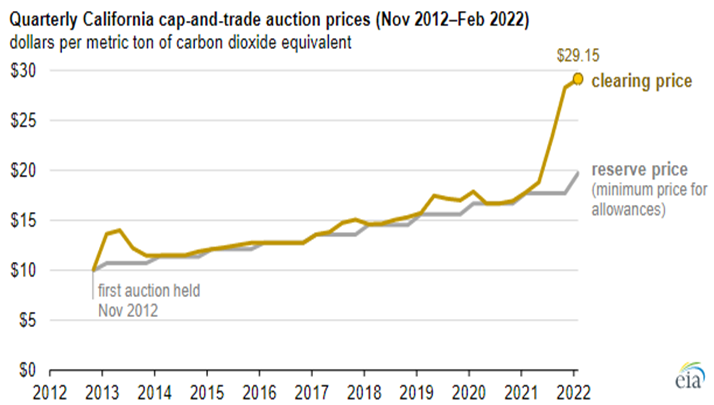

We have written extensively about carbon prices over the last two years and followers of our dedicated ESG and Climate service will know that our expectation is for all CO2 markets to see prices rise to levels that justify large investments to avoid CO2 production or sequester it. We see that price closer to $100 per ton than the $50 per ton that 45Q will rise to by 2026. The California price shown below has much more upside as credits demand rises. Many of the net-zero pledges made by manufacturers and energy producers today cannot be achieved without buying some sort of credit and we expect demand to rise relative to supply through the balance of the decade and possibly quite quickly.

Carbon Prices Rising, Wind & Solar Costs Also

Apr 5, 2022 12:32:08 PM / by Graham Copley posted in ESG, Climate Change, CO2, Energy, Net-Zero, carbon abatement, solar, renewable energy, wind, carbon prices

Carbon Offsets: Definitions Are More Important Than Trading Architecture

Dec 16, 2021 1:51:21 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CO2, Emissions, ESG Investing, carbon credit, carbon offsets, direct air capture, carbon offset, climate, carbon credits, carbon prices

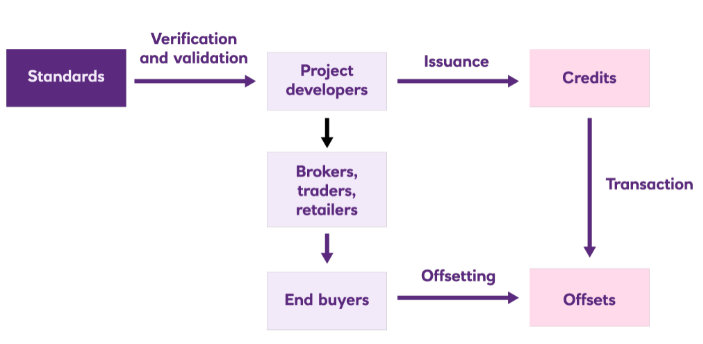

The carbon credit schematic below helps understand the mechanics, but the diagram does not sufficiently emphasize the critical importance of the “Verification and Validation” step. This is a great example of a mechanism that should work logically, but if the input is wrong the output will be also. Potential buyers and sellers of carbon credits understand the process well, but they are more concerned about what goes in the front end as the value of the credit will be very dependent on the quality. Today the only “sure thing” carbon offset is direct air capture, as all of the agriculture-based offsets need much tighter definitions. See research - Carbon Prices – Inequitable and Uncertain – Not What We Need

Carbon Momentum Building

Dec 8, 2021 12:27:25 PM / by Graham Copley posted in ESG, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Carbon, IEA, climate, CCUS, carbon prices, solar capacity, wind capacity, hydrogen capacity

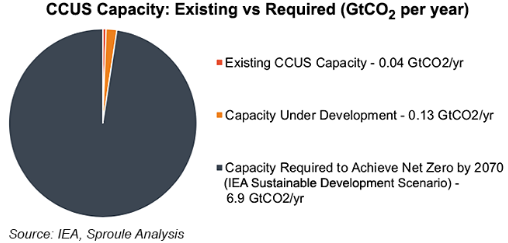

Most of the focus today is on carbon, in part because the CCS momentum is picking up, with more initiatives being announced daily all around the world, and partly because of the surge in European carbon prices as shown in Exhibit 1 from today's daily report. The IEA CCS projections in the Exhibit below, are likely low in our view, despite the significant investment needed to reach the target shown. In our ESG and climate report today we focus on many of the materials supply limitations that will likely emerge as the world tries to add wind and solar capacity at higher and higher rates. Our analysis of the IEA net-zero projections published earlier this year suggested that the IEA might be too ambitious on renewable power and that the balancing effect would likely be increased natural gas use versus its base case and more than forecast CCS. We have a long way to go to get there given the shortfall in the exhibit below, but at the same time, carbon prices are moving to make it happen. The European price has spiked again this week and is now slightly higher than $100 per ton of CO2, a level reached by the UK price late last week. At this level, we should see investments in Europe to abate carbon without additional local subsidies, or with minimal subsidies. The constraint in Europe will be finding inexpensive CCS locations. A $100 carbon price in the US would, in our opinion, drive a very significant investment in the US, not only in CCS capacity but also in new blue and green hydrogen capacity.

CCS Can't Afford Long Pipelines

Dec 2, 2021 2:20:56 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Emissions, Carbon Price, Net-Zero, LCFS credit, climate, pipelines, carbon storage, carbon prices

In our ESG and Climate piece yesterday we briefly discussed the mid-west carbon capture projects, questioning their economic viability. Two of the most expensive components of any CCS project are pipelines and compression costs and we cannot see how a long network of pipe in the mid-west to pick up what are essentially small volumes can work economically. These projects are reliant on very high LCFS-like credits, and as we showed in last week’s report, LCFS credits have fallen this year and could fall further. The pipeline right of way issue is another major hurdle and we have seen growing resistance to pipelines of any sort over the last few years. Those who oppose CCS in principle could cripple these mid-west plans simply by co-opting enough land-owners on the path of the proposed pipelines and refusing access. We are supporters of CCS, but have done substantial work on economics and show that the process only begins to make economic sense if the sequestration is close to the emissions. Relying on possible artificially high carbon prices to justify the projects will only lead to pain, assuming the pipeline right of ways can be obtained.