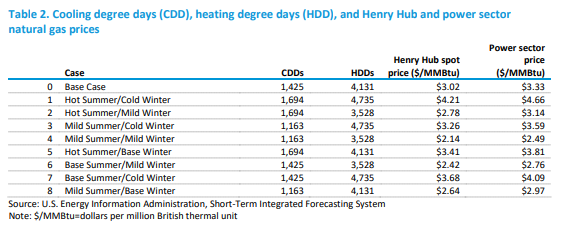

The table below is from an interesting analysis published by the EIA this week that focuses on possible power demand scenarios for the US – all weather-related – and then backs into the power sources that would be needed to meet the demand, concluding with the US carbon emissions that would correspond to each scenario. The conclusions should not be surprising, which are that carbon emissions rise disproportionately faster as power demand rises – as more coal is required to balance generation needs, and fall disproportionately more quickly as power demand falls (as less coal is needed). The analysis is effectively a study of how much less CO2 emissions are using natural gas to generate power versus coal. As renewable generation increases as a share of the total, however, the math will change, and the EIA study does not take into account the weather factor on renewable power, it looks at cooling degree days and heating degree days at a national level only. This is reasonable as there is likely not enough data to be able to put good reliability estimates yet around renewable power annual volatility and more importantly, the impact of weather on renewable power is likely to be short-term in nature. Perhaps this analysis could be improved by adding a “daily risk band” around each scenario, showing how much renewable power volatility could cause peaks in the high scenario and lows in the low, etc.

Natural Gas Based Power Not Going Away Anytime Soon

Jul 8, 2021 2:03:50 PM / by Graham Copley posted in ESG, Coal, CO2, Renewable Power, Emissions, carbon abatement, natural gas, power demand, carbon emissions, EIA, US carbon emissions

Carbon Abatement – A Multi-client Analysis

Jul 7, 2021 1:01:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax, Carbon Fuels, CCS, CO2, Renewable Power, Carbon, Carbon Neutral, Emission Goals, Net-Zero, decarbonization, carbon footprint, ESG Fund, carbon dioxide, carbon credit, carbon value, carbon abatement, power, carbon cost, carbon offset, offsets, ESG investment, carbon emissions, clean energy, climate

A major initiative by C-MACC in collaboration with the Power Research Group

Bold Climate Initiatives Will Need Equally Bold Incentives & Some Economic Logic

Jun 29, 2021 12:59:46 PM / by Graham Copley posted in ESG, Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Net-Zero, fossil fuel, bp, natural gas, EV

There is an unusual number of interesting topics in today's report, versus the normal mix of small pet projects or broad and unsubstantiated announcements. The EU 2030 targets are worth highlighting and they are in part connected to the central theme of the ESG and climate report that we will publish tomorrow. The European targets are not coordinated with what is happening in the rest of the World and while we admire the ambition, we suspect that the goal is not achievable, simply because the challenges of replacing the power and fossil fuel associated with the emissions to be avoided are too great, given the timeline. The level of additional renewable power generation, EV adoption, and hydrogen production needed to offset so much CO2 are extremely high, and it will be hard to get substantially more CCS offset than already announced because of land rights issues in Europe and logistics. To get the power, EV, and hydrogen, the EU will be competing with other regions that have their own targets and we see scare resources bidding up the price of power, impacting all of the elements, power itself, the cost of running EVs (see the chart below – the EV story does not work of you are using coal as a marginal source of power), and the cost of hydrogen.

Fairness & A Step Change In Investment Could Come From Revised CCS Bill

Jun 25, 2021 1:01:59 PM / by Graham Copley posted in ESG, LNG, Carbon Tax, CCS, Blue Hydrogen, CO2, Sequestration, carbon abatement, US Government, 45Q carbon credits, LCFS credit, tax credit, blue ammonia

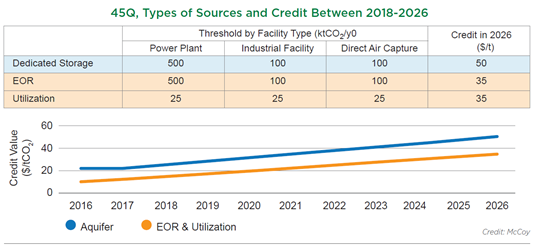

Senator Cramer’s proposed Bill to increase the value of the 45Q carbon credits for sequestration and use as well as remove the annual cap could be a game-changer in many ways. The threshold removal is necessary regardless of the credit value. In our view, the cap creates a potential competitive disadvantage for smaller companies competing with larger ones, especially in the chemical space. Should the Bill increase the tax credit enough to drive real investment in abatement but not remove the threshold we would expect to see litigation from smaller disadvantaged companies. The chart below shows the current expectations for 45Q. To date, the only real investment activity we are seeing is around sequestering CO2 from ethanol production in the US. This is because the CO2 stream is easy to separate in a fermentation process and because some of the ethanol can benefit from the much higher LCFS credit if the fuel is sold into California.

Will The Offset Market Be Big Enough?

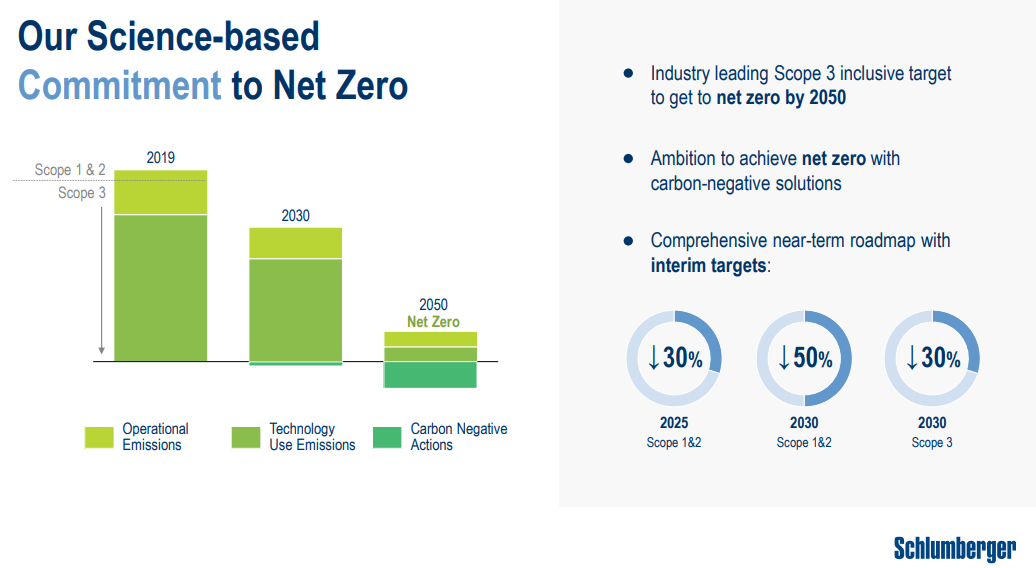

Jun 24, 2021 2:08:50 PM / by Graham Copley posted in ESG, Carbon Capture, Methane, CO2, Carbon, Net-Zero, Schlumberger, direct air capture, carbon offset, offsets

The Schlumberger net-zero goals, as discussed in a couple of articles in today's daily and the presentation linked, set some aggressive but bold ambitions, especially as they are looking to solve problems that they share with their customers, methane leakage from oil and gas wells, and minimizing flaring. Schlumberger is a little dependent on collaboration from its customers here as the technology solutions are likely to be more expensive than current options and the oil and gas producers will need to pay up.

Competition For Renewable Power Likely To Exceed Availability

Jun 23, 2021 1:56:35 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, Electric Vehicles, fossil fuel, carbon footprint, renewable energy, Green Industry, electric power, renewables, power demand, Amazon, carbon cost

There are several headlines today that speak to one of the most pressing issues that we have with the pace of energy transition – the competition for renewable power and the likely inability of the industry to keep up with the competing needs, let alone do so without significant power cost inflation.

More Climate Discord Unlikely To Help Necessary Progress

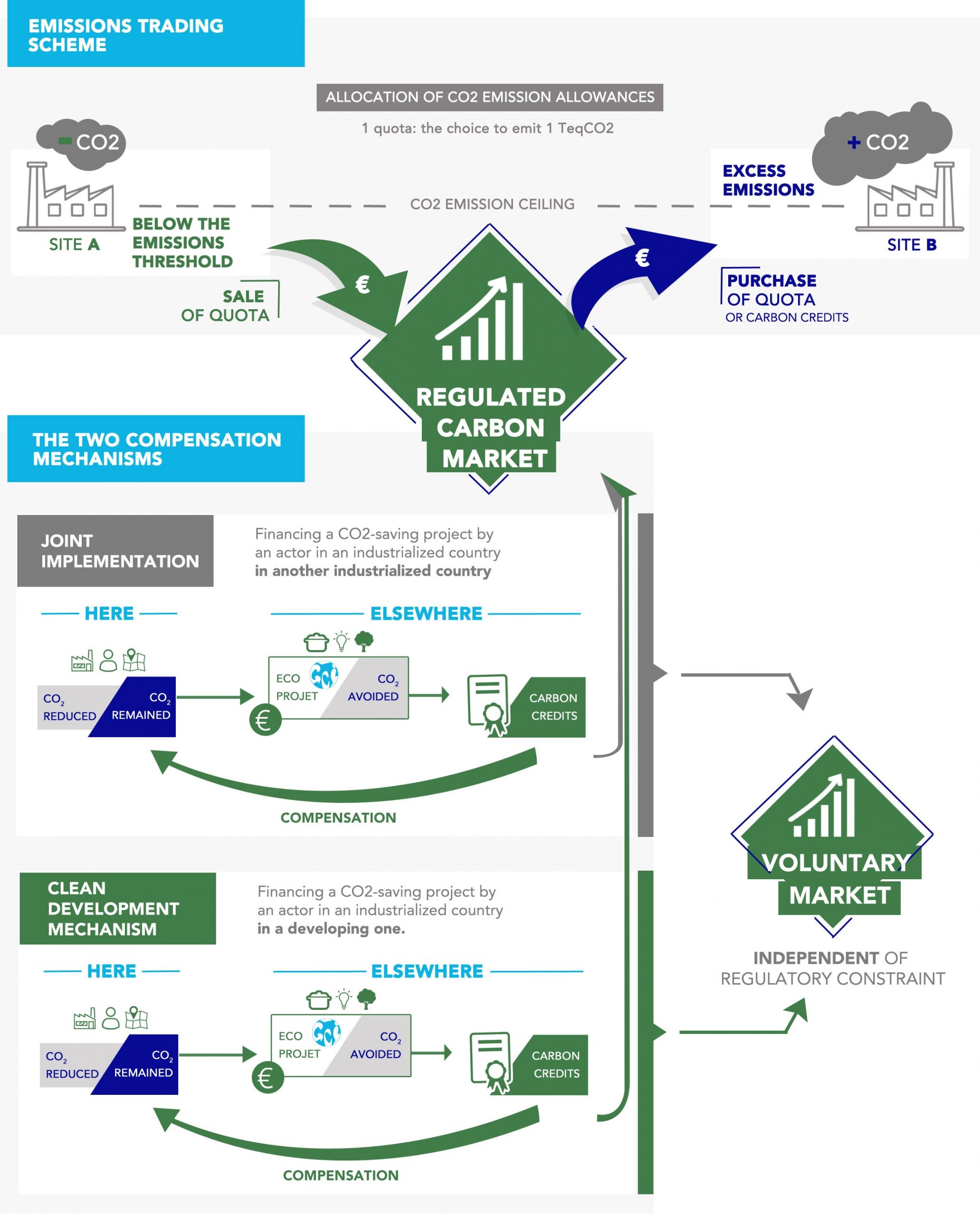

Jun 18, 2021 1:51:45 PM / by Graham Copley posted in ESG, Climate Change, CO2, Carbon, Emissions, ESG Investing, carbon credit, investment managers, US Government, carbon values, carbon offsets, carbon trading

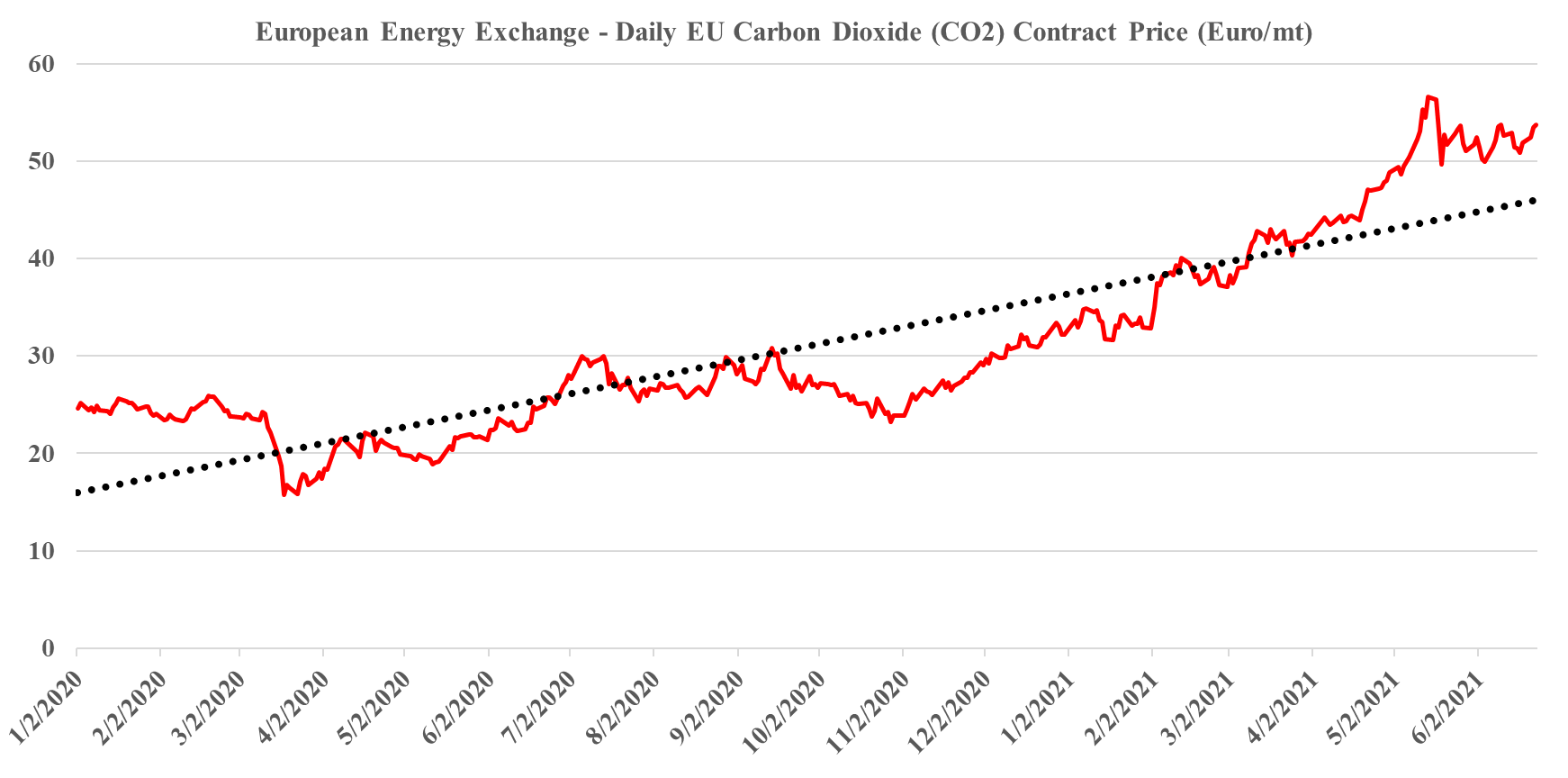

There have been some disappointing headlines out of the UN climate meeting this week, which is intended to pave the way for some of the COP26 discussions and come up with proposals that are likely to be agreed upon at the meeting. Most of the issues are around who is paying for what and whether developed nations are investing enough to help developing nations, using the guidelines put forward when the Paris Agreement was signed. In the US, the climate agenda and the Biden plan are bogged down in Congress and the plan is unlikely to pass in its current form.

We Need To Be More Inventive On Carbon Values In The US

Jun 16, 2021 2:00:36 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, CO2, Emissions, carbon credit, carbon abatement

In our ESG and Climate report published today we focus on hydrogen and what we believe are some unrealistic cost/timing estimates for green hydrogen. One of our concerns is that the hope of cheap green hydrogen, and absent any other strong incentives, will put the brakes on other carbon abatement initiatives and if the cost of hydrogen does not fall we could reach 2030 having made little progress on any front.

Could DoE Ambitious Hydrogen Plans Have Unintended Consequences?

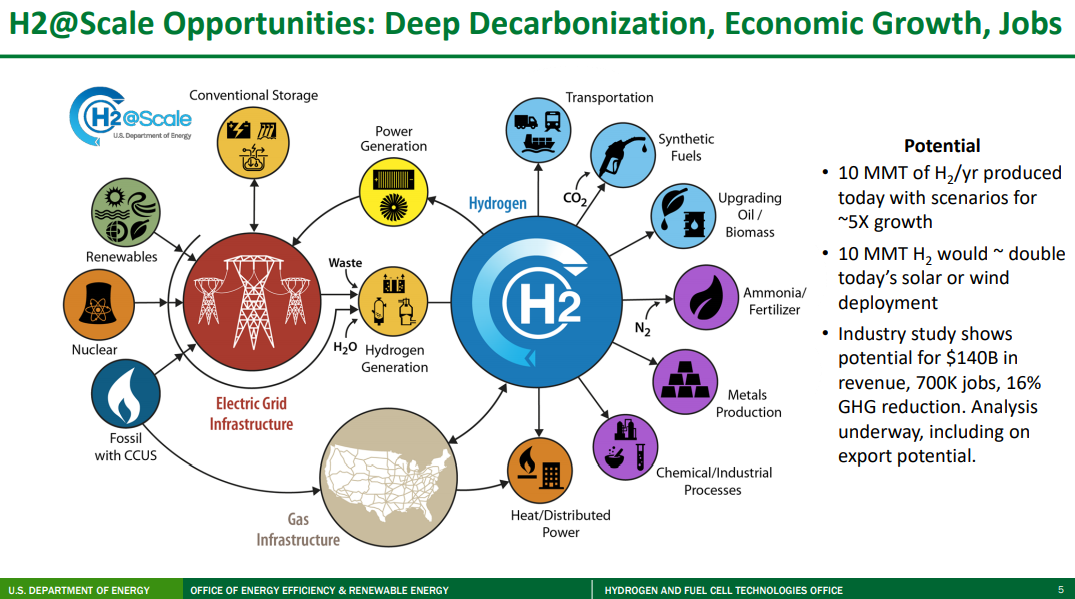

Jun 11, 2021 1:17:40 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Electric Vehicles, Materials Inflation, Emission Goals, Net-Zero, Ammonia, carbon footprint, natural gas, R&D, capital cost, Praxair, DoE, production cost

We will cover the very comprehensive DoE hydrogen work in more detail in the ESG report next week, but a couple of the charts from that work are worth mentioning today. The first picture below accurately depicts all of the potential uses of hydrogen and shows that over time it could solve a lot of “hard to solve” CO2 emission problems, especially where electricity cannot do the job efficiently. The reason why so many countries and companies are so interested in hydrogen is because of its potential versatility and because of its minimal carbon footprint (there is some carbon leakage in the full lifecycle of the production coming from construction around the plants themselves and infrastructure to use the hydrogen).

Navigator: A Pipe Dream or Pipe Nightmare?

Jun 3, 2021 9:56:39 AM / by Graham Copley posted in Carbon Capture, CO2, Sequestration, Emissions, Pipeline, carbon dioxide, ethanol, corn based ethanol

The Navigator CCS announcement is extraordinary in its boldness and potential lack of any real chance of economic success. The idea of building 1200 miles of high-pressure CO2 pipe (See exhibit below) to collect small volumes from corn-based ethanol producers and potentially have multiple sequestration sites is extremely expensive and would not begin to be covered by the 45Q tax credit, which would easily be consumed by the compression and pipeline costs alone. If some of the ethanol is making it into the LCFS markets, each ethanol producer that has some material heading that way will want a piece of the pie and if each had to jointly file with CARB, with Navigator, for what would be small portions of the overall ethanol output, the administration might be overwhelming, as would be a chain of custody process which satisfies CARB. Navigator is not an altruist fund and consequently, must see a way to make a return on the idea. This may be based on the hope that LCFS or something like it will spread to other states.