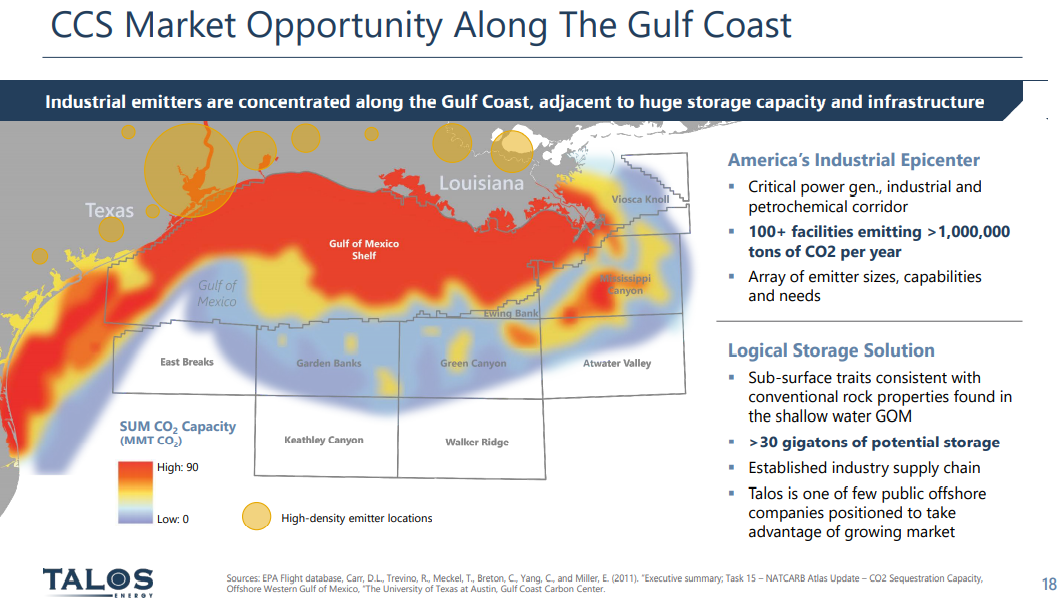

The Talos release and the map shown in the Exhibit below, highlight some of the potential for offshore CCS along the US Gulf Coast. We will likely see some of this developed over time, in our view, but the question of cost is important, not because the US Gulf is likely to be more expensive than some of the offshore locations that are proposed for Europe, but because the same offshore geology on the US Gulf exists onshore, and the onshore opportunities will likely be much lower cost. Given that one of the overriding concerns around carbon abatement is cost and how it will be paid for, who will pay for it ultimately, and what it means for the competitive landscape, finding the lowest cost solutions will be key. This is something that we have covered at length in our dedicated ESG and climate research. Building high-pressure pipelines is expensive, and high relative to the onshore cost of sequestration. Talos might find interest from CO2 suppliers but may be undercut by onshore projects – assuming these get the green light from regulators – not giving them the green light would likely be imposing further unnecessary costs on industry.

Offshore CCS Is Good: But Onshore CCS Should Be Cheaper

Aug 27, 2021 12:49:53 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, CCS, CO2, Sequestration, carbon abatement, Offshore CCS, Talos, Onshore CCS

Will The Climate Frenzy Leave Plastic Waste Ignored For Now?

Aug 13, 2021 11:46:37 AM / by Graham Copley posted in ESG, Climate Change, Plastic Waste, Plastics, CCS, CO2, Emissions, Carbon Price, carbon abatement, climate, IPCC, Plastics producers, COP26, virgin plastic, plastic tax

As we sift through the positioning for the upcoming COP26 meeting and the attention focusing report from the IPCC this week, it is a reasonable question to ask what this means for the plastic waste issue. If governments, lobbyists, and activists are likely to be more focused on climate change action over the next few years, which seems to be a reasonable conclusion, will there be the bandwidth for plastic waste? The plastic waste issue is less open to interpretation than the climate change issue and is a visible problem for all, but if governments need to prioritize where they spend their incremental dollar, and/or where they provide incentives of penalties, the climate is going to be pushed to the front of the line in our view. Plastics producers will have to deal with emissions, like any other industrial user of power and heat. The risk is that local governments, looking for revenue to support climate initiatives see taxing virgin plastic (or unrecycled plastic) as a way to both push plastic waste initiatives forward and raise revenue. Adding a plastic tax in the US to the superfund proposal in the infrastructure bill would be hitting the chemicals industry from two sides and would give bodies like the ACC far more grounds for pushback. For more on the IPCC analysis see our ESG & Climate Change report from this week.

Chemical Recycling Is Good, But So Is Blue Hydrogen

Aug 12, 2021 2:02:17 PM / by Graham Copley posted in Hydrogen, Climate Change, Plastics, Methane, CCS, Blue Hydrogen, CO2, carbon abatement, natural gas, chemical recycling, NGL, plastics industry, methane emissions, CO2 footprint

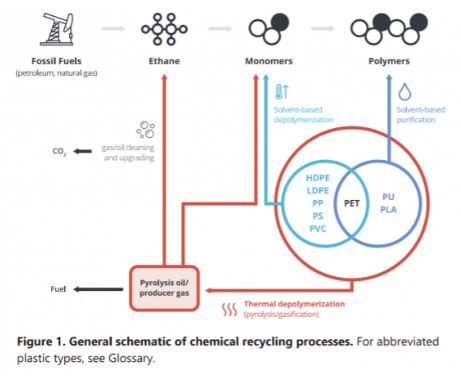

We believe that the plastics industry is right to get as much state backing for chemical recycling as it can – see Louisiana headline and diagram below. While chemical recycling is not as neat as mechanical recycling, it has far more chance of dealing with the core issue, which is the disposal of plastic waste – see report linked here. Our support for chemical recycling stems from the view that it will be very hard to get the behavioral change needed to ramp up mechanical recycling quickly and to a level that will impact waste.

Friday Trio: Troubling US EV math, PET Tires, & New Exxon?

Aug 6, 2021 2:18:25 PM / by Graham Copley posted in ESG, Recycling, CO2, PET, ExxonMobil, Net-Zero, decarbonization, EV, carbon emissions, US Gasoline, electric vehicle goal, recycled PET, Continental

There are several things worthy of comment today. First, the math looks wrong in the Biden EV executive order, especially when combined with tighter fuel efficiency standards that are also on the table. The US consumes around 340 million gallons (approx. 8.1 million barrels) of gasoline a day and a reduction of 340,000 would only be a 1% reduction by 2030, even assuming growth in driving over the next 10 years we would expect the fuel standards and EV introduction to have a much more meaningful impact if successful. We will write more on this is our dedicated ESG and climate work.

Should Physical Carbon Offsets Trade Higher Than Agricultural Offsets?

Aug 4, 2021 12:56:59 PM / by Graham Copley posted in Carbon Capture, CO2, carbon footprint, carbon abatement, carbon offsets, offsets, offset futures trade, agriculture offsets, physical offsets

There are some serious players behind the CME offset futures trade highlighted in the linked headline. However, the press release does not provide enough information around how the offset is calculated and this will be critical if the futures product is to develop into a fully functional and fungible market. The agriculture-based offsets sound good and, in many cases, they can be robust in terms of the genuine contribution to lowering CO2 in the atmosphere – for example, where a new tree is planted and there would not have been a new tree without the direct action. But there remains a great deal of debate around whether an initiative is more positive than its alternative. Would a tree have grown naturally if the project was not there? Is the carbon footprint of any wetlands mitigation initiative taken into account when looking at the CO2 offset – same with tree planting? How do you risk adjust the CO2 value of a tree or other agriculture offset – what if the forest burns?

The Pressure Is On The SEC For Better ESG Metrics & Disclosures

Jul 29, 2021 1:32:27 PM / by Graham Copley posted in ESG, CO2, Emissions, Emission Goals, LyondellBasell, ESG investment, Environment, Borealis, SEC, Chemical Sector, OMV, ESG Metrics

As we discussed in yesterday’s ESG and Climate report, the SEC has some challenges ahead, not just because there are high hopes that it will start mandating a change in terms of disclosure accuracy and consistency, as well as fund definition, but also because, as yet, it does not have the mandate to do so. All eyes are on the regional regulators, in the US, Europe, and other countries to police what is the wild west of reporting. The E piece of ESG is the major challenge and it is where corporates and fund managers alike are dealing with issues and measures that are likely very different company by company within a sector, let alone between the sectors themselves – it is far more complex and harder to analyze than, for example, board diversity.

Carbon Offsets: Direct Air Capture Is Not The Only Option

Jul 28, 2021 12:55:50 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Emissions, carbon abatement, carbon values, carbon offsets, direct air capture, methane emission, DAC

There has been a lot of press over the last couple of months around carbon offsets – not least because of Mark Carney’s efforts to legitimize the idea. Mr. Carney’s focus is to create a robust trading platform for the buying and selling of legitimate offsets so that a carbon market can operate efficiently. He believes that without accurate and realistic carbon values, and the ability to buy and sell them, the capital markets around emission reduction will be inefficient and that less money will be attracted into the area. On this, he is probably correct, but in our view, the carbon offset markets have a long way to go.

Economics Have Driven US Emission Reductions More Than Policy

Jul 27, 2021 2:01:49 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Coal, CO2, Renewable Power, Energy, Emissions, natural gas, EV, clean power investments, power sector

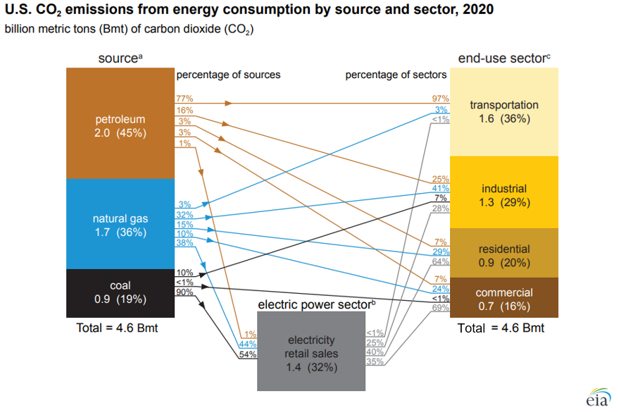

We are increasingly concerned that the US will remain a laggard concerning climate change initiatives given the major challenges of moving to the next steps and the bifurcated congressional views. The emissions reductions that the US has seen over the last 10 years have been more happenstance than planning, with the abundance of natural gas following the shale boom of the last decade creating economic reasons to replace coal-fired power with natural gas rather than environmental reasons. Lower costs for wind and solar power and focused industrial demand for that clean power have been the bigger driver of clean power investments. In the chart below, the decline in emission from the power sector is evident and it should continue. The diagram below shows sources and uses for US emissions in 2020, but the accompanying write-up talks about the step down in emissions overall in 2020. Except for the continuing electric power transition, most of the other 2020 declines are COVID-related and are expected to rebound in the near term, especially transport. The market share gains of EVs are not significant enough yet to make a difference. See more in today's daily report.

Carbon Capture (If Supported) Will Create Competitive Dislocations

Jul 21, 2021 1:08:19 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, CO2, fossil fuel, carbon footprint, carbon abatement, renewables, European Carbon price, climate

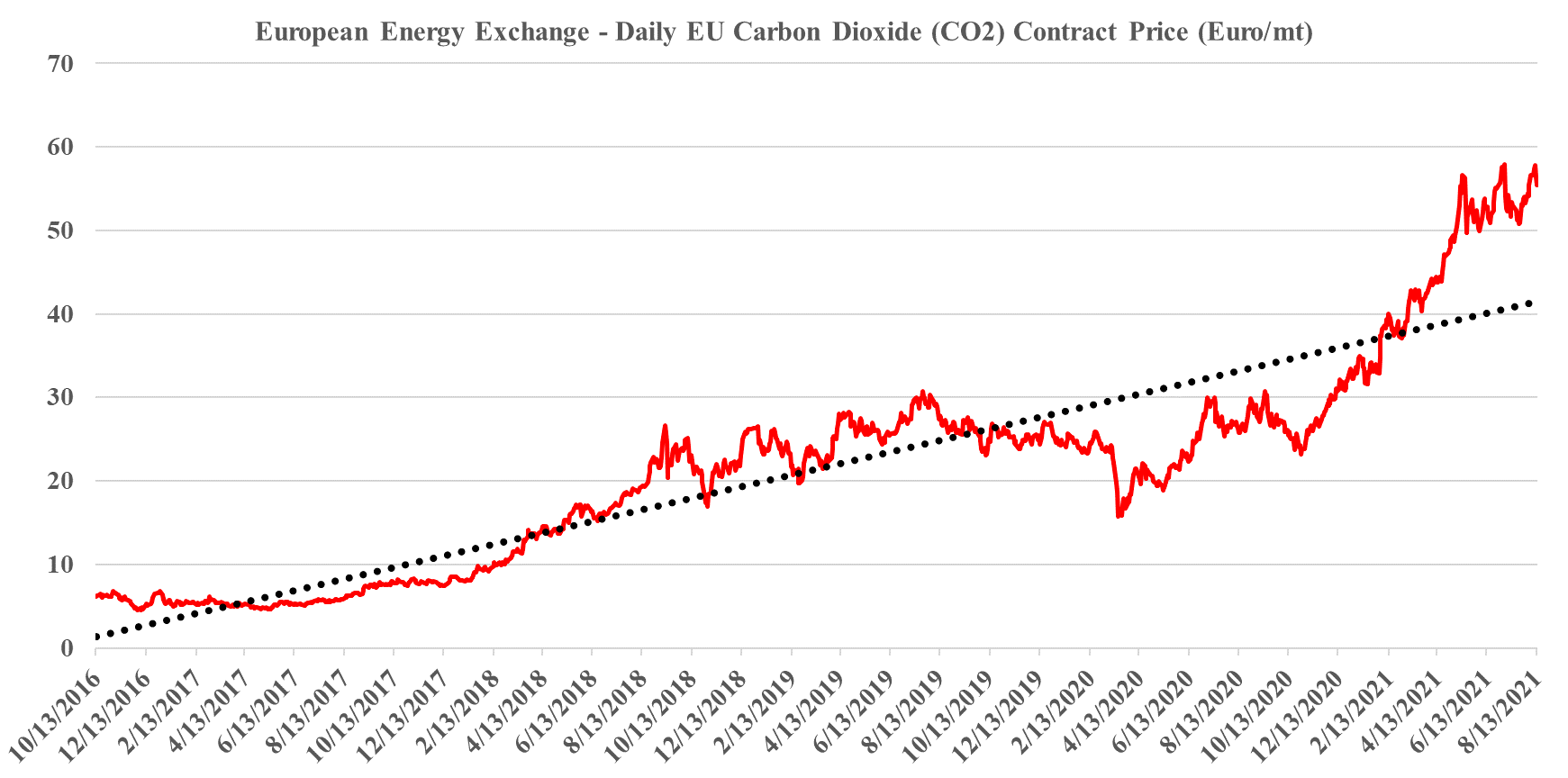

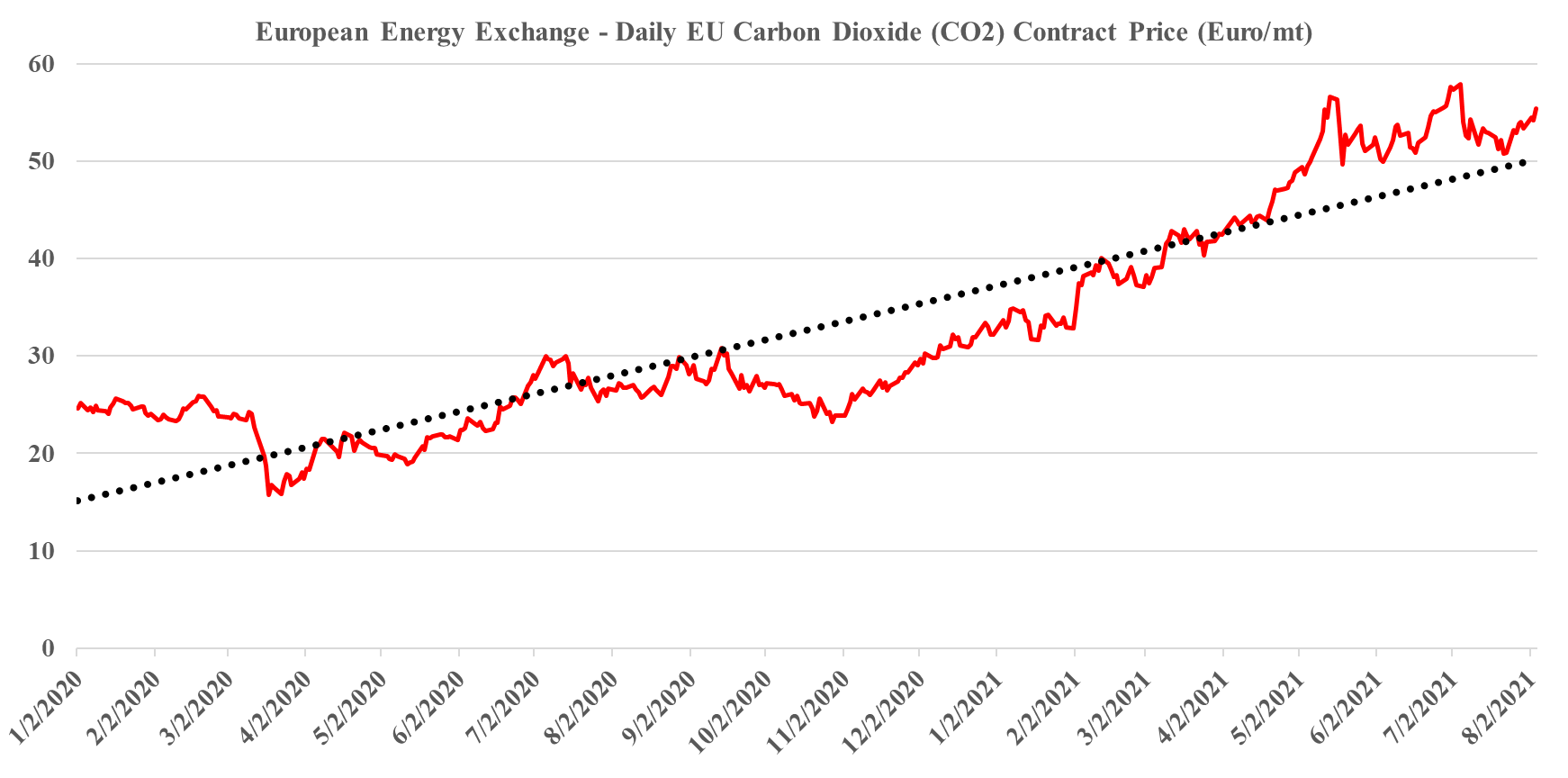

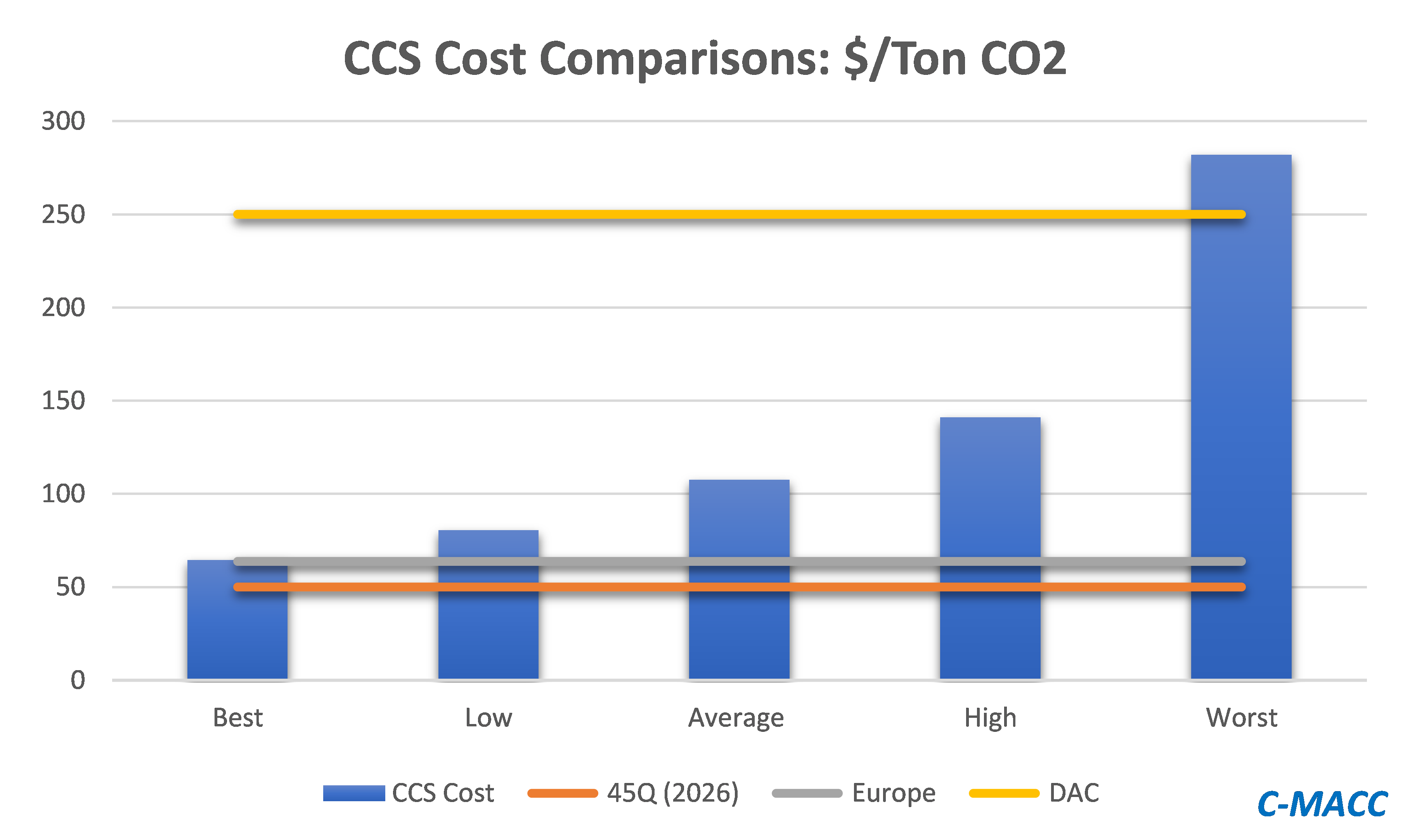

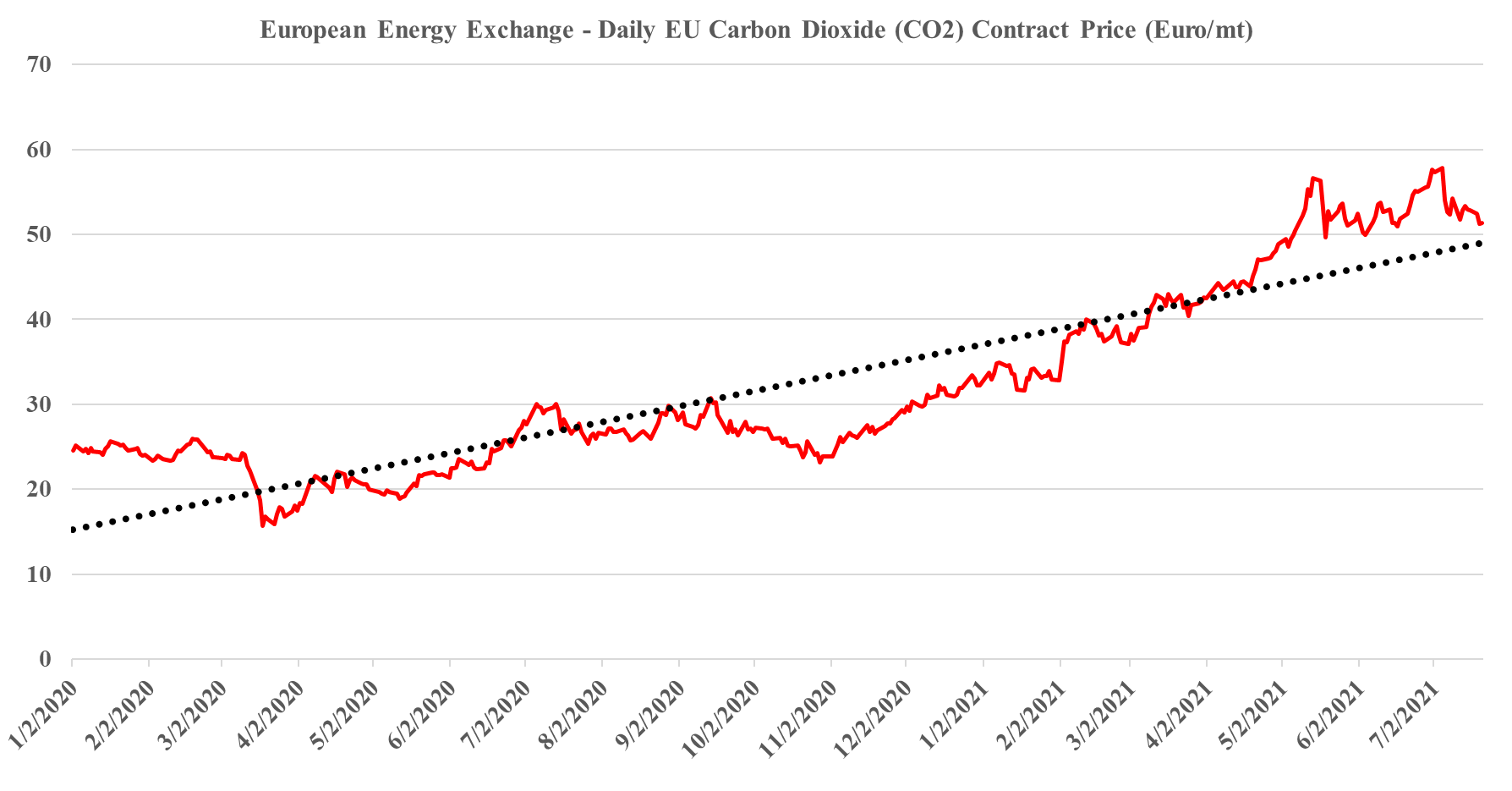

In our ESG and climate piece today we focus on Carbon Capture and Sequestration (CCS) and the likely very steep cost curve between the mega projects and those less fortunate. But as we discuss CCS, we should not forget that the World is still not convinced about CCS as part of the solution set for carbon abatement, as the headline linked discusses. The naysayers are focused on the lifeline that CCS offers to the fossil fuel industry, but always fail to offer an economic rationale for the quick elimination of fossil fuels and their replacement by renewables. Few of the proponents of CCS see it as an alternative to a long term path to alternative means of abatement, but all recognize that relying on renewable power investments will likely leave the World with a much larger CO2 footprint from 2030 to 2050 than what could be achievable with CCS – note that the 45Q incentive in the US has a finite lifespan as there is an expectation that eventually CCS will be unnecessary because of fossil fuel replacement. Chevron has not helped the CCS proponents with its missed targets in Australia as it adds fuel to the argument that CCS has not lived up to its potential. While the European carbon price trend has stalled in recent weeks – chart below – the trend remains distinct and it would be foolhardy to ignore the likelihood of prices rising to a level that makes CCS attractive – especially for the mega-projects.

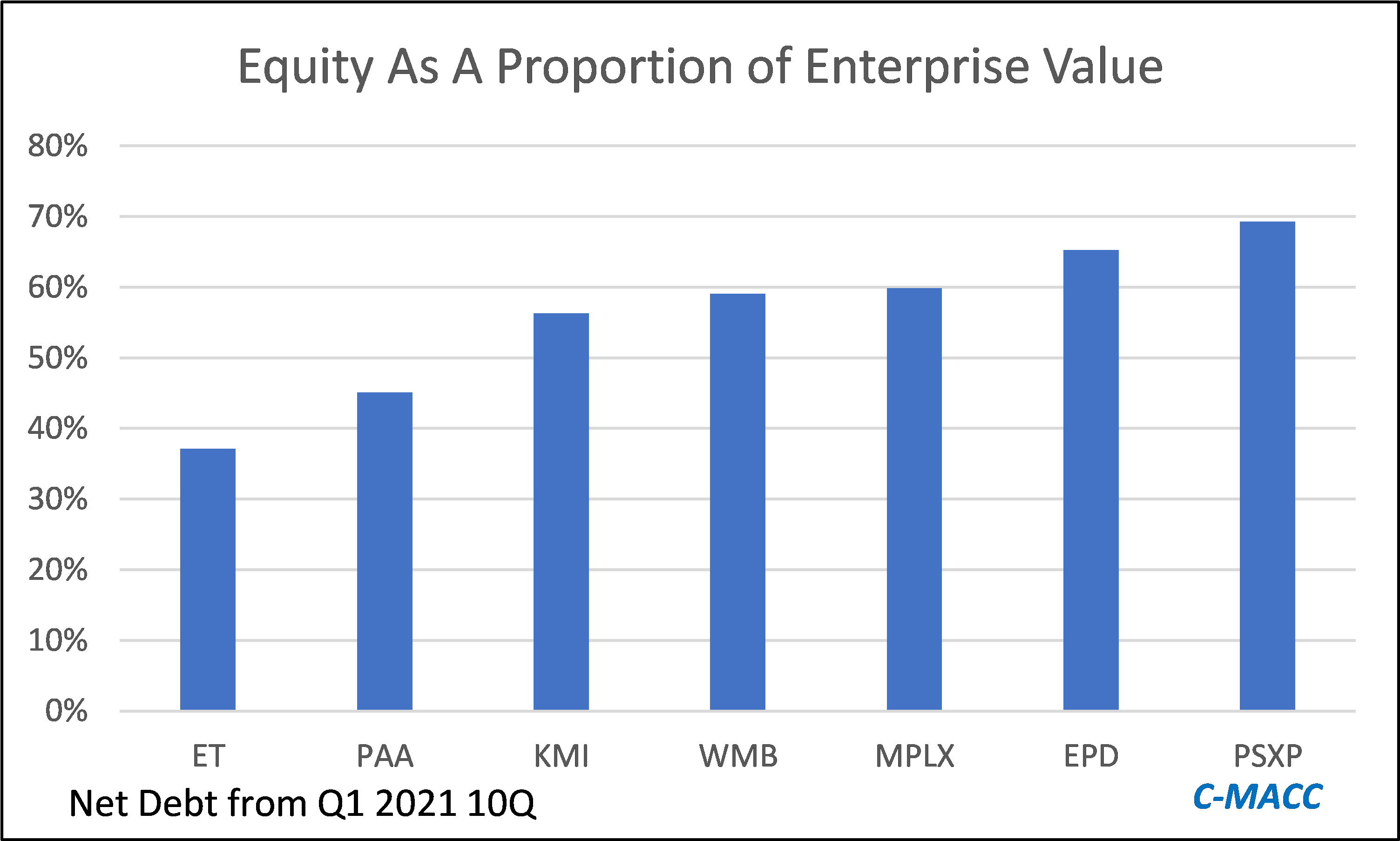

ESG: Could There Be Some Winners In Midstream Companies?

Jul 14, 2021 2:00:02 PM / by Graham Copley posted in ESG, Hydrogen, CO2, carbon footprint, pipelines, Energy Transfer

The MLP headline linked covers a subject that we have addressed in prior work as it looks at the ESG related opportunities for pipelines, not just because pipelines are the lowest cost and lowest carbon footprint means of moving large scale existing gases and liquids around the US, but because of their future potential role moving CO2 and hydrogen. Because the opportunities to grow earnings in the cleaner fuels space will likely be a function of both opportunity (whether you already have some infrastructure that can be repurposed and whether you are in the right locations) and strategy (whether you seize the opportunities as they arise and think a little outside the box), how to play the opportunity from a stock perspective is more challenging as there will be winners and losers. We suggest one of two paths – either buy a basket of the pipeline names or focus on the idea of a positive sector re-rating, in which case you want to own the company with the highest equity leverage to any EV/EBITDA re-rating, which among the large and liquid names would be Energy Transfer – Exhibit below. For more on this see today's ESG report.