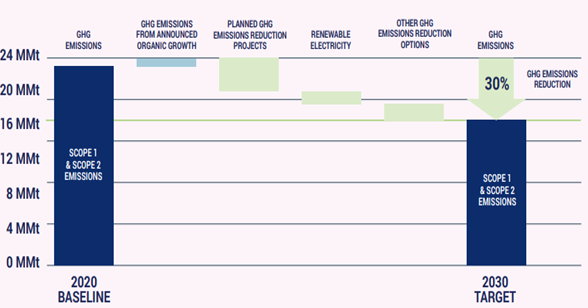

Given the lead time to get some of the emission abatement projects in place – whether it be renewable power or hydrogen with carbon capture – many of the 2030 goals that we see, like the LyondellBasell chart below – are likely to be just that – plans for 2030, with not much in the years in between. We see very little CCS coming online in the US over the next 5 years because of permitting and because of the lead time for any large hydrogen or power project that might be associated with the CCS. Not too many companies seem interested in cleaning up existing CO2 streams and are more interested in building alternative capacity that generates easier to capture CO2 – such as hydrogen from an ATR. These are expensive and long lead-time projects. LyondellBasell, ExxonMobil, Dow, and others might meet their 2030 targets but it might all happen in 2029/30.

Many Of The 2030 Climate Targets Will Not Come Much Before 2030

Apr 13, 2022 3:14:36 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Renewable Power, Emissions, ExxonMobil, LyondellBasell, Dow, carbon abatement, renewable fuels

Carbon Prices Rising, Wind & Solar Costs Also

Apr 5, 2022 12:32:08 PM / by Graham Copley posted in ESG, Climate Change, CO2, Energy, Net-Zero, carbon abatement, solar, renewable energy, wind, carbon prices

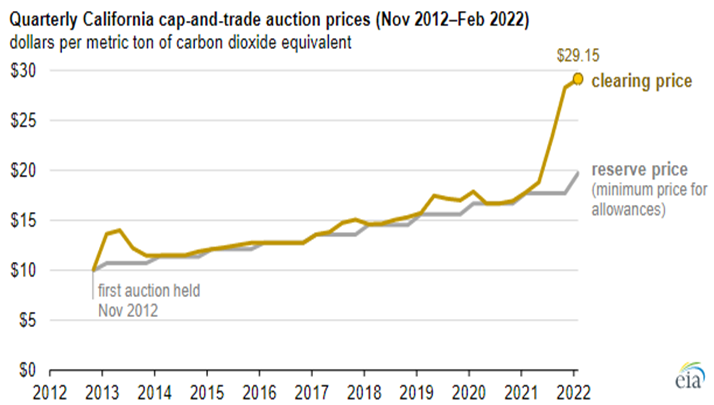

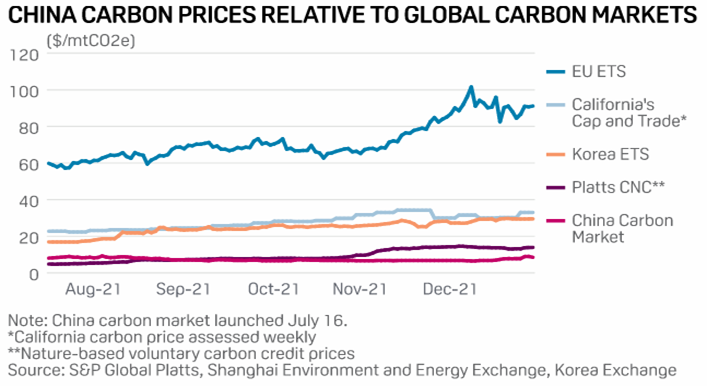

We have written extensively about carbon prices over the last two years and followers of our dedicated ESG and Climate service will know that our expectation is for all CO2 markets to see prices rise to levels that justify large investments to avoid CO2 production or sequester it. We see that price closer to $100 per ton than the $50 per ton that 45Q will rise to by 2026. The California price shown below has much more upside as credits demand rises. Many of the net-zero pledges made by manufacturers and energy producers today cannot be achieved without buying some sort of credit and we expect demand to rise relative to supply through the balance of the decade and possibly quite quickly.

Everyone Is Pushing For A US Carbon Policy, Except Congress

Mar 24, 2022 2:54:22 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Carbon Tax, CO2, Carbon Price, Emission Goals, Inflation, Chemical Industry, Net-Zero, decarbonization, Dow, carbon abatement, carbon emissions, carbon pricing, nuclear power, WPC

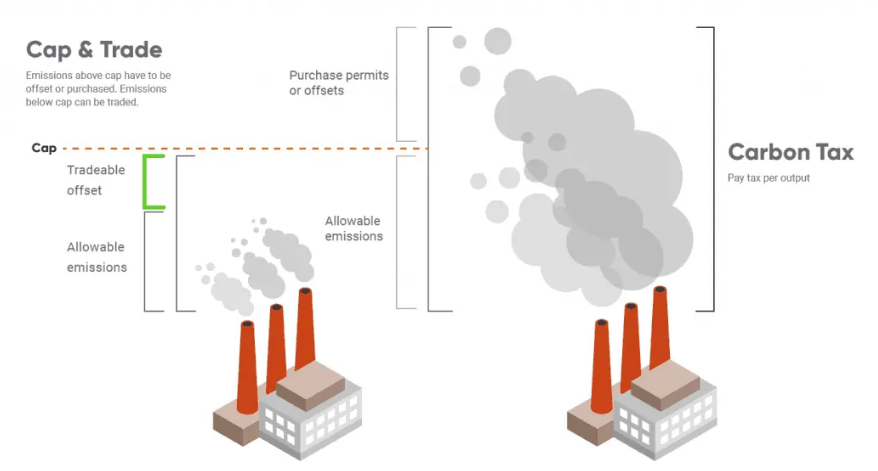

There was a very strong focus at the WPC on the need for carbon pricing in the US to facilitate investment decisions around many initiatives focused on carbon abatement. The consensus was very much that a carbon price – so a cap and trade system like they have in Europe – was the best mechanism, and far more likely to drive action and limit inflation than a carbon tax. This is something that we broadly agree with but the US is a bit late to the game and the right caps need to be set so that CO2 prices don’t languish at very low levels for years, as they did in Europe. Jim Fitterling of Dow was somewhat provocative in his comments around nuclear power, but we see this as part of a broader initiative aimed at getting a serious dialogue moving around how we make the practical steps needed to drive carbon lower. Nuclear power provides stable baseload and is carbon-free – a small modular nuclear reactor could generate enough steam and enough power to drive the decarbonization of major chemical complexes – one investment for example could transform one of the larger Dow sites. If we are going to get to net-zero targets without nuclear, we need much more progressive policies – especially around carbon pricing – which is likely the direction that Dow would like to take the discussion.

Carbon Pricing Will Be Critical For Investment Decisions, Lack of Clarity Will Cause Delays

Mar 3, 2022 1:35:16 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, CCS, Blue Hydrogen, CO2, Carbon Price, bp, carbon dioxide, carbon abatement, manufacturing, carbon pricing, Evonik, cost curves

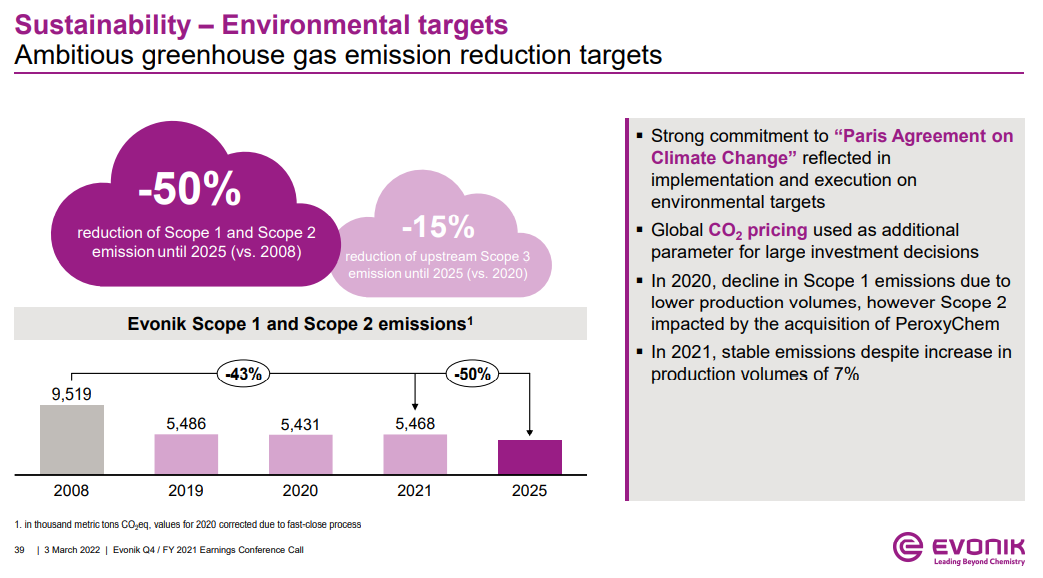

The Evonik discussion around CO2 prices is both relevant and important as CO2 values will be a critical component of investment decisions for many industries going forward. Those waiting for explicit guidance on CO2 prices are likely to be disappointed as we are not seeing much global coordination today and as we discussed yesterday, the European market, which had been the better indicator in our view over the last 18 months, has collapsed in the wake of the Russia/Ukraine conflict as some countries ask for it be suspended, while speculators are assuming that lower gas supplies into Europe will lead to lower emissions and less demand for credits. One of the options here is to take the bp approach and assume a carbon price in investment decisions. Early last year, bp indicated that it would fix on a carbon price of $100 per ton in its longer-term planning. We believe that this is a ballpark steady-state for CO2 pricing but that traded prices could be quite volatile around that level, depending on the mechanisms used. But even if we have a consistent carbon price, we will see significant changes in industry costs and competitive cost curves based on the various costs of carbon abatement. We have written in the past that we could see huge benefits to the US manufacturing base because of the combination of relatively low-cost hydrocarbons and relatively low-cost CCS opportunities. By contrast, we see costs rising steeply in places like central West Europe, where the local CCS opportunity is off the table. Even if Europe can produce cost-effective blue hydrogen on the coast, getting it to central Europe will be an issue. The landscape is less clear in Asia, but we expect to see some competitive edge for countries with low-cost CCS options – Malaysia, Indonesia, Thailand, and parts of China. See more in today's daily.

Could Cutting Emissions Give ExxonMobil A Competitive Edge?

Jan 19, 2022 2:11:51 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Sustainability, LNG, Plastics, CCS, CO2, Renewable Power, Emissions, ExxonMobil, Net-Zero, carbon abatement, climate, carbon neutral hydrocarbons, Climate Goals

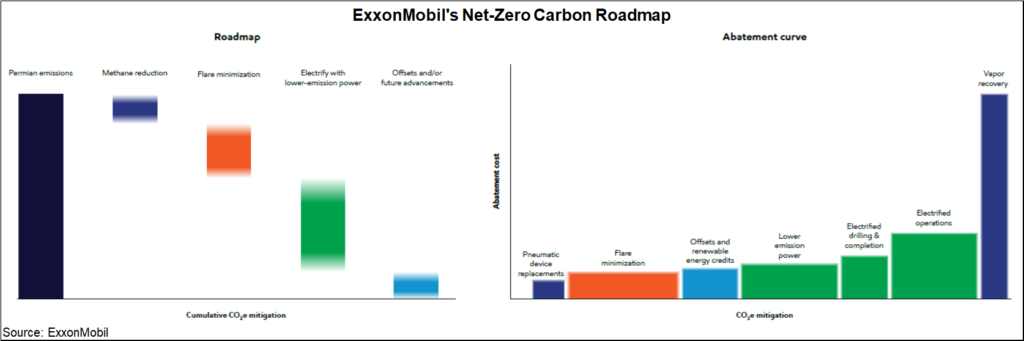

One piece of big news early this week was ExxonMobil’s announcement that it is developing plans that will drive net-zero emissions by 2050 and the company shared a detailed overview. We have picked some charts from the report, some of which can help us draw conclusions for ExxonMobil, but others are more general. The company is banking on a lot of emission reduction and CCS to get to the 2030 target and a large part of the goal is likely to come from the plans for the Permian and the previously stated net-zero target that the company has for 2030 – detail on how this will be achieved is shown in the Exhibit below, see more in today's ESG report.

Few Carbon Prices Justify Abatement Investment Today

Jan 6, 2022 12:06:19 PM / by Graham Copley posted in carbon abatement, Carbon Sequestration, carbon pricing

As the chart below shows, there are some very wide ranges in carbon prices today, with only the European price (and only this year) reflecting an approximation to the cost of physically abating carbon dioxide emissions. We cover carbon values in detail in our focused ESG and Climate work and have been suggesting since before we began the dedicated service that it will take an incentive of around $100 per ton of CO2 to get the acceleration of investment needed for CCS to play a major role in emission abatement and perhaps high levels than this for alternative heating technologies than furnaces to makes sense in areas where CCS is not an option.

CCS Is A Cost And Some Projects Look Too Expensive

Dec 15, 2021 1:53:44 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, carbon dioxide, carbon abatement, LCFS credit, climate, pipelines, 45Q, Carbon Sequestration, abatement costs, CAPEX, CO2 pipelines, OPEX, Summit Carbon Solutions

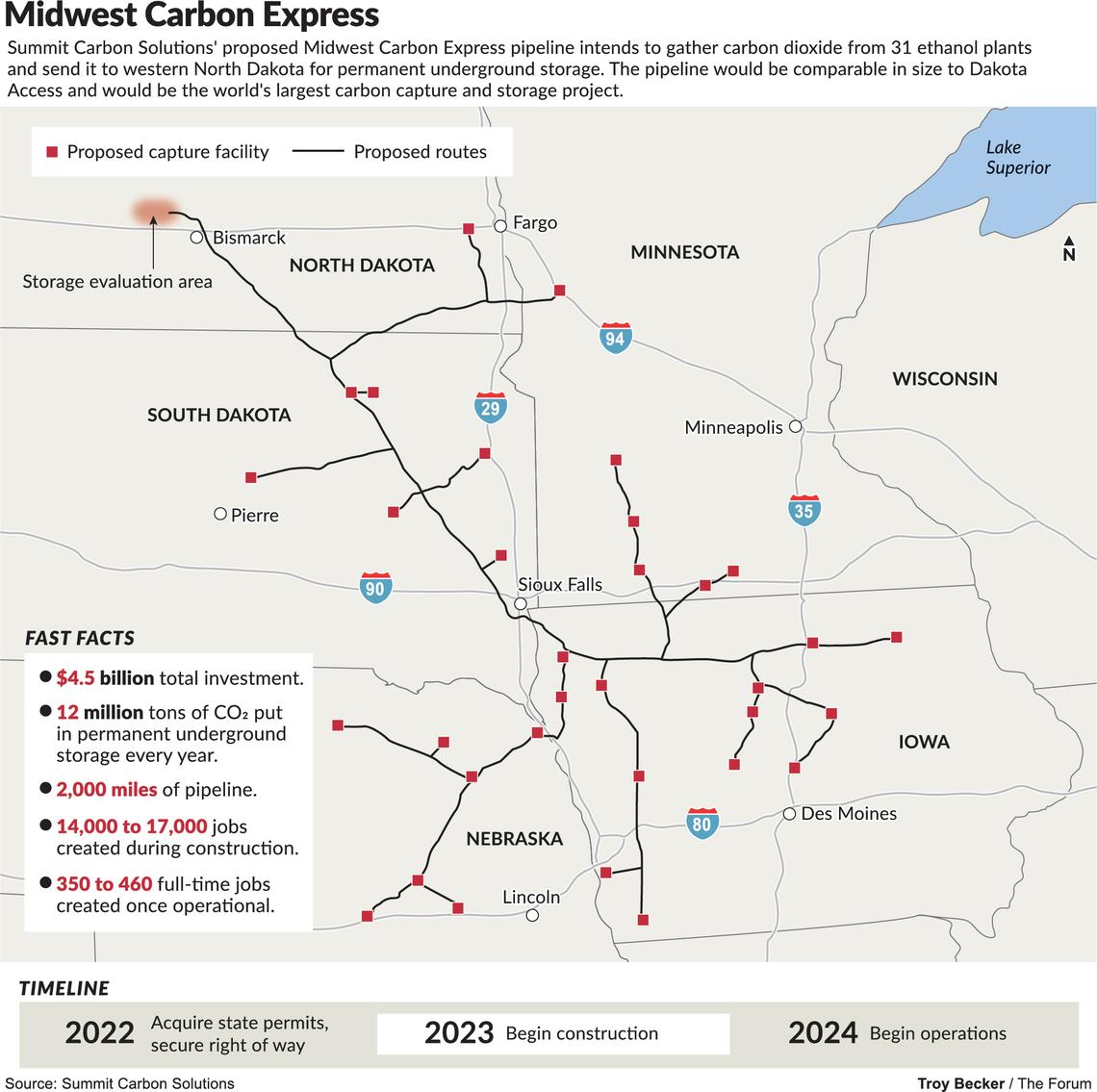

As we have mentioned before, we see a couple of major challenges with the CO2 pipelines proposed for the mid-West, one of which is summarized in the Exhibit below. The first issue is pipeline right-of-ways, as there are already activists determined to oppose the pipelines, and opposition to pipelines has been a core them of the last 10 years. The second issue is cost. Carbon abatement is a cost for all looking for solutions and even where incentives exist, such as the 45Q program or the LCFS fuels program, the challenge will still be creating a path with the lowest. Compression and pumping costs are high for CO2, especially if the pipeline wants a pressure that will allow for direct injection into a series of wells. Lower pressure transportation by pipe is inefficient and raises the capital cost of the pipeline – so it becomes a trade-off – CAPEX vs OPEX. $4.5 billion of investment – as suggested by Summit – is $375 per annual ton of carbon dioxide sequestered - $37per ton assuming 10-year straight-line payback – twice that if you want a 10% return. This is before a dollar of OPEX and pipeline costs could easily exceed another $30+ per ton, with separation and purification of the CO2 stream also not free. Unless the ethanol producers are paying Summit and Navigator to take the CO2, the math becomes very challenging. See today's daily report and our weekly ESG and Climate report for more.

Uncertainty And ESG Pressure Likely To Cause More Energy Price Spikes

Nov 24, 2021 2:09:08 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Renewable Power, Energy, Emissions, ESG Investing, Net-Zero, carbon footprint, carbon abatement, carbon offset, energy transition, climate, energy inflation, energy prices, carbon pricing, ESG Pressure, fossil fuels

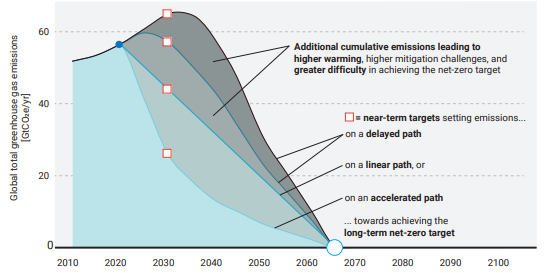

In a media interview earlier this week (more details to follow) we were involved in a discussion about inflation and specifically energy. The discussion covered much more than this, but the chart below is perhaps one of the easier ways of showing where our concern lies, and it ties directly to the behavioral patterns that are emerging concerning climate change and ESG focused investing. As noted in the title of the chart, the likelihood that the linear path from here to net-zero will work is very low, given that we would need global government coordination now, and we are far from it. The other scenarios are much more likely, at least in the early years, and they call for an increase in emissions, which implies growing demand for fossil fuels and other materials that have a high emissions footprint. If you are an oil or gas producer and you look at the chart you could quickly conclude that while your products are in demand today and likely to be in growing demand for several years, the longer-term outlook is very unclear. This might slow down your investment plans, or at least make you think twice about the shorter lead-time projects – such as on-shore and shale-based. However, it could kill any longer-term offshore/deepwater projects that take many years to bring on stream. Today we see energy investment hesitancy everywhere (see our Chemical Blog), but at the same time, we do not see the global coordination to drive a faster energy transition, assuming we had the materials and the investment dollars to move any faster. The risk that we run out of produced fossil fuels from time to time over the next 3-5 years is very high.

As The Focus On Carbon Increases, Fairness Will Become An Issue

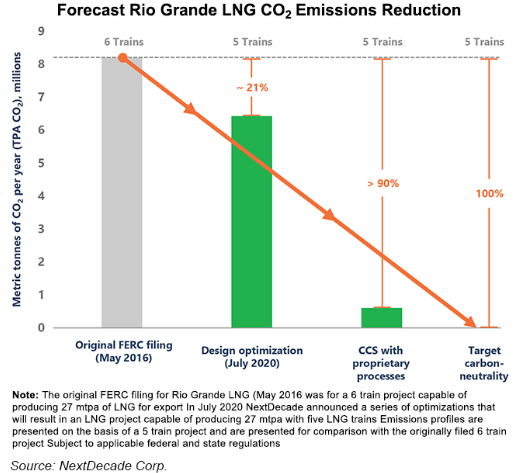

Nov 23, 2021 12:31:25 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, LNG, CCS, CO2, Emissions, Carbon Price, Air Products, decarbonization, BASF, carbon abatement, climate, Venture Global, Freeport LNG, Golden Pass, Cameron, NextDecade, decarbonize LNG, Cheniere

In our ESG and Climate report tomorrow we are focusing on the very wide range of carbon prices and the structures of the various emission reduction incentive schemes, with a focus on what it does to the competitive landscape within the impacted markets. For example, with the government subsidy being offered to BASF and Air Liquide for the CCS project in Antwerp, some level of competitive edge will be granted to the companies, because similar subsidies might not be available to others. Last week we discussed the very wide range of potential carbon abatement costs for companies in the same business, driven by technology and geography. If we add to that the potential for some projects to attract subsidies, while others do not, we change the landscape of the competitive playing field. Could we, for example, see BASF shutter production in Germany, where abatement costs are high, and move more manufacturing to Antwerp – something likely to be very unpopular with the German government and trade unions. This is more problematic in Europe because of the open trade policy. For Germany to give the same benefit that BASF has at Antwerp to chemical manufacturers in Germany could be prohibitively expensive given the much higher inland costs of CCS in Europe, assuming any permits would be issued. Alternatives to CCS, such as the electrification of industrial heating processes or the use of hydrogen as fuel might be equally expensive. We see some of the select European subsidies possibly causing discord between the member states.

There Is No Single Solution For Carbon Abatement

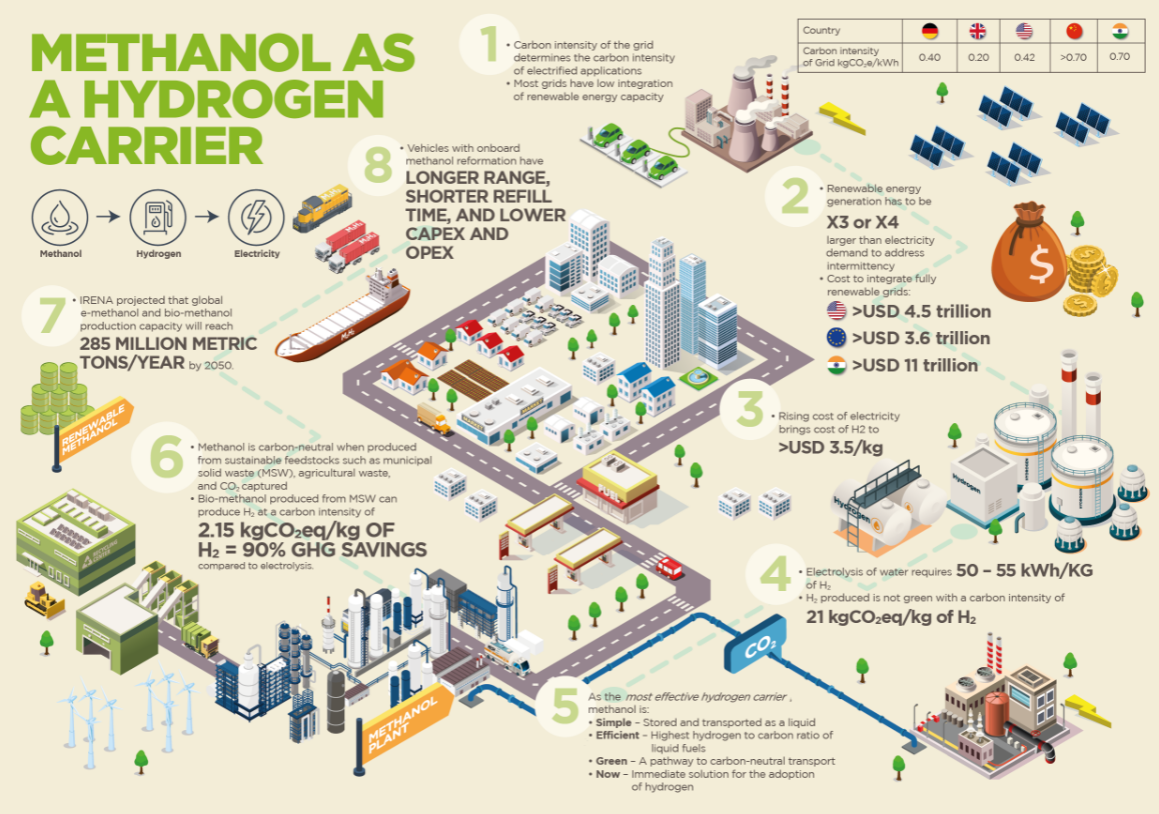

Nov 19, 2021 12:23:34 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, Methanol, CO2, Emissions, Ammonia, carbon abatement, batteries, climate, COP26, carbon credits, carbon pricing

We are going to focus our Sunday Thematic this week (will be found here) on a couple of related topics: alternative technologies that only make sense when prices are high, and whether this has changed with ESG and climate pressure, and ESG solution fixation – “methanol is the only solution” – see infographic below – or it’s hydrogen or ammonia or batteries. Sticking with the theme that seems to have hit a chord with COP26 attendees and something that we discussed in a report around carbon capture several months ago – we cannot let a foolhardy quest for “perfect” get in the way of more economic “good enough” solutions. The emission issues are generally site and process specific and different solutions will be more practical and affordable for different processes and in different geographies – there is no “one size fits all” solution.