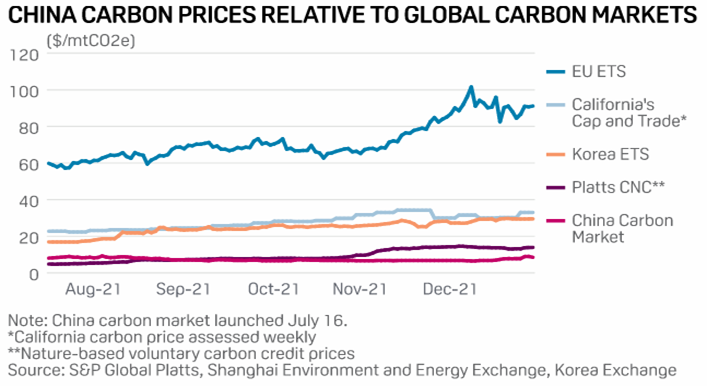

As the chart below shows, there are some very wide ranges in carbon prices today, with only the European price (and only this year) reflecting an approximation to the cost of physically abating carbon dioxide emissions. We cover carbon values in detail in our focused ESG and Climate work and have been suggesting since before we began the dedicated service that it will take an incentive of around $100 per ton of CO2 to get the acceleration of investment needed for CCS to play a major role in emission abatement and perhaps high levels than this for alternative heating technologies than furnaces to makes sense in areas where CCS is not an option.

Few Carbon Prices Justify Abatement Investment Today

Jan 6, 2022 12:06:19 PM / by Graham Copley posted in carbon abatement, Carbon Sequestration, carbon pricing

CCS Is A Cost And Some Projects Look Too Expensive

Dec 15, 2021 1:53:44 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, carbon dioxide, carbon abatement, LCFS credit, climate, pipelines, 45Q, Carbon Sequestration, abatement costs, CAPEX, CO2 pipelines, OPEX, Summit Carbon Solutions

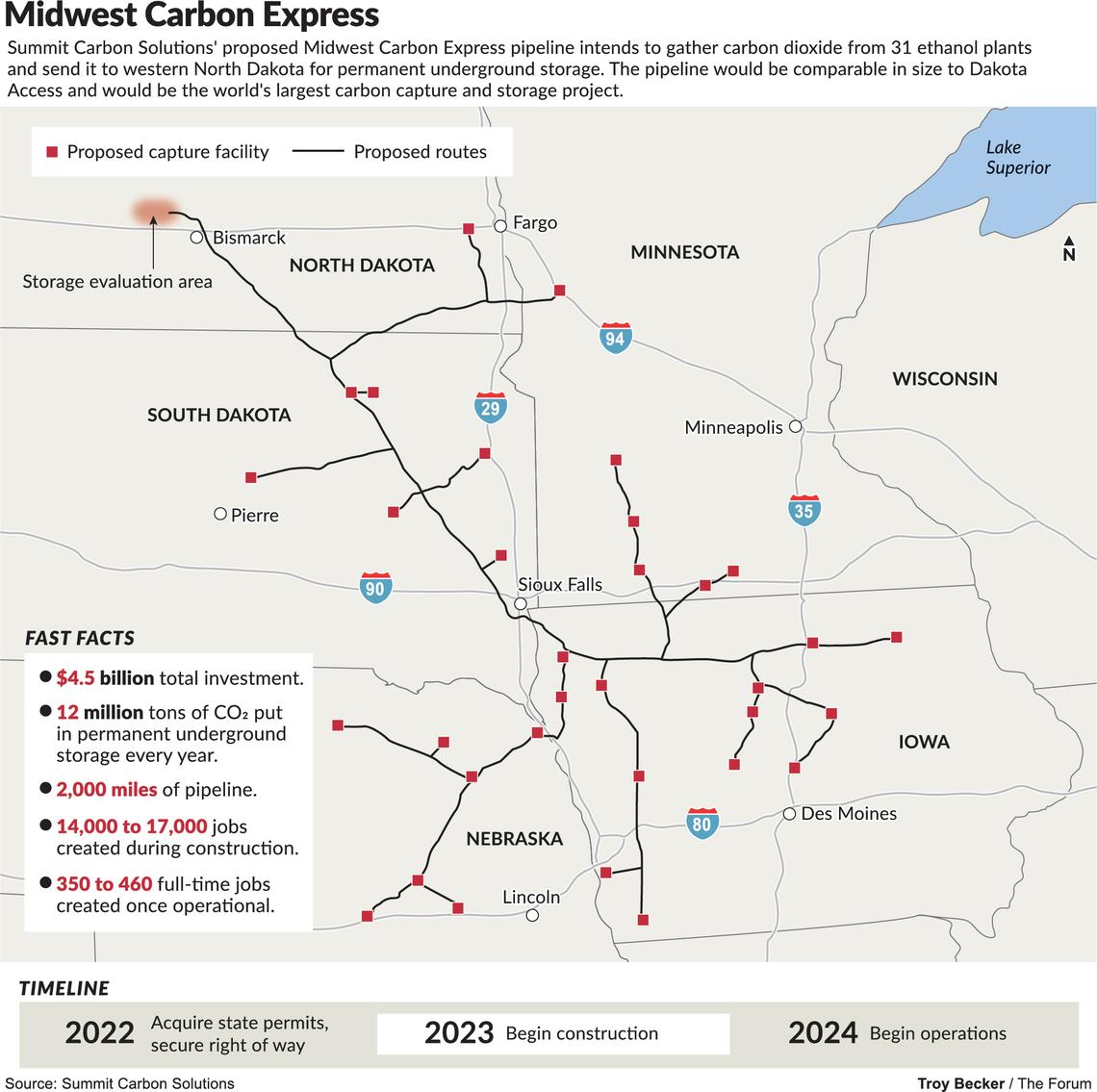

As we have mentioned before, we see a couple of major challenges with the CO2 pipelines proposed for the mid-West, one of which is summarized in the Exhibit below. The first issue is pipeline right-of-ways, as there are already activists determined to oppose the pipelines, and opposition to pipelines has been a core them of the last 10 years. The second issue is cost. Carbon abatement is a cost for all looking for solutions and even where incentives exist, such as the 45Q program or the LCFS fuels program, the challenge will still be creating a path with the lowest. Compression and pumping costs are high for CO2, especially if the pipeline wants a pressure that will allow for direct injection into a series of wells. Lower pressure transportation by pipe is inefficient and raises the capital cost of the pipeline – so it becomes a trade-off – CAPEX vs OPEX. $4.5 billion of investment – as suggested by Summit – is $375 per annual ton of carbon dioxide sequestered - $37per ton assuming 10-year straight-line payback – twice that if you want a 10% return. This is before a dollar of OPEX and pipeline costs could easily exceed another $30+ per ton, with separation and purification of the CO2 stream also not free. Unless the ethanol producers are paying Summit and Navigator to take the CO2, the math becomes very challenging. See today's daily report and our weekly ESG and Climate report for more.

Air Products Claiming The Hydrogen Highground

Oct 14, 2021 3:04:12 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, Blue Hydrogen, Air Products, Ammonia, natural gas, carbon values, blue ammonia, Carbon Sequestration

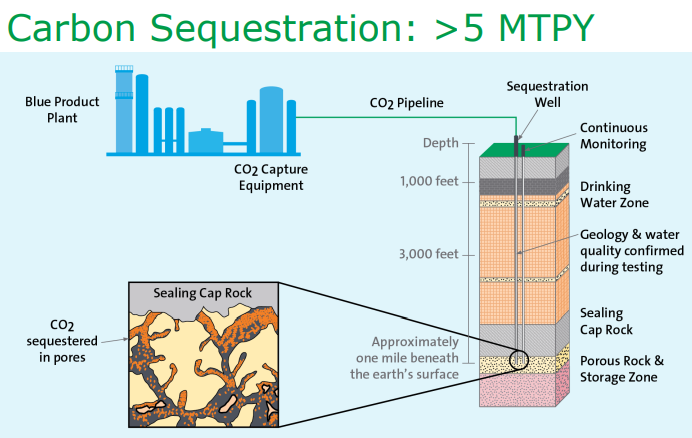

In our ESG piece yesterday we talked about the competitive edge that Canada now has with respect to both natural gas (because of lower prices versus the US) and CCS, both because of relatively low costs but also because of the clear value on carbon. Yet today we see an announcement in the US!