First, it is going to be an uphill struggle to get some common sense around the continued use of fossil fuels during any period of energy transition if the activists take away all resources from the energy industry – banking, PR, etc. While there is plenty of work to be done to minimize greenwashing, there is also plenty of work that needs to be done to explain why fossil fuels are still needed and how we can use them as cleanly as possible. If it becomes a business risk to bank or advise any company in the fossil fuel industry, while there will inevitably be workarounds, the net effect will be continued underinvestment, in production and in cleaning up the fuels and the concerns that we raised for natural gas in our Sunday Thematic will happen.

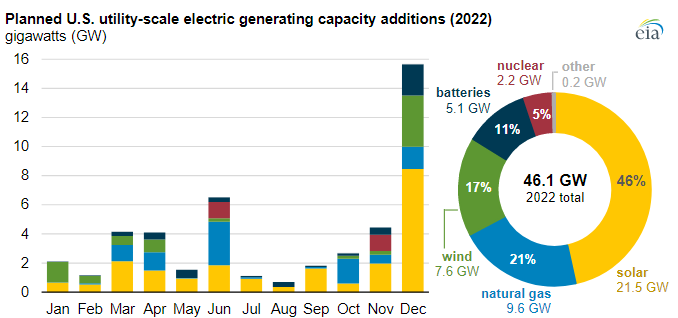

2022 Power Additions Look Ambitious - More Upward Pressure On Natural Gas?

Jan 11, 2022 2:01:38 PM / by Graham Copley posted in LNG, Coal, Renewable Power, Energy, natural gas, power, energy transition, greenwashing, fossil fuels, material shortages, energy industry, power capacity, natural gas demand

ExxonMobil: Going Heavy On CCS (The Right Move), But Pushing For Support

Nov 12, 2021 2:07:37 PM / by Graham Copley posted in Hydrogen, CCS, Carbon, Emissions, ExxonMobil, Emission Goals, carbon footprint, carbon abatement, biofuel, carbon offsets, carbon trading, greenwashing

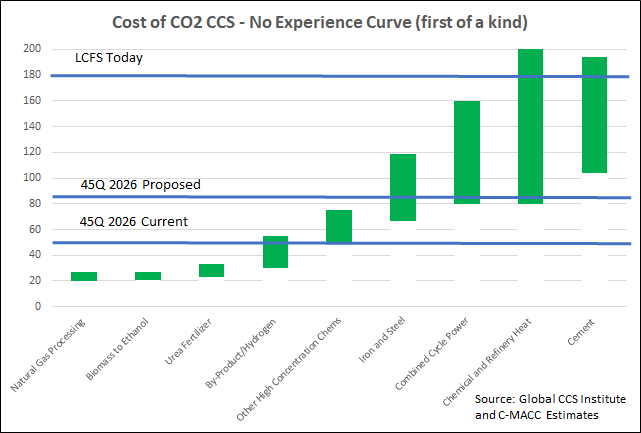

ExxonMobil is seriously upping its lower-carbon game with the CCS announcements over the last few weeks and the release this week that states the company will spend $15 billion over the next 6 years on lower carbon initiatives. In this linked headline ExxonMobil states that it will meet its 2025 emission goals this year – we are assuming that this must be correct as the company would not want to risk the accusation of greenwashing. Either way, the critics will weigh in, either claiming “greenwashing” or suggesting that the targets were not high enough, to begin with. The ExxonMobil focus is very much on CCS, which makes sense for an oil and gas-centric company whose only real play right now is to lower the carbon footprint of its fuel portfolio. In the release linked above, ExxonMobil also talks about biofuel and hydrogen initiatives, but again calls for supportive policies from governments and we suspect that the underlying push here is towards the US government. ExxonMobil and others have indicated that $100 per ton is the right incentive to drive CCS and other carbon abatement strategies and we would agree with this estimate as it backs up much of the work that we have done over the last year. See - Carbon: Trading, Offsets, and CCS as a Service – It’s All Coming! and - Carbon Games – Appetite, But Not Enough Hunger Yet. The other reason why ExxonMobil and others would like to see the US act is because other jurisdictions in which they operate will likely take a lead from the US.

Direct Air Capture Is Expensive, But Demand Is There

Sep 10, 2021 1:43:32 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CO2, Emission Goals, carbon dioxide, carbon offsets, direct air capture, greenwashing, DAC, carbon neutral hydrocarbons

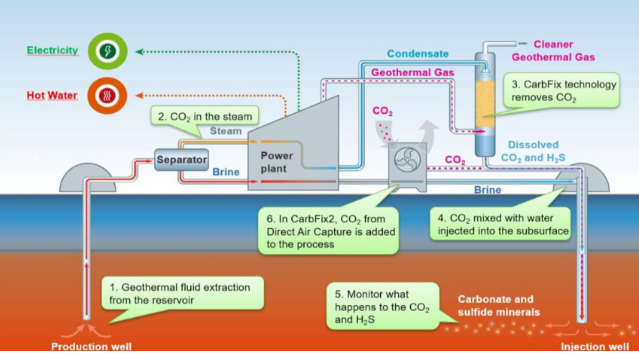

The most notable news from the Iceland CO2 direct air capture (DAC) project, illustrated in the Exhibit below, is not that it is working and how energy efficient it is, but that the CO2 capture costs are extremely high and yet all of the offsets are sold. One report talks about the costs per credit approximating $1000 per ton of CO2, which is likely accurate given that the facility is relatively small scale, at 4 thousand metric tons per year. The same report also states that the credits are almost sold out for the 12 years that they are being offered. We believe that this is indicative of the marginal demand for uncontestable carbon offsets, and this is a topic we have covered at length in our ESG and climate work. Shell, bp, and others are selling what they claim to be carbon neutral hydrocarbons around the world and are buying offsets to do so, but they are coming under quite a lot of “greenwashing” fire because of the less tangible/auditable nature of the credits they are buying – often related to agricultural or specific tree conservation/planting initiatives that are questioned because of the validity of the capture claim or the vulnerability of the credit to weather, fires, and forest maintenance years in the future.

Carbon Pricing May See Several Sources Of Volatility

Jul 9, 2021 1:02:30 PM / by Graham Copley posted in ESG, Climate Change, Carbon, Carbon Price, Carbon Neutral, carbon abatement, carbon offsets, offsets, climate, greenwashing

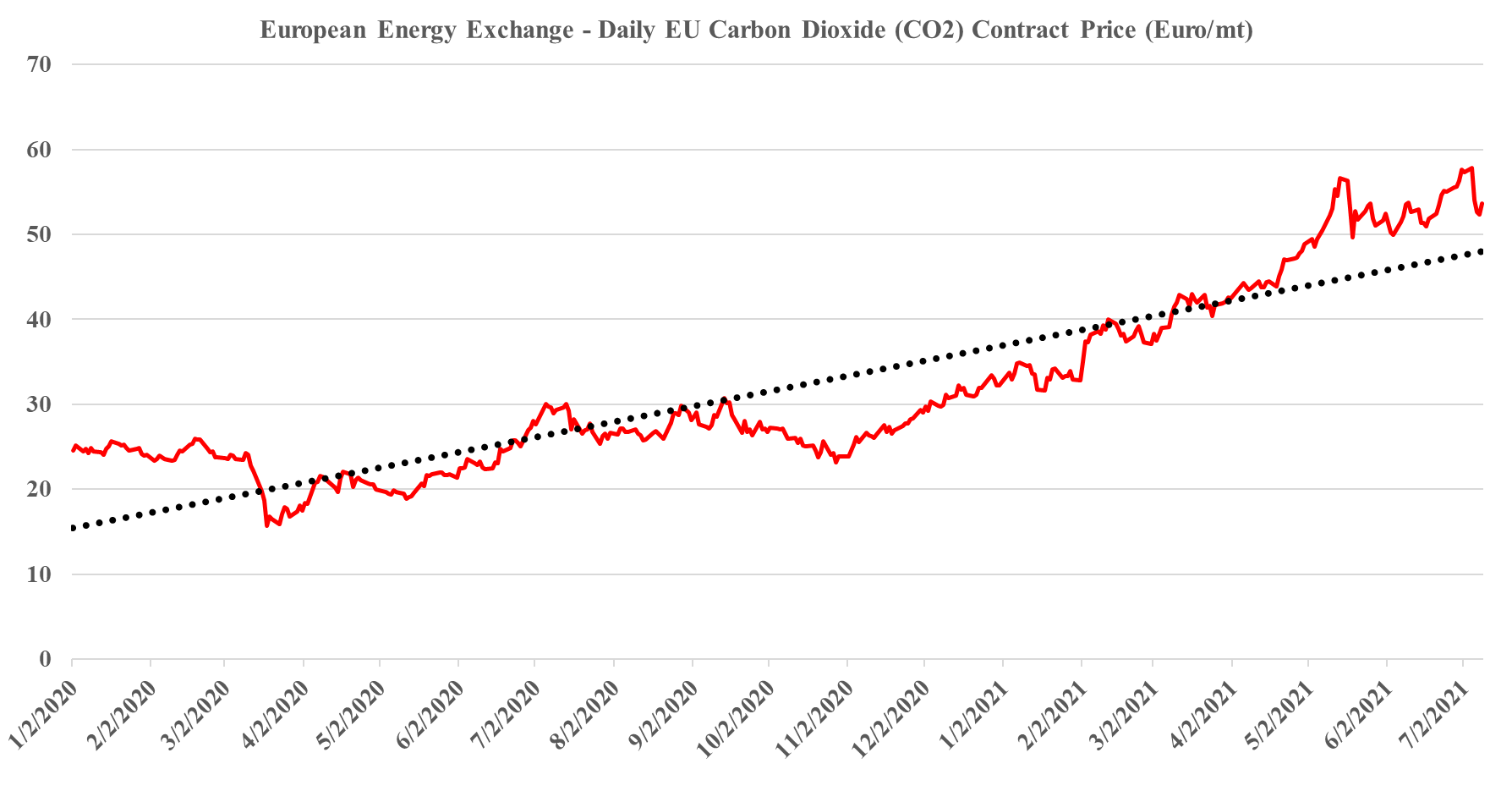

We are skeptical about carbon offsets and we are more skeptical about announcements around carbon-neutral fuel and chemical cargoes. The ESG and climate activists have their radars finely tuned for “greenwashing” and other exaggerated claims, and when we get into offsets, whether as a traded market or as a one-off green cargo we rightly see the skeptics. The cargoes – ethylene below and an LNG cargo earlier this week - are PR stunts in our view and while the accounting may be accurate, the one-off costs are likely high, and the ability to repeat the process for significant volumes is limited. It may be proof that you can create carbon neutrality through offsets, but the supply of offsets will likely never be large enough to create affordable permanent pathways, and offsets should be looked at by all as a way to go the last mile, having exhausted all other options, including carbon avoidance and carbon use or sequestration. We have noted in prior work that we see a risk of too many people banking on a share of the offset market than the likely size of the market – creating price inflation and ultimately lower revenues than could have been achieved through alternate means. Current offset markets are cheap – at least relative to other costs of carbon abatement, but higher levels of oversight, which are both needed and planned, will likely limit availability going forward – also suggesting higher pricing.