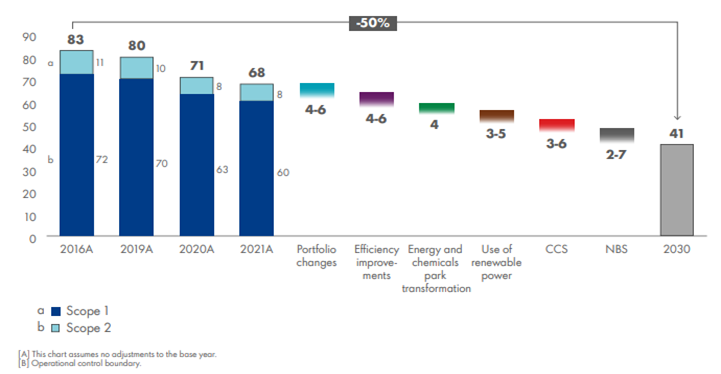

Shell issued its 2021 energy transition progress this morning and the report contains a lot of detail about what Shell has done so far and what the company intends to do. The report is a record of progress and intent and is targeting both general stakeholders as well as the Shell board and annual meeting, where approval of the plan will be sought. When compared with other reports we have seen from other companies, this summary is comprehensive. It provides some concrete steps to achieving emission goals in 2030 – exhibit below - while remaining appropriately vague about getting to 2040 and 2050 targets. However, we would note how much portfolio changes likely added to the 2016 to 2021 progress – likely proportionately much more than they are expected to contribute from 2022 to 2030. Both renewable power and CCS figure in the 2030 projections below and Shell will need to get moving on the CCS front of it is to sequester 3-6 million tons of CO2 per annum by 2030. The expectations are likely based on the European offshore projects, as it may take longer than 8 years to get permits and investments in place in the US. The US could move faster but the EPA would likely need to grant primacy to at least Louisiana and Texas for things to speed up and we are not convinced that this will happen soon. Like many of the other company 2030 plans that we have seen, it is likely that much of Shell’s progress will come in the last couple of years of the decade – especially on CCS.

Shell Saying All The Right Things, But Likely Not Enough

Apr 20, 2022 2:24:59 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, LNG, CCS, CO2, Energy, Shell, fossil fuel, carbon values, energy transition, carbon intensity

Is There A Place For Coal In Energy Transition?

Dec 23, 2021 12:35:22 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Coal, CCS, Blue Hydrogen, Net-Zero, fossil fuel, IEA, carbon footprint, natural gas, energy transition, climate, carbon storage, Climate Goals, material shortages, clean fossil fuel, coal gasification, Build Back Better

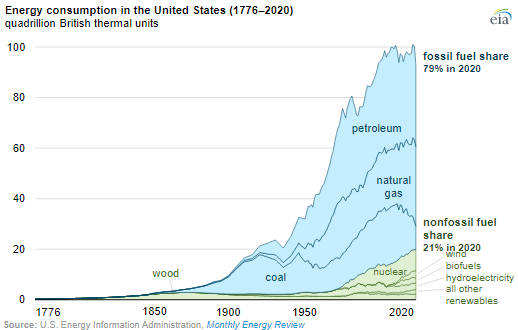

In yesterday's ESG and Climate report, we looked at an extreme example of how the right support for clean fossil fuel use through a long period of energy transition, could create economic growth, support job growth, and not require subsidies – coal gasification to produce low-cost hydrogen. With the opposition to the “Build Back Better” bill, there is a clear opportunity for the fossil fuel industry to step up and suggest compromises, and we are seeing increasing interest in large scale CCS, despite its cost, in part because it is a path that will allow natural gas and other fossil fuels to meet increasing demand in a way that has a much lower carbon footprint, and in part, because it will still be cheaper than some of the heavily subsidized ideas to try and accelerate investments in renewable power that will inevitably fall foul of equipment and material shortages – something we have written about at length in past research – linked here. The EIA has already noted that coal use in 2021 has risen globally and it is likely that it will rise again, given the increasing demand for electric power and the lack of supply elasticity in the renewable power and natural gas-based systems – coal is a large part of the swing capacity these days. Many of the CCS projects proposed for the US are not much more than proposals today, but we are seeing some initial investment to prove that subsurface storage opportunities are feasible.

Carbon Use: Important But Not As Impactful As Sequestration

Oct 19, 2021 1:45:27 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Methanol, CCS, CO2, fossil fuel, carbon footprint, carbon abatement, energy transition, Celanese, Carbon Use

We want to focus on carbon use today, in part because we have written extensively on sequestration recently, in part because of the headline highlighted below, and in part, because we need something fresh for our ESG and Climate report tomorrow! Carbon use does not get much press beyond EOR, but there are emerging technologies and there is a lot of R&D spending – on how to collect CO2 more efficiently and on what it might then be used for. We suspect that almost everything being looked at will have some application, but that there will be limits to those applications and they will likely be niches in nature, but not necessarily unprofitable.

Net-Zero Pledges Remain Well Below What Is Needed: 2030 Particularly Worrying

Oct 13, 2021 12:27:36 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Energy, Net-Zero, fossil fuel, IEA, clean energy, COP26, Climate Goals, energy technologies

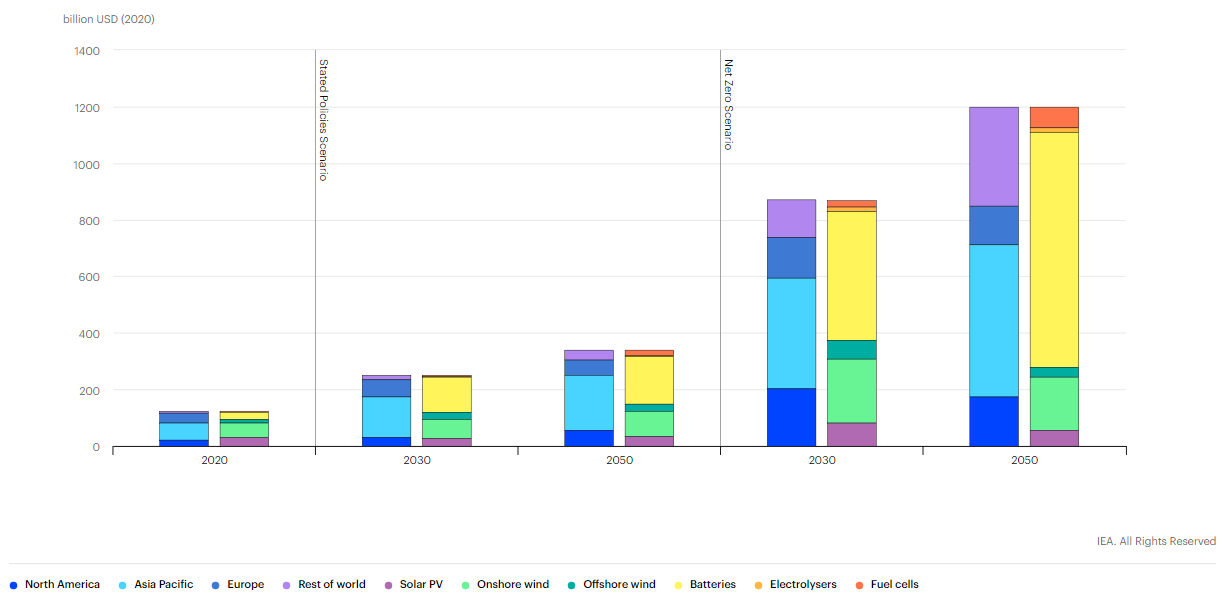

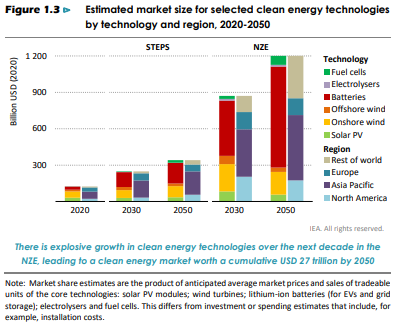

The IEA chart in the exhibit below is another stark reminder of how far away stated policies for clean energy are from what will be needed, and the 2030 gap is the most significant in our view as there is little time to correct it. The IEA has presented several studies over the last year that presents a series of “straw men” examples around how the World and, most recently China, might meet their respective net-zero targets, and the chart below is intended to show how far adrift we are, comparing what is needed to what has been stated. As we have mentioned a couple of times, it would be unusual for companies and countries to have firm plans for 2050 that sum to what the IEA is looking for as there are new technologies under development and the incentive/penalty landscape is still uncoordinated and very unclear. The latter is also a problem looking forward to 2030, but closing the gap between the STEPs scenario and the NZE scenario by 2030 looks almost insurmountable today, without a much tougher and more globally coordinated regulatory landscape, which looks unlikely given some of the low expectations for COP26 specifically. Note that how under the Net-Zero scenario discussed by the IEA, fossil fuel would peak by 2025 and compare this with the EIA analysis that we discuss in today's daily report – there is a huge disconnect.

Chevron Joins The Club, But The Focus On Cleaning Up Its Fossil Fuel Footprint Could Be Important

Oct 12, 2021 2:05:37 PM / by Graham Copley posted in ESG, Carbon Capture, Biofuels, Climate Change, Sustainability, LNG, Methane, CCS, Renewable Power, Carbon, Net-Zero, fossil fuel, carbon abatement, natural gas, carbon trading, offsets, EIA, Chevron, methane emissions, CO2 footprint, COP26, low carbon, methane leakage, carbon credits

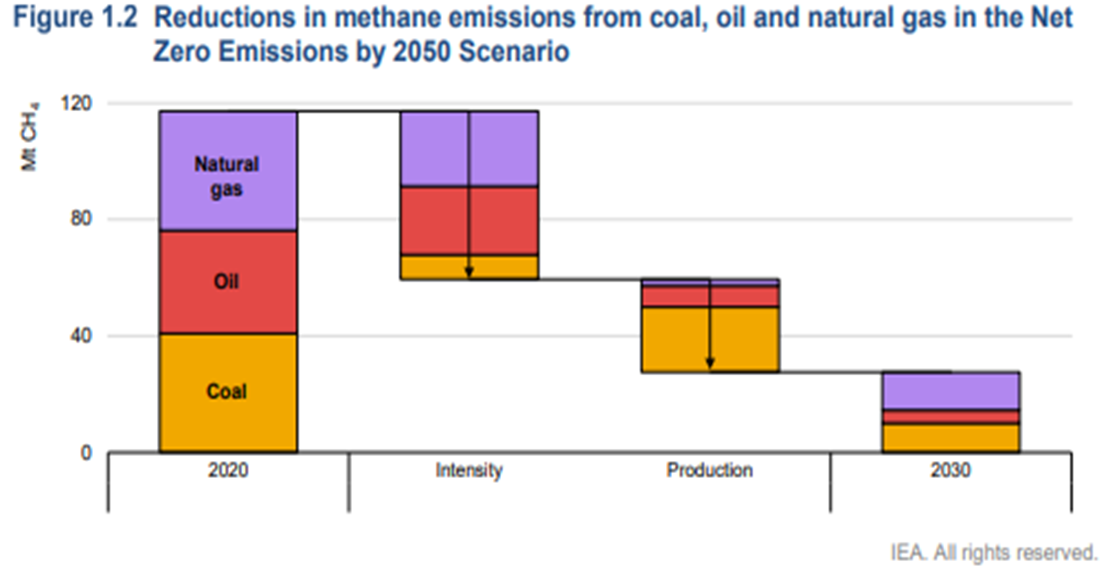

A couple of things worth highlighting in today's daily report – the first being Chevron’s move to join the net-zero club – focusing all eyes now on ExxonMobil in particular but also the rest of the US E&P crowd. Chevron will have some major challenges getting to net-zero and will likely face much of the same skepticism that bp, Shell, and TotalEnergies attracted in Europe initially and still face today. The Europeans have placed a lot of their bets on moving into renewable power – for the moment, Chevron is focused on moving to net zero in its own operations, which we read as biofuels and a lot of CCS. Given the acute shortage of international natural gas, it would make the most sense for the independent natural gas E&P companies and the LNG sellers to jump on the same boat. By promising low carbon natural gas and LNG, the industry is much more likely to gain support for the expansion that the world needs to counter some of the EIA assumptions around coal and petroleum product use from 2030 to 2050. Of course, it would be a whole lot easier for the US industry to do this if they had a value on carbon to work with! The chart below looks at one of the core clean-up issues, which is methane leakage. This is a subject we cover extensively in our ESG and Climate service linked here.

Are We Heading For Fuels/Power Crisis?

Sep 23, 2021 1:25:31 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Carbon Fuels, CCS, CO2, Renewable Power, fossil fuel, carbon footprint, power, synthetic fuels, aviation fuel

In our ESG and Climate report yesterday we focused on sustainable aviation fuel, discussing a recent report from Shell and Deloitte, which shows some of the challenges with getting the aerospace industry to net zero. The report focused on the need for sustainable aviation fuel now, and in large volumes, as this is the only thread that the industry can pull on today – synthetic fuels (from CO2 and hydrogen will be uneconomic for decades, and neither electric powered or hydrogen-powered aircraft are going to be a solution before 2050). The bp, Delta, and Boeing linked headline is one of many that we expect to see as the need for near-term progress is urgent, given the scale of investment required. See yesterday’s report for more detail.

ESG Investing: Reaching Too High vs Staying Too Late

Aug 17, 2021 1:58:20 PM / by Graham Copley posted in ESG, Biofuels, ESG Investing, Fuel Cell, fossil fuel, ESG investment, clean energy stocks, biodegradable polymers

There are two elements/risks to ESG investing and both are highlighted in articles in today's daily report. The first is a reminder that returns matter and this is a reference to the very high multiples that are being applied to some of the more speculative clean energy stocks where there is credit being given today for technology and scale tomorrow. As with the tech bubble, there will inevitably be companies that fail, either because they have an offering that either will not work or will not be economic or because the market moves away from what they are doing. The fuel cell stocks would be at risk if hydrogen remains too expensive to consider as a transport fuel and if batteries or bio-based fuels become the dominant solution. Equally, bio-fuels could fall out of favor if hydrogen is abundant. On the polymer side, better collection and more chemical recycling could make switching to biodegradable polymers unnecessary or uneconomic. There will be winners and losers on this basis and the better strategy is to buy baskets of new technologies rather than bet on just one.

Carbon Capture (If Supported) Will Create Competitive Dislocations

Jul 21, 2021 1:08:19 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, CO2, fossil fuel, carbon footprint, carbon abatement, renewables, European Carbon price, climate

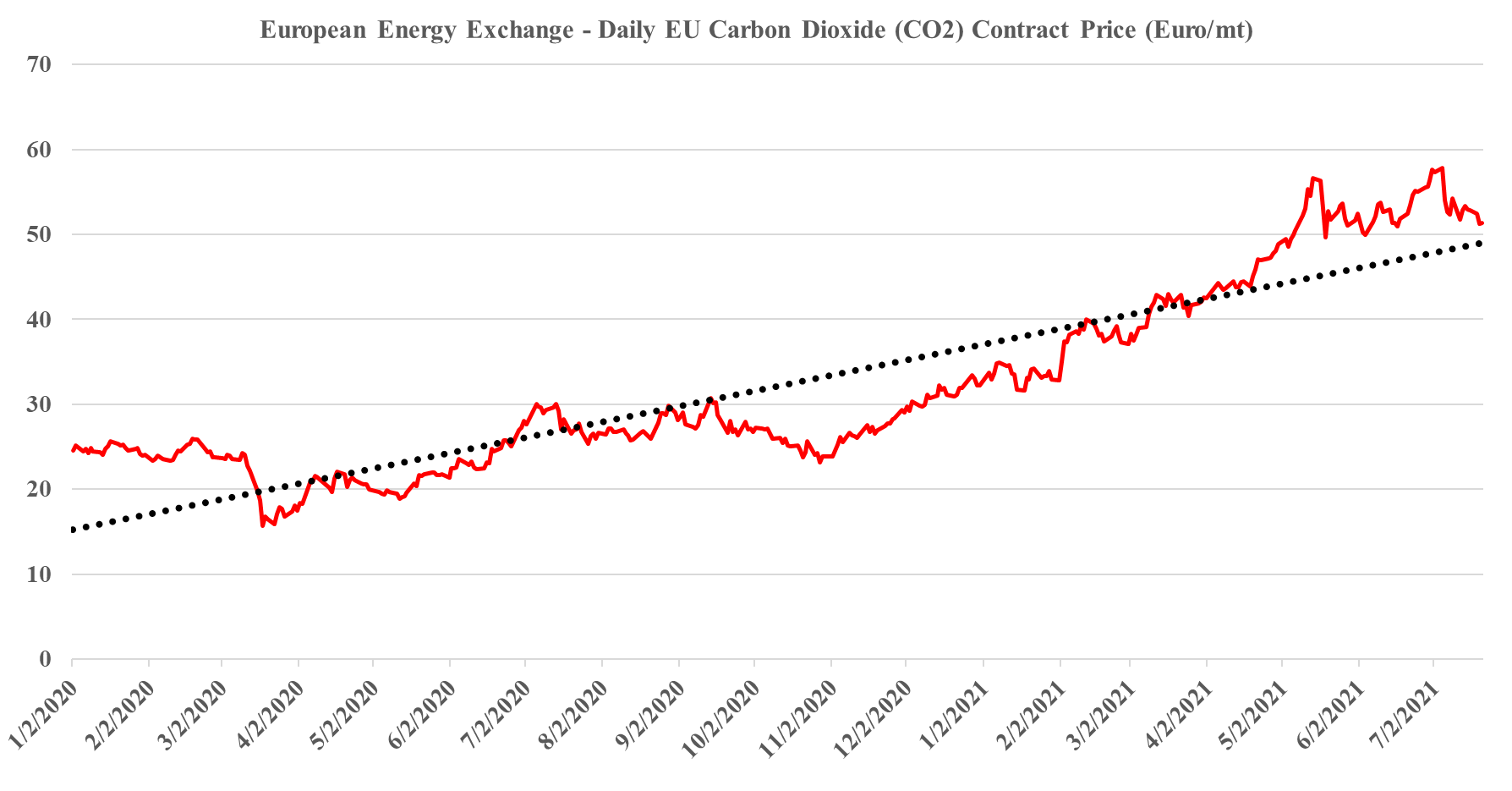

In our ESG and climate piece today we focus on Carbon Capture and Sequestration (CCS) and the likely very steep cost curve between the mega projects and those less fortunate. But as we discuss CCS, we should not forget that the World is still not convinced about CCS as part of the solution set for carbon abatement, as the headline linked discusses. The naysayers are focused on the lifeline that CCS offers to the fossil fuel industry, but always fail to offer an economic rationale for the quick elimination of fossil fuels and their replacement by renewables. Few of the proponents of CCS see it as an alternative to a long term path to alternative means of abatement, but all recognize that relying on renewable power investments will likely leave the World with a much larger CO2 footprint from 2030 to 2050 than what could be achievable with CCS – note that the 45Q incentive in the US has a finite lifespan as there is an expectation that eventually CCS will be unnecessary because of fossil fuel replacement. Chevron has not helped the CCS proponents with its missed targets in Australia as it adds fuel to the argument that CCS has not lived up to its potential. While the European carbon price trend has stalled in recent weeks – chart below – the trend remains distinct and it would be foolhardy to ignore the likelihood of prices rising to a level that makes CCS attractive – especially for the mega-projects.

Unrealistic US Green Power Targets May Cause More Harm Than Good

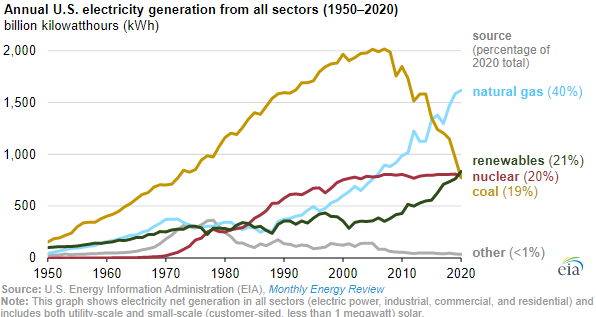

Jul 1, 2021 2:16:28 PM / by Graham Copley posted in Hydrogen, Climate Change, Coal, CCS, raw materials inflation, fossil fuel, natural gas, renewables, batteries, US Green Power, power storage, clean energy, petroleum

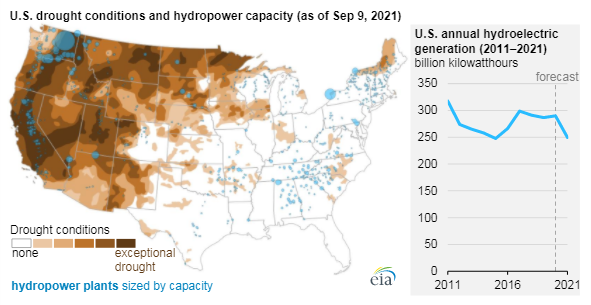

One of the themes that we have focused on in our ESG and Climate work is the lack of realism in the Biden climate plan as it relates to power generation and the same with the plan in California. The more limited reliability factor in renewable power (because of its dependence on cooperation from the weather), means that you have to build a lot more new power capacity than you are replacing and you need to build a storage system for the power – batteries, hydrogen or hydraulic. This gets very expensive and will be more so if the push drives inflation in raw materials – which is already a factor YTD in 2021. Natural gas turbines are a cleaner and reliable source of power and cleaner still if combined with CCS. Politicians in the US are taking a considerable risk by promoting plans that could leave the power grid more vulnerable to some of the issues that we have already seen over the last 12 months (California and Texas). Of course, as the plans call for natural gas phase-outs in 10-12 years, none of those making the decisions today will be in the office to face the consequences!

Bold Climate Initiatives Will Need Equally Bold Incentives & Some Economic Logic

Jun 29, 2021 12:59:46 PM / by Graham Copley posted in ESG, Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Net-Zero, fossil fuel, bp, natural gas, EV

There is an unusual number of interesting topics in today's report, versus the normal mix of small pet projects or broad and unsubstantiated announcements. The EU 2030 targets are worth highlighting and they are in part connected to the central theme of the ESG and climate report that we will publish tomorrow. The European targets are not coordinated with what is happening in the rest of the World and while we admire the ambition, we suspect that the goal is not achievable, simply because the challenges of replacing the power and fossil fuel associated with the emissions to be avoided are too great, given the timeline. The level of additional renewable power generation, EV adoption, and hydrogen production needed to offset so much CO2 are extremely high, and it will be hard to get substantially more CCS offset than already announced because of land rights issues in Europe and logistics. To get the power, EV, and hydrogen, the EU will be competing with other regions that have their own targets and we see scare resources bidding up the price of power, impacting all of the elements, power itself, the cost of running EVs (see the chart below – the EV story does not work of you are using coal as a marginal source of power), and the cost of hydrogen.