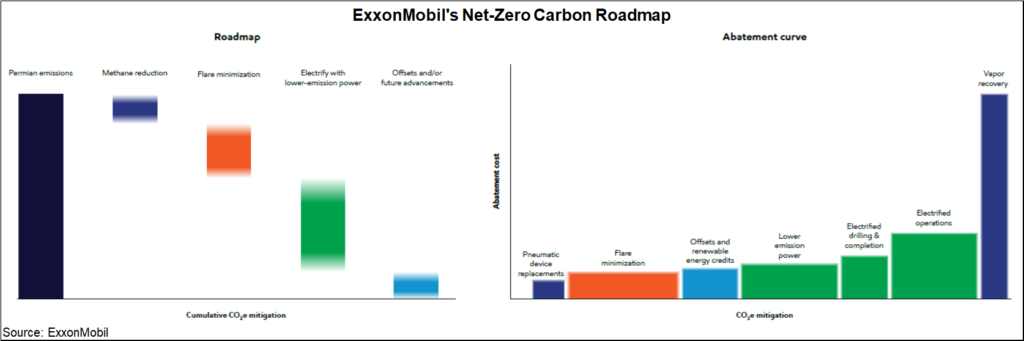

One piece of big news early this week was ExxonMobil’s announcement that it is developing plans that will drive net-zero emissions by 2050 and the company shared a detailed overview. We have picked some charts from the report, some of which can help us draw conclusions for ExxonMobil, but others are more general. The company is banking on a lot of emission reduction and CCS to get to the 2030 target and a large part of the goal is likely to come from the plans for the Permian and the previously stated net-zero target that the company has for 2030 – detail on how this will be achieved is shown in the Exhibit below, see more in today's ESG report.

Could Cutting Emissions Give ExxonMobil A Competitive Edge?

Jan 19, 2022 2:11:51 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Sustainability, LNG, Plastics, CCS, CO2, Renewable Power, Emissions, ExxonMobil, Net-Zero, carbon abatement, climate, carbon neutral hydrocarbons, Climate Goals

Direct Air Capture Is Expensive, But Demand Is There

Sep 10, 2021 1:43:32 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CO2, Emission Goals, carbon dioxide, carbon offsets, direct air capture, greenwashing, DAC, carbon neutral hydrocarbons

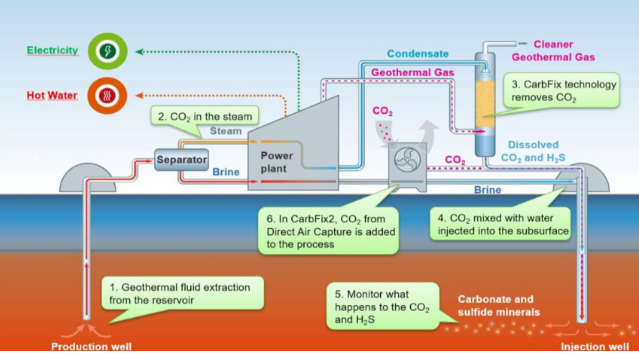

The most notable news from the Iceland CO2 direct air capture (DAC) project, illustrated in the Exhibit below, is not that it is working and how energy efficient it is, but that the CO2 capture costs are extremely high and yet all of the offsets are sold. One report talks about the costs per credit approximating $1000 per ton of CO2, which is likely accurate given that the facility is relatively small scale, at 4 thousand metric tons per year. The same report also states that the credits are almost sold out for the 12 years that they are being offered. We believe that this is indicative of the marginal demand for uncontestable carbon offsets, and this is a topic we have covered at length in our ESG and climate work. Shell, bp, and others are selling what they claim to be carbon neutral hydrocarbons around the world and are buying offsets to do so, but they are coming under quite a lot of “greenwashing” fire because of the less tangible/auditable nature of the credits they are buying – often related to agricultural or specific tree conservation/planting initiatives that are questioned because of the validity of the capture claim or the vulnerability of the credit to weather, fires, and forest maintenance years in the future.