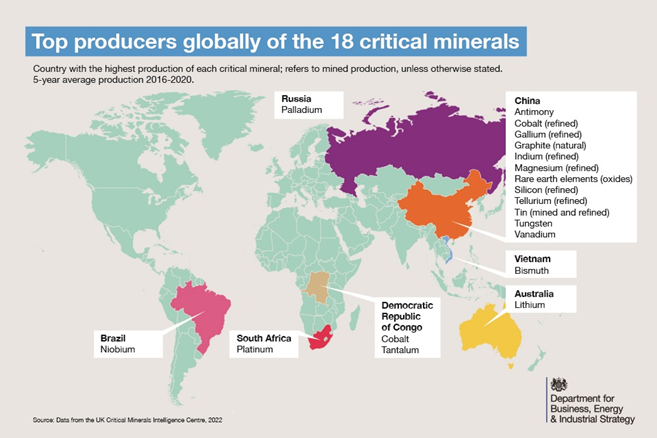

We are seeing more focus on supply chains as they relate to the energy transition. Some European countries are realizing what we have noted in prior research - EU Energy Policy: Swapping A Bad Supplier For Something Worse? - switching to an aggressive focus on renewable energy may reduce your energy exposure to Russia but it currently doubles down on your exposure to China. It is very easy to look at the scale of the problem – the share that China has in critical metals, as shown below – the share that China has of solar modules – etc., and conclude that it is too hard, especially in Europe where you will find an environmental lobby trying to stop you doing anything industrial. But the net effect is severe reliance on China. One advantage that the UK now has with its exit from the EU is more industrial freedom and the country could benefit from the right industrial policies that would attract broader energy transition investment. In our ESG and Climate report this week we talked about the U.S. desire to “friend-shore” rather than re-shore because of local investment challenges in the U.S. as a consequence of some of the political issues. The UK could benefit from becoming an industrial partner with the U.S. for some critical materials.

Energy Transition - Lots at Risk and Funding Harder To Find

Jul 22, 2022 2:14:51 PM / by Graham Copley posted in ESG, Sustainability, Metals, ESG Investing, Supply Chain, renewable energy, energy transition, materials, minerals

ESG Insight From Washington

Jun 10, 2022 12:00:00 PM / by Christopher Sheeron posted in ESG, Sustainability, Renewable Power, Energy, Oil, solar, renewable energy, wind, climate, energy inflation, gasoline, water, OPEC+, NOPEC

We share views from Christopher Sheeron - The first-ever guest author for C-MACC's most recent ESG and Climate report titled "Does DC Understand Economics – Energy Proposals Suggest No".

Main Points from this report include:

So Fresh So Clean, Nutrien Looks To Be Going Green

May 19, 2022 2:45:36 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Coal, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Ammonia, blue ammonia, electrolysis, CF Industries, fuel, green ammonia, Denbury, Nutrien, LSB Industries

Despite all of the rhetoric about the need for green hydrogen, we see most of the large ammonia producers pursuing large blue projects – with Nutrien’s announcement yesterday coming on the heels of a CF new facility announcement and the CO2 capture project announced by LSB a couple of weeks ago. While there are some small (proof of concept) green projects in the works, they are very small, tiny when compared with the ammonia need, whether to replace lost material from Russia and Ukraine or whether to supply what could be substantial needs in Asia to co-fire coal plants, or as a shipping fuel, or as a carrier for hydrogen (see third chart below). The ammonia majors are not waiting around for “green” economics to improve as they see meaningful near-term demand that cannot wait for scale efficiencies of available power on the green side. Large-scale sources of cheap renewable power are hard to find, and where they may exist, there is competition from uses that may be able to pay more.

We Need Fossil Fuels For Longer, Especially If We Cant Make Enough Batteries

May 13, 2022 1:32:32 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Energy, decarbonization, renewables, EV, Lithium, materials, energy costs, fossil fuels, battery, nickel

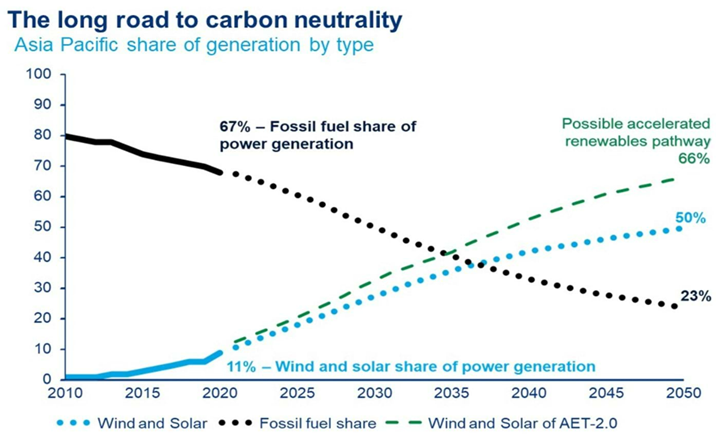

In the exhibit below, we see another chart that we find unhelpful when looking at the path to net-zero or something close. It is not an either/or game with fossil fuels and renewables. Those promoting this idea are setting impossible goals for the renewable industries, which will keep severe upward pressure on all energy costs. Wood Mackenzie may not mean what is implied in the chart below but taken at face value it suggests that more pressure will be placed on an underfunded materials market to supply an underfunded renewable power market, in which any opportunity to use decarbonized fossil fuels will be frowned upon. It would be good to see an analysis of how much global power could be generated from decarbonized natural gas and how much pressure that would take off the renewable industries.

Tesla And Bloom Driving Renewable Power Demand. CCS Needs To Be Part Of The Answer

May 6, 2022 3:49:31 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CCS, Renewable Power, EV, energy transition, fuel cells, Bloom Energy, Tesla, electrolyzers, Enbridge

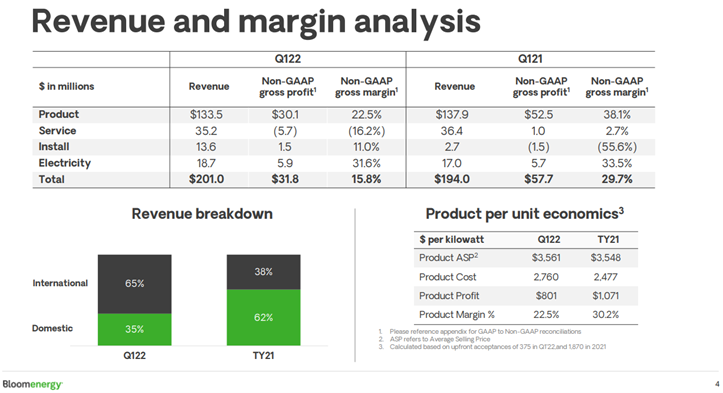

Looking at the Bloom results and reflecting on our many recent client discussions, the low-cost providers of fuel cells and electrolyzers are going to win disproportionately in our view, but whether that is Bloom or others remains to be seen. Lower costs will come with scale, and this should allow the leaders to stay ahead, especially if they control their equipment production as Bloom does. The negative for Bloom is that its equipment production is in the US, which may add costs, but the positive is that it is on-shore and this gives the company more control over delivery in the US. Companies that can scale quickly in this space and other renewable sectors, should see the benefit of economies of scale and this should drive more wins and more economies.

Managing Waste To Maximize Value Requires Multiple Processes

May 4, 2022 2:15:03 PM / by Graham Copley posted in ESG, Recycling, Climate Change, Sustainability, LyondellBasell, chemical recycling, waste, polymer recycling, waste recycling

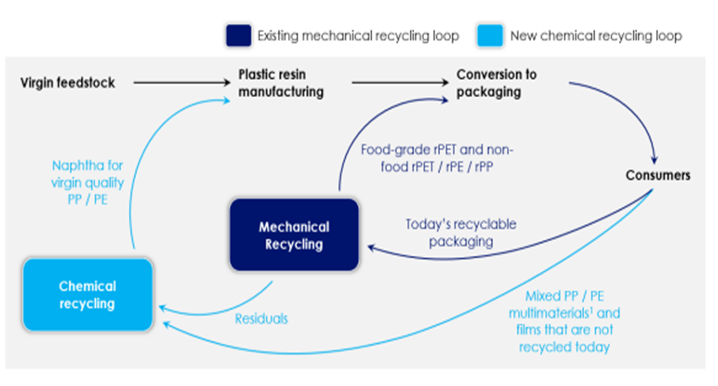

In the first picture below we see another schematic that shows how different options for polymer recycling could work together. We have suggested a more complex site than the one in the chart as there will be opportunities to recycle some polymers into non-like-for-like applications such as roadbed modification and other durable applications. In addition, there may be a better return in waste to energy versus chemical recycling and that may be an alternative or an add-on. This sort of complex site is what we believe LyondellBasell could be looking at for the Houston refinery site. An integrated waste treatment facility that optimizes that use for each tranche of the waste stream could improve the overall investment returns. In the second picture below we show our version of what a comprehensive waste recycling operation should look like. See more on recycling!

More Woes For Wind

May 3, 2022 1:20:32 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, CCS, Renewable Power, Inflation, Supply Chain, wind, Westlake, renewable, Vestas, Williams, low carbon power

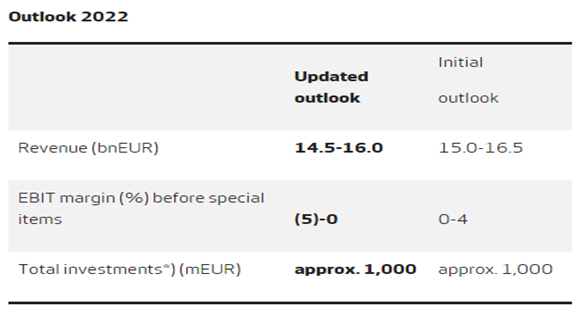

We discussed the woes of the wind power industry at length in a dedicated ESG and Climate piece last week, and the Vestas results below play into the same theme. The company is cutting guidance again for 2022, which is already much lower than estimates would have suggested 6 months ago. While Siemens Gamesa has the added headache of a mismanaged platform change, all of the issues raised by Vestas are shared industry wide, delayed installations because of supply chain issues and material shortages, as well as significant cost inflation. In tomorrow’s ESG and Climate report we discuss some of the increases in European PPAs in 1Q 2022, reversing a multi-year trend of lower installed costs of power. This reversal will likely impact plans for 2022 and 2023, especially for those banking on lower power costs to justify many of the announced hydrogen ventures – particularly in Europe. Those who press ahead despite higher power costs and higher construction costs in general, may stretch both balance sheets and borrowing capacity.

WACKER Is Recognizing Supply Chain Issues Which Threaten Renewable Power Goals

Apr 28, 2022 2:17:23 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, CCS, Renewable Power, Supply Chain, Wacker, raw material

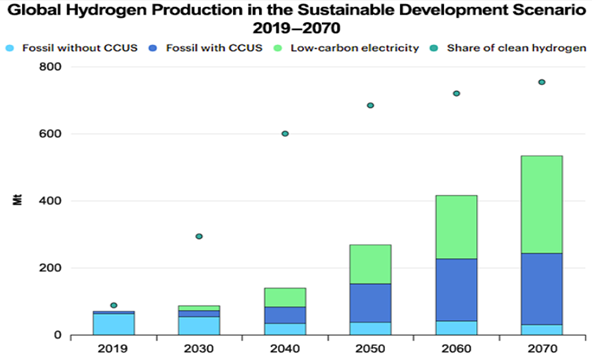

Anyone who read our ESG and Climate reports of the last two weeks will know that we do not believe in the hydrogen projections below as we see renewable power as a potentially scarce resource. Furthermore and also covered yesterday, should the API be successful with its carbon tax proposal in the US and should this be additive to the 45Q incentive for CCS, we could see an explosion of blue hydrogen investments in the US, especially on the Gulf Coast.

A Boost For Carbon Capture: More Constrains For Renewable Power

Apr 27, 2022 12:25:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, Carbon Tax, CCS, Blue Hydrogen, Renewable Power, Chemical Industry, decarbonization, Aemetis, renewable energy, clean energy, SAF, 45Q tax credit, Fulcrum Bioenergy

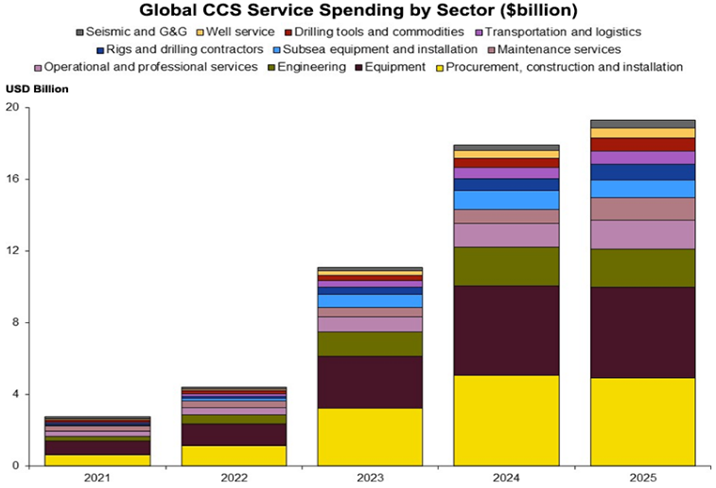

The CCS spending chart below is quite detailed, but shows the limited amount of spending in 2021 and 2022 and may underestimate the amount of seismic spending needed, especially in the US, as companies prepare permit applications. We do not expect to see much spending in the US before mid-decade beyond permit applications. However, as we discuss in today’s ESG and Climate report, should the API proposed carbon tax, or something similar, be additive to the 45Q tax credit, we could see a step-change in CCS when/if the tax is approved. The tax on its own is likely not enough to drive decarbonizing investment, but when added to 45Q it could be a specific trigger for CCS investment, and we could see a step-change in the second half of the decade. This might involve large-scale blue hydrogen production, especially on the Gulf Coast to decarbonize the refining and chemical industries.

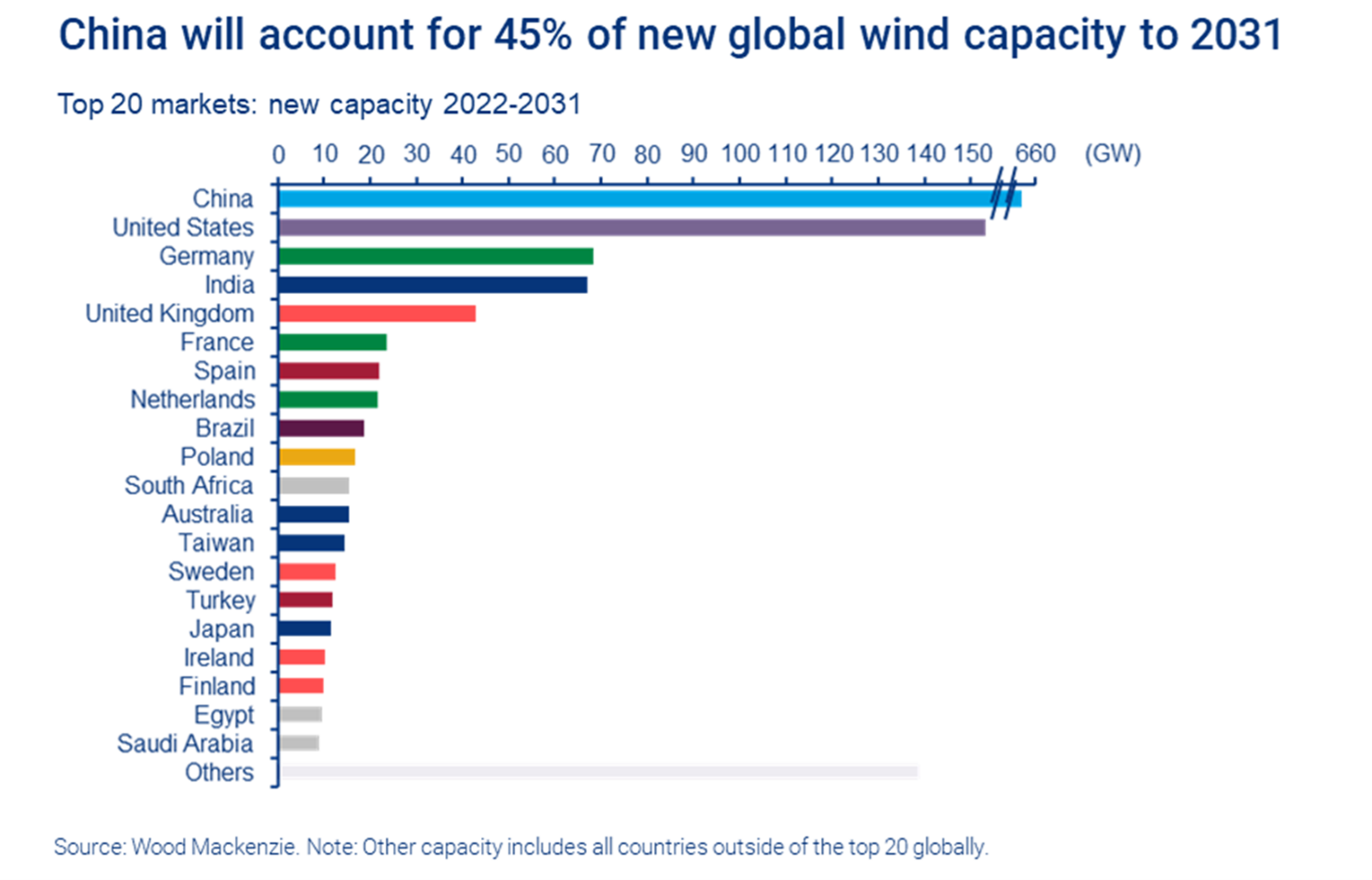

Blown Away By China: Will There Be Equipment For Anyone Else?

Apr 26, 2022 1:25:51 PM / by Graham Copley posted in ESG, Sustainability, raw materials inflation, wind, energy transition, climate, materials, logistic constraints, Siemens Gamesa, wind industry, raw material, equipment

In our ESG and Climate report tomorrow we are focusing on the wind industry and specifically the problems that Siemens Gamesa is facing with execution, costs, and logistics. The estimates for China and the rest of the world in the chart below assume a significant step-up in the rate of installation, and in 2022 we are seeing an industry that is struggling with that. Siemens Gamesa is having problems with its new platform, which had been intended to deliver projects more cheaply from an installed cost basis and an operating costs basis and is perhaps an illustration of what can happen when you are trying to move too quickly – partly because your customers are demanding it. Operational problems at Siemens Gamesa have been compounded by logistic challenges and raw material price and availability, such that current expectations are for the company to break even at an EBITDA level in 2022. This is another great example of the policy and investor disconnects that we see in several aspects of energy transition – we are encouraging investment in front line capacity, but not in the materials and feedstocks needed to feed the front line – metals, natural gas, crops. See our recent body of ESG and Climate work for more on this. These subjects are at the heart of many of the private engagements that we have with several clients in this space.