In our ESG and Climate report tomorrow, we will focus on SAF from a carbon intensity perspective. The Colonial pipeline initiative was inevitable given the demand for jet fuel at the East Coast airports. Still, we would not expect much volume to move in the near term for several reasons. First, there is not that much to move, and second, California can still pay more because of the LCFS credit. The Biden administration is planning to introduce a broad SAF credit which would help encourage use outside California, but this would also need to stimulate production as the volumes are still small and much smaller than the airlines would want – even the projection of volumes by bodies like the IEA fall well short of potential airline demand by 2030 and 2040. This is an investable theme, in our view, and we will discuss it in more detail tomorrow.

Demand And Infrastructure For SAF Is Likely Well Ahead Of Supply

Apr 19, 2022 1:34:16 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, IEA, renewable energy, EVs, materials, sustainable aviation fuel, renewable fuels, fuel, material shortages, carbon intensity, battery, nickel, SAF, airlines

Big Hydrogen Plans But Likely Not Yet...

Mar 9, 2022 12:28:34 PM / by Graham Copley posted in Hydrogen, Green Hydrogen, Blue Hydrogen, Renewable Power, Emission Goals, renewable energy, renewables, materials, material shortages, inflationary pressure, hydrogen economics, electrolyzer, Houston, renewable industry

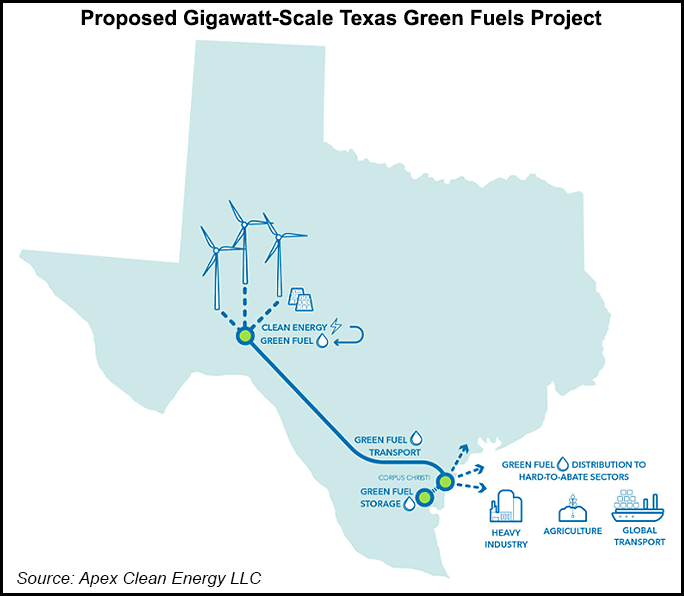

The Texas hydrogen hub is getting a lot of press and we also cover the idea in our ESG and Climate report today. We see this as not a lot more than intent today and would be surprised if any part of the project would be up and running, assuming it gets built at all, before the end of the decade. Green hydrogen economics do not (yet) make sense and some considerable efficiency learning curves need to emerge before any project could expect to make economic sense without significant subsidy. We have talked at length about the inflationary effects of material shortages and this is the core topic of our ESG report again today, where we suggest that a global recession may be the best thing for the renewable industry as it would slow other sectors' demand for critical materials. But the other wild card is renewable power demand, and how many industrial and materials companies along the Gulf Coast have their eyes on the same renewable power capacity to meet 2030 emission reduction goals. No one must buy renewable power today, because no one has 2022 emission goals. So, renewable power demand is likely understated and it is why the premium to buy renewable power in Texas today is quite low. Fast forward to 2030 – when promises have been made – and we will likely see demand spike and prices rise relative to conventionally generated power. This would materially impact the economics of the green hydrogen hub in Texas even if the electrolyzer costs could be reduced. Given the abundant pore space both onshore and offshore, blue hydrogen makes much more economic sense for Houston.

Turbulent Times For The Wind Industry

Feb 4, 2022 1:17:36 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Wind Power, CCS, Renewable Power, natural gas, solar, renewable energy, wind, energy transition, material shortages, wind capacity, onshore wind, price inflation, Siemens Gamesa, logistic issues, offshore wind, solar industry, wind industry

The linked Siemens Gamesa news could not have been a more clear example of one of our key research themes of the last year – backlog up, suggesting strong demand for new wind power capacity – deliveries and profits down because of material shortages – price inflation and logistic issues. While the company is getting squeezed because of higher costs on contracts that have limited opportunity to pass through the cost, at the same time slide 8 of the earnings release deck shows that selling prices rose in fiscal 1Q 2022. This breaks a declining trend in pricing and one of the core assumptions behind many energy transition plans – that renewable power prices can keep falling. Onshore wind orders are falling, but offshore orders are rising – and these come with higher costs and the need for more materials as we showed in a chart in yesterday’s daily. The added costs burden of more offshore wind projects may only serve to tighten markets for materials further, leading to further increases in installed costs.

Another Illustration Of How Important Metals Are To Energy Transition

Jan 21, 2022 1:07:16 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Renewable Power, Metals, Raw Materials, solar, renewable energy, wind, energy transition, Lithium, climate, advanced recycling, materials, low carbon, material shortages, low carbon economy, renewable power production

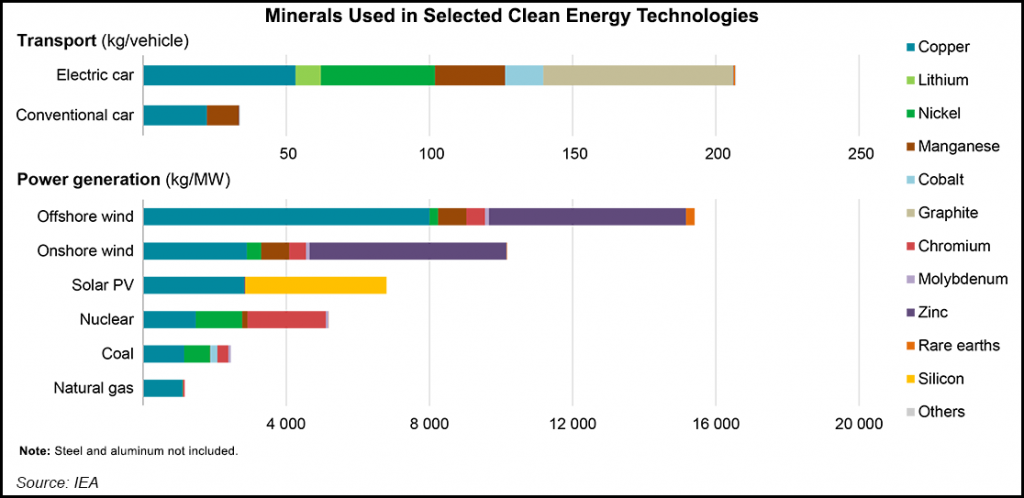

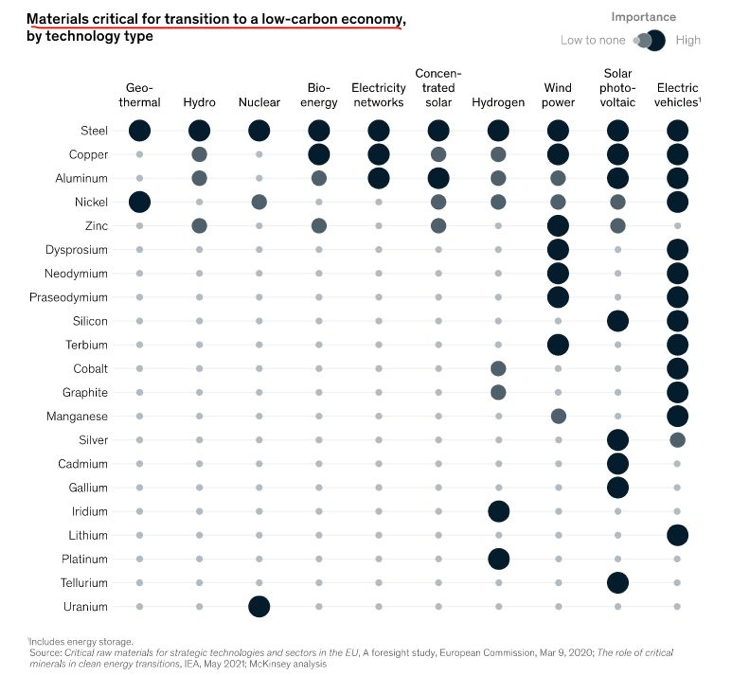

The materials chart in the exhibit below from today's daily report, is worth noting as it highlights all of the materials that are needed to advance the production of equipment required to drive renewable power production and demand. We would make one change to the chart in that lithium should also be added to the wind and solar categories to account for storage that needs to be built, although this could be done through hydrogen production or hydraulically, depending on location. One of our primary concerns concerning renewable power projections is the availability of some of these materials and we have written about the topic at length – most comprehensively in - 2022 – Policy Key, But Inflation Will Distract – Maybe Beneficially.

Renewable Projects: The Constraints Of Material Shortages

Jan 20, 2022 11:58:06 AM / by Graham Copley posted in ESG, Sustainability, Renewable Power, solar, renewable energy, climate, EIA, US natural gas, materials, energy inflation, material shortages, solar capacity, US natural gas demand, renewable capacity

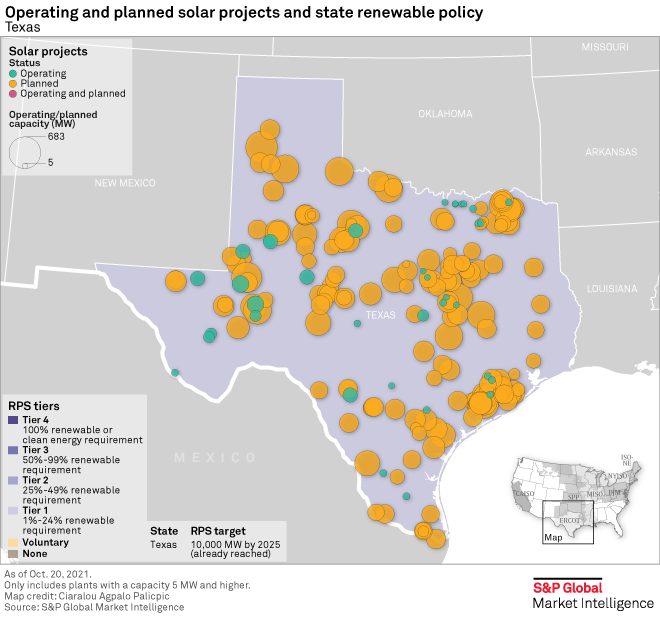

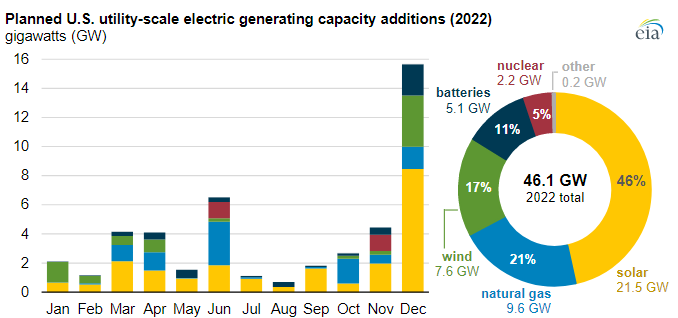

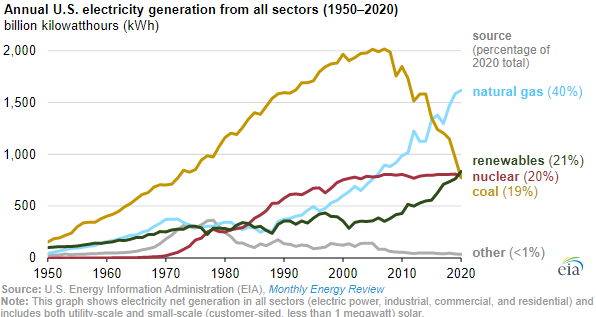

We struggle with both of the charts below, as we see the rate of potential renewable additions as far too optimistic, not because of a lack of capital, but because of a lack of materials and the knock on effect that this could have on capital if project costs increase meaningfully or if timelines extend. The solar expansions planned for Texas for example all require solar modules and there is simply not enough capacity to make these modules and in many cases not enough raw materials. All of these projects are not planned for the same year, but regardless, when you add the Texas plans to plans all over the World, you have an annual rate of addition that the equipment makers will not be able to meet. Today, many of the projects are in the planning and financing stage and the installers have yet to go looking for equipment – when they do, they may have to rethink.

Energy Is Going To Be A Real Challenge In 2022 Regardless

Jan 14, 2022 2:36:39 PM / by Graham Copley posted in ESG, Sustainability, LNG, Coal, Energy, decarbonization, IEA, natural gas, renewable energy, EV, climate, materials, decarbonize LNG, material shortages, transition fuel

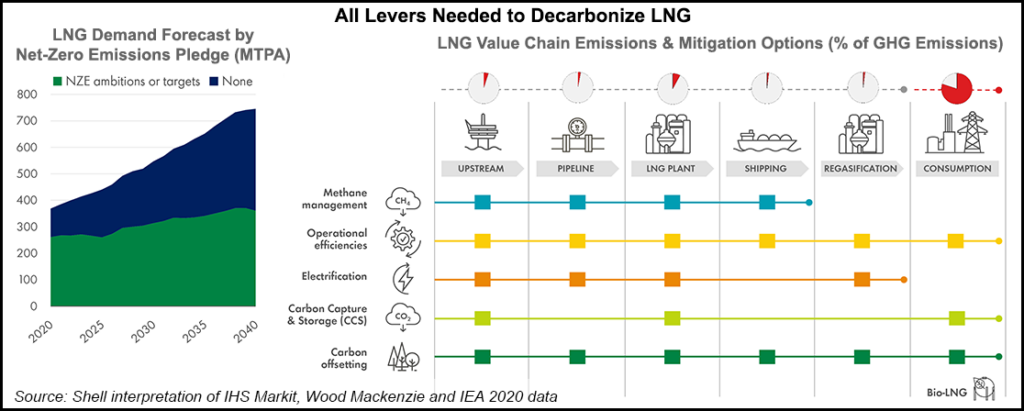

The first chart below has been included in a similar form in prior work and is a good summary of what is needed to decarbonize the LNG market to the greatest degree possible. There is a lot of resistance to the idea of endorsing natural gas as a transition fuel, but so many developed and developing countries need natural gas – often in the form of LNG – to displace or avoid (additional) coal use. If the LNG industry does not start to pursue the paths suggested in the exhibit, and reasonably quickly, it will stand very little chance of winning, or perhaps surviving, a PR battle that is very much stacked against it.

2022 Power Additions Look Ambitious - More Upward Pressure On Natural Gas?

Jan 11, 2022 2:01:38 PM / by Graham Copley posted in LNG, Coal, Renewable Power, Energy, natural gas, power, energy transition, greenwashing, fossil fuels, material shortages, energy industry, power capacity, natural gas demand

First, it is going to be an uphill struggle to get some common sense around the continued use of fossil fuels during any period of energy transition if the activists take away all resources from the energy industry – banking, PR, etc. While there is plenty of work to be done to minimize greenwashing, there is also plenty of work that needs to be done to explain why fossil fuels are still needed and how we can use them as cleanly as possible. If it becomes a business risk to bank or advise any company in the fossil fuel industry, while there will inevitably be workarounds, the net effect will be continued underinvestment, in production and in cleaning up the fuels and the concerns that we raised for natural gas in our Sunday Thematic will happen.

Is There A Place For Coal In Energy Transition?

Dec 23, 2021 12:35:22 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Coal, CCS, Blue Hydrogen, Net-Zero, fossil fuel, IEA, carbon footprint, natural gas, energy transition, climate, carbon storage, Climate Goals, material shortages, clean fossil fuel, coal gasification, Build Back Better

In yesterday's ESG and Climate report, we looked at an extreme example of how the right support for clean fossil fuel use through a long period of energy transition, could create economic growth, support job growth, and not require subsidies – coal gasification to produce low-cost hydrogen. With the opposition to the “Build Back Better” bill, there is a clear opportunity for the fossil fuel industry to step up and suggest compromises, and we are seeing increasing interest in large scale CCS, despite its cost, in part because it is a path that will allow natural gas and other fossil fuels to meet increasing demand in a way that has a much lower carbon footprint, and in part, because it will still be cheaper than some of the heavily subsidized ideas to try and accelerate investments in renewable power that will inevitably fall foul of equipment and material shortages – something we have written about at length in past research – linked here. The EIA has already noted that coal use in 2021 has risen globally and it is likely that it will rise again, given the increasing demand for electric power and the lack of supply elasticity in the renewable power and natural gas-based systems – coal is a large part of the swing capacity these days. Many of the CCS projects proposed for the US are not much more than proposals today, but we are seeing some initial investment to prove that subsurface storage opportunities are feasible.

Investment Constraints On Solar Before We Even Start With Hydrogen

Dec 14, 2021 1:17:04 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Green Hydrogen, Renewable Power, ESG Investing, Materials Inflation, Inflation, solar, ESG investment, climate, solar energy, material shortages, product shortages, onshore wind

Much of the core focus of both our chemical industry and ESG and Climate research recently has been on inflation and materials shortages; we would point you to: Inaction, Caused By Inflation Fears, Is Driving More Inflation! and Coming Up Short: Materials Availability To Limit Climate Progress. This linked article suggests that, as we have predicted, cost and availability pressures are taking a toll on solar installation plans for 2022 in the US. While the inflation piece is real and the product shortages highlight some of the capacity constraints for materials and panels, the broader conclusions that can be drawn from the headline are more concerning. These shortages (and higher prices) are coming well before we see any step change in attempts to increase renewable power installations associated with all of the green hydrogen projects that have been announced over the last 6-9 months. All of these investments are relying on the deflationary trends continuing, especially for onshore wind and solar.

More Evidence To Suggest Material Shortages For Energy Transition

Nov 30, 2021 1:34:42 PM / by Graham Copley posted in ESG, Hydrogen, Coal, CCS, Renewable Power, Energy, hydrocarbons, natural gas, solar, wind, energy transition, energy sources, fossil fuels, nuclear, bioenergy, hydro, geothermal, material shortages

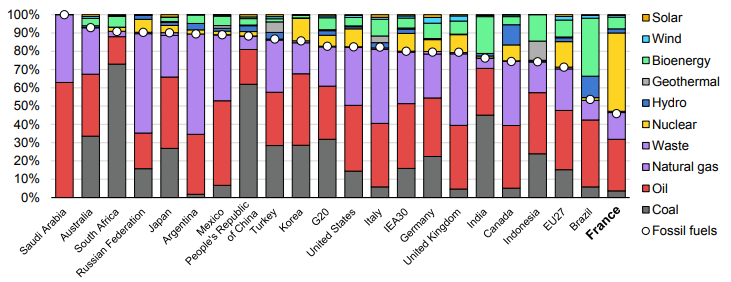

The fuel use data in the Exhibit below is very much a function of geology and the good and bad luck associated with it. The large hydrocarbon users' consumption patterns are a function of what they have – if you have a lot of coal, you use a lot of coal. The significant build-out of nuclear in France is partly because of Frances’ exceptional track record with the technology but also because the country does not have anything else to fall back on. Japan’s nuclear component was much higher before Fukashima. It is, however, worth noting the almost insignificant share of wind and solar anywhere, and then to put this into context with the collective ambitions, not just for 2050, but for the much shorter 2030 targets.