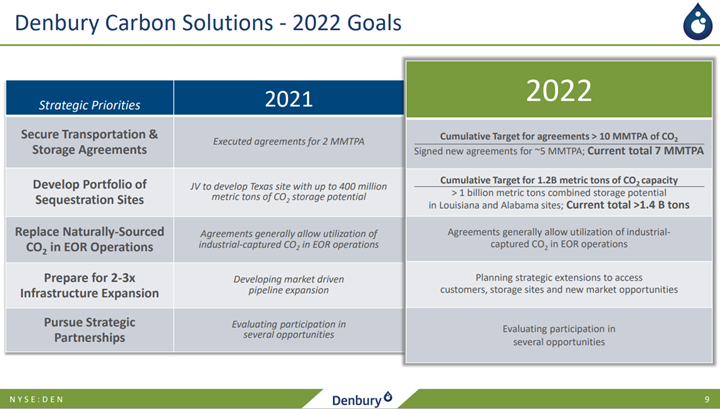

We are seeing a flood of CCUS announcements in the US in 2022, but they look like “gathering” exercises at this stage rather than projects that are ready for FID. Companies are chasing potential pore space and, like Talos, leasing onshore and offshore (mainly offshore) acreage, where they believe opportunities exist to sequester CO2. These announcements sometimes include firm commitments from companies that have CO2 surpluses and sometimes are more speculative. At this stage, it seems like a “land grab” and “customer grab”. There is wide agreement that the incentive structure in the US – centered around the 45Q tax credit scheme – is not enough to drive much real investment, unless it can be stacked with other credits like the LCFS structure, which only applies to fuels in California today. We see the land grab as relatively low-cost and low-risk positioning in the hope that incentives or economics change. There are some instances where investments will go ahead, and these will focus on processes that have a reasonably low cost of carbon capture – fermentation, urea, natural gas clean-up for LNG, and a handful of other processes. The LSB Industries announcement for Arkansas, highlighted this week, is likely an example of where the economics work even if LSB cannot get much of a premium for the low-carbon urea.

CCS And Plastic Recycling Ambitions Running High

May 5, 2022 12:31:00 PM / by Graham Copley posted in Carbon Capture, Recycling, LNG, CCS, CO2, natural gas, fermentation, Talos, urea, low carbon, CCUS, Denbury, Plastics recycling, LSB Industries, Berry Global

Low Cost CCS Could Be A Game Changer For The US

Feb 16, 2022 1:41:38 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Climate Change, Sustainability, Green Hydrogen, CCS, CO2, Sequestration, Ammonia, blue ammonia, CF Industries, crude oil, low carbon, green ammonia, carbon intensity, carbon market

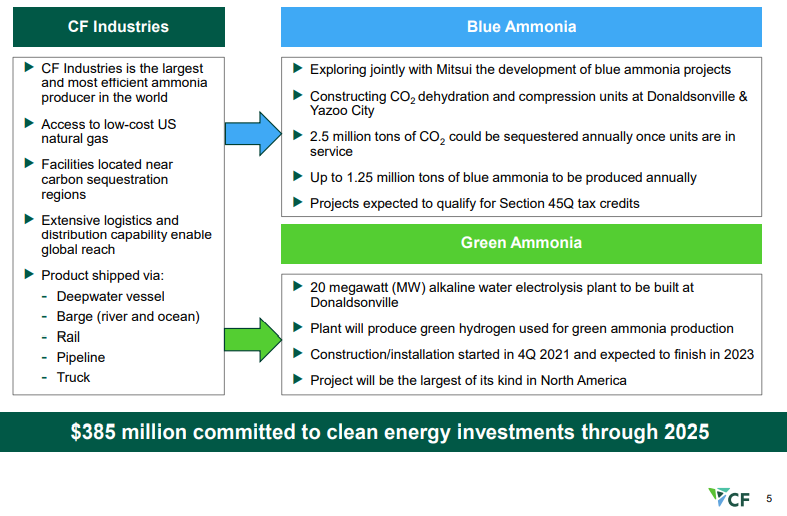

We continue to believe that the US has a cost advantage in CCS versus many of the other regions of the world and that when coupled with low natural gas prices the US should be able to take a lead in developing low carbon chemicals. CF is pushing the idea of both blue ammonia in the US as well as green ammonia, and while the company has yet to announce sequestration plans for the CO2 it is working to purify – see Exhibit - once dehydrated and compressed the incremental cost of storage should be low.

No Carbon Price In The US: A Competitive Disadvantage!

Jan 26, 2022 2:11:28 PM / by Graham Copley posted in Climate Change, Methane, CCS, Energy, Carbon, Emissions, Carbon Price, carbon value, natural gas, carbon values, low carbon, methane leakage, carbon pricing, fuels, reshoring, oil and gas, pipeline emissions, low carbon materials

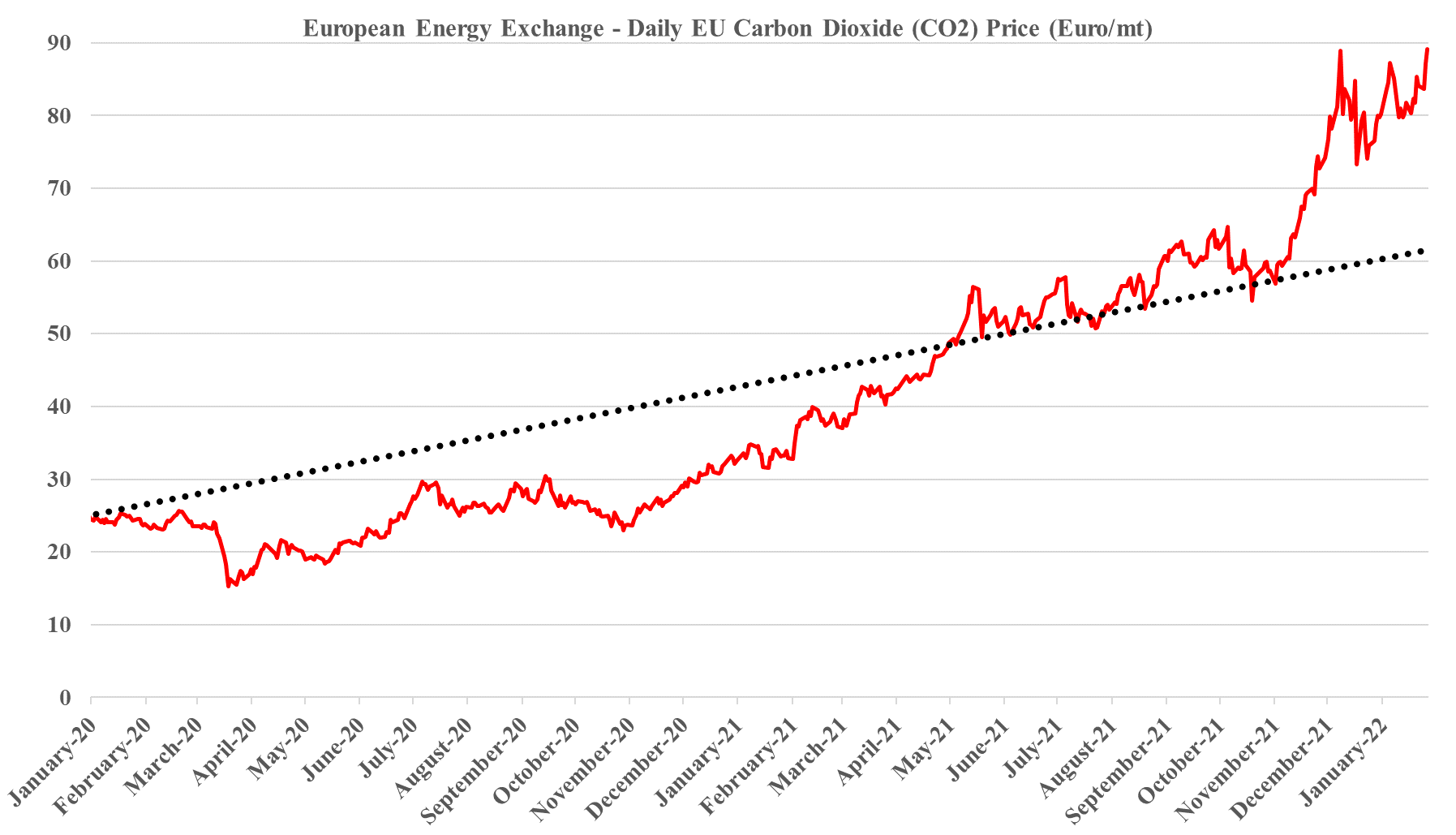

The linked Canada headline supports one of the themes that we have been highlighting for a while, which is that certainty around carbon pricing is likely to drive investment rather than discourage it. Canada, and specifically Alberta, has seen several new investments announced over the last few months because manufacturers can now add some certainty around carbon values to other advantages offered by the province, including cheap natural gas and what appears to be low-cost CCS opportunities. We are also seeing investments shape up in Europe – also to produce low carbon materials and fuels – and this is also driven by greater certainty around carbon value. The lack of a carbon price in the US is becoming a competitive disadvantage for the country and those opposing it in government are, in our view, very misguided. If China can develop a credible and broad carbon pricing mechanism, it will also likely gain investment dollars, possibly at the expense of the US. Not having a sound climate change and carbon value framework in the US is a major threat to many of the reshoring initiatives that US retailers and manufacturers would like to see.

Another Illustration Of How Important Metals Are To Energy Transition

Jan 21, 2022 1:07:16 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Renewable Power, Metals, Raw Materials, solar, renewable energy, wind, energy transition, Lithium, climate, advanced recycling, materials, low carbon, material shortages, low carbon economy, renewable power production

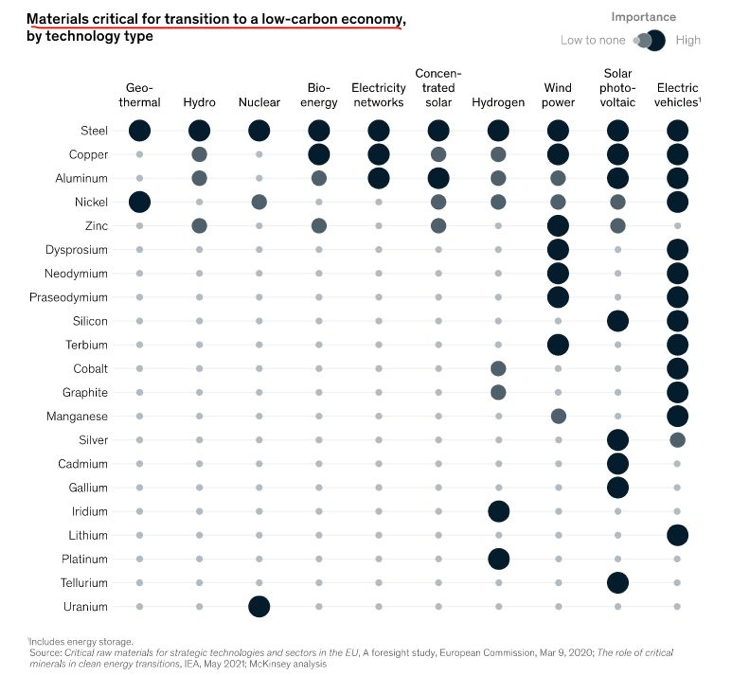

The materials chart in the exhibit below from today's daily report, is worth noting as it highlights all of the materials that are needed to advance the production of equipment required to drive renewable power production and demand. We would make one change to the chart in that lithium should also be added to the wind and solar categories to account for storage that needs to be built, although this could be done through hydrogen production or hydraulically, depending on location. One of our primary concerns concerning renewable power projections is the availability of some of these materials and we have written about the topic at length – most comprehensively in - 2022 – Policy Key, But Inflation Will Distract – Maybe Beneficially.

Recycle Availability Still Expected To Be A Headache For Packagers

Nov 16, 2021 1:02:05 PM / by Graham Copley posted in ESG, Recycling, Polymers, Sustainability, PET, Coca-Cola, polymer producers, renewable polymers, chemical recycling, low carbon, PepsiCo, Unilever, zero carbon, recycled polymers, FMCG, recycling goals

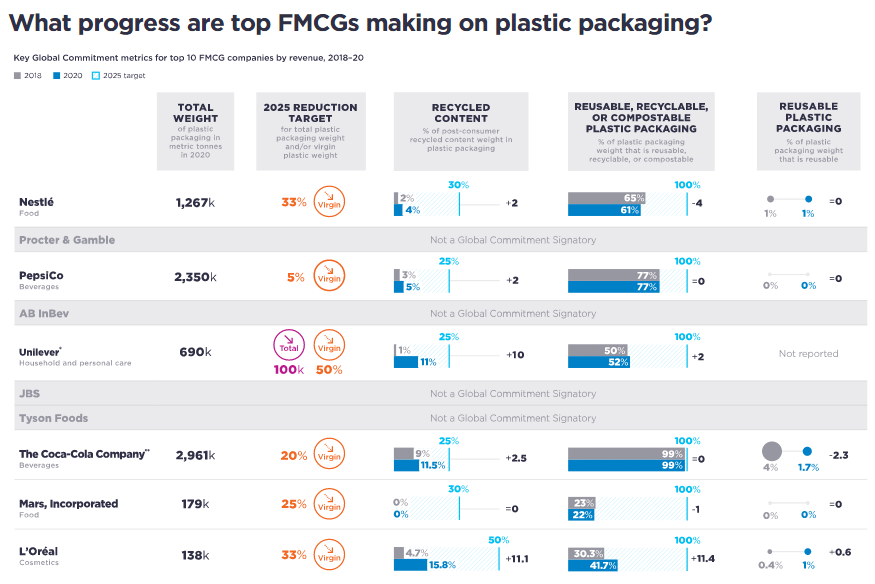

The chart below on recycling progress by the major FMCG companies is timely as it bumps into plenty of “national recycling day” headlines which include as many stories around recycling polymers into new applications as stories about like for like recycling. The more polymer that moves through collection and sorting and into roadbeds or composite particleboard replacement, etc., the less there is available for the FMCG companies to meet recycling goals. We see this as a major opportunity for the renewable polymer makers, but it is unlikely that there will be enough renewable-based polymers available to close the 2025 gap for most of the companies listed below. What is likely, in our view, is that the packagers will embrace chemical recycling as a way to increase their recycled content and will strike very specific deals with those able to show a chain of custody from collection through new polymer production.

Chevron Joins The Club, But The Focus On Cleaning Up Its Fossil Fuel Footprint Could Be Important

Oct 12, 2021 2:05:37 PM / by Graham Copley posted in ESG, Carbon Capture, Biofuels, Climate Change, Sustainability, LNG, Methane, CCS, Renewable Power, Carbon, Net-Zero, fossil fuel, carbon abatement, natural gas, carbon trading, offsets, EIA, Chevron, methane emissions, CO2 footprint, COP26, low carbon, methane leakage, carbon credits

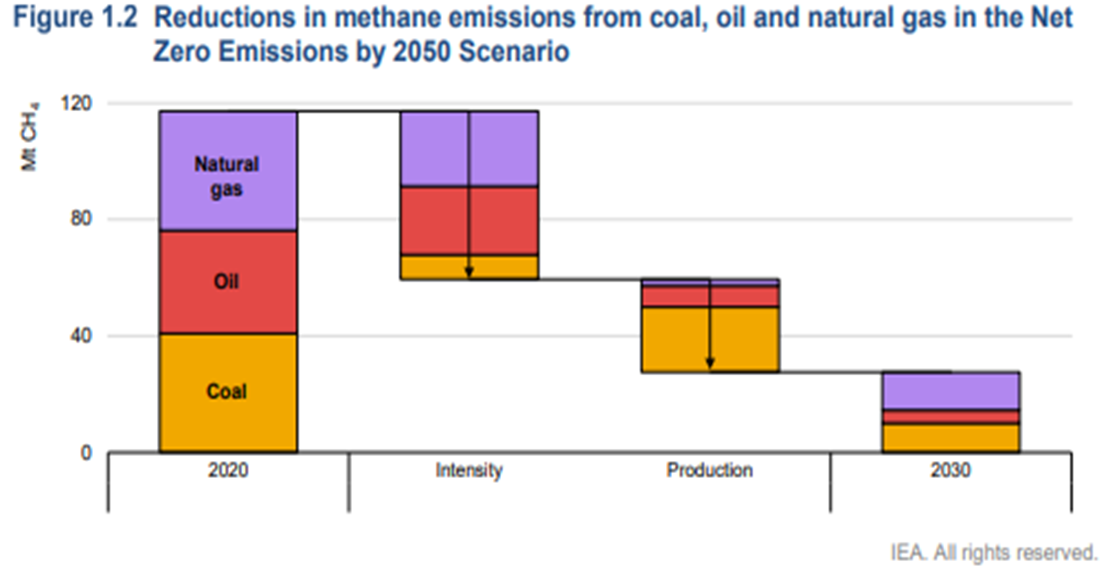

A couple of things worth highlighting in today's daily report – the first being Chevron’s move to join the net-zero club – focusing all eyes now on ExxonMobil in particular but also the rest of the US E&P crowd. Chevron will have some major challenges getting to net-zero and will likely face much of the same skepticism that bp, Shell, and TotalEnergies attracted in Europe initially and still face today. The Europeans have placed a lot of their bets on moving into renewable power – for the moment, Chevron is focused on moving to net zero in its own operations, which we read as biofuels and a lot of CCS. Given the acute shortage of international natural gas, it would make the most sense for the independent natural gas E&P companies and the LNG sellers to jump on the same boat. By promising low carbon natural gas and LNG, the industry is much more likely to gain support for the expansion that the world needs to counter some of the EIA assumptions around coal and petroleum product use from 2030 to 2050. Of course, it would be a whole lot easier for the US industry to do this if they had a value on carbon to work with! The chart below looks at one of the core clean-up issues, which is methane leakage. This is a subject we cover extensively in our ESG and Climate service linked here.