The Dow chart below was included in the presentation around the Canada project and repeated today in the earnings call. We have talked about the Canada project at length as well as the more recently announced Air Products blue hydrogen project in the US. The more interesting debate from here is what will happen next. Are Dow’s and Air Product’s phones ringing off the hooks with potential customers saying “we want some of that”, or is it quieter? We suspect that the phones are ringing and ringing a lot. Perhaps because people genuinely want the low carbon polyethylene or hydrogen, but also perhaps because users of polyethylene and hydrogen are likely obligated to find out more so that they can explore both the opportunities of buying from Dow or Air Products, or evaluating what their alternatives might be. We suspect that a surge in genuine customer interest is likely, good for both Dow and Air Products, but also good for others either considering decarbonizing projects or offering a carbon-free alternative already. See our ESG and Climate piece from yesterday for more on this.

Dow And Air Products Have Got The Ball Rolling, But How Fast?

Oct 21, 2021 1:54:22 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Polyethylene, Blue Hydrogen, Air Products, decarbonization, Dow, climate, low carbon polyethylene

A Climate Plan For China: Ambitious But Late

Sep 29, 2021 2:06:29 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Emissions, Net-Zero, power, clean energy, climate, chemical prices

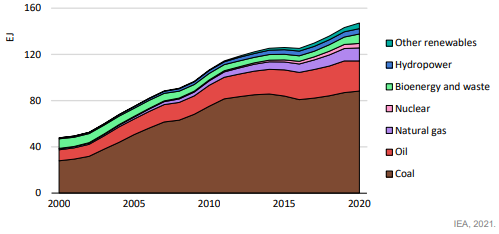

Overnight there has been a very good IEA report on how China could get to net-zero by 2060, and further news of more industries hit by power cuts because of power shortages, some of which are apparently due to tighter emissions standards. These are both important and far-reaching topics and will require some analysis to provide the kind of insight that we believe is necessary, and accordingly, we will push these to next week’s report (all input welcome). In the meantime, we have included a couple of charts that show the way up and the IEA view of the way down. The power outages are interesting as while they may cause some manufacturing cutbacks and we have seen recent news to that effect, China has overbuilt in the last couple of years relative to domestic demand growth, and with port and shipping congestion the country has surpluses of many products sitting around at very low values. The power moves may help correct some of these imbalances and we are already seeing some chemical prices bounce off recent lows because of production cutbacks. We discussed the acetic acid chain in one of our dailies last week – linked here.

US CO2 Footprint Shrinking, But Not Fast Enough

Sep 9, 2021 1:00:13 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, carbon footprint, climate, EIA, CO2 footprint

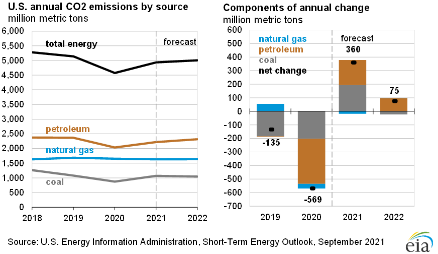

The CO2 emissions chart from the EIA should not be a surprise as the step-up in 2021 and 2022 is a recovery from the economic contraction and habit changes associated with COVID, and the projected increases in 2021 and 2022 are combined lower than the step down in 2020, suggesting that the trend is still negative. The problem is that the trend is not negative enough and as we have written about at length, it will not trend lower fast enough without all corrective opportunities at play – more renewable power, more conservation, and a lot of CCS. See our ESG and Climate work for more.

Will The Climate Frenzy Leave Plastic Waste Ignored For Now?

Aug 13, 2021 11:46:37 AM / by Graham Copley posted in ESG, Climate Change, Plastic Waste, Plastics, CCS, CO2, Emissions, Carbon Price, carbon abatement, climate, IPCC, Plastics producers, COP26, virgin plastic, plastic tax

As we sift through the positioning for the upcoming COP26 meeting and the attention focusing report from the IPCC this week, it is a reasonable question to ask what this means for the plastic waste issue. If governments, lobbyists, and activists are likely to be more focused on climate change action over the next few years, which seems to be a reasonable conclusion, will there be the bandwidth for plastic waste? The plastic waste issue is less open to interpretation than the climate change issue and is a visible problem for all, but if governments need to prioritize where they spend their incremental dollar, and/or where they provide incentives of penalties, the climate is going to be pushed to the front of the line in our view. Plastics producers will have to deal with emissions, like any other industrial user of power and heat. The risk is that local governments, looking for revenue to support climate initiatives see taxing virgin plastic (or unrecycled plastic) as a way to both push plastic waste initiatives forward and raise revenue. Adding a plastic tax in the US to the superfund proposal in the infrastructure bill would be hitting the chemicals industry from two sides and would give bodies like the ACC far more grounds for pushback. For more on the IPCC analysis see our ESG & Climate Change report from this week.

The UN Report Is Alarming - Right or Wrong, We Cannot Ignore It

Aug 10, 2021 12:30:31 PM / by Graham Copley posted in ESG, Climate Change, Emissions, climate, UN, United Nations, IPCC, abatement, Sea Levels

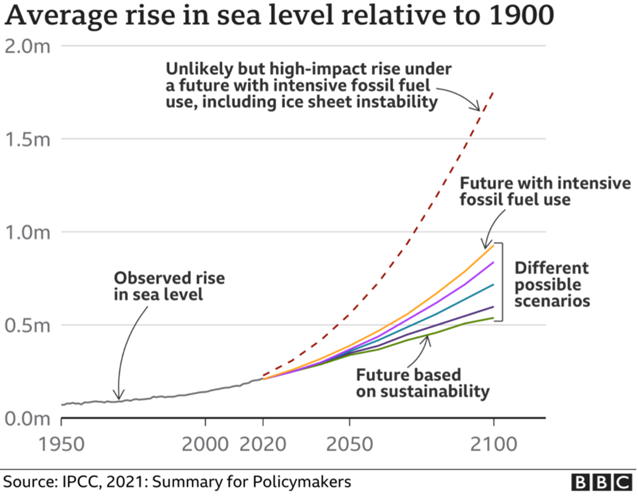

The IPCC (UN) report is all over every news outlet and its content and the ramifications of the analysis will be the core of our ESG and Climate piece tomorrow – in the Exhibit below we show a chart that was republished by the BBC which looks at projections around sea level increases. While the UN report has compelling academic and government backing and is certainly the most coordinated analysis on climate change, it is still littered with “most likely” and “more likely” comments, suggesting that the projections are still shrouded in uncertainty. There is a very good chart that shows “observed” climate change data over the last 50 years, and the ranges around the primary causality (human versus natural) conclusions are significant, suggesting that different models are telling very different stories, some less scary than others.

Carbon Capture (If Supported) Will Create Competitive Dislocations

Jul 21, 2021 1:08:19 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, CO2, fossil fuel, carbon footprint, carbon abatement, renewables, European Carbon price, climate

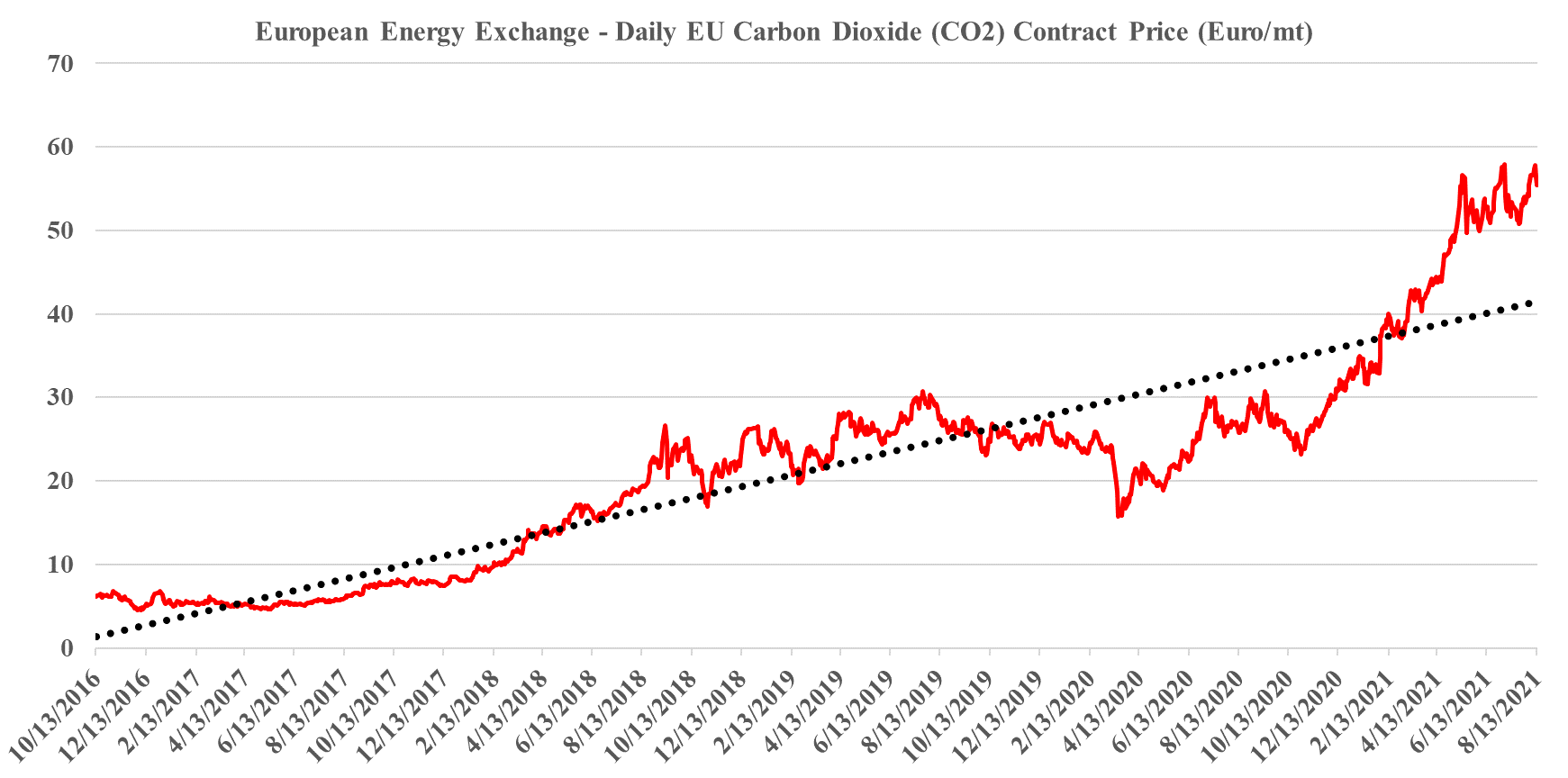

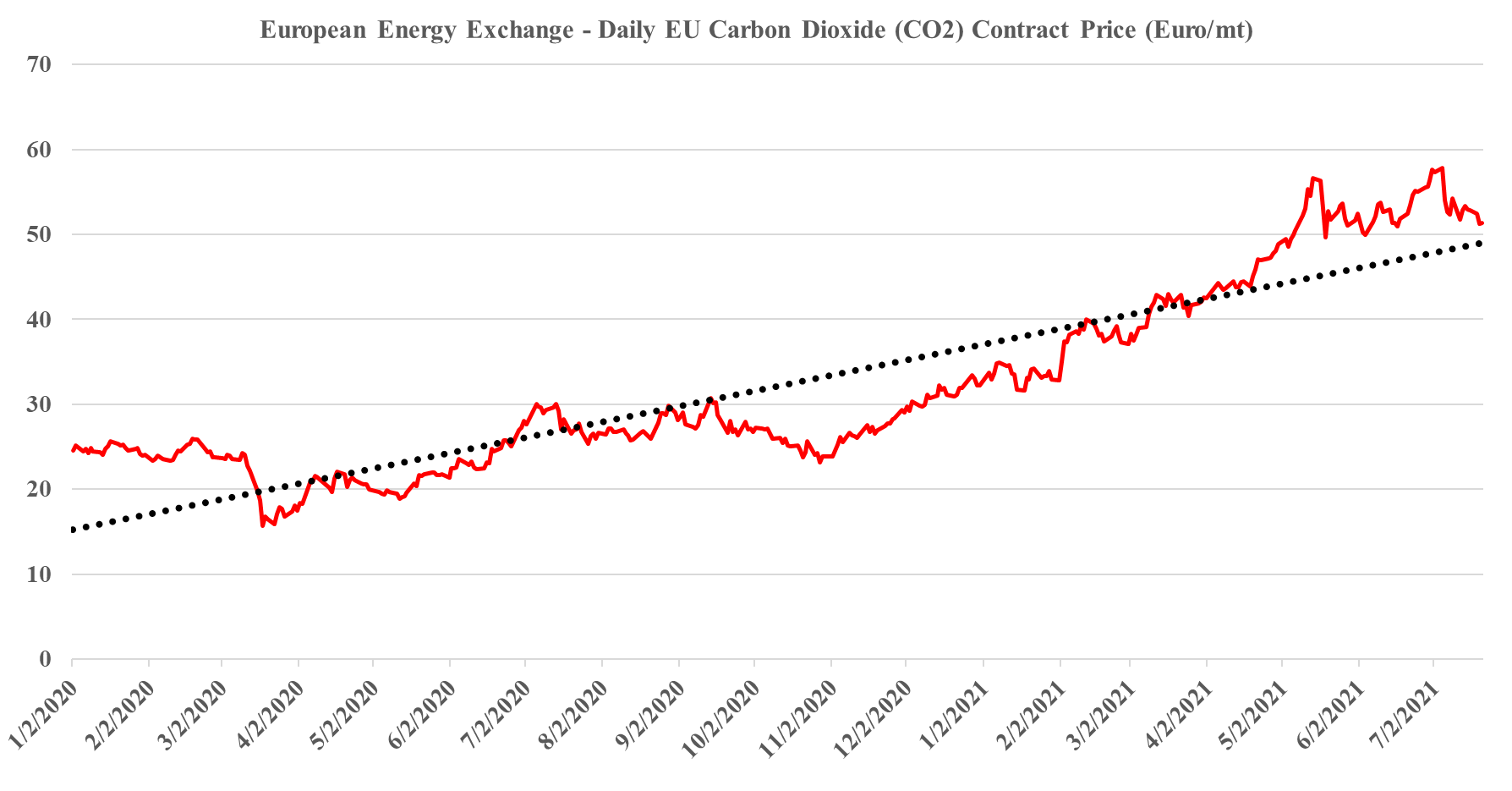

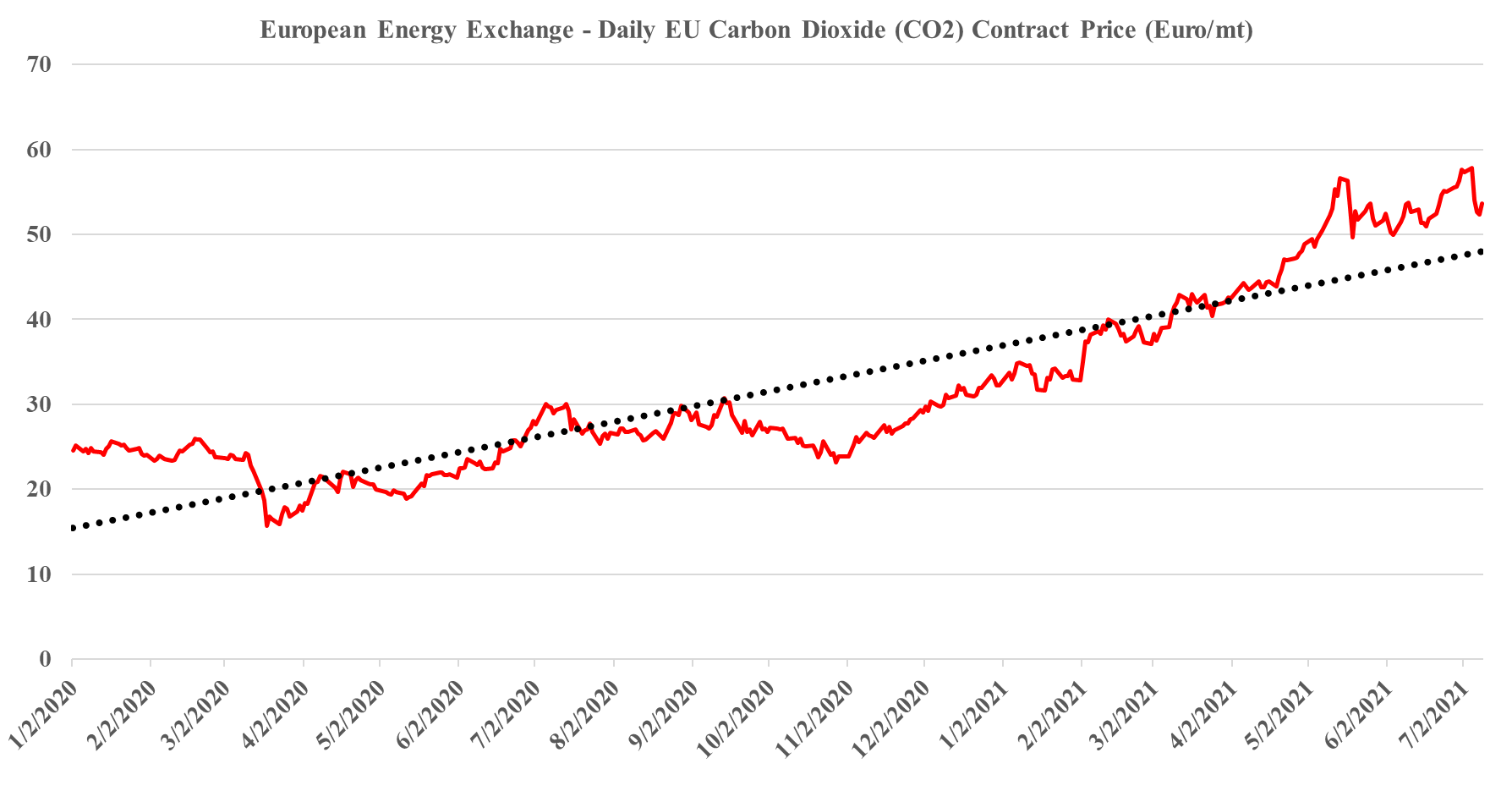

In our ESG and climate piece today we focus on Carbon Capture and Sequestration (CCS) and the likely very steep cost curve between the mega projects and those less fortunate. But as we discuss CCS, we should not forget that the World is still not convinced about CCS as part of the solution set for carbon abatement, as the headline linked discusses. The naysayers are focused on the lifeline that CCS offers to the fossil fuel industry, but always fail to offer an economic rationale for the quick elimination of fossil fuels and their replacement by renewables. Few of the proponents of CCS see it as an alternative to a long term path to alternative means of abatement, but all recognize that relying on renewable power investments will likely leave the World with a much larger CO2 footprint from 2030 to 2050 than what could be achievable with CCS – note that the 45Q incentive in the US has a finite lifespan as there is an expectation that eventually CCS will be unnecessary because of fossil fuel replacement. Chevron has not helped the CCS proponents with its missed targets in Australia as it adds fuel to the argument that CCS has not lived up to its potential. While the European carbon price trend has stalled in recent weeks – chart below – the trend remains distinct and it would be foolhardy to ignore the likelihood of prices rising to a level that makes CCS attractive – especially for the mega-projects.

Carbon Pricing May See Several Sources Of Volatility

Jul 9, 2021 1:02:30 PM / by Graham Copley posted in ESG, Climate Change, Carbon, Carbon Price, Carbon Neutral, carbon abatement, carbon offsets, offsets, climate, greenwashing

We are skeptical about carbon offsets and we are more skeptical about announcements around carbon-neutral fuel and chemical cargoes. The ESG and climate activists have their radars finely tuned for “greenwashing” and other exaggerated claims, and when we get into offsets, whether as a traded market or as a one-off green cargo we rightly see the skeptics. The cargoes – ethylene below and an LNG cargo earlier this week - are PR stunts in our view and while the accounting may be accurate, the one-off costs are likely high, and the ability to repeat the process for significant volumes is limited. It may be proof that you can create carbon neutrality through offsets, but the supply of offsets will likely never be large enough to create affordable permanent pathways, and offsets should be looked at by all as a way to go the last mile, having exhausted all other options, including carbon avoidance and carbon use or sequestration. We have noted in prior work that we see a risk of too many people banking on a share of the offset market than the likely size of the market – creating price inflation and ultimately lower revenues than could have been achieved through alternate means. Current offset markets are cheap – at least relative to other costs of carbon abatement, but higher levels of oversight, which are both needed and planned, will likely limit availability going forward – also suggesting higher pricing.

Carbon Abatement – A Multi-client Analysis

Jul 7, 2021 1:01:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax, Carbon Fuels, CCS, CO2, Renewable Power, Carbon, Carbon Neutral, Emission Goals, Net-Zero, decarbonization, carbon footprint, ESG Fund, carbon dioxide, carbon credit, carbon value, carbon abatement, power, carbon cost, carbon offset, offsets, ESG investment, carbon emissions, clean energy, climate

A major initiative by C-MACC in collaboration with the Power Research Group