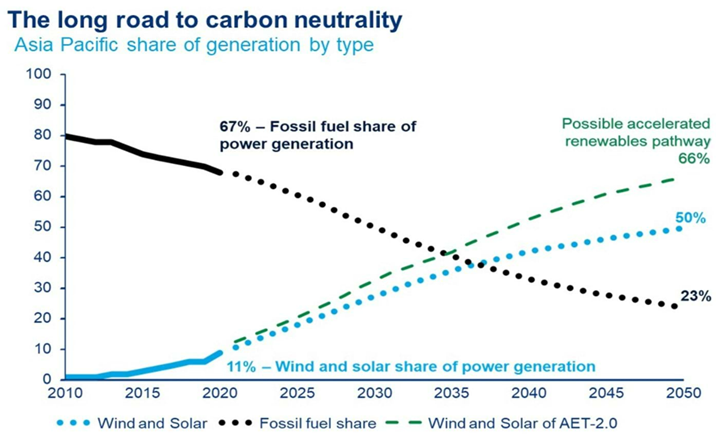

In the exhibit below, we see another chart that we find unhelpful when looking at the path to net-zero or something close. It is not an either/or game with fossil fuels and renewables. Those promoting this idea are setting impossible goals for the renewable industries, which will keep severe upward pressure on all energy costs. Wood Mackenzie may not mean what is implied in the chart below but taken at face value it suggests that more pressure will be placed on an underfunded materials market to supply an underfunded renewable power market, in which any opportunity to use decarbonized fossil fuels will be frowned upon. It would be good to see an analysis of how much global power could be generated from decarbonized natural gas and how much pressure that would take off the renewable industries.

We Need Fossil Fuels For Longer, Especially If We Cant Make Enough Batteries

May 13, 2022 1:32:32 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Energy, decarbonization, renewables, EV, Lithium, materials, energy costs, fossil fuels, battery, nickel

Ambitious Renewable Power Estimates Likley Underestimate Inflation

Dec 30, 2021 12:26:23 PM / by Graham Copley posted in Inflation, renewable energy, renewable investment, energy costs, power shortages

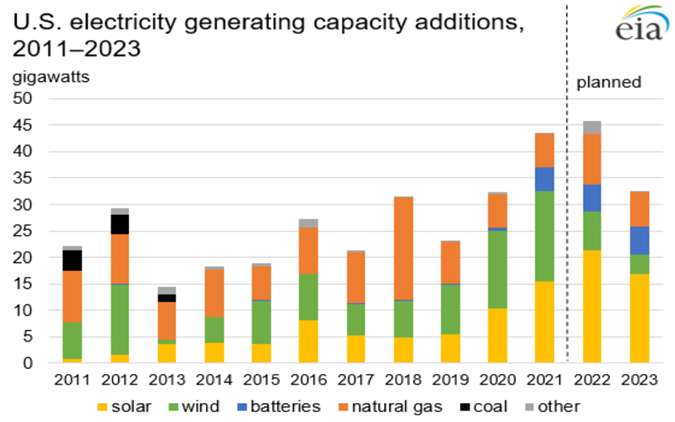

In our ESG and Climate report yesterday we highlighted inflation as one of the most significant risks for 2022 and the estimates in the exhibits below do not leave us any less concerned. The US has struggled to meet solar installation plans for 2021, falling short of early-year estimates because of limited equipment availability and higher equipment prices. While some of this has been the result of the supply chain challenges of 2021, some shortages have also been the result of very strong global demand. The idea that we can increase solar installations in 2022 without creating more supply issues (and more inflation) should be questioned, especially in light of planned additions in China, which will consume an increasing share of Chinese solar modules.

$40 LNG - Time To Buy Our Own Cow?

Dec 28, 2021 11:32:38 AM / by Graham Copley posted in ESG, LNG, Renewable Sources, natural gas, renewable energy, climate, low carbon fuel, energy costs, green energy, renewable natural gas, power shortages

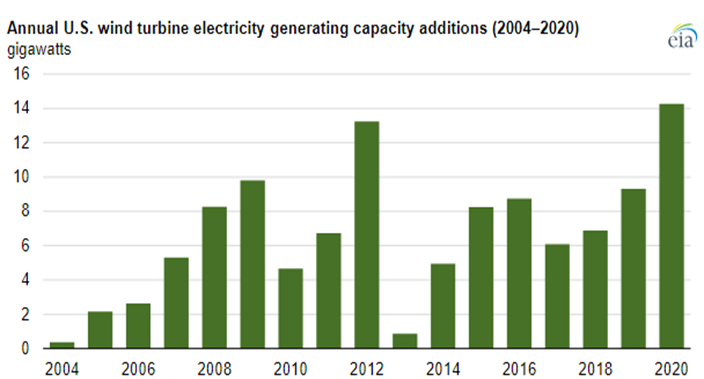

It should not be surprising that 2021 has seen a rebound in emissions as nothing has changed fast enough over the last 24 months in terms of renewable power additions and carbon abatement to offset more than the underlying growth in power demand, and based on what we are seeing in European and Asia LNG markets, we have fallen short of demand growth. The wind capacity chart below has one main conclusion – not enough. One of our main inflationary fears for 2022 is that both wind and solar installation rates need to step up meaningfully from current levels to make a difference – the IEA suggests that installation rates need to double (at a minimum). It has already proven difficult to meet installation targets in 2021, in part because of supply chain issues but also in part because of material shortages, all of which have led to rising installation costs, against the longer-term run of falling costs because of learning curve gains. We believe that costs will rise again in 2022 and 2023 as installers/projects compete for limited solar module and wind turbine components