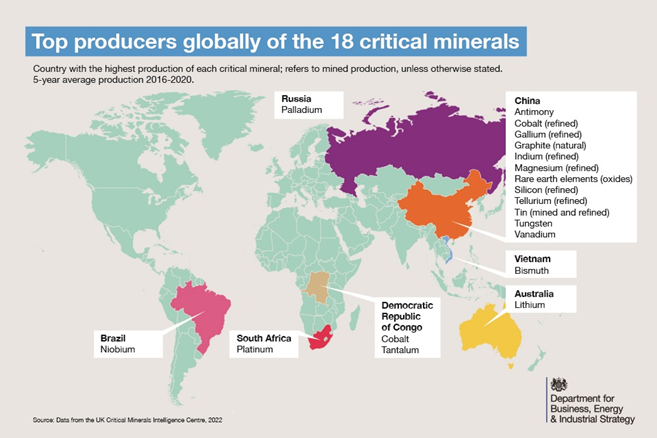

We are seeing more focus on supply chains as they relate to the energy transition. Some European countries are realizing what we have noted in prior research - EU Energy Policy: Swapping A Bad Supplier For Something Worse? - switching to an aggressive focus on renewable energy may reduce your energy exposure to Russia but it currently doubles down on your exposure to China. It is very easy to look at the scale of the problem – the share that China has in critical metals, as shown below – the share that China has of solar modules – etc., and conclude that it is too hard, especially in Europe where you will find an environmental lobby trying to stop you doing anything industrial. But the net effect is severe reliance on China. One advantage that the UK now has with its exit from the EU is more industrial freedom and the country could benefit from the right industrial policies that would attract broader energy transition investment. In our ESG and Climate report this week we talked about the U.S. desire to “friend-shore” rather than re-shore because of local investment challenges in the U.S. as a consequence of some of the political issues. The UK could benefit from becoming an industrial partner with the U.S. for some critical materials.

Energy Transition - Lots at Risk and Funding Harder To Find

Jul 22, 2022 2:14:51 PM / by Graham Copley posted in ESG, Sustainability, Metals, ESG Investing, Supply Chain, renewable energy, energy transition, materials, minerals

Renewable Power Bottlenecks = More Fossil Fuels

Dec 22, 2021 1:44:32 PM / by Graham Copley posted in ESG, Sustainability, LNG, Coal, Renewable Power, ESG Investing, raw materials inflation, solar, renewable energy, wind, climate, shortages, fuels, renewable power inflation, oil production, Permian basin, coal demand, electricity, LNG supply

While we would generally avoid quoting work from a company that we might consider a peripheral competitor, we are happy to do so when it backs up one of our central themes – in this case, inflation in renewable power costs. The quote is taken from the Wood Mackenzie report flagged article linked here and discusses a view on how challenges that renewable power installers have faced in 2021 will extend into 2022. The quote talks about shortages of renewable power equipment, and the obvious consequence will be higher prices for that equipment, especially as raw material prices for components remain high and possibly move higher. In our ESG and Climate report today, we talk about the need for some commonsense oversight such that impractical ESG investing targets do not limit the ability of producers of critical fuels and materials to operate.

European Natural Gas: The Price Of Impractical Energy Transition Policy

Dec 21, 2021 2:13:22 PM / by Graham Copley posted in ESG, Sustainability, LNG, PVC, Coal, Methanol, ESG Investing, Inflation, Ammonia, natural gas, natural gas prices, energy transition, climate, renewable power investments, Climate Goals, shortages, fossil fuels, Europe, low carbon LNG

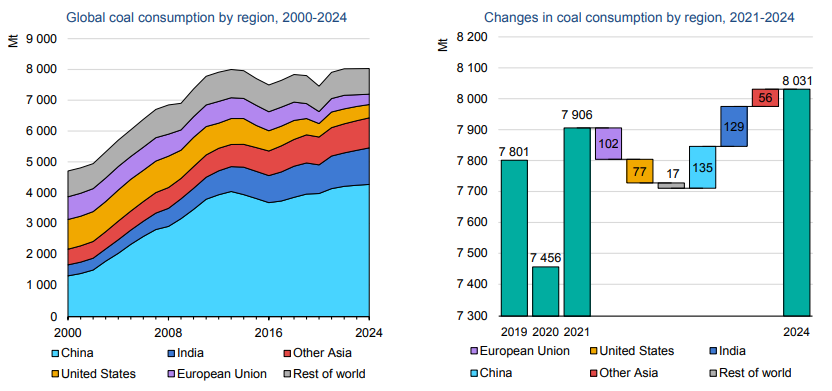

International natural gas prices are hitting new highs this week, both on an absolute basis and relative to the US - see both charts below. At the same time, we see new contracts being signed for US LNG to move to China and Europe, but mainly China. This is happening despite significant renewable power investments globally in 2021 and it would appear that many have underestimated energy demand growth in projections and policy. The other net effect of the supply/demand imbalance this winter and possibly through 2022 will be increased coal use in Europe and the US, with local governments unable to meet near-term climate goals, especially in Europe, but also in parts of Asia and, at the same time keep the people warm and the lights on. In our ESG and Climate piece tomorrow we will focus on one highly unpopular but likely very practical opportunity for coal as part of a planned energy transition program, and it is likely that, while climate goals may not need to change, some socially unpopular decisions around the use of fossil fuels will be needed to prevent even more socially unpopular inflation or absolute shortages.

Carbon Offsets: Definitions Are More Important Than Trading Architecture

Dec 16, 2021 1:51:21 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CO2, Emissions, ESG Investing, carbon credit, carbon offsets, direct air capture, carbon offset, climate, carbon credits, carbon prices

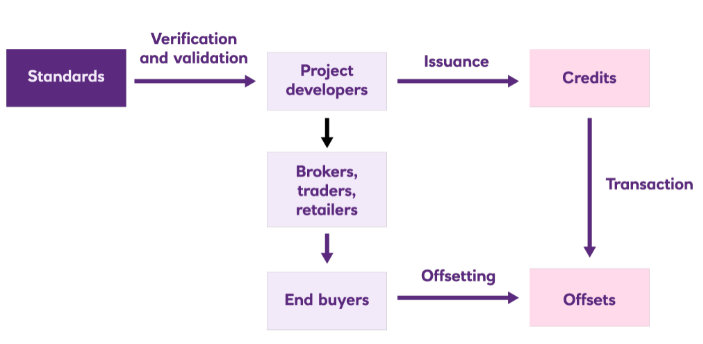

The carbon credit schematic below helps understand the mechanics, but the diagram does not sufficiently emphasize the critical importance of the “Verification and Validation” step. This is a great example of a mechanism that should work logically, but if the input is wrong the output will be also. Potential buyers and sellers of carbon credits understand the process well, but they are more concerned about what goes in the front end as the value of the credit will be very dependent on the quality. Today the only “sure thing” carbon offset is direct air capture, as all of the agriculture-based offsets need much tighter definitions. See research - Carbon Prices – Inequitable and Uncertain – Not What We Need

Investment Constraints On Solar Before We Even Start With Hydrogen

Dec 14, 2021 1:17:04 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Green Hydrogen, Renewable Power, ESG Investing, Materials Inflation, Inflation, solar, ESG investment, climate, solar energy, material shortages, product shortages, onshore wind

Much of the core focus of both our chemical industry and ESG and Climate research recently has been on inflation and materials shortages; we would point you to: Inaction, Caused By Inflation Fears, Is Driving More Inflation! and Coming Up Short: Materials Availability To Limit Climate Progress. This linked article suggests that, as we have predicted, cost and availability pressures are taking a toll on solar installation plans for 2022 in the US. While the inflation piece is real and the product shortages highlight some of the capacity constraints for materials and panels, the broader conclusions that can be drawn from the headline are more concerning. These shortages (and higher prices) are coming well before we see any step change in attempts to increase renewable power installations associated with all of the green hydrogen projects that have been announced over the last 6-9 months. All of these investments are relying on the deflationary trends continuing, especially for onshore wind and solar.

Uncertainty And ESG Pressure Likely To Cause More Energy Price Spikes

Nov 24, 2021 2:09:08 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Renewable Power, Energy, Emissions, ESG Investing, Net-Zero, carbon footprint, carbon abatement, carbon offset, energy transition, climate, energy inflation, energy prices, carbon pricing, ESG Pressure, fossil fuels

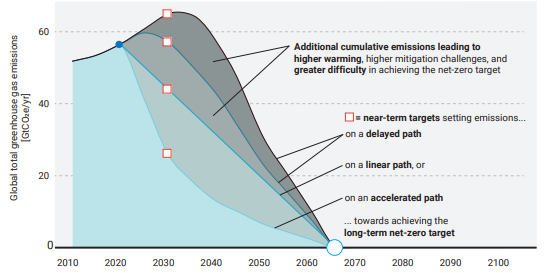

In a media interview earlier this week (more details to follow) we were involved in a discussion about inflation and specifically energy. The discussion covered much more than this, but the chart below is perhaps one of the easier ways of showing where our concern lies, and it ties directly to the behavioral patterns that are emerging concerning climate change and ESG focused investing. As noted in the title of the chart, the likelihood that the linear path from here to net-zero will work is very low, given that we would need global government coordination now, and we are far from it. The other scenarios are much more likely, at least in the early years, and they call for an increase in emissions, which implies growing demand for fossil fuels and other materials that have a high emissions footprint. If you are an oil or gas producer and you look at the chart you could quickly conclude that while your products are in demand today and likely to be in growing demand for several years, the longer-term outlook is very unclear. This might slow down your investment plans, or at least make you think twice about the shorter lead-time projects – such as on-shore and shale-based. However, it could kill any longer-term offshore/deepwater projects that take many years to bring on stream. Today we see energy investment hesitancy everywhere (see our Chemical Blog), but at the same time, we do not see the global coordination to drive a faster energy transition, assuming we had the materials and the investment dollars to move any faster. The risk that we run out of produced fossil fuels from time to time over the next 3-5 years is very high.

Chevron: Working Hard, But Will It Be Enough?

Sep 16, 2021 2:57:56 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, ESG Investing, ESG investment, Chevron, carbon storage

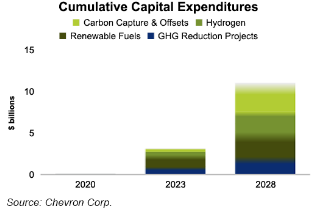

We focused on several aspects of carbon in our ESG and Climate report yesterday and we see several headlines today that focus on carbon and storage, whether it is the blue hydrogen project in France or the Chevron interest in CCS. Chevron has some experience with CCS with the Gorgon natural gas project in Australia and while the company has been criticized recently for falling short of its capture goals for the facility – we believe that all learning experiences are valuable, and what happened in Australia likely leaves Chevron better equipped than many to pursue successful projects going forward. The likely disappointment for Chevron will be the lack of investor appreciation that it may get for the initiatives, as the focus will remain on the scale of fossil fuel exposure – see our Sunday Piece from this week. The barrage of announcements from Chevron is likely in response to the investor pressure that the company (and the industry) is under, but as we discussed on Sunday, it may not make a difference – it did not for Shell in the eyes of the Dutch court.

Big Oil Will Struggle To Get Investor Attention With Small ESG Moves

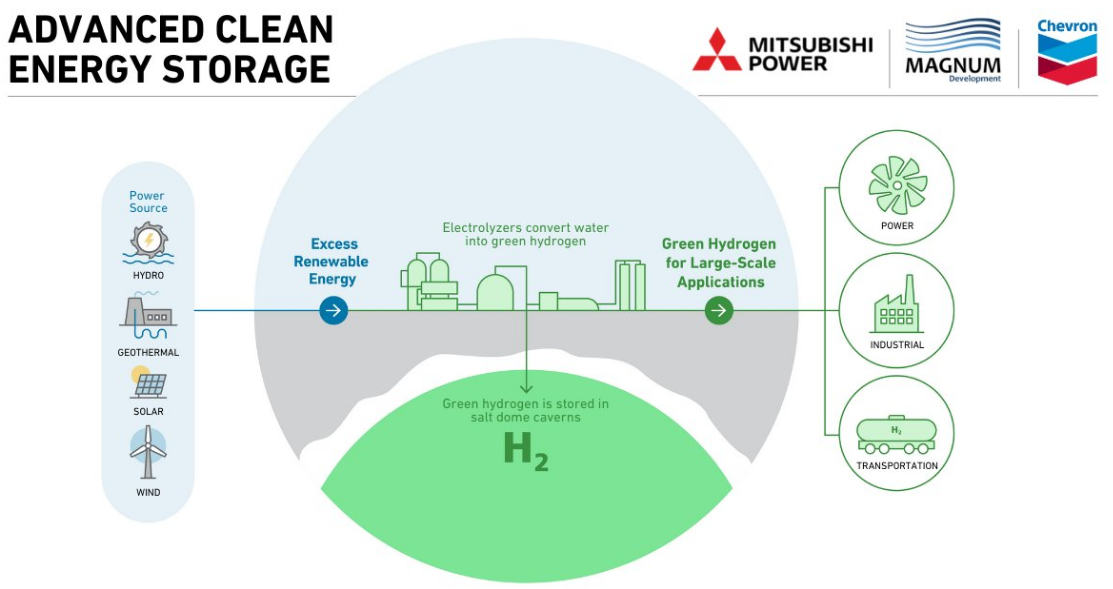

Sep 14, 2021 1:16:08 PM / by Graham Copley posted in ESG, Green Hydrogen, CCS, ESG Investing, ExxonMobil, Gevo, Oil, ESG investment, Chevron, Mitsubishi Power, Engine No1

The Engine No1 headline and the Chevron headline are not necessarily the right way to think about the challenges for Chevron and whether or not the challenges are just really beginning for ExxonMobil. The Engine No 1 approach to ExxonMobil was not ESG focused and hit on a larger issue of very poor shareholder returns, with ESG/Climate only one-line item on a list. What Engine No 1 is doing now, is focusing more specifically on climate, and ExxonMobil is likely as large a target as Chevron on this basis. Last week in our Sunday report, we commented on how good the Chevron Gevo deal was for Gevo, but that it did not move the needle for Chevron. Chevron, ExxonMobil, and others are aggressively pursuing renewable fuels, mostly from waste and vegetable oils until the Gevo agreement, and there is another headline today about Chevron pursuing CCS opportunities with Enterprise and the chart below discusses a green hydrogen plan for Chevron. All of these initiatives do not sum to something that investors will take note of for any of these companies yet, and while they might be important building blocks towards a net-zero future, larger tangible investments are probably needed to get any investor buy-in. In the meantime, the activists have a lot of room to work.

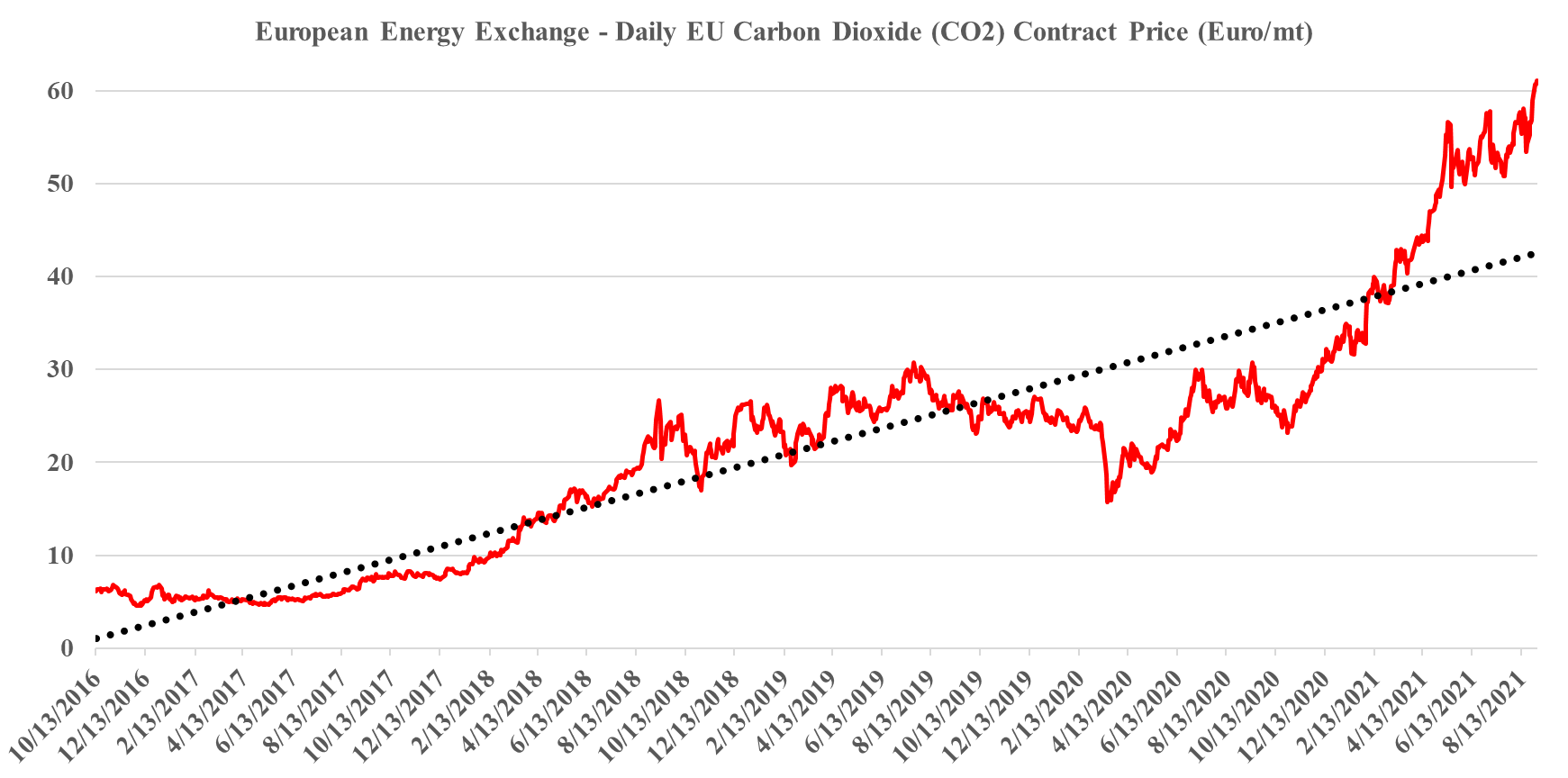

Europe's Record Carbon Prices: Not High Enough Yet

Sep 1, 2021 12:54:34 PM / by Graham Copley posted in ESG, Climate Change, CCS, Carbon Price, ESG Investing, carbon dioxide, carbon value, carbon abatement, renewable power investments

We have maintained all year that the strength in the European carbon price is sustainable and that it should go even higher and consequently, we are not surprised by this week’s move, even if much of the impetus is speculation. The European price is still not high enough to justify unsubsidized CCS or widespread renewable power investments to replace carbon-heavy energy sources, especially as renewable power costs rise. We estimate that a price in the €85-100 per metric ton range would be needed to stimulate investment, but because of the structure of the European market prices could overshoot this level meaningfully and be quite volatile until the level of abatement spending accelerates. When we start seeing investments in Europe to lower carbon that are not highly subsidized by local governments (in addition to the incentive of the carbon price) we will have a better guide around where 45Q needs to go in the US (or other mechanisms) to get investments rolling. Our analysis suggests that the US has some lower-cost abatement opportunities than Europe, especially on the CCS front, but not by much. For more on carbon costs and prices see today's ESG & Climate report.

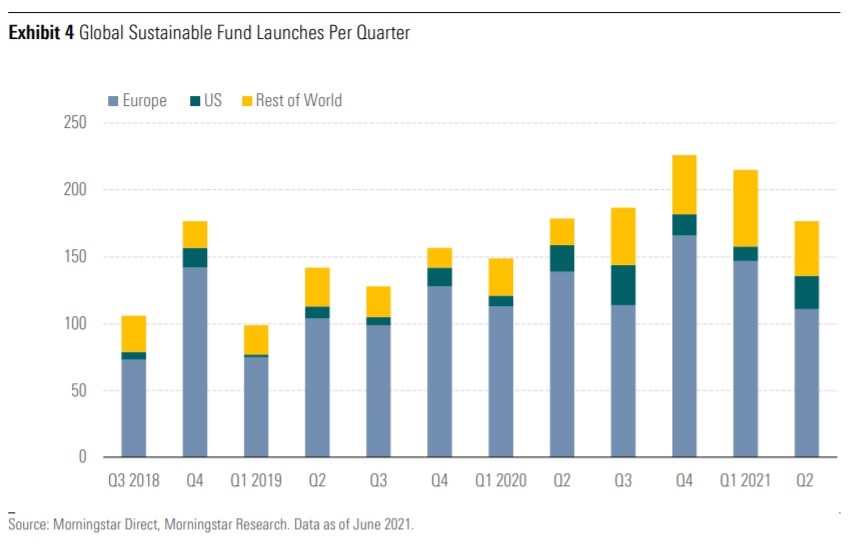

Is ESG Investing Making A Difference?

Aug 24, 2021 12:57:09 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, ESG Investing, ESG funds

There is a significant increase in the number of commentators taking a swing at ESG investing and suggesting that it is neither effective nor in the best interest of investors as it likely puts them at risk of underperformance. The performance piece has largely been a moot point until now as the funds flowing into the ESG space have been high enough to ensure outperformance from a simple supply/demand perspective, see chart below. However, should the flow of funds slow and investments be judged on their own merits many fund managers are going to find that they own some egregiously expensive stocks with fundamentals that do not support the valuation. If this then leads to a rotation out of a sub-set of names, the future outperformance of the class is far from guaranteed.