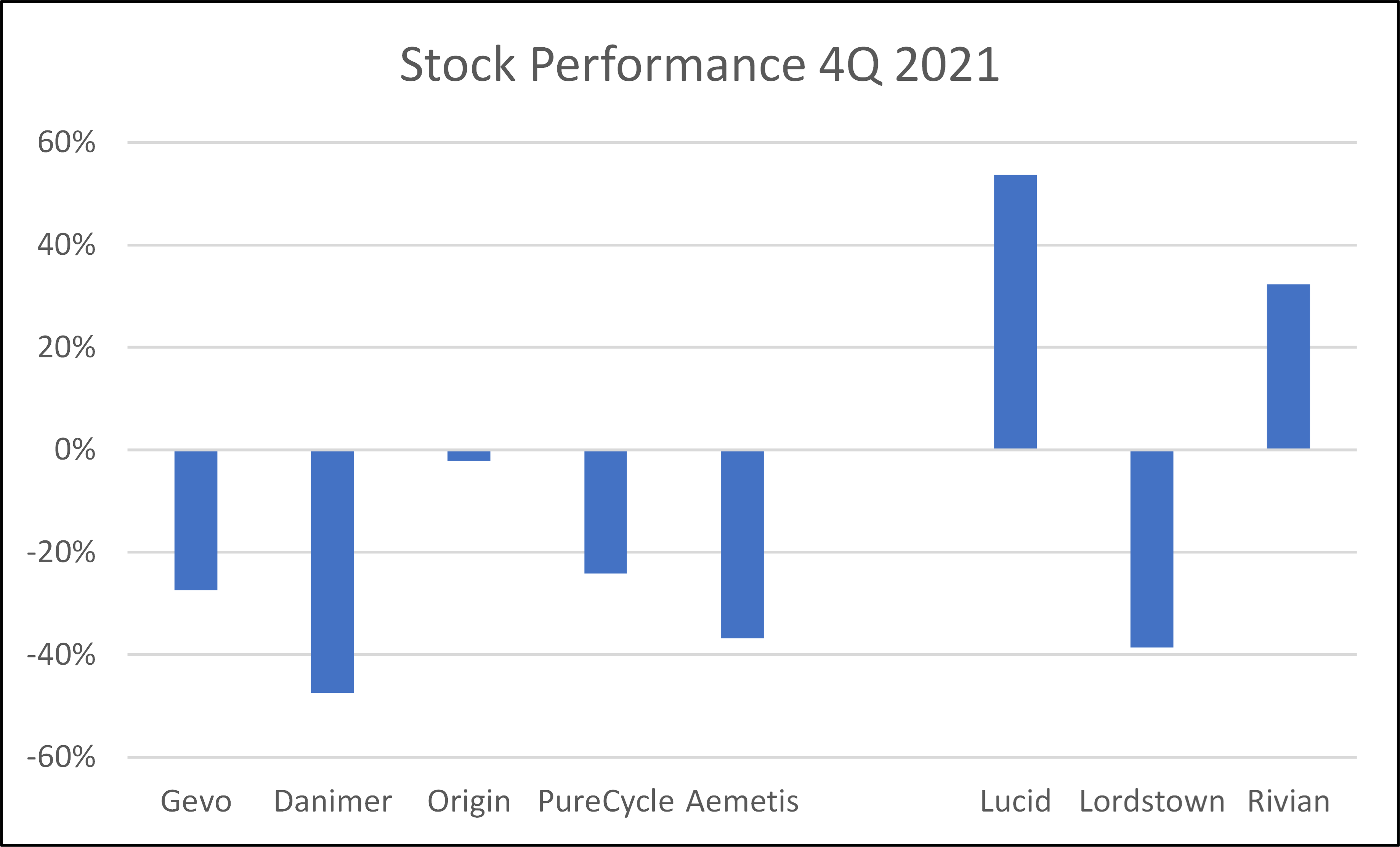

Life in 2022 is likely to be tougher for the new companies in materials and fuels, as all of them need capital to support projects that now look riskier from a cost inflation perspective and the market has moved to reflect that risk – Exhibit below. For every company below, the 2022 story was supposed to be capital spending to create commercial-scale production. The poor stock performance for many has tracked rising raw material prices – especially steel – as well as concerns around supply chain-driven delays and labor shortages. Few have the financial capacity to absorb significant cost overruns and/or construction delays. Danimer Scientific has done a recent capital raise and its impact created roughly half of the downside shown below – Danimer still likely needs more capital, but with more cash on the balance sheet may be able to get the rest through loans. Gevo, which in our view has the more impressive portfolio of potential offtake partners at this point likely plans to borrow at the facility level, and the stock weakness is likely a combination of inflation fears, the declining LCFS value, and the wait for the company to announce that it has a completed FEED study for the first plant and has reached FID. We would struggle to invest in any of these names today given the step-change in company development that each needs to make in 2022, and we would need more offtake agreements and process/construction guarantees than any company can likely get today, and if they could, they might not want to make some agreements public. See more in today's ESG and Climate report

Biofuels and Biopolymers - Inflation Could Spoil The 2022 Story

Dec 29, 2021 12:31:50 PM / by Graham Copley posted in Biofuels, Materials Inflation, Inflation, biodegradable plastics, energy shortages, bioplastics

Bioplastics: Probably Important But Small For Now

Dec 7, 2021 2:50:00 PM / by Graham Copley posted in ESG, Recycling, Polymers, Sustainability, Plastics, biodegradable, ESG investment, climate, plastics industry, biodegradable polymers, biodegradable plastics, polymer demand, bioplastics

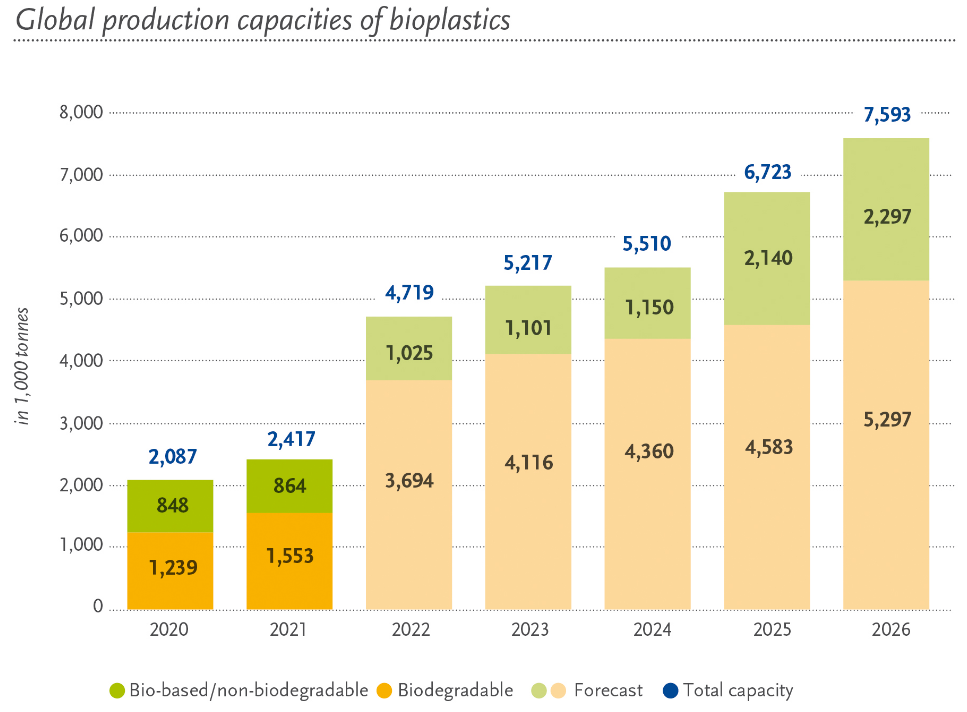

The bioplastics chart below (from today's daily report) is interesting from a couple of perspectives, the first being whether the projections are reasonable and the second being the significance of the investments. We believe that the volume targets are optimistic, given the capital requirements and that many of the companies pursuing bioplastics are relatively new and need to borrow most or all of the capital needs. The volumes would be easier to believe if the participants were large companies with strong balance sheets. The second point is just how small the volumes are in the grand scheme of plastics. Global demand for plastics exceeds 300 million tons and consequently, the 2026 projection would account for only 2.5% of global polymer demand. Note that in the article (linked here) around the uptake of biodegradable plastics – in this case in the UEA – one of the constraints to growth listed is availability. The other constraint, which likely faces producers in all markets is consumer education. Introducing a new polymer – or range of polymers – into an already confusing mix will require consumer education around what is biodegradable and what to do with the material. This topic follows on from the recycling theme in last week's ESG and Climate Report.