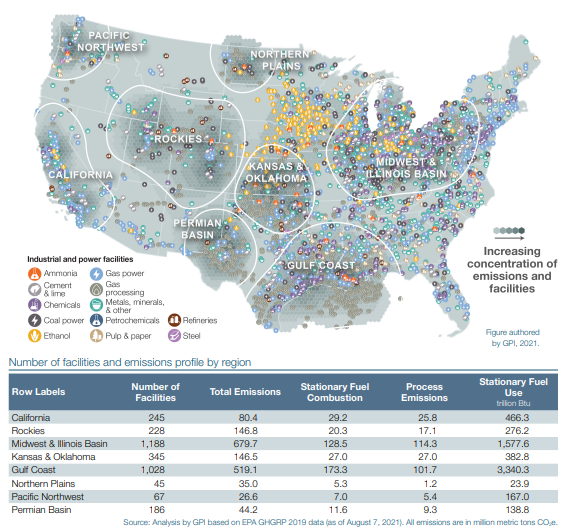

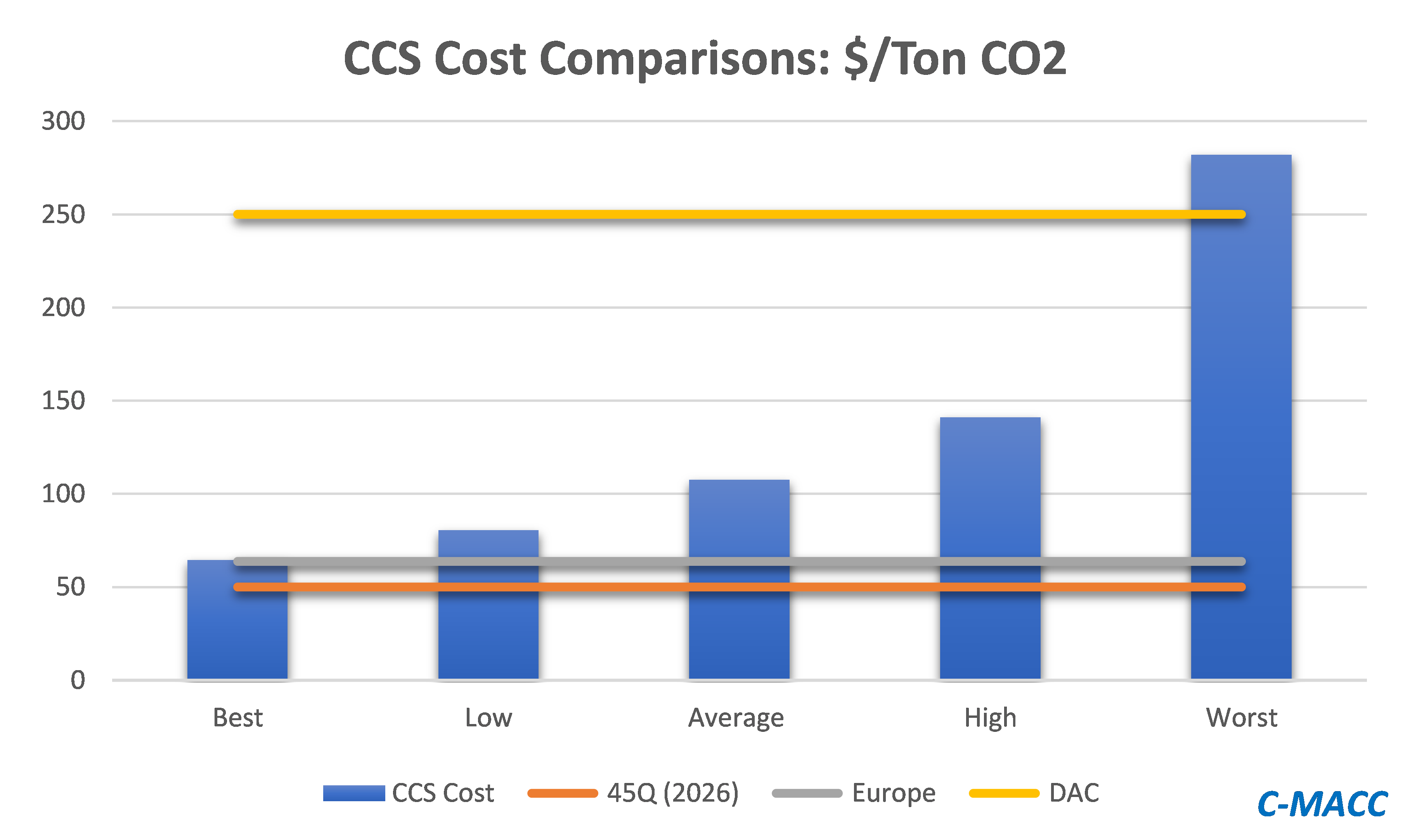

The Green Plains Institute analysis below draws heavily on the EPA emissions data by facility, but correctly, in our view, identifies where CCS makes the most sense in the US. We still struggle with the pipeline distances associated with some of these ideas as CO2 disposal is still a cost for emitters and in any attempt to reduce costs, pipeline distances will be key. We have discussed the opportunity recently for massive blue hydrogen investment (including CCS) to replace industrial heating fuel and this would apply in all of the regions below. Note our conclusions in today’s ESG and Climate report that we expect renewable power installation goals to fall short – requiring more use of natural gas (for power generation or hydrogen production) with accompanying CCS.

Carbon Capture Plans Advance. US Incentives Remain Inadequate

Feb 2, 2022 12:38:58 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Renewable Power, Emissions, ExxonMobil, Pipeline, natural gas, carbon offsets, direct air capture, carbon offset, climate, DAC, chemical producers, Green Plains Institute

Carbon Offsets: Definitions Are More Important Than Trading Architecture

Dec 16, 2021 1:51:21 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CO2, Emissions, ESG Investing, carbon credit, carbon offsets, direct air capture, carbon offset, climate, carbon credits, carbon prices

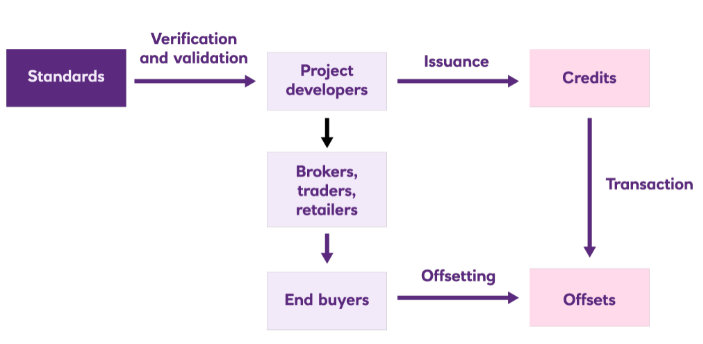

The carbon credit schematic below helps understand the mechanics, but the diagram does not sufficiently emphasize the critical importance of the “Verification and Validation” step. This is a great example of a mechanism that should work logically, but if the input is wrong the output will be also. Potential buyers and sellers of carbon credits understand the process well, but they are more concerned about what goes in the front end as the value of the credit will be very dependent on the quality. Today the only “sure thing” carbon offset is direct air capture, as all of the agriculture-based offsets need much tighter definitions. See research - Carbon Prices – Inequitable and Uncertain – Not What We Need

Direct Air Capture Is Expensive, But Demand Is There

Sep 10, 2021 1:43:32 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CO2, Emission Goals, carbon dioxide, carbon offsets, direct air capture, greenwashing, DAC, carbon neutral hydrocarbons

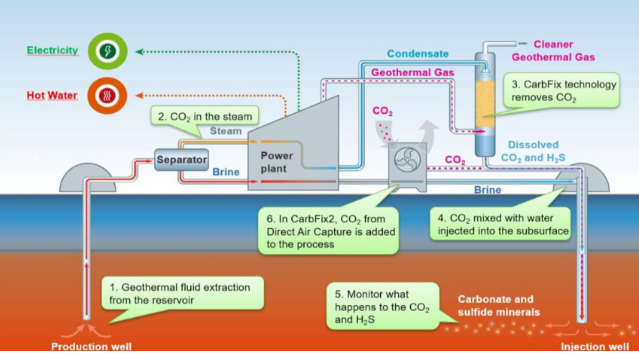

The most notable news from the Iceland CO2 direct air capture (DAC) project, illustrated in the Exhibit below, is not that it is working and how energy efficient it is, but that the CO2 capture costs are extremely high and yet all of the offsets are sold. One report talks about the costs per credit approximating $1000 per ton of CO2, which is likely accurate given that the facility is relatively small scale, at 4 thousand metric tons per year. The same report also states that the credits are almost sold out for the 12 years that they are being offered. We believe that this is indicative of the marginal demand for uncontestable carbon offsets, and this is a topic we have covered at length in our ESG and climate work. Shell, bp, and others are selling what they claim to be carbon neutral hydrocarbons around the world and are buying offsets to do so, but they are coming under quite a lot of “greenwashing” fire because of the less tangible/auditable nature of the credits they are buying – often related to agricultural or specific tree conservation/planting initiatives that are questioned because of the validity of the capture claim or the vulnerability of the credit to weather, fires, and forest maintenance years in the future.

Carbon Offsets: Direct Air Capture Is Not The Only Option

Jul 28, 2021 12:55:50 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Emissions, carbon abatement, carbon values, carbon offsets, direct air capture, methane emission, DAC

There has been a lot of press over the last couple of months around carbon offsets – not least because of Mark Carney’s efforts to legitimize the idea. Mr. Carney’s focus is to create a robust trading platform for the buying and selling of legitimate offsets so that a carbon market can operate efficiently. He believes that without accurate and realistic carbon values, and the ability to buy and sell them, the capital markets around emission reduction will be inefficient and that less money will be attracted into the area. On this, he is probably correct, but in our view, the carbon offset markets have a long way to go.

Will The Offset Market Be Big Enough?

Jun 24, 2021 2:08:50 PM / by Graham Copley posted in ESG, Carbon Capture, Methane, CO2, Carbon, Net-Zero, Schlumberger, direct air capture, carbon offset, offsets

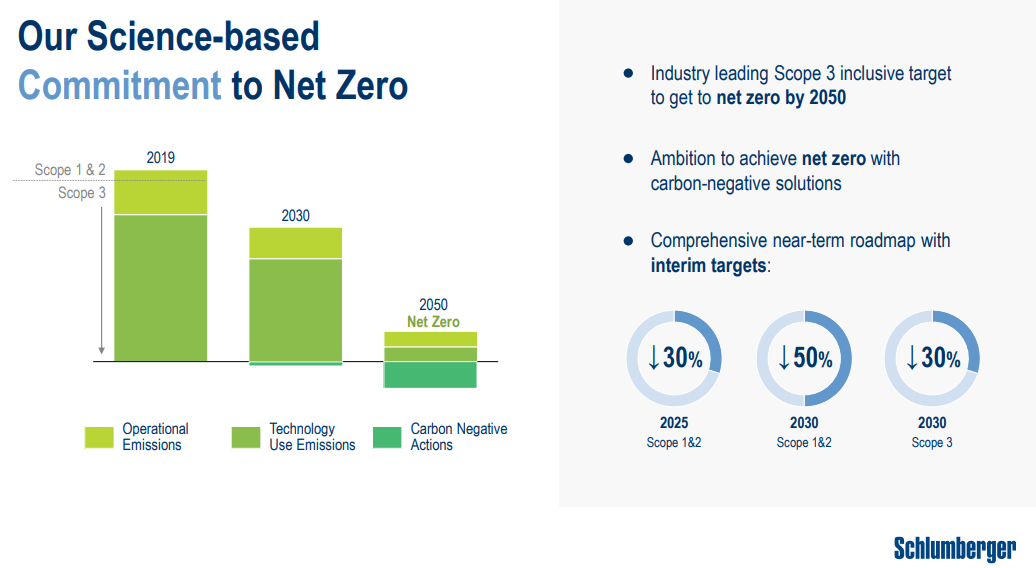

The Schlumberger net-zero goals, as discussed in a couple of articles in today's daily and the presentation linked, set some aggressive but bold ambitions, especially as they are looking to solve problems that they share with their customers, methane leakage from oil and gas wells, and minimizing flaring. Schlumberger is a little dependent on collaboration from its customers here as the technology solutions are likely to be more expensive than current options and the oil and gas producers will need to pay up.