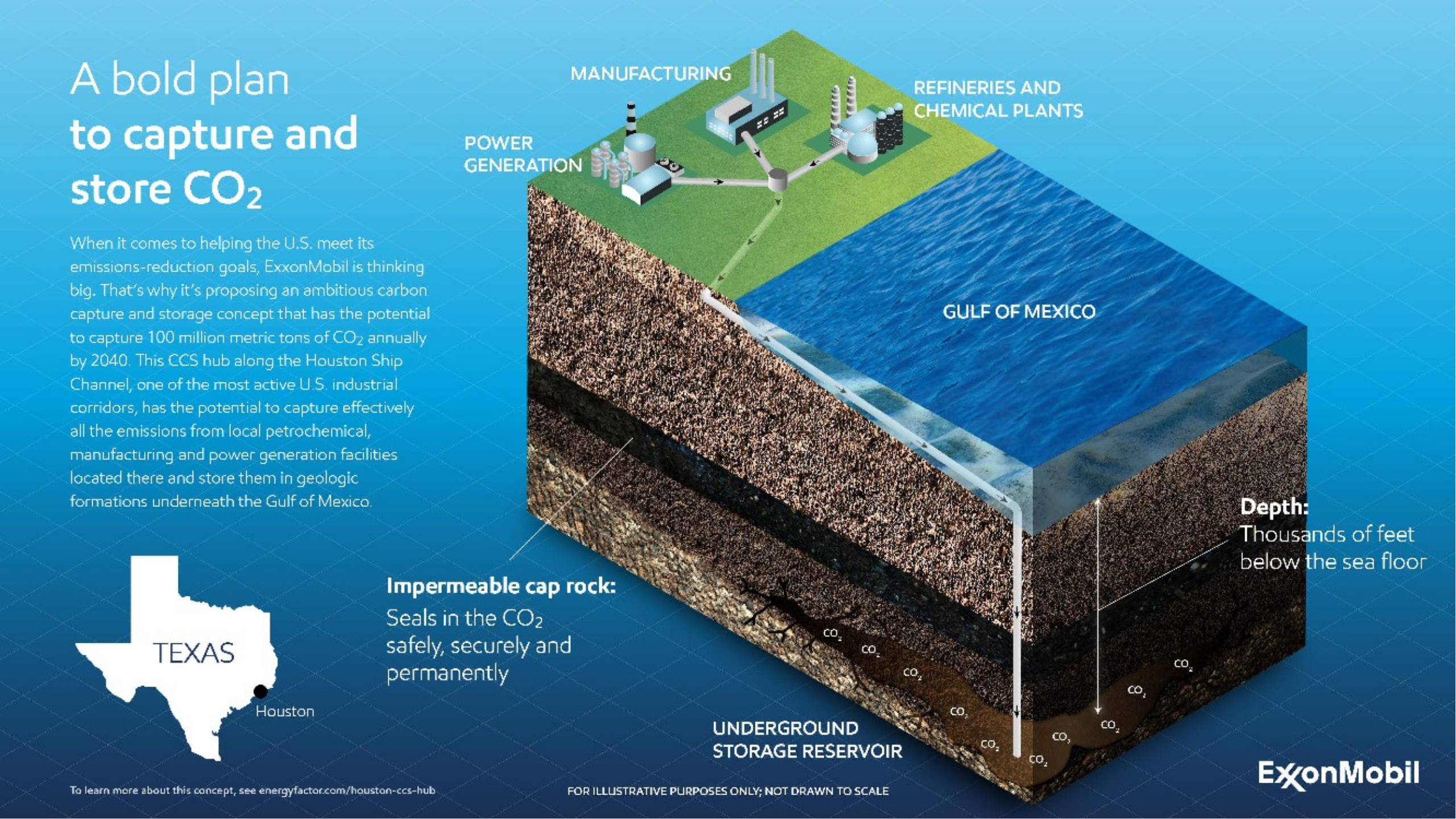

Sep 17, 2021 12:32:39 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, CCS, CO2, Sequestration, Emissions, ExxonMobil, Emission Goals

News that ExxonMobil has support for its large CCS hub in Houston should not be a surprise. According to the EPA data, for 2019, Harris and Galveston counties combined have more than 50 million tons of CO2 emissions and there are another 20 million tons in Brazoria county, which is close enough to be included. The devil will be in the details as the cost of building a high-pressure pipe network will be high, as will drilling wells with sufficient capacity offshore. We believe that this hub, or cluster (as they are called in Europe), approach will help drive CCS costs down, but we are concerned by the competitive disadvantage that this might cause for those without access to a hub or cluster – see our ESG report - Cluster F***ed: The Dangerous Scale Component of CCS – for more.

Direct Air Capture Is Expensive, But Demand Is There

Sep 10, 2021 1:43:32 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CO2, Emission Goals, carbon dioxide, carbon offsets, direct air capture, greenwashing, DAC, carbon neutral hydrocarbons

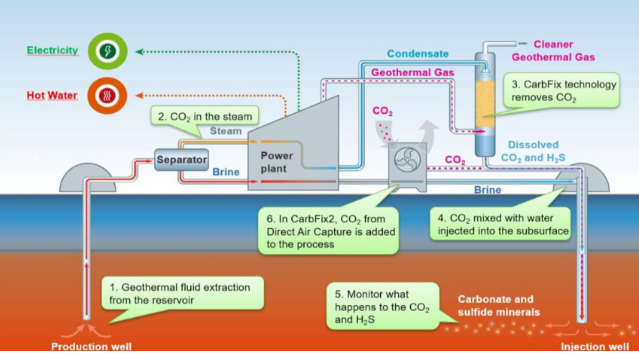

The most notable news from the Iceland CO2 direct air capture (DAC) project, illustrated in the Exhibit below, is not that it is working and how energy efficient it is, but that the CO2 capture costs are extremely high and yet all of the offsets are sold. One report talks about the costs per credit approximating $1000 per ton of CO2, which is likely accurate given that the facility is relatively small scale, at 4 thousand metric tons per year. The same report also states that the credits are almost sold out for the 12 years that they are being offered. We believe that this is indicative of the marginal demand for uncontestable carbon offsets, and this is a topic we have covered at length in our ESG and climate work. Shell, bp, and others are selling what they claim to be carbon neutral hydrocarbons around the world and are buying offsets to do so, but they are coming under quite a lot of “greenwashing” fire because of the less tangible/auditable nature of the credits they are buying – often related to agricultural or specific tree conservation/planting initiatives that are questioned because of the validity of the capture claim or the vulnerability of the credit to weather, fires, and forest maintenance years in the future.

Inflation Challenges In Europe; Overall Challenges In China

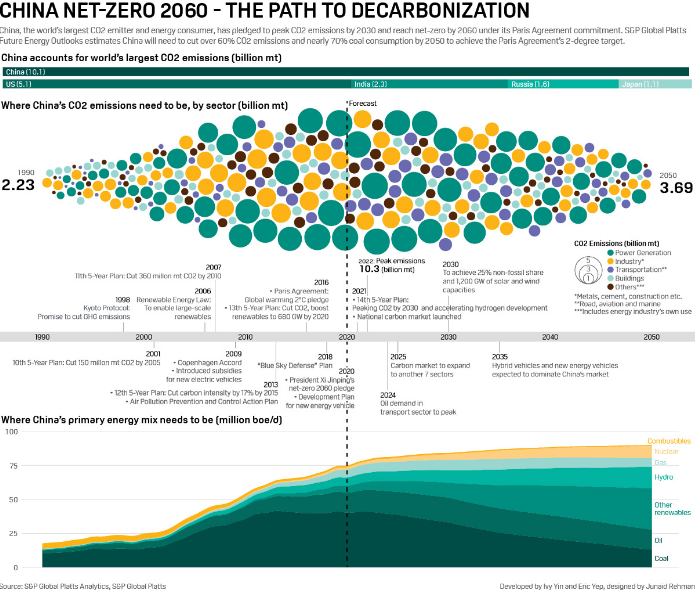

Sep 8, 2021 2:02:16 PM / by Graham Copley posted in LNG, Emissions, Carbon Price, Emission Goals, Inflation, China, carbon values, carbon emissions, COP26

Europe is likely to be a test case of how much inflation a country or region is willing to bear on its path to clean energy. Costs are rising in Europe, as LNG markets tighten and as carbon prices rise. The net result is increased power prices, with reports of unhappiness in many countries – this is a topic we have discussed at length in our dedicated ESG and climate work and was a focus of last week's report – linked here.

Carbon Capture: Front and Center & Enabling Hydrogen Growth

Aug 5, 2021 1:17:52 PM / by Graham Copley posted in Hydrogen, Chemicals, Carbon Capture, Polymers, Green Hydrogen, CCS, Blue Hydrogen, Emissions, Emission Goals, natural gas, carbon emissions, CBAM, NGLs, gray hydrogen

The primary reason for the flurry of carbon capture related headlines in the US over the last few weeks – and our analysis shows a significant step up – is because it looks like this will be the one technology/route to lower carbon emissions that will get a real boost from the infrastructure bill. There is bipartisan support for CCS because the fossil fuel industry sees it as a way to stay in the game and the unions believe that it will create jobs. This combination should garner enough votes to push it into the bill and get it passed, although the details around how CCS would be supported remain unclear. The infrastructure bill has very few real sources of income in it to offset the very high costs – something we will discuss on Sunday – and consequently giving a bigger tax break, through the 45Q program would create an even larger funding gap than we have today. The value/cost dynamic has to rise to get the activity that everyone is looking for and maybe that could be achieved by overlaying a carbon credit onto the program. Anyone exporting to Europe and concerned about the CBAM extending to natural gas, NGLs, chemicals, and polymers would likely consider CCS if they were eligible for 45Q and could also claim an offset on their exported products to neutralize the CBAM tax/fee.