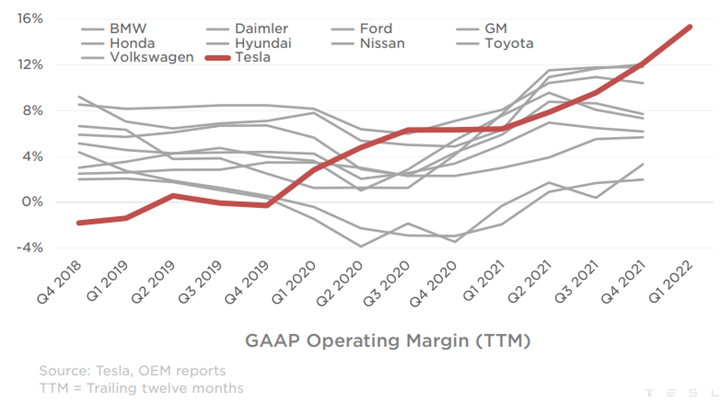

Tesla is on a roll, and showing other EV makers what is possible. The company priced its vehicles to be profitable at lower volumes and is currently seeing the benefit of scale, likely to be enhanced further as the manufacturing footprint grows. While the operating margin below looks very good, we would note that Tesla is not done scaling yet so there is considerable upside to the margin, most likely. One obvious conclusion from this analysis is that Tesla has plenty of wiggle room on pricing should macro conditions impact new car sales or should other EV makers try to steal share with pricing. Tesla has built a huge first-mover advantage in EVs and this will likely benefit the company for many years to come as long as they keep making vehicles that people want.

Tesla Margins Should Scare The Competition. Dow Details Decarbonization

Apr 21, 2022 2:53:05 PM / by Graham Copley posted in ESG, Sustainability, LNG, Electric Vehicles, Dow, carbon values, EV, manufacturing, Tesla, ESG pledges

Hey Mr. President/Prime Minister, Will You Buy My Car?

Nov 4, 2021 1:58:06 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Emissions, Electric Vehicles, Net-Zero, IEA, climate, EVs, ICE, carbon footprints

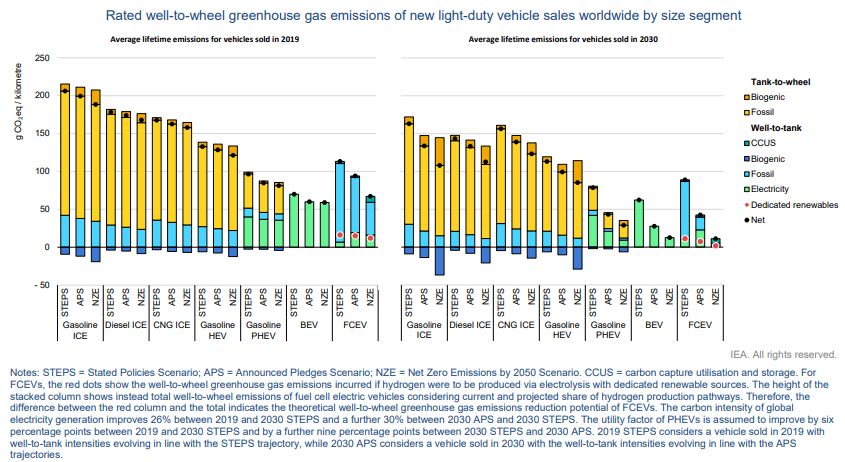

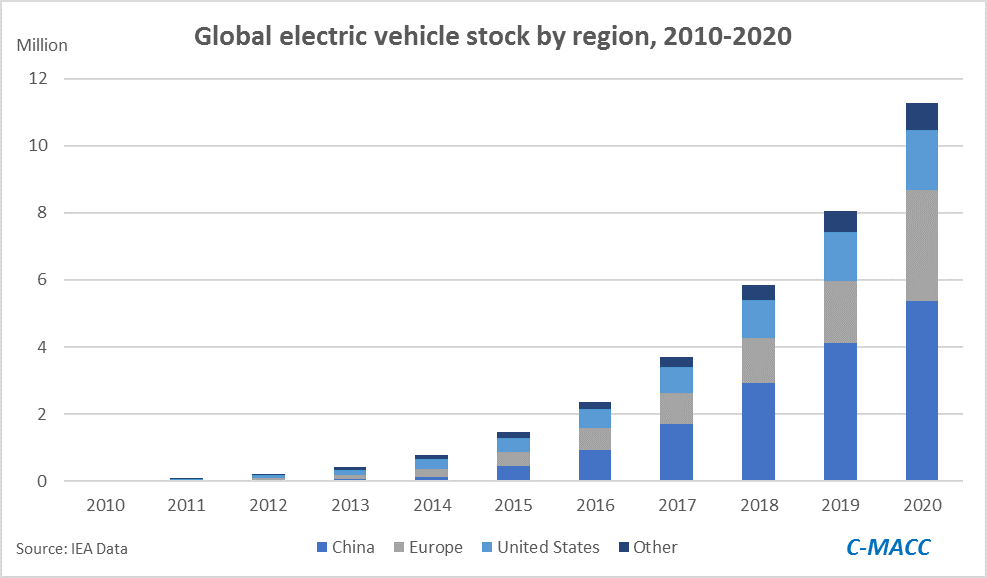

We highlight more from the IEA on the importance of EVs versus other vehicles to bring down “well to wheel” carbon footprints and the second (not unexpected) “kick in the pants” chart that shows the World woefully short in terms of its projected EV adoption rate. There are – probably expensive – hurdles to reaching the IEA net-zero goals with respect to EVs. The first is going to be the need to pay or tax consumers enough for them to give up a perfectly good ICE vehicle long before the end of its natural life.

Competition For Renewable Power Likely To Exceed Availability

Jun 23, 2021 1:56:35 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, Electric Vehicles, fossil fuel, carbon footprint, renewable energy, Green Industry, electric power, renewables, power demand, Amazon, carbon cost

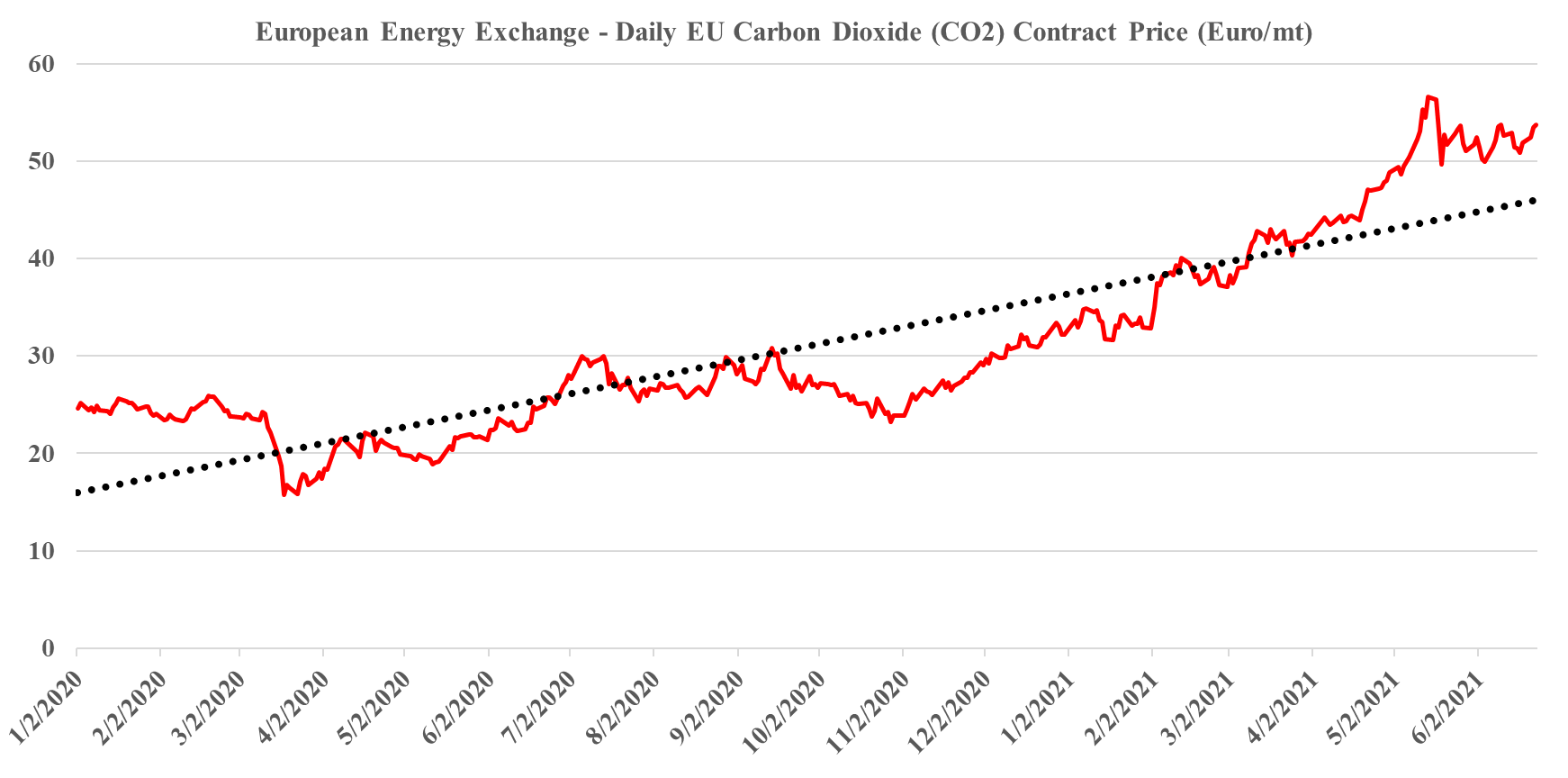

There are several headlines today that speak to one of the most pressing issues that we have with the pace of energy transition – the competition for renewable power and the likely inability of the industry to keep up with the competing needs, let alone do so without significant power cost inflation.

Solar: A Clear Example Of Potential Renewable Energy Inflation

Jun 17, 2021 1:32:30 PM / by Graham Copley posted in ESG, Hydrogen, Biofuels, Polymers, ESG Investing, Electric Vehicles, Raw Materials, LyondellBasell, Inflation, Gevo, solar, polysilicon, Wacker, copper, silver, Aemetis, renewable energy

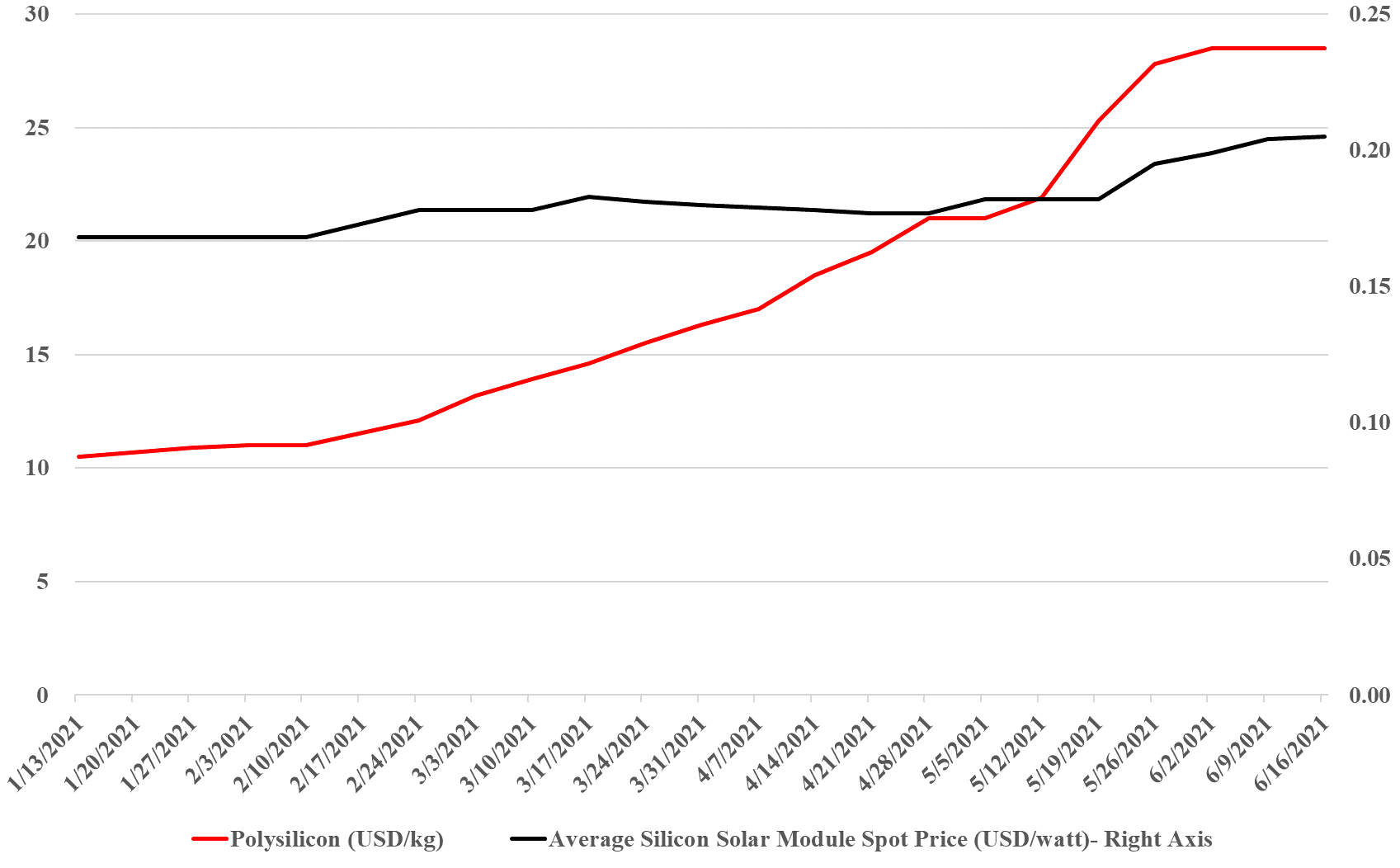

The exhibit below summarizes well one of the primary concerns that we have with some of the very ambitious goals for decarbonizing power grids, EV introduction, the further electrification of industry, and hydrogen. While the solar module price increase does not look that significant (yet), to put it in context, solar module prices have collapsed from over $1.80 per watt in 2010 to below $0.20 in 2020, and many of the expectations around cheap hydrogen require the cost to keep falling. The bigger concern is the polysilicon price, which is up 160% this year, good for the polysilicon producers like Wacker (see the headline here), but bad for the solar module producers, who are seeing major margin squeezes, especially given the rise in copper and silver as well this year. The raw material pressure should drive further increases in solar module pricing and while the higher margins for polysilicon will likely drive expansion investment, the metals are harder to call, given the ESG views on mining. We remain firmly of the view that raw material availability and price inflation, as well as module and wind turbine manufacturing capacity, will be the rate-determining constraint in terms of the growth in renewable power and this is why we question all of the near-term cheap power and cheap hydrogen goals that are being suggested by potential producers and government agencies.

Could DoE Ambitious Hydrogen Plans Have Unintended Consequences?

Jun 11, 2021 1:17:40 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Electric Vehicles, Materials Inflation, Emission Goals, Net-Zero, Ammonia, carbon footprint, natural gas, R&D, capital cost, Praxair, DoE, production cost

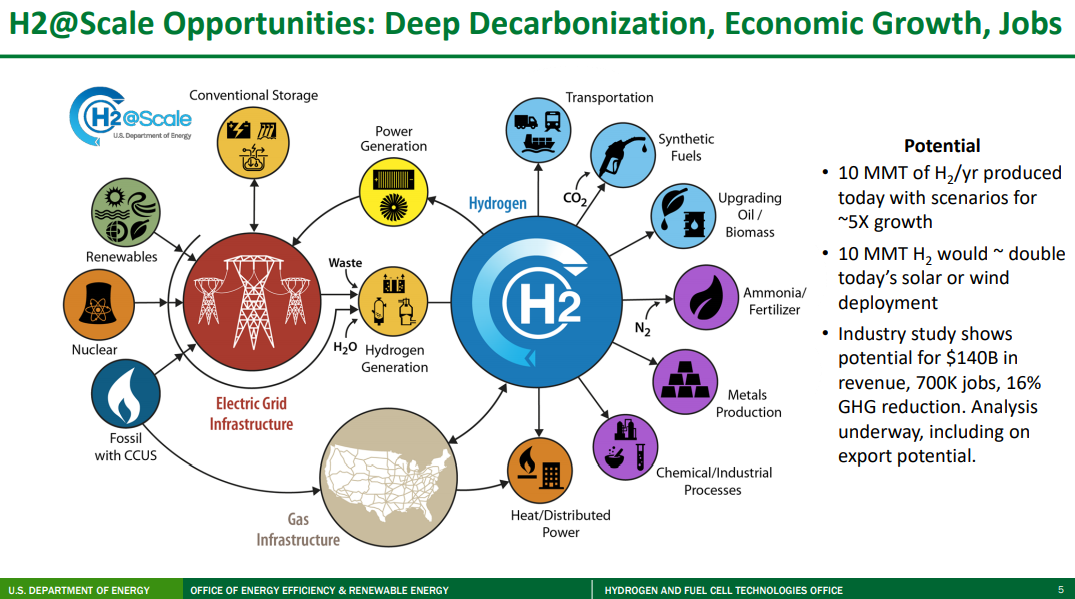

We will cover the very comprehensive DoE hydrogen work in more detail in the ESG report next week, but a couple of the charts from that work are worth mentioning today. The first picture below accurately depicts all of the potential uses of hydrogen and shows that over time it could solve a lot of “hard to solve” CO2 emission problems, especially where electricity cannot do the job efficiently. The reason why so many countries and companies are so interested in hydrogen is because of its potential versatility and because of its minimal carbon footprint (there is some carbon leakage in the full lifecycle of the production coming from construction around the plants themselves and infrastructure to use the hydrogen).

Not Enough EVs To Make A Difference Yet...

May 4, 2021 1:39:12 PM / by Graham Copley posted in ESG, Electric Vehicles, Fuel Cell, Materials Inflation

If you read our ESG and climate report which focused on the Biden agenda - The Biden Plan: Taking The Harder Path, Limiting Odds Of Success – you will understand how underwhelming the EV data is in the exhibit below. For the US to reduce its automotive transport carbon footprint to the proposed 2030 goals, the country would need to replace over 130 million ICE vehicles with EV or fuel cell-powered vehicles – 12x the total number of EVs in the world today and more than 100x the number currently in the US. This is a challenge that has almost zero chance of being met unless the benefit of switching is so high or the cost of not switching so high that consumers want to make the change – and – there are enough vehicles to buy. Both of these are remote possibilities today, but likely why we see increased focus on lithium, batteries, and faster roll-out of EVs from the majors as they attempt to do their part to move in the right direction. One unintended consequence that we have discussed at length and will cover in tomorrow's ESG and Climate report is inflation in materials, which will not be helped if the ESG lobby will not support the industries that need to provide the materials and the interlinking infrastructure investment.