Despite all of the rhetoric about the need for green hydrogen, we see most of the large ammonia producers pursuing large blue projects – with Nutrien’s announcement yesterday coming on the heels of a CF new facility announcement and the CO2 capture project announced by LSB a couple of weeks ago. While there are some small (proof of concept) green projects in the works, they are very small, tiny when compared with the ammonia need, whether to replace lost material from Russia and Ukraine or whether to supply what could be substantial needs in Asia to co-fire coal plants, or as a shipping fuel, or as a carrier for hydrogen (see third chart below). The ammonia majors are not waiting around for “green” economics to improve as they see meaningful near-term demand that cannot wait for scale efficiencies of available power on the green side. Large-scale sources of cheap renewable power are hard to find, and where they may exist, there is competition from uses that may be able to pay more.

So Fresh So Clean, Nutrien Looks To Be Going Green

May 19, 2022 2:45:36 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Coal, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Ammonia, blue ammonia, electrolysis, CF Industries, fuel, green ammonia, Denbury, Nutrien, LSB Industries

Demand And Infrastructure For SAF Is Likely Well Ahead Of Supply

Apr 19, 2022 1:34:16 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, IEA, renewable energy, EVs, materials, sustainable aviation fuel, renewable fuels, fuel, material shortages, carbon intensity, battery, nickel, SAF, airlines

In our ESG and Climate report tomorrow, we will focus on SAF from a carbon intensity perspective. The Colonial pipeline initiative was inevitable given the demand for jet fuel at the East Coast airports. Still, we would not expect much volume to move in the near term for several reasons. First, there is not that much to move, and second, California can still pay more because of the LCFS credit. The Biden administration is planning to introduce a broad SAF credit which would help encourage use outside California, but this would also need to stimulate production as the volumes are still small and much smaller than the airlines would want – even the projection of volumes by bodies like the IEA fall well short of potential airline demand by 2030 and 2040. This is an investable theme, in our view, and we will discuss it in more detail tomorrow.

Carbon Footprints Matter, For Polymers And LNG

Nov 18, 2021 1:55:23 PM / by Graham Copley posted in ESG, Hydrogen, Recycling, Polymers, LNG, Polyethylene, CCS, Ethylene, decarbonization, HDPE, carbon abatement, ethane, naphtha, climate, carbon footprints, recycled polymers, virgin polymers, fuel, Freeport LNG

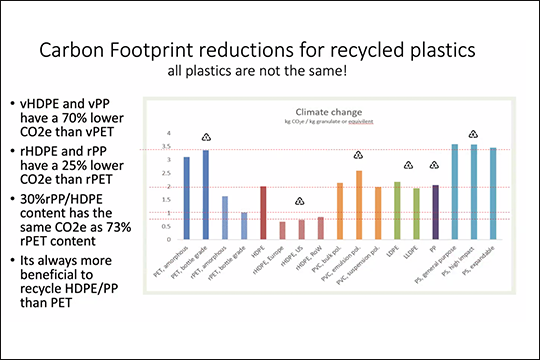

It is interesting to watch the pivot between recycled versus virgin polymer to the carbon footprint of the various options as outlined in the chart below. We are assuming that the numbers in the chart are averages as there is a sizeable range for everything. As we note in today's daily report, ethylene feedstock will impact the carbon footprint of ethylene and consequently, the footprint of polyethylene – HDPE made from ethane based ethylene in the US where the ethylene producer is recycling hydrogen back into the furnaces, will have a much lower carbon footprint than HDPE made from naphtha based ethylene in Europe, for example. On the recycling side, there will also be a range based on transportation costs for collection and sorting and then distribution to a customer.