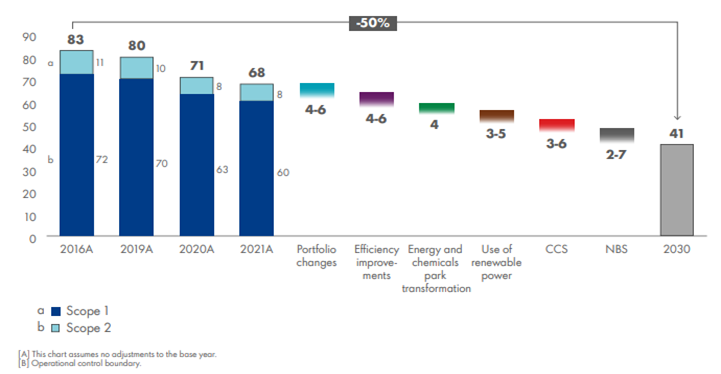

Shell issued its 2021 energy transition progress this morning and the report contains a lot of detail about what Shell has done so far and what the company intends to do. The report is a record of progress and intent and is targeting both general stakeholders as well as the Shell board and annual meeting, where approval of the plan will be sought. When compared with other reports we have seen from other companies, this summary is comprehensive. It provides some concrete steps to achieving emission goals in 2030 – exhibit below - while remaining appropriately vague about getting to 2040 and 2050 targets. However, we would note how much portfolio changes likely added to the 2016 to 2021 progress – likely proportionately much more than they are expected to contribute from 2022 to 2030. Both renewable power and CCS figure in the 2030 projections below and Shell will need to get moving on the CCS front of it is to sequester 3-6 million tons of CO2 per annum by 2030. The expectations are likely based on the European offshore projects, as it may take longer than 8 years to get permits and investments in place in the US. The US could move faster but the EPA would likely need to grant primacy to at least Louisiana and Texas for things to speed up and we are not convinced that this will happen soon. Like many of the other company 2030 plans that we have seen, it is likely that much of Shell’s progress will come in the last couple of years of the decade – especially on CCS.

Shell Saying All The Right Things, But Likely Not Enough

Apr 20, 2022 2:24:59 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, LNG, CCS, CO2, Energy, Shell, fossil fuel, carbon values, energy transition, carbon intensity

Friday Question: What Is Next For Oil? Help Us Write Our Next Report!

May 28, 2021 1:50:42 PM / by Graham Copley posted in Oil Industry, Energy, Emissions, Shell, Oil

We talked about the Dutch ruling against Shell in yesterday's report and the latest refinery sale in the US is another indication of one of the risks of unilateral court-based decisions. Shell could easily get to lower emissions by divesting assets, as can anyone else with a medium-term emission target on the books. We have written previously about the possibility of an energy equivalent of the “bad bank” structure that was set up during the financial crisis, where emissions challenged assets are divested into either private entities or public holding companies that have mandates to improve excessive emission pools but also have significant cash flows and pay investors to wait.

If Carbon Prices Don't Rise, The Tax Payer Will Foot The Bill Anyway

May 12, 2021 1:28:52 PM / by Graham Copley posted in Chemicals, CO2, Carbon Price, ESG Investing, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Emission Goals

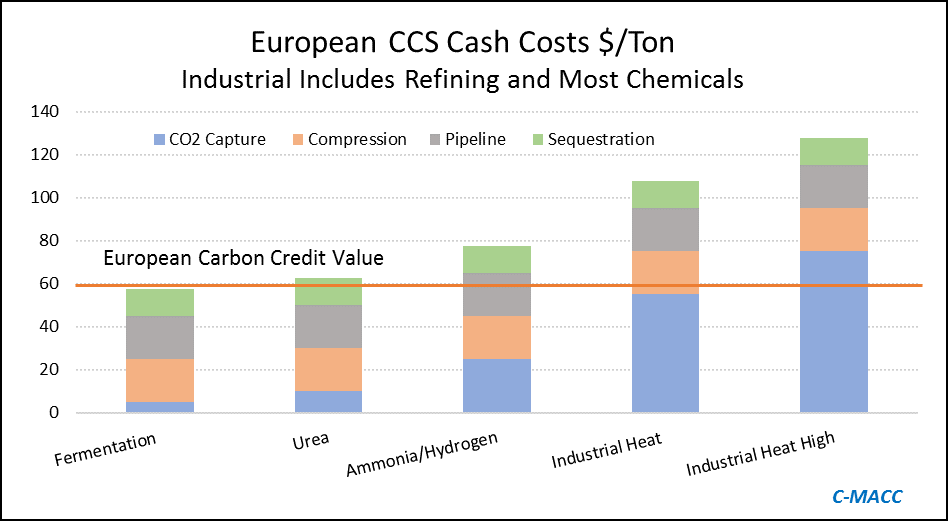

The big news of the week is the massive grant that the Dutch government approved for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be localized within the Port of Rotterdam, where both oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the $2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $65 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs – see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir). For more see today's ESG report.

Source: Global CCS Institute and C-MACC Analysis and Estimates

Another Expensive CCS Project With Limited Capacity

May 11, 2021 11:39:27 AM / by Graham Copley posted in Hydrogen, Chemicals, Carbon Capture, Climate Change, CCS, Emissions, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Gulf Coast Sequestration, Emission Goals

The big news of the day is the massive grant that the Dutch government approved yesterday for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be focused within the Port of Rotterdam, where both of the oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the 2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $60 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs –see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir).

Source: Global CCS Institute, C-MACC Analysis, 2021

This is another example of a grossly inflated project, in terms of costs and while it may be the best option for the Port of Rotterdam we would make the following observations.

- It will consume a fraction of the CO2 in the local area

- It might give the Dutch operators a competitive edge over other European companies – either because they can produce low carbon fuel or hydrogen or other chemicals (which may get a premium price), or because they avoid paying the carbon prices. This may cause issues within the EU

- It might artificially lower the European carbon price by creating (subsidized) credits – if this project and other government-backed projects (the UK and Scandinavia so far) overwhelm the credit market, they may depress carbon values and discourage other moves to lower CO2 footprints

- Note that we expect a potential fly up in European carbon prices near-to-medium-term, and these mega-projects will not come into operation for a couple of years

- Like the ExxonMobil proposal for Houston, the implied cost per sequestered ton of CO2 is extremely high and while it might reflect problems with land rights, pipeline “right of ways” and other constraints specific to The Netherlands, it is multiples of the cost that we would expect US for on-shore sequestration and we would encourage all to check out the plans (currently with the EPA) that Gulf Coast Sequestration has in Louisiana.