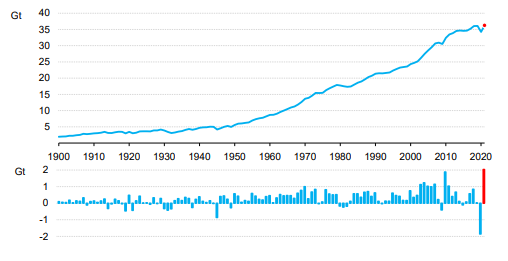

The IEA CO2 emissions data is not a surprise as it has been telegraphed for a while by several commentators that the world went backward in 2021. There were several causes, not least of which was an economy which, with the benefit of hindsight, was overstimulated, pushing up demand for resources in general, including energy. There has also been an overestimation of the rate of investment in renewable power, something which is finally gaining attention more generally, triggered by the energy supply fears that have emerged from the Russia/Ukraine conflict. It will take time to make the very large investments needed to abate the CO2 associated with industrial and consumer activity and there is no overnight fix. Accommodative policies are needed today for investments that will start a decline in emissions several years from now.

2021 CO2 Emissions Levels - The Result Of Too Much Hope

Mar 10, 2022 2:27:05 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Renewable Power, Energy, Emissions, carbon dioxide, renewable energy, renewable investment, manufacturing, CO2 emissions, weather, energy supply, energy demand

Ambitious Renewable Power Estimates Likley Underestimate Inflation

Dec 30, 2021 12:26:23 PM / by Graham Copley posted in Inflation, renewable energy, renewable investment, energy costs, power shortages

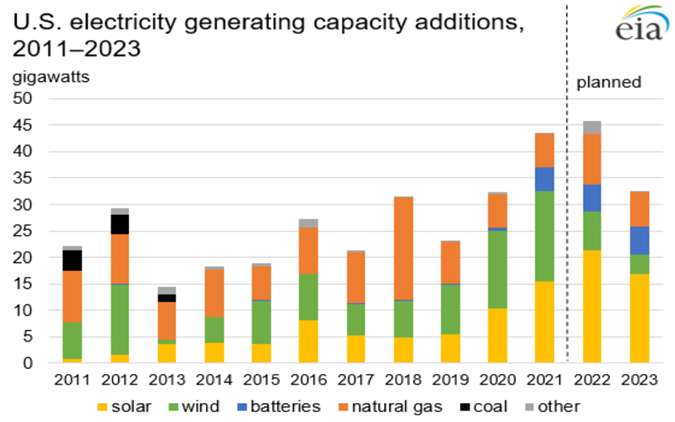

In our ESG and Climate report yesterday we highlighted inflation as one of the most significant risks for 2022 and the estimates in the exhibits below do not leave us any less concerned. The US has struggled to meet solar installation plans for 2021, falling short of early-year estimates because of limited equipment availability and higher equipment prices. While some of this has been the result of the supply chain challenges of 2021, some shortages have also been the result of very strong global demand. The idea that we can increase solar installations in 2022 without creating more supply issues (and more inflation) should be questioned, especially in light of planned additions in China, which will consume an increasing share of Chinese solar modules.

Solar Module Raw Material Costs Reversing Long Term Price Declines

Sep 2, 2021 1:57:21 PM / by Graham Copley posted in ESG, Renewable Power, Energy, Raw Materials, raw materials inflation, solar, renewable energy, renewable investment, solar energy, solar module

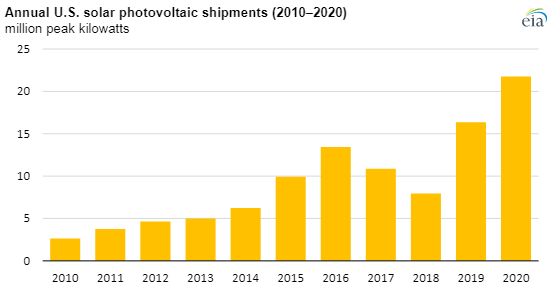

In our ESG and climate piece yesterday we discussed rising costs of climate-related actions, with a focus on some of the likely inflation in renewable power costs. The optimists are looking at the Exhibit below, and what were falling module costs through 2020, and concluding that solar installations can grow and that costs can still fall. While the module shipment growth in 2020 was impressive at 33%, some of the forecasts of what will be needed call for a much more dramatic rate of module growth than we saw in 2020.