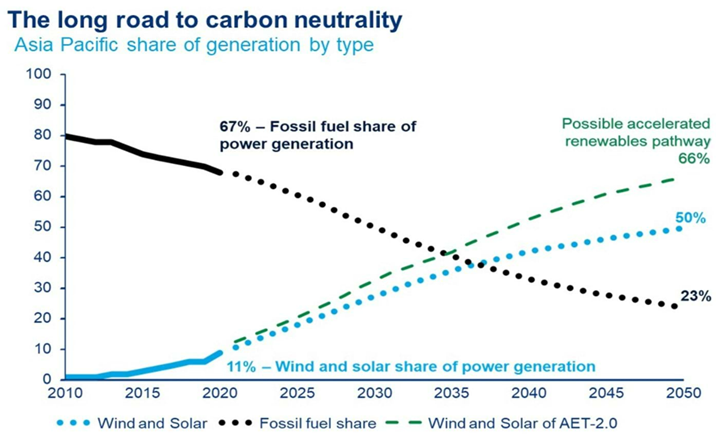

In the exhibit below, we see another chart that we find unhelpful when looking at the path to net-zero or something close. It is not an either/or game with fossil fuels and renewables. Those promoting this idea are setting impossible goals for the renewable industries, which will keep severe upward pressure on all energy costs. Wood Mackenzie may not mean what is implied in the chart below but taken at face value it suggests that more pressure will be placed on an underfunded materials market to supply an underfunded renewable power market, in which any opportunity to use decarbonized fossil fuels will be frowned upon. It would be good to see an analysis of how much global power could be generated from decarbonized natural gas and how much pressure that would take off the renewable industries.

We Need Fossil Fuels For Longer, Especially If We Cant Make Enough Batteries

May 13, 2022 1:32:32 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Energy, decarbonization, renewables, EV, Lithium, materials, energy costs, fossil fuels, battery, nickel

Demand And Infrastructure For SAF Is Likely Well Ahead Of Supply

Apr 19, 2022 1:34:16 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, IEA, renewable energy, EVs, materials, sustainable aviation fuel, renewable fuels, fuel, material shortages, carbon intensity, battery, nickel, SAF, airlines

In our ESG and Climate report tomorrow, we will focus on SAF from a carbon intensity perspective. The Colonial pipeline initiative was inevitable given the demand for jet fuel at the East Coast airports. Still, we would not expect much volume to move in the near term for several reasons. First, there is not that much to move, and second, California can still pay more because of the LCFS credit. The Biden administration is planning to introduce a broad SAF credit which would help encourage use outside California, but this would also need to stimulate production as the volumes are still small and much smaller than the airlines would want – even the projection of volumes by bodies like the IEA fall well short of potential airline demand by 2030 and 2040. This is an investable theme, in our view, and we will discuss it in more detail tomorrow.

Renewable Power Urgency Complicated By Material Availability

Mar 8, 2022 1:49:00 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Coal, Energy, natural gas, solar, renewable energy, power demand, manufacturing, wind, EIA, reshoring, offshore wind, raw material, battery

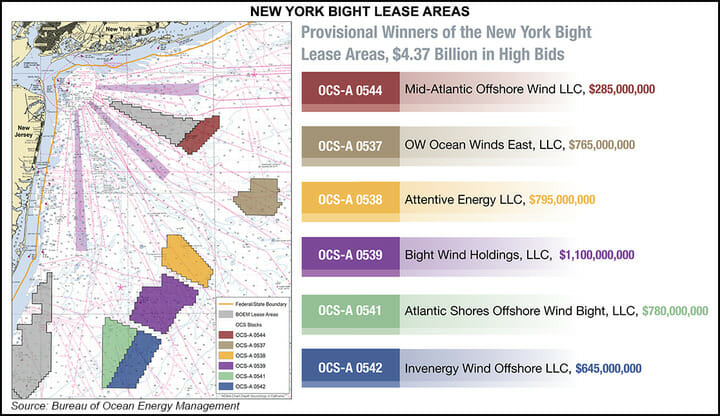

We include a couple of headlines and charts in today's daily report that step into the central theme of this week’s ESG and climate report, which will be published tomorrow (see here). The offshore wind ambitions and the EIA solar and battery projections both assume that the materials are available to build the capacity. In the case of the offshore wind leases, the winning bidders do not need to be in the market for all of the projects today and while the opportunities will lead to a step-change in demand for turbines in the US, the timing is less clear today that it will be in a few months and that timing may be adjusted to reflects equipment timing and costs, etc.