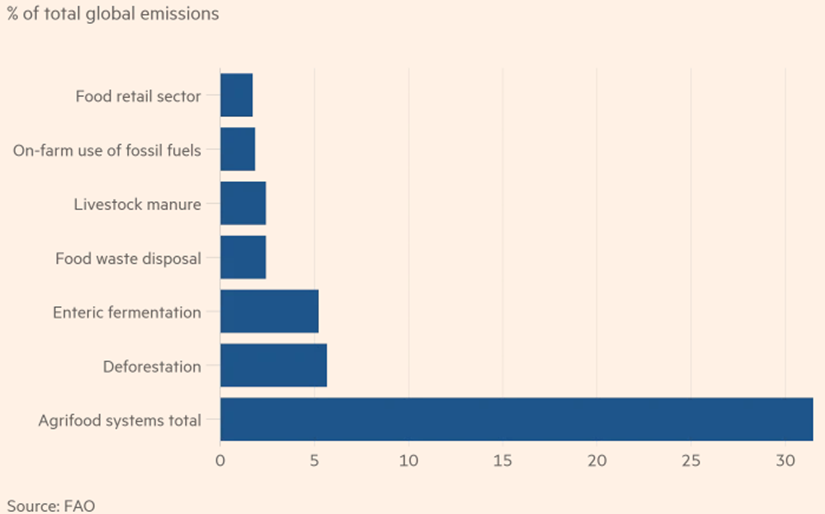

We have not spoken much about the agriculture industry and its emissions footprint – but it is significant and the sector is coming under greater focus as a consequence. It is not clear to us that the chart below is complete as it does not appear to include the carbon footprint of the fertilizer used in farming unless it is included in the fossil-fuel category, which seems unlikely. Much of the renewable natural gas planning in the US is relying on farm-based production, and there are initiatives to increase the amount of “low-tillage” farming as it has the effect of releasing far less CO2 from the soil than heavy tilling/plowing. Some of the categories listed below can be addressed through better land and waste management, but others will require offsets, another reason why the offset market needs work. For more on carbon offsets see today's ESG and Climate report.

Agriculture, A Big Part To Play In Emission Abatement

Nov 10, 2021 2:06:41 PM / by Graham Copley posted in CO2, Emissions, carbon footprint, offsets, fertilizer, renewable natural gas, Agriculture, Emission abatement

Hey Mr. President/Prime Minister, Will You Buy My Car?

Nov 4, 2021 1:58:06 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Emissions, Electric Vehicles, Net-Zero, IEA, climate, EVs, ICE, carbon footprints

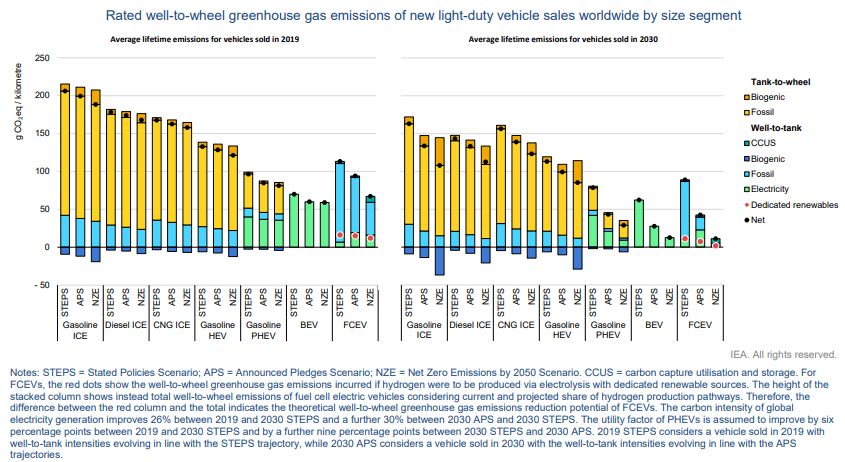

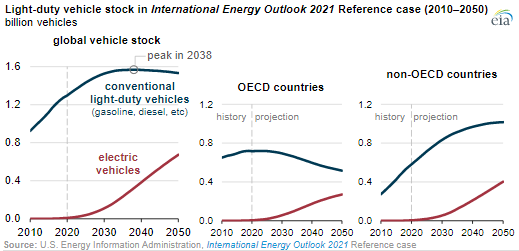

We highlight more from the IEA on the importance of EVs versus other vehicles to bring down “well to wheel” carbon footprints and the second (not unexpected) “kick in the pants” chart that shows the World woefully short in terms of its projected EV adoption rate. There are – probably expensive – hurdles to reaching the IEA net-zero goals with respect to EVs. The first is going to be the need to pay or tax consumers enough for them to give up a perfectly good ICE vehicle long before the end of its natural life.

The US Remains Divided On How To Price Carbon

Nov 3, 2021 1:34:59 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, LNG, CCS, CO2, Energy, Emissions, Carbon Price, carbon credit, renewables, LCFS credit, COP26

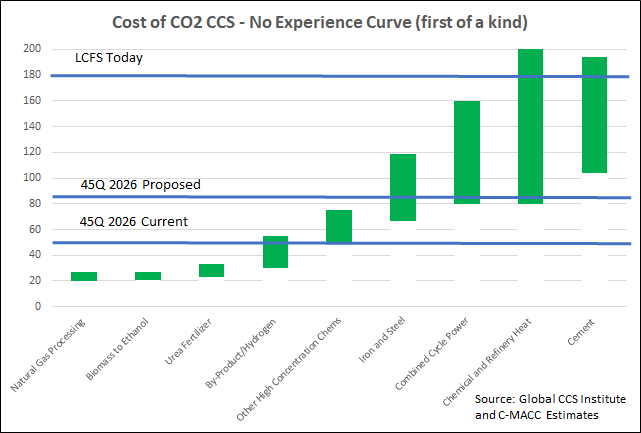

We want to focus today on the headlines around the possible increase in the 45Q CCS credit in the US and discuss the false logic of those that are objecting to it. There is no scenario where the US can move to a lower emissions power and transport profile while avoiding runaway inflation and social disorder without the continued use of fossil fuel-based power and transportation fuels for decades. The reliance on these fuels should and will decline over the years, but it is unreasonable to expect a transition that causes it to stop overnight. In the meantime, CCS is a mechanism that would allow fossil fuels to play a part with a much lower emissions footprint, and given that the CO2 impact on global warming is cumulative, if we can capture and store several billion tons of CO2 underground over that transition period it should be a good thing. Members of the Sierra Club and others would do well to look at the energy inflation problems in Europe and the move this week to put natural gas and nuclear back in the energy transition mix (too late in our view) because the move to renewables cannot keep pace with demand, which will grow faster as more EVs hit the road. The proposed 45Q credit is shown in the chart below vs. the current credit, the LCFS credit, and estimates of CCS costs.

Net-Zero Goals Need Stronger Action Plans

Oct 29, 2021 1:56:53 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, CO2, Energy, Air Products, Industrial Gas, LyondellBasell, Net-Zero, Dow, carbon footprint, carbon emissions, climate, COP26, materials, low carbon polyethylene, Linde

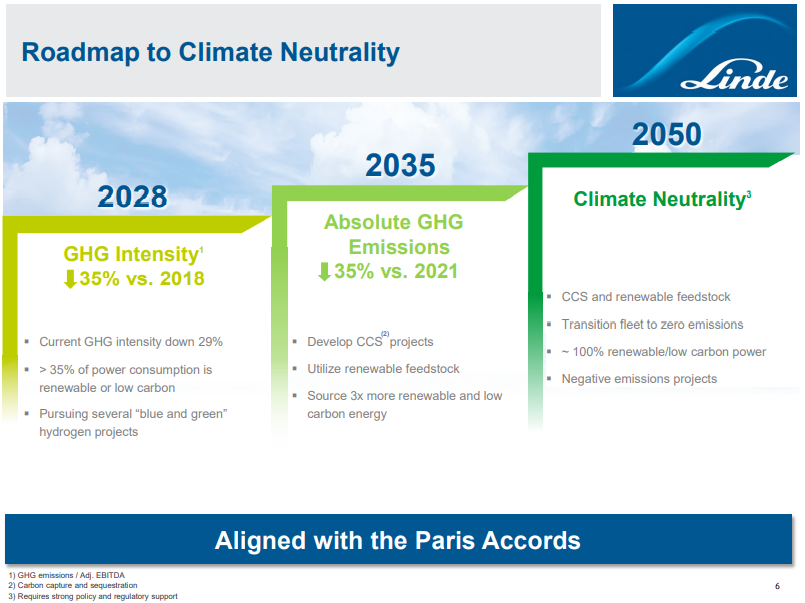

It is interesting to contrast Linde and LyondellBasell with Air Products and Dow. Air Products and Dow have transitioned away from the more generic messaging around broad objectives, and while they still have them, have started talking about concrete plans and spending aimed at lowering carbon emissions. Dow has a project on the books that will lower the emissions of existing capacity while Air Products is talking about greenfield low carbon investments at this point. Many of the commentators and climate activists are calling for concrete plans as opposed to broad objectives and we suspect that most of the narrative will move that way across energy and materials.

COP26: Some Tough Decisions For A Divided Group

Oct 27, 2021 1:44:48 PM / by Graham Copley posted in ESG, Sustainability, Methane, CO2, Net-Zero, methane emissions, COP26, Climate Goals, CO2 emissions, carbon pricing

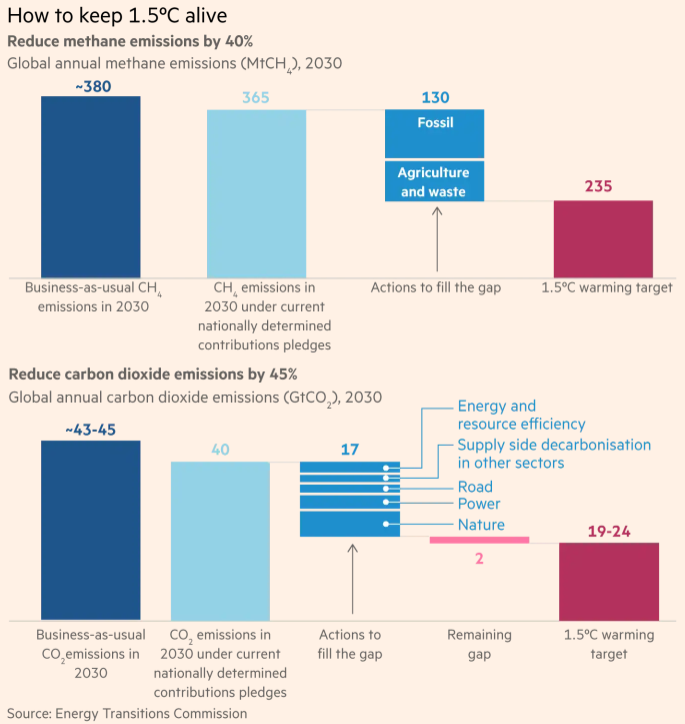

Our ESG and Climate Piece today focuses heavily on COP26, which begins this weekend, and has been the subject of many of this week's stories, as attending countries make their concerns and preferences known and as companies and lobbying groups try to be heard. The linked FT article talks about the minimum needs from COP26. We highlight this because we have been talking about the same things for months – the significant gap between what is pledged for 2030 and what is needed, and the need to attack emissions of methane and CO2 aggressively. The methane issue can likely best be achieved through legislation – especially as some of the leaks around the world may not belong to anyone, who could benefit from an incentive or be penalized for the leak. The CO2 emission issue will always be bet addressed through a pricing mechanism on carbon.

Gevo: Ticking All The Boxes To Be A Sustainable Fuel Provider

Oct 26, 2021 12:48:37 PM / by Graham Copley posted in ESG, Sustainability, CO2, Carbon, Gevo, Chevron, gasoline, sustainable aviation fuel, renewable fuels, Sustainable Fuel, Axens, ADM

Gevo is racking up the agreements to produce sustainable fuels, announcing deals with Chevron, Axens, and now ADM since September. Our view on the need for sustainable aviation fuel is that everyone building will likely be capital constrained relative to the potential demand – this is also true for sustainable diesel and gasoline, which is relevant given that the EIA sees the conventional light vehicle stock peaking globally as late as 2038 (this is not inconsistent with other estimates we have seen) see chart below.

Fly Me To The Moon - Sustainably Please...

Oct 22, 2021 1:18:10 PM / by Graham Copley posted in ESG, Sustainability, CO2, climate, waste oil, vegetable oil, EVs, aviation fuel, gasoline, sustainable aviation fuel, renewable diesel

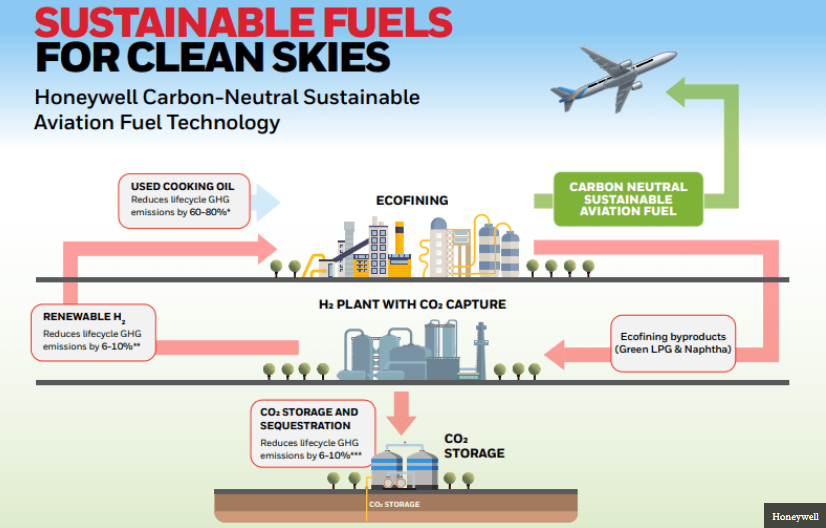

We have spent a lot of time in our ESG and Climate work talking about the huge impending challenge of producing enough sustainable aviation fuel to meet airlines desired needs for 2030 and beyond and we highlighted a Ryanair release yesterday that suggested that the company would struggle to meet its 12.5% goal by 2030. The Honeywell schematic in the exhibit below is one of many different processes that are being considered to meet both the demand for sustainable aviation fuel and renewable diesel and gasoline demand. With gasoline more likely to be replaced with increased numbers of EVs over time, we believe that the sustainable fuel focus will switch to aviation as the main priority, and we will need every technology that we can get to meet the volume needs. Waste oil and vegetable oil, with carbon capture around the refining process, is one route, fermentation-based processes are another, and waste to oil is a third, although we remain skeptical about the reliability and economics around a waste gasification-based approach.

The COP26 Challenges Go Beyond Net-Zero

Oct 20, 2021 2:02:43 PM / by Graham Copley posted in ESG, Sustainability, CO2, Carbon, Emissions, Net-Zero, IEA, carbon value, COP26, Climate Goals, Paris Agreement

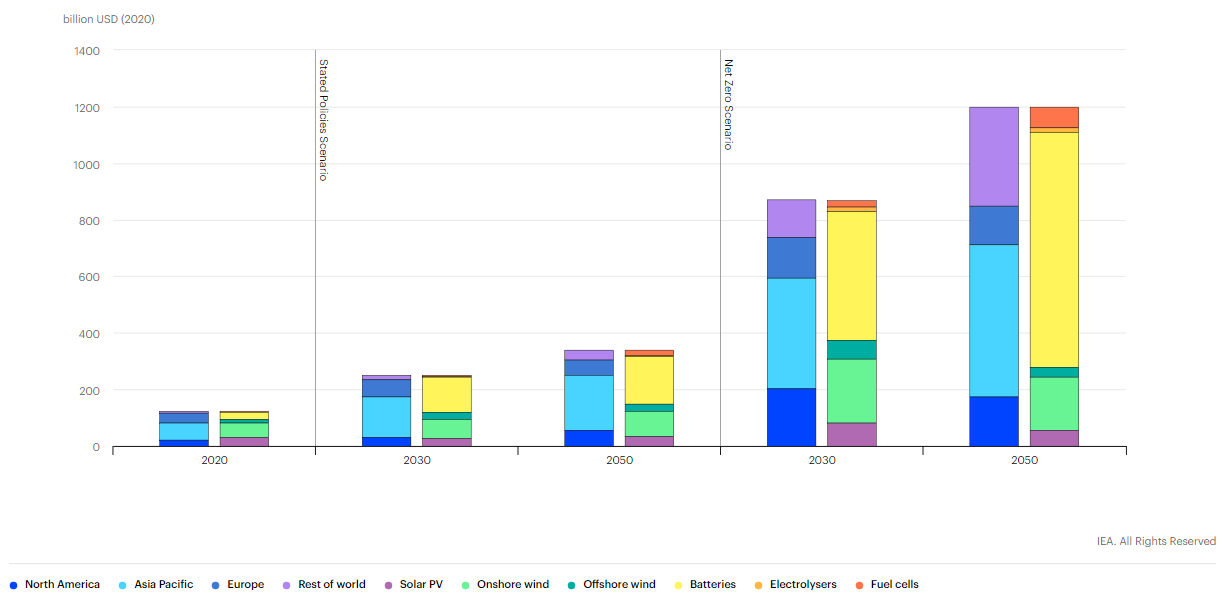

The Financial Times opinion piece linked in the bullet below and from which the chart is taken has used the IEA data that we have featured in recent work. The piece comprehensively walks through how the world is likely to come up short, and while it gives the measures that are needed and the money that likely needs to be spent, it is not an optimistic review of what will most likely occur. We remain firmly of the belief that much more progress could be made if there was a global agreement to make carbon very expensive – accompanied by an agreement on how to share the spoils of that expensive carbon such that the inflationary pressures are offset where they are most needed and that environmental injustices are minimized – this is idealistic are we recognize that.

Carbon Use: Important But Not As Impactful As Sequestration

Oct 19, 2021 1:45:27 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Methanol, CCS, CO2, fossil fuel, carbon footprint, carbon abatement, energy transition, Celanese, Carbon Use

We want to focus on carbon use today, in part because we have written extensively on sequestration recently, in part because of the headline highlighted below, and in part, because we need something fresh for our ESG and Climate report tomorrow! Carbon use does not get much press beyond EOR, but there are emerging technologies and there is a lot of R&D spending – on how to collect CO2 more efficiently and on what it might then be used for. We suspect that almost everything being looked at will have some application, but that there will be limits to those applications and they will likely be niches in nature, but not necessarily unprofitable.

Existing Carbon Black Producers Should Look For Ways to Decarbonize

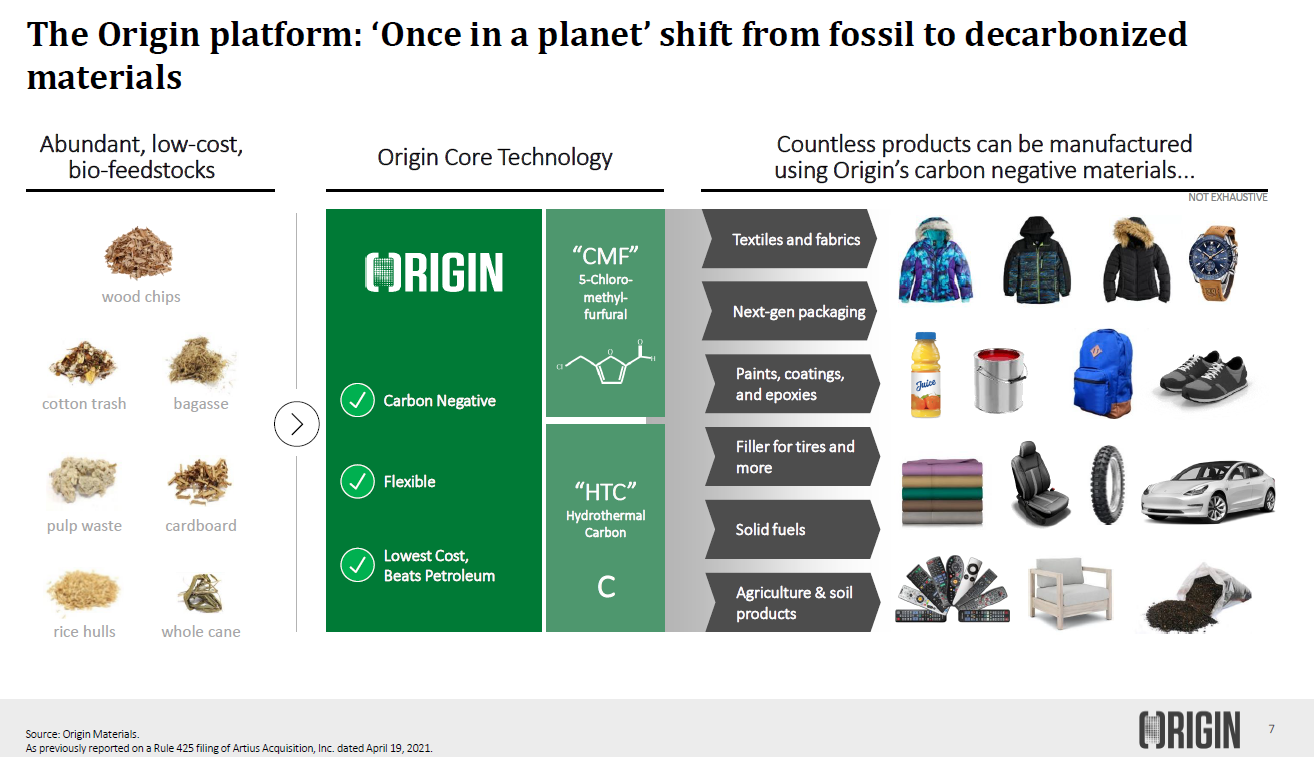

Oct 6, 2021 2:27:54 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CCS, CO2, Carbon Black, Carbon, Emissions, PET, decarbonization, Origin Materials

We think that Orion Engineered Polymers and its fellow traditional carbon black producers could be in for a rough ride.