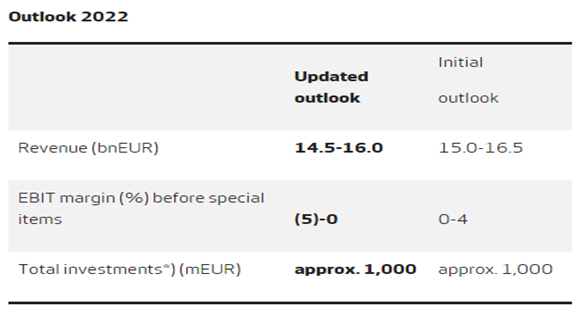

We discussed the woes of the wind power industry at length in a dedicated ESG and Climate piece last week, and the Vestas results below play into the same theme. The company is cutting guidance again for 2022, which is already much lower than estimates would have suggested 6 months ago. While Siemens Gamesa has the added headache of a mismanaged platform change, all of the issues raised by Vestas are shared industry wide, delayed installations because of supply chain issues and material shortages, as well as significant cost inflation. In tomorrow’s ESG and Climate report we discuss some of the increases in European PPAs in 1Q 2022, reversing a multi-year trend of lower installed costs of power. This reversal will likely impact plans for 2022 and 2023, especially for those banking on lower power costs to justify many of the announced hydrogen ventures – particularly in Europe. Those who press ahead despite higher power costs and higher construction costs in general, may stretch both balance sheets and borrowing capacity.

More Woes For Wind

May 3, 2022 1:20:32 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, CCS, Renewable Power, Inflation, Supply Chain, wind, Westlake, renewable, Vestas, Williams, low carbon power

Turbulent Times For The Wind Industry

Feb 4, 2022 1:17:36 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Wind Power, CCS, Renewable Power, natural gas, solar, renewable energy, wind, energy transition, material shortages, wind capacity, onshore wind, price inflation, Siemens Gamesa, logistic issues, offshore wind, solar industry, wind industry

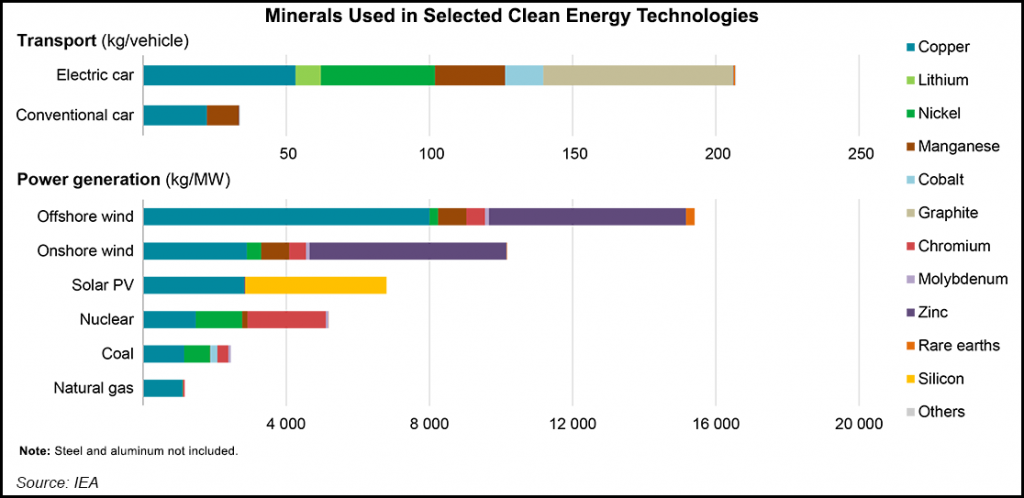

The linked Siemens Gamesa news could not have been a more clear example of one of our key research themes of the last year – backlog up, suggesting strong demand for new wind power capacity – deliveries and profits down because of material shortages – price inflation and logistic issues. While the company is getting squeezed because of higher costs on contracts that have limited opportunity to pass through the cost, at the same time slide 8 of the earnings release deck shows that selling prices rose in fiscal 1Q 2022. This breaks a declining trend in pricing and one of the core assumptions behind many energy transition plans – that renewable power prices can keep falling. Onshore wind orders are falling, but offshore orders are rising – and these come with higher costs and the need for more materials as we showed in a chart in yesterday’s daily. The added costs burden of more offshore wind projects may only serve to tighten markets for materials further, leading to further increases in installed costs.

Inflation Could Spoil A Lot Of ESG Plans in 2022

Dec 31, 2021 12:26:02 PM / by Graham Copley posted in Wind Power, Renewable Power, Metals, raw materials inflation, Inflation, solar, EVs

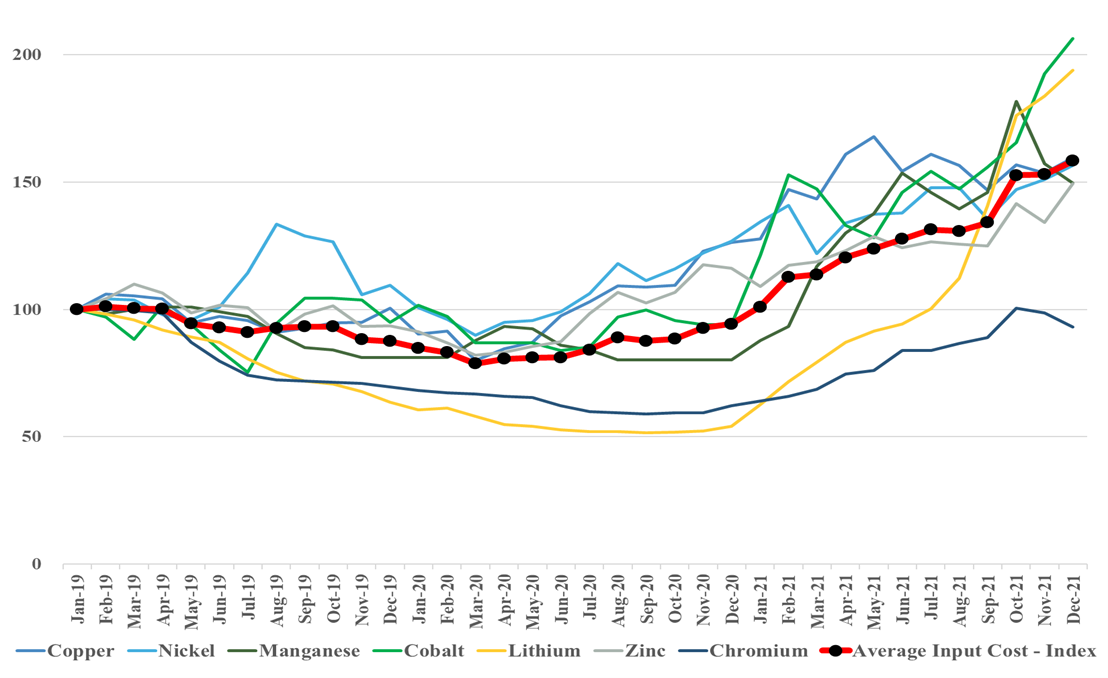

Continuing with our inflation theme this week, we show our renewables metals price index in the Exhibit below, which continues to climb and is now 50% higher than it was 2 years ago, with cobalt and lithium leading the charge at around 100% higher. These are critical components for EV and renewable power manufacture, and with 2022 forecasts for all suggesting much stronger growth, we do not see the materials supply/demand balances improving, suggesting that pricing will go higher. Energy shortages today, will only add more upward pressure to build more renewable capacity quickly and add even greater inflation risk to both components and the materials used to make them. We are concerned that, on the list below, only lithium is seeing significant capital thrown at increasing availability, suggesting that while lithium may peak in pricing, other metals could keep marching up. See our recent Daily, ESG Report, and upcoming Sunday Thematic for more.

Higher Costs Likely To Undermine Some Clean Energy Timetables

Sep 21, 2021 1:37:55 PM / by Graham Copley posted in Hydrogen, Wind Power, Renewable Power, Metals, raw materials inflation, Inflation, renewable energy, solar energy, EVs

The charts below both support our view that we will see continued inflation in renewable energy costs, rather than the deflation that is baked into all of the forward models. It is easy to forget that some of the early solar installations are coming to the end of their useful lives and are retiring – these are gaps that new solar will need to fill. Wind power has the same issue, as many of the original wind farms need equipment replaced and the introduction of recyclable wind turbine blades has been in recent manufacturers' announcements. When we see analysis of who is going to use which tranche of new renewable power for which new hydrogen project we see major gaps in the power demand analysis, in part related to power demand growth at the domestic consumer – because the more rapid introduction of EVs – and in part because or retirement of facilities and the need to replace them.

Shipping Hydrogen: Expensive Anyway You Do It

Aug 31, 2021 2:09:19 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, Green Hydrogen, Renewable Power, Air Products, Ammonia, renewable energy, solar energy, shipping, transportation, nitrogen, hydrogen electrolyser, toluene, methylcyclohexane

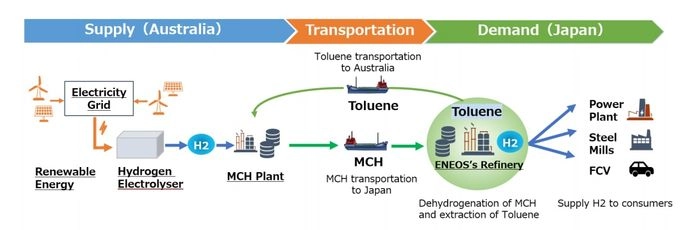

The exhibit below highlights one of the more significant constraints for green hydrogen, which is that the abundant low-cost power opportunities (strong wind and lots of sunshine) are often not where demand for hydrogen exists and the challenge is how to transport it. The problem with reacting it to make something else and then recovering it at the point of use or a distribution hub is that hydrogen is very light and you end up moving a lot of something else to get a little hydrogen. Air Products is looking at making ammonia in Saudi Arabia and shipping the liquid ammonia and the project below is looking at using toluene as a carrier in what appears to be a closed-loop with toluene moving one way and methylcyclohexane moving the other way. The liquid shipping would be cheap, but with the MCH route, only 5% of what you would be moving to Japan would be the green hydrogen. Using ammonia the green hydrogen content is slightly less than 18%, but you have to make the nitrogen on-site. The cost of making the nitrogen would be a function of the local cost of power and these remote locations should have very low-cost renewable power. In the example below, the opportunity is likely unique to the refinery structure and shipping opportunity and we doubt that it is easily replicated in a way that would be more economic than shipping ammonia or shipping compressed hydrogen itself.

Source: H2 Bulletin, August 2021

Carbon Pricing: Tax Could Enable a Game Changer

Mar 2, 2021 10:30:26 AM / by Graham Copley posted in ESG, Carbon Capture, Wind Power, Biofuels

The most significant item worth discussing today is yesterday’s news that the API is likely to support a carbon pricing mechanism in the US. We will have more on this in our ESG and climate piece tomorrow. This is not a game-changer in itself, but it opens the door for one. Imposing a cost on emissions, whether a direct tax or a trading mechanism, as in Europe (but hopefully better managed in the early stages), will likely drive real change and significant investment, as it has done in Europe. The devil will be in the details and how many loopholes are attached to any regulation. For example, the chemical and energy industries are likely to lobby hard for no carbon taxes on exports for fear of losing competitiveness.

Wind Power - Volatility and Possible Solutions

Feb 22, 2021 9:18:07 AM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Wind Power

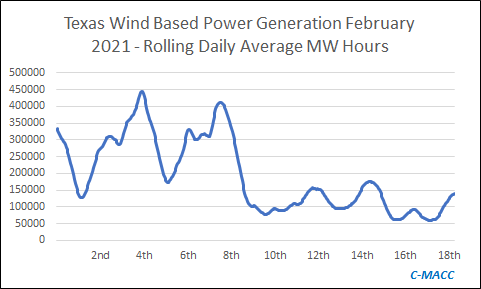

Texas wind-based power in February 2021: