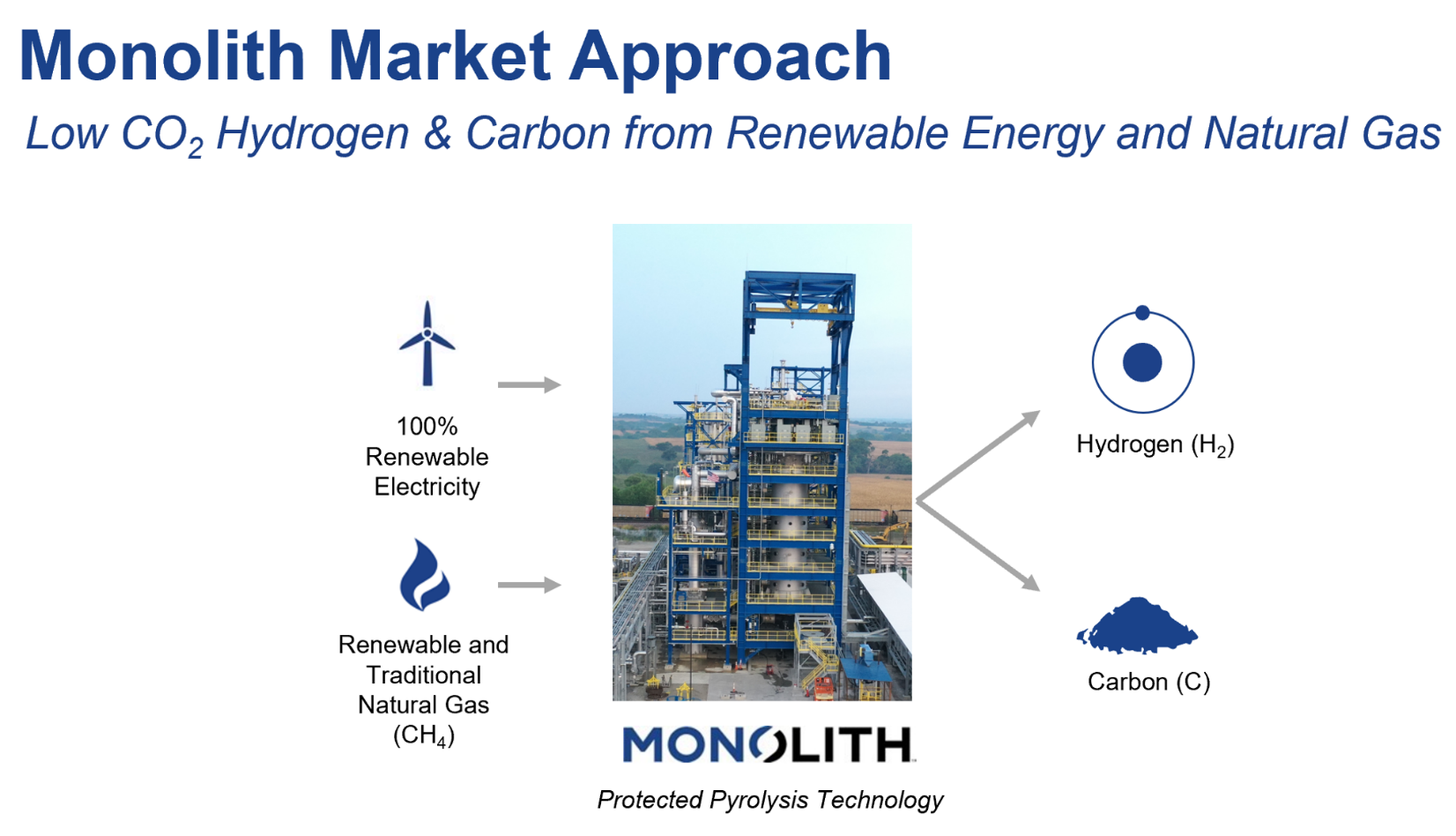

The Monolith announcement is not that surprising, as the auto industry is very focused on its carbon footprint and its suppliers, like Goodyear, are under pressure to look for more sustainable solutions. While Monolith uses natural gas as a feed, it’s carbon black is produced with very limited Scope 1 emissions, unlike the traditional route, used by the incumbents. It is not clear what the production economics are for Monolith because the co-product value of hydrogen could vary greatly depending on local needs, but the emergence of a competitor who sees carbon black potentially as a by-product is not likely to be good news for the traditional makers. A by-product that is more environmentally friendly is even more of a threat. Complicating the picture further could be the arrival of larger volume production from Origin Materials, which has a renewable based carbon black like material, which may also be seen as a by-product.

Carbon Black: By-Product Economics Pose A Threat To Incumbents

Dec 10, 2021 12:03:28 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, Carbon Black, Emissions, Renewable Sources, carbon footprint, natural gas, climate, Environment, Origin Materials, sustainable solutions, Monolith, natural gas feed, manufacturers, by-product

The Pressure Is On The SEC For Better ESG Metrics & Disclosures

Jul 29, 2021 1:32:27 PM / by Graham Copley posted in ESG, CO2, Emissions, Emission Goals, LyondellBasell, ESG investment, Environment, Borealis, SEC, Chemical Sector, OMV, ESG Metrics

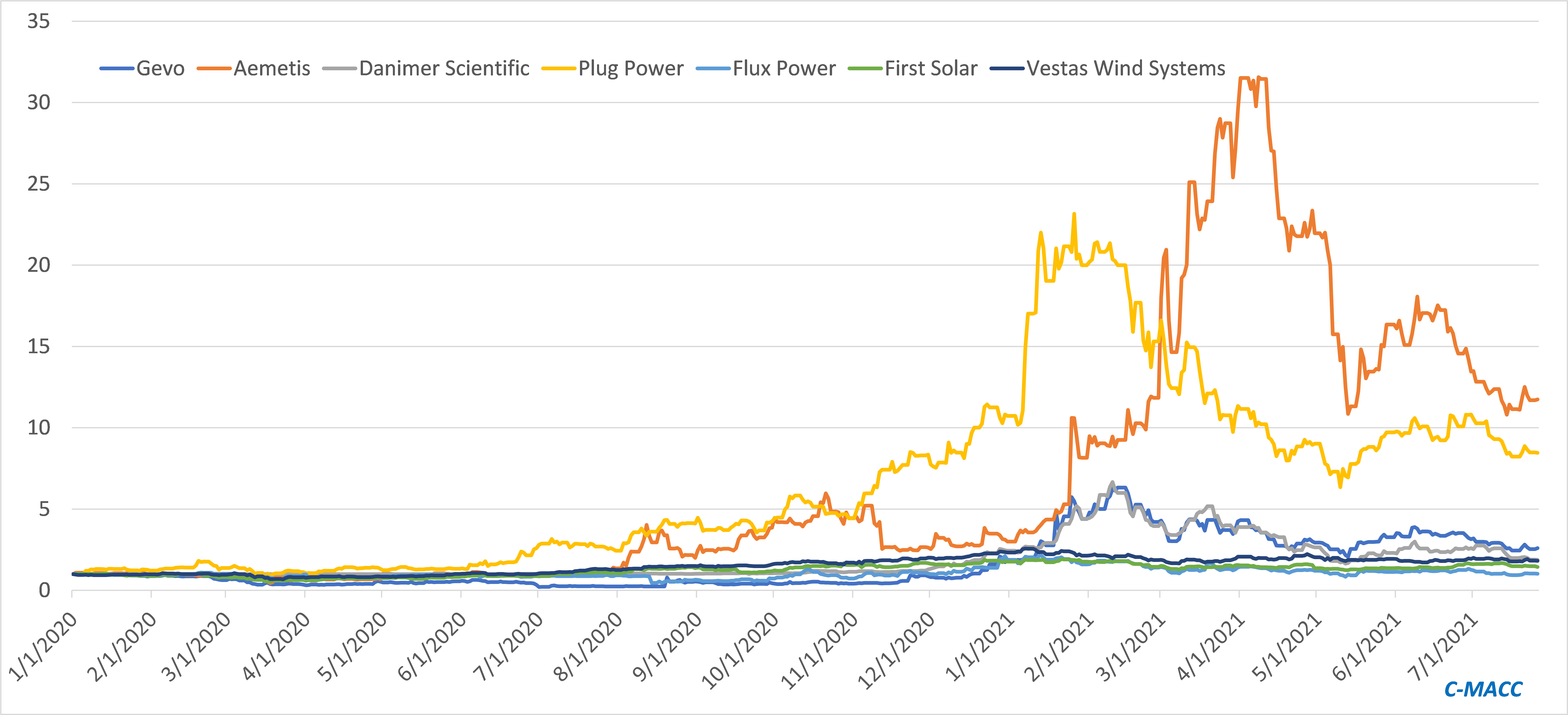

As we discussed in yesterday’s ESG and Climate report, the SEC has some challenges ahead, not just because there are high hopes that it will start mandating a change in terms of disclosure accuracy and consistency, as well as fund definition, but also because, as yet, it does not have the mandate to do so. All eyes are on the regional regulators, in the US, Europe, and other countries to police what is the wild west of reporting. The E piece of ESG is the major challenge and it is where corporates and fund managers alike are dealing with issues and measures that are likely very different company by company within a sector, let alone between the sectors themselves – it is far more complex and harder to analyze than, for example, board diversity.