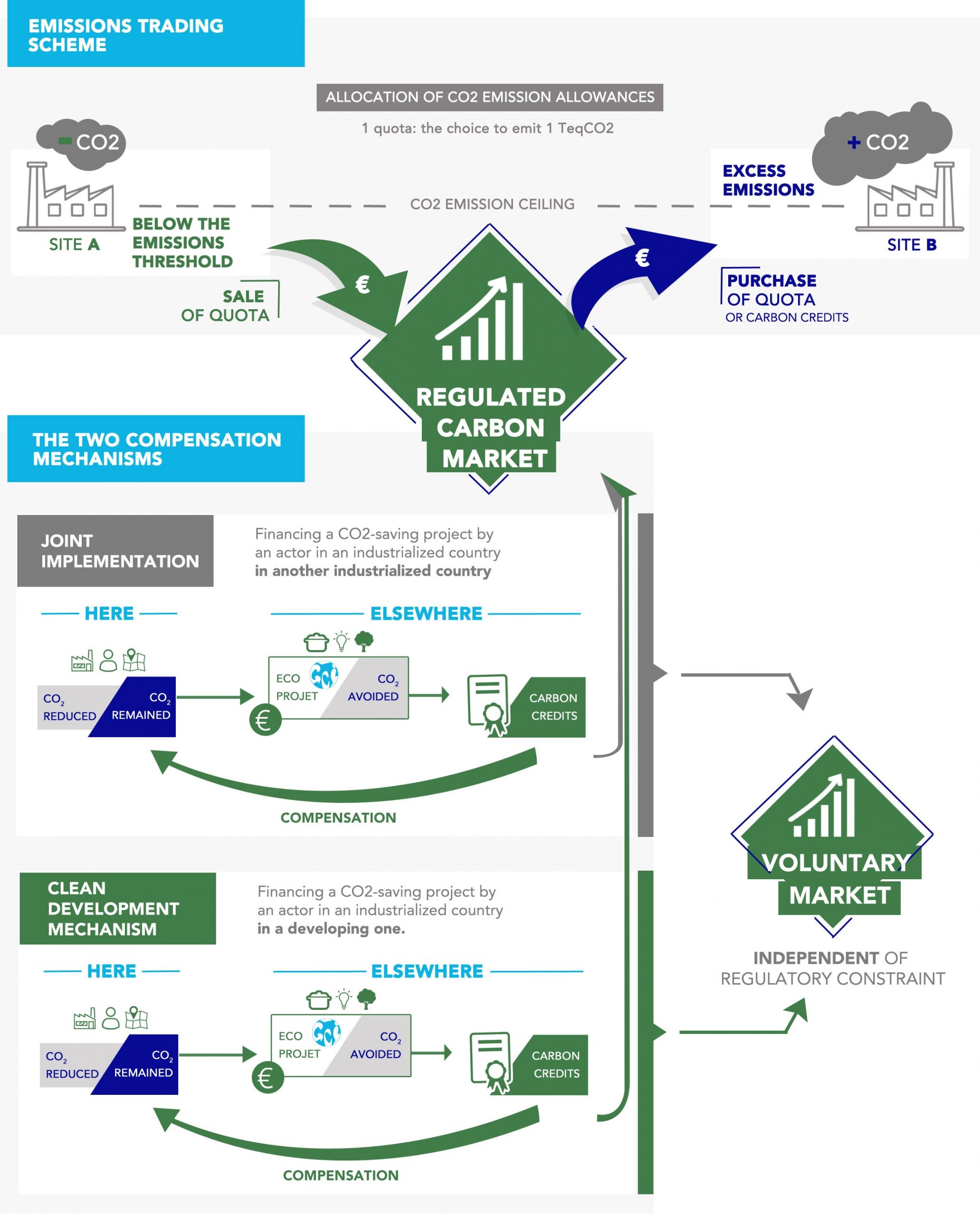

We are skeptical about carbon offsets and we are more skeptical about announcements around carbon-neutral fuel and chemical cargoes. The ESG and climate activists have their radars finely tuned for “greenwashing” and other exaggerated claims, and when we get into offsets, whether as a traded market or as a one-off green cargo we rightly see the skeptics. The cargoes – ethylene below and an LNG cargo earlier this week - are PR stunts in our view and while the accounting may be accurate, the one-off costs are likely high, and the ability to repeat the process for significant volumes is limited. It may be proof that you can create carbon neutrality through offsets, but the supply of offsets will likely never be large enough to create affordable permanent pathways, and offsets should be looked at by all as a way to go the last mile, having exhausted all other options, including carbon avoidance and carbon use or sequestration. We have noted in prior work that we see a risk of too many people banking on a share of the offset market than the likely size of the market – creating price inflation and ultimately lower revenues than could have been achieved through alternate means. Current offset markets are cheap – at least relative to other costs of carbon abatement, but higher levels of oversight, which are both needed and planned, will likely limit availability going forward – also suggesting higher pricing.

Carbon Pricing May See Several Sources Of Volatility

Jul 9, 2021 1:02:30 PM / by Graham Copley posted in ESG, Climate Change, Carbon, Carbon Price, Carbon Neutral, carbon abatement, carbon offsets, offsets, climate, greenwashing

Carbon Abatement – A Multi-client Analysis

Jul 7, 2021 1:01:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax, Carbon Fuels, CCS, CO2, Renewable Power, Carbon, Carbon Neutral, Emission Goals, Net-Zero, decarbonization, carbon footprint, ESG Fund, carbon dioxide, carbon credit, carbon value, carbon abatement, power, carbon cost, carbon offset, offsets, ESG investment, carbon emissions, clean energy, climate

A major initiative by C-MACC in collaboration with the Power Research Group

Expected ESG Regulation Likely Good For Pure-Play Energy Transition Stocks

Jun 30, 2021 4:05:20 PM / by Graham Copley posted in ESG, Biofuels, Plastic Waste, CCS, Carbon, Dow, ESG Fund, solar, ESG investment, wind, European Carbon price, carbon emissions

The ESG investment shakeup could be one of the major events of this year, and as many of the headlines in our daily report suggest, there is a lot of work to be done, whether it is agreeing on a common set of measurement metrics – note the US and European differences discussed in one story – or the introduction of more empirical methods to judge whether what is labeled as an ESG investment fund is labeled correctly. There is also the issue of comparable disclosures, especially for companies in complex industries. It is interesting to note that in many analyses we see around carbon footprint or greenhouse gas emissions, and the potential routes to and cost of abatement, the chemical industry is omitted, except for ethanol and hydrogen. This is despite the industry accounting for 15% of the non-power emissions in the US industrial sector (similar in size to refineries). We believe that this is because the complexity of the industry makes it hard to model, and analysts choose to exclude it because they are not sure what they are doing.

Will The Offset Market Be Big Enough?

Jun 24, 2021 2:08:50 PM / by Graham Copley posted in ESG, Carbon Capture, Methane, CO2, Carbon, Net-Zero, Schlumberger, direct air capture, carbon offset, offsets

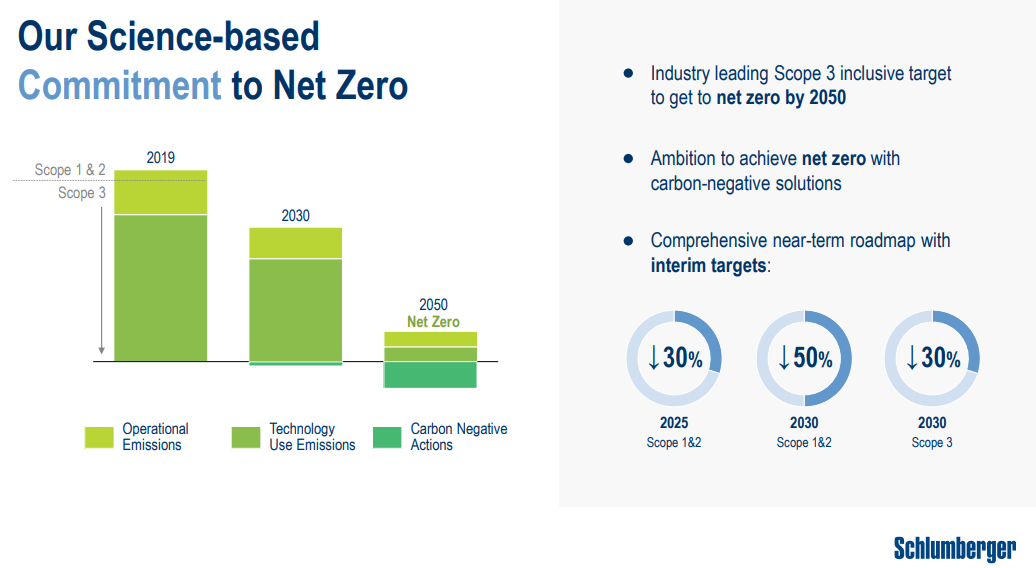

The Schlumberger net-zero goals, as discussed in a couple of articles in today's daily and the presentation linked, set some aggressive but bold ambitions, especially as they are looking to solve problems that they share with their customers, methane leakage from oil and gas wells, and minimizing flaring. Schlumberger is a little dependent on collaboration from its customers here as the technology solutions are likely to be more expensive than current options and the oil and gas producers will need to pay up.

More Climate Discord Unlikely To Help Necessary Progress

Jun 18, 2021 1:51:45 PM / by Graham Copley posted in ESG, Climate Change, CO2, Carbon, Emissions, ESG Investing, carbon credit, investment managers, US Government, carbon values, carbon offsets, carbon trading

There have been some disappointing headlines out of the UN climate meeting this week, which is intended to pave the way for some of the COP26 discussions and come up with proposals that are likely to be agreed upon at the meeting. Most of the issues are around who is paying for what and whether developed nations are investing enough to help developing nations, using the guidelines put forward when the Paris Agreement was signed. In the US, the climate agenda and the Biden plan are bogged down in Congress and the plan is unlikely to pass in its current form.

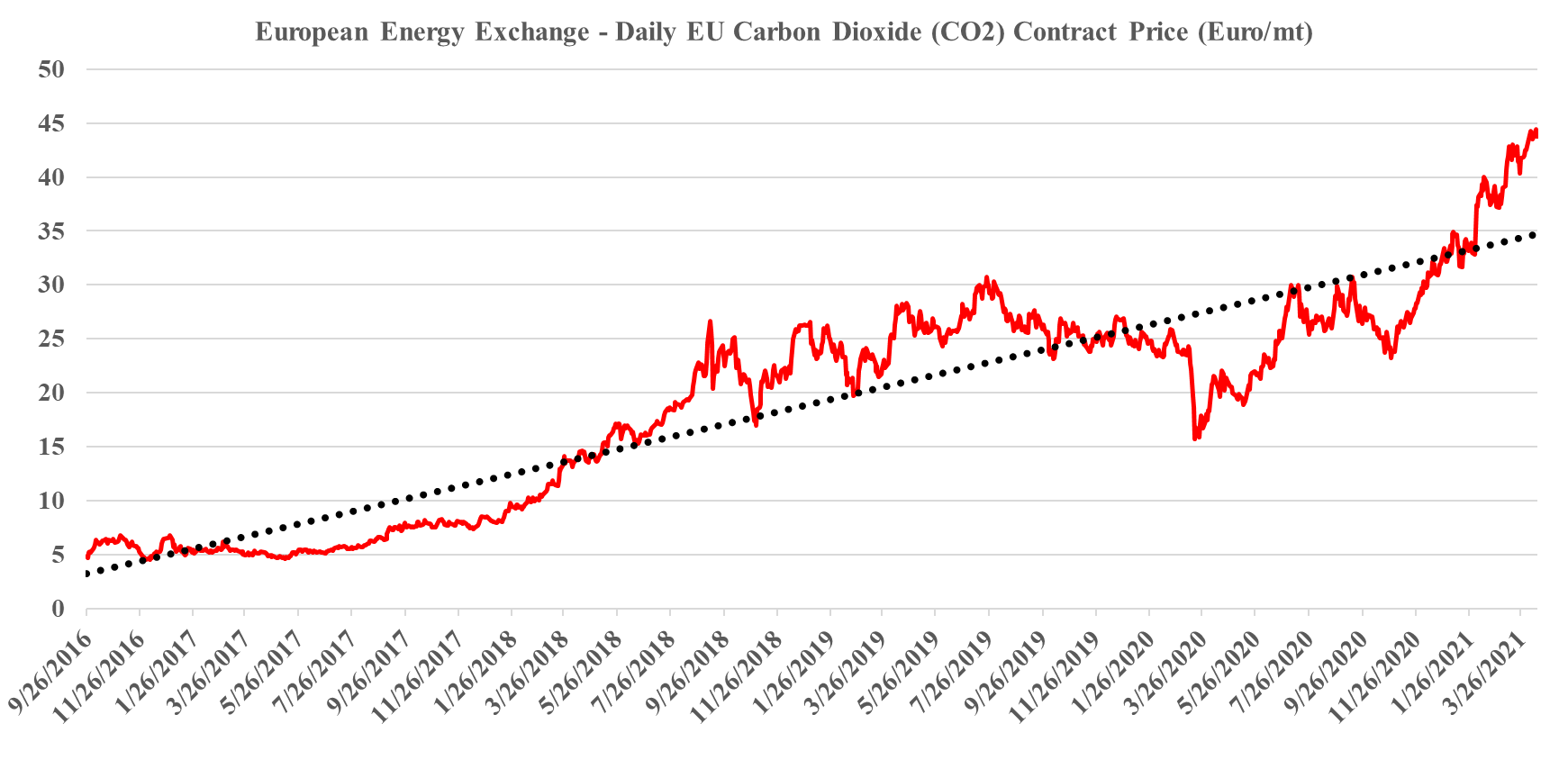

Carbon Values are Rising Except in the US

Apr 14, 2021 12:33:25 PM / by Graham Copley posted in Carbon

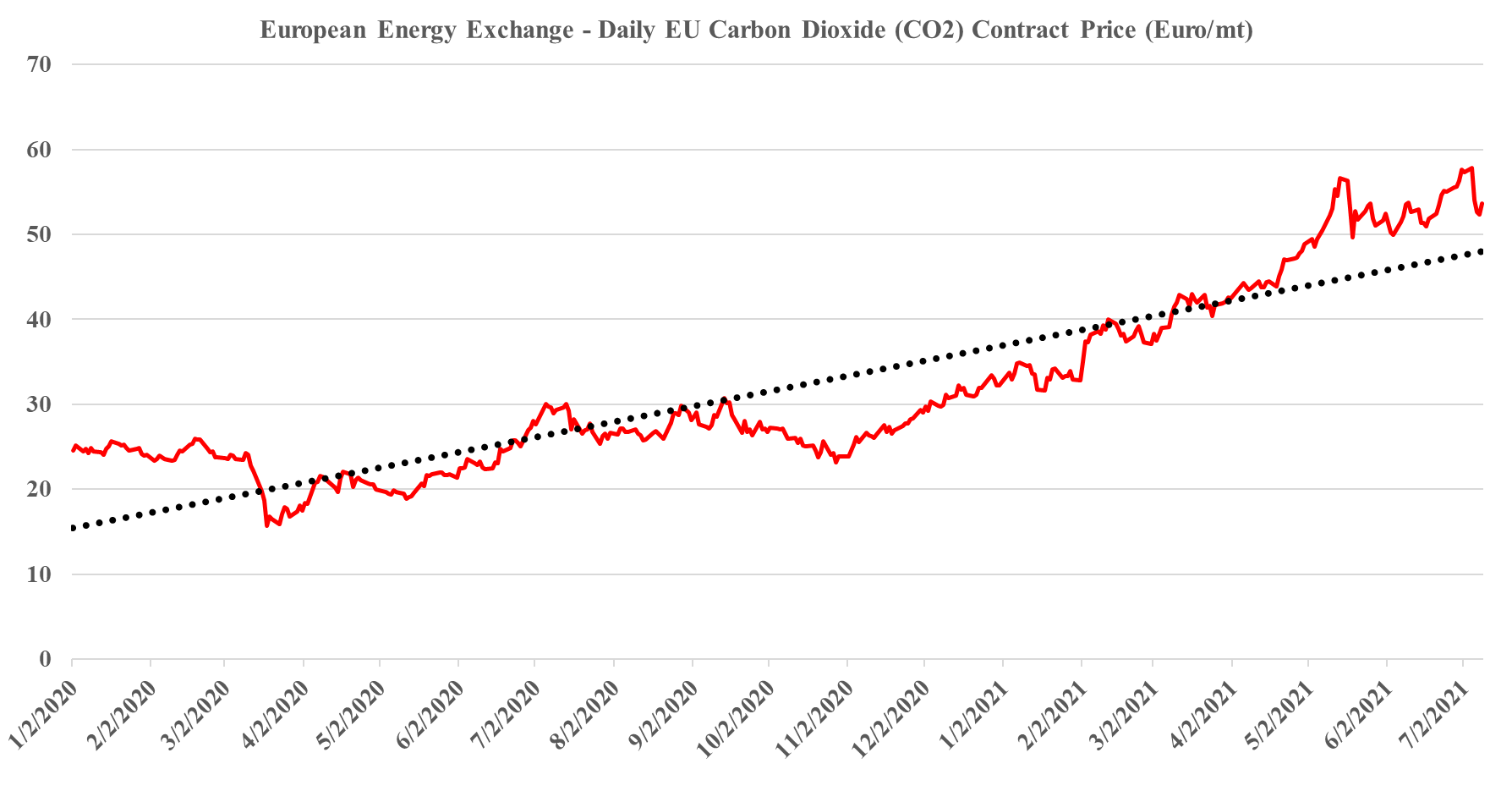

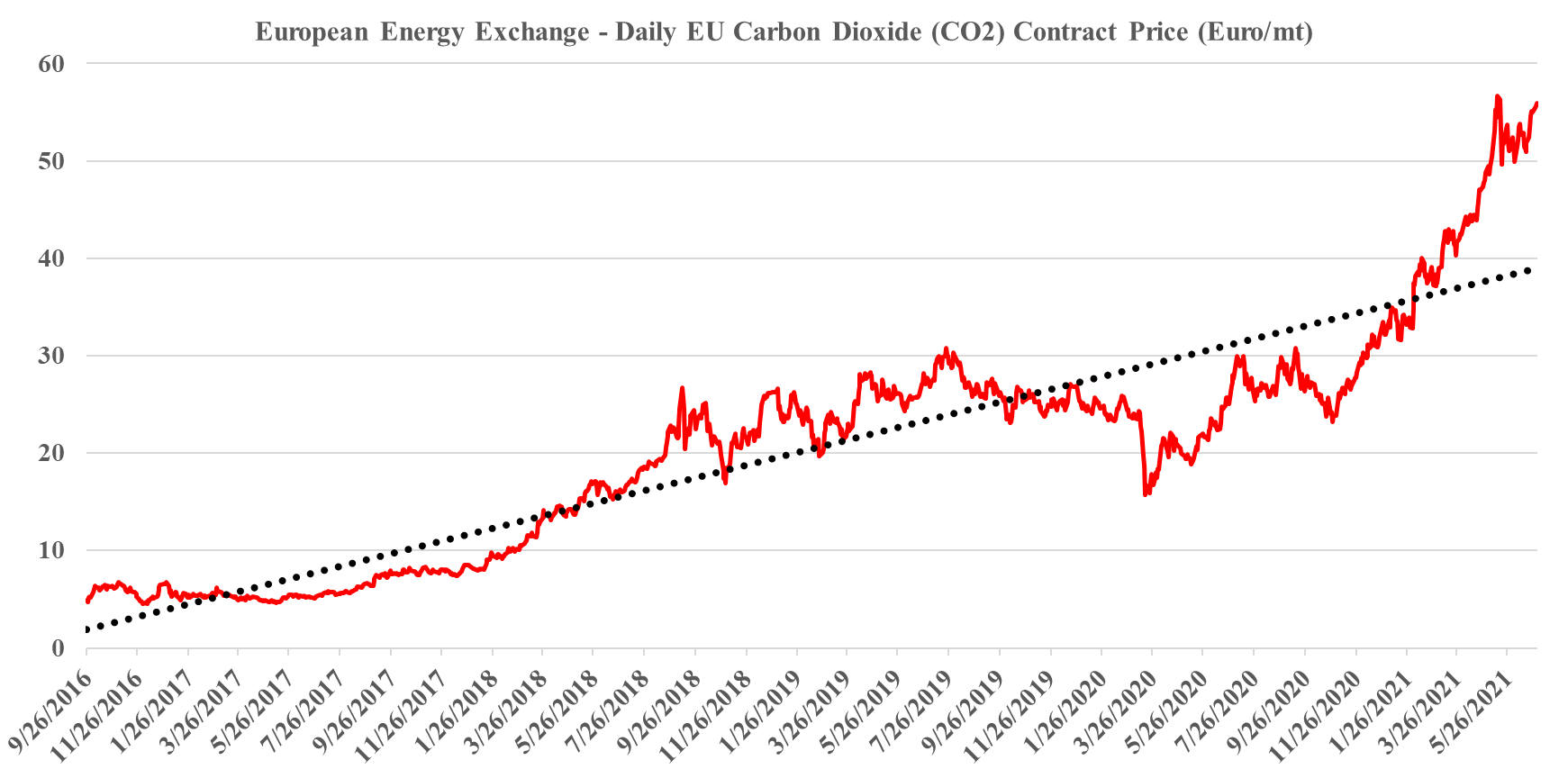

Carbon values are rising around the world and are prompting activity as they do. The expectation of a high carbon tax in Canada has spurred investment plans for low carbon fuels, methanol, hydrogen, and ammonia all using carbon capture, and the rising European carbon price is an indication that carbon credit demand will increase to the point that many of the CCS plans in Europe make better economic sense.