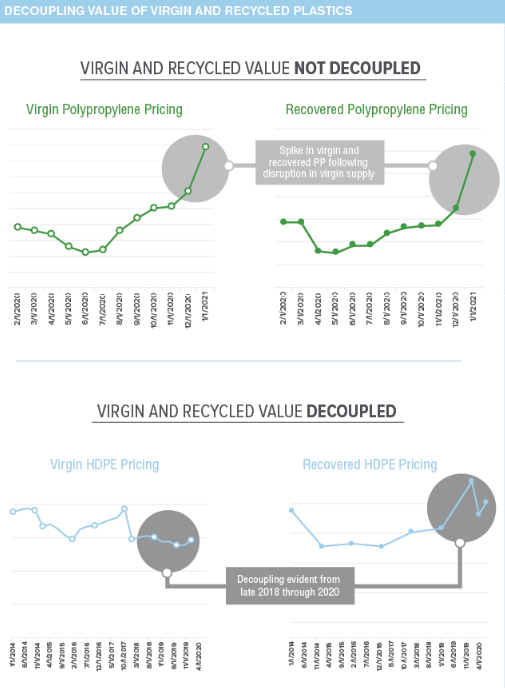

We talked a little about recycled polymer pricing in our ESG and Climate report yesterday. Recycled polymer pricing is rising relative to virgin polymer pricing (see chart below) and is likely to continue to rise unless hydrocarbon prices push virgin resins materially higher. Demand for recycled polymer is growing quickly and more quickly than supply, and we expect this to be reflected in an increased premium, barring more raw material inflation. Recycling is a fixed cost business – each step has a well-understood cost and companies are innovating to try and lower the cost of each step, but as so many different stakeholders are in the chain, it is a complex problem. One of the reasons why see the LyondellBasell/Suez venture works in The Netherlands is because Suez controls the waste in a region where recycling compliance at the household level is high. Despite this, it has taken a couple of years to get to the volumes needed to make the venture adequately profitable – mostly ensuring enough pure recycled polyethylene and polypropylene makes it to the facility. If polymer buyers are willing to cover the full cost of recycling in terms of the prices they are willing to pay, more material will become available – if LyondellBasell/Suez can demonstrate that they can make money when all the stars are aligned, it will likely encourage them to work with other municipalities in other parts of Europe (first) to see if they can replicate what they are doing now. In our view, all of the other advertised recycling programs are very small, very focused on niche applications, and don’t move the needle.

Consistent Supply Of Recycled Plastics Will Require Consistent & High Enough Pricing

May 13, 2021 1:37:30 PM / by Graham Copley posted in Recycling, Polymers, Polyethylene, Plastics, Polypropylene, recycled polymer, polymer pricing, hydrocarbon prices, virgin resins, supply and demand, raw materials inflation, LyondellBasell, Suez, polymer buyers