There are several headlines today that speak to one of the most pressing issues that we have with the pace of energy transition – the competition for renewable power and the likely inability of the industry to keep up with the competing needs, let alone do so without significant power cost inflation.

Competition For Renewable Power Likely To Exceed Availability

Jun 23, 2021 1:56:35 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, Electric Vehicles, fossil fuel, carbon footprint, renewable energy, Green Industry, electric power, renewables, power demand, Amazon, carbon cost

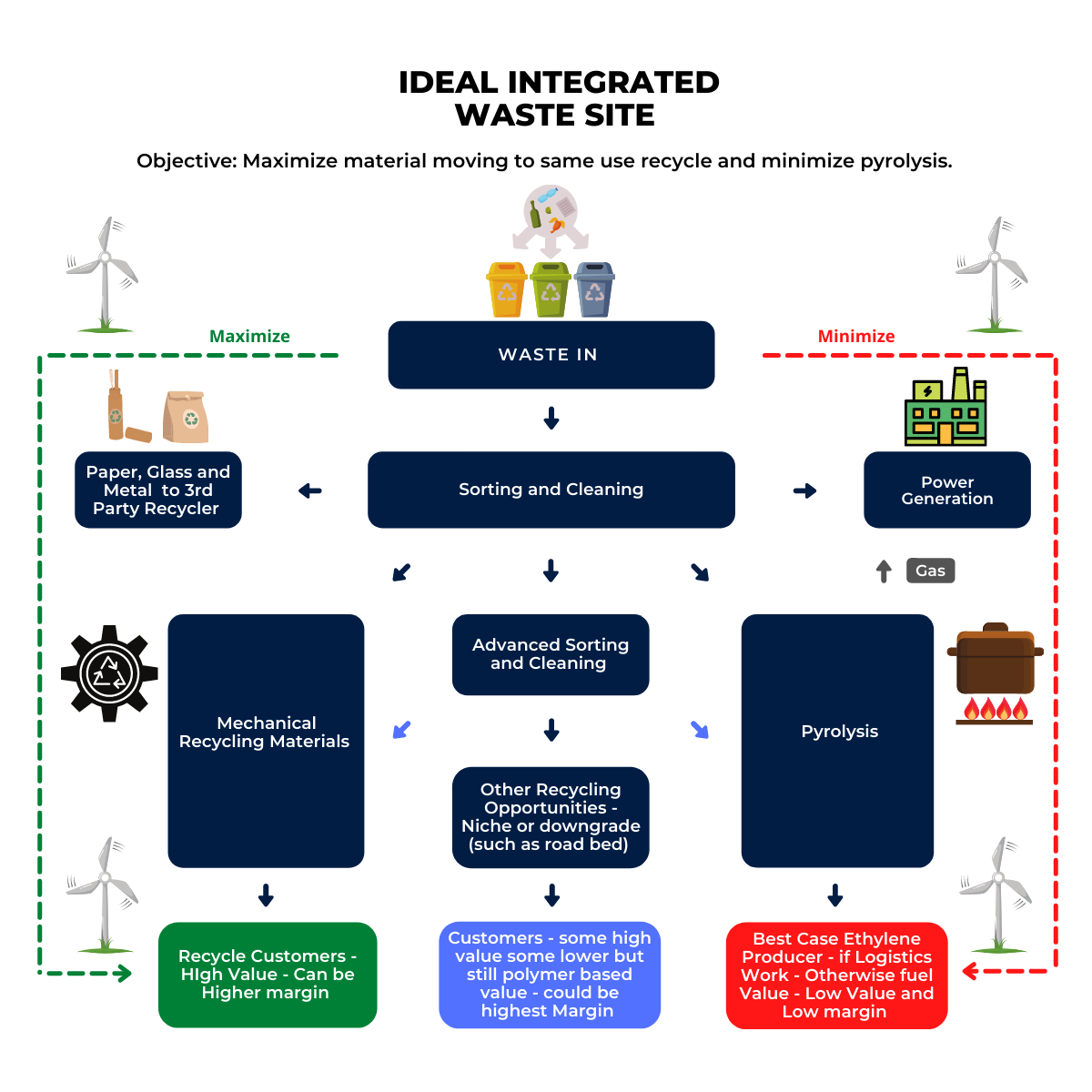

Recycling Confusion Continues: Brand Owners Could Struggle To Meet Goals

Jun 22, 2021 1:48:14 PM / by Graham Copley posted in ESG, Recycling, Sustainability, Plastic Waste, Plastics, Mechanical Recycling, carbon footprint, polymer producers, chemical recycling

We want to focus on the following headline as it is both relevant and confusing:

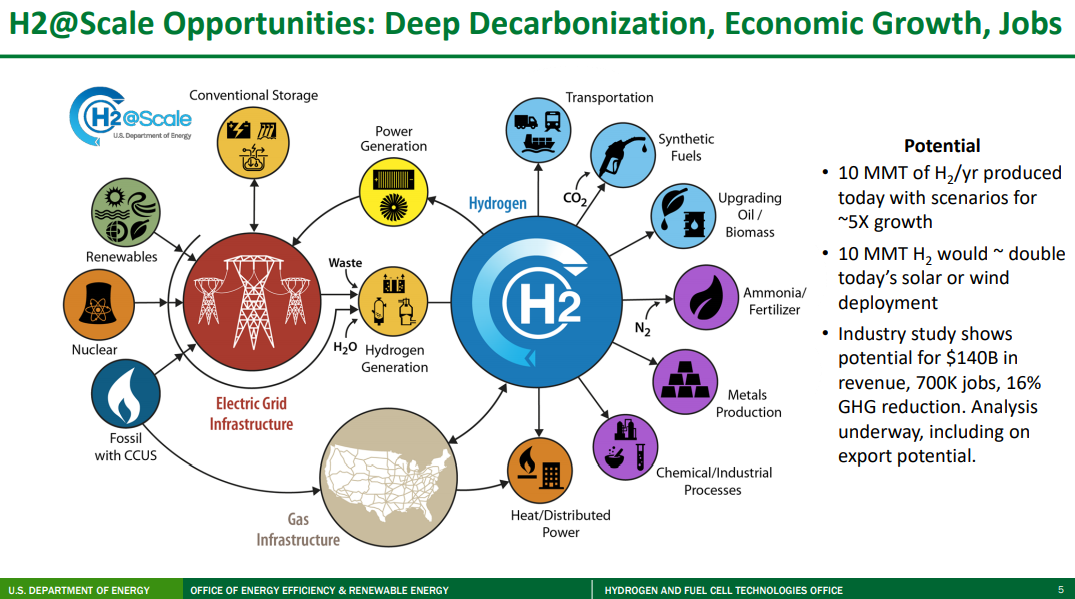

Could DoE Ambitious Hydrogen Plans Have Unintended Consequences?

Jun 11, 2021 1:17:40 PM / by Graham Copley posted in ESG, Hydrogen, Green Hydrogen, CCS, Blue Hydrogen, CO2, Renewable Power, Electric Vehicles, Materials Inflation, Emission Goals, Net-Zero, Ammonia, carbon footprint, natural gas, R&D, capital cost, Praxair, DoE, production cost

We will cover the very comprehensive DoE hydrogen work in more detail in the ESG report next week, but a couple of the charts from that work are worth mentioning today. The first picture below accurately depicts all of the potential uses of hydrogen and shows that over time it could solve a lot of “hard to solve” CO2 emission problems, especially where electricity cannot do the job efficiently. The reason why so many countries and companies are so interested in hydrogen is because of its potential versatility and because of its minimal carbon footprint (there is some carbon leakage in the full lifecycle of the production coming from construction around the plants themselves and infrastructure to use the hydrogen).

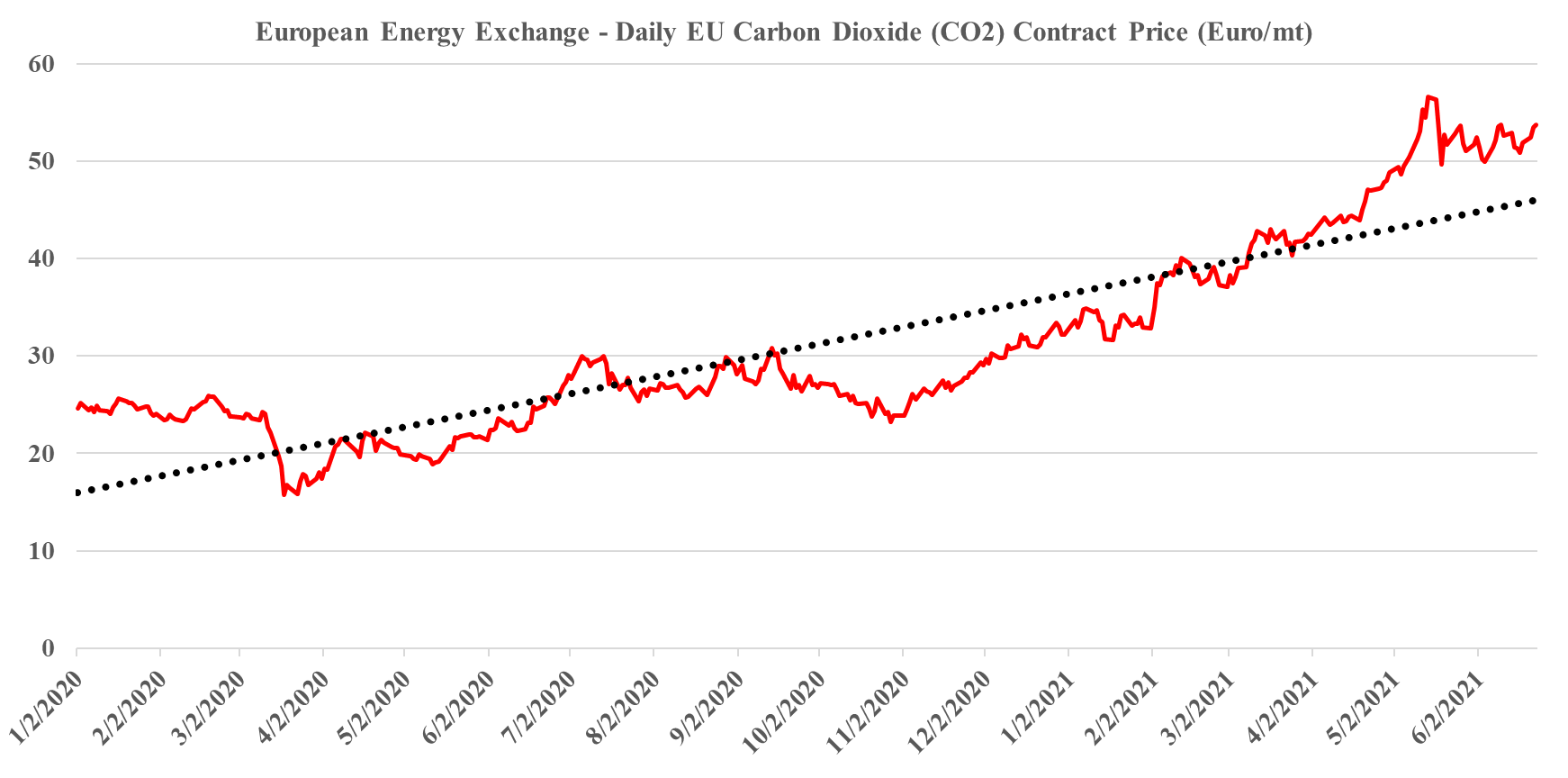

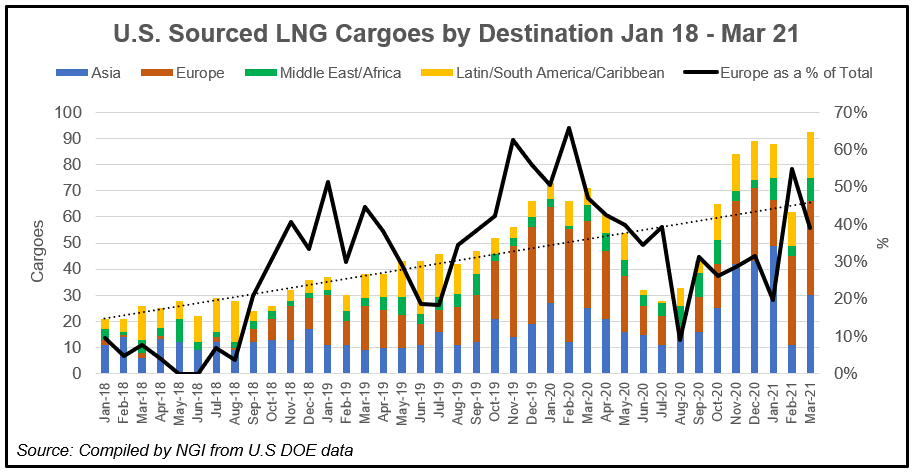

Larry Fink Finally Gets It! And The Carbon Value Of LNG

Jun 4, 2021 12:00:51 PM / by Graham Copley posted in ESG, LNG, Coal, fossil fuel, carbon footprint, ESG Rhetoric, Power Plants, Larry Fink, carbon credit, carbon value

Finally, Larry Fink has recognized the flaw in his aggressive ESG rhetoric. Maybe he knew this all along, but it is good to see him step into the debate in favor of not crippling the fossil fuel industry by denying it access to capital and investors too quickly. However, that boat may have sailed, with investors like Engine No. 1 feeling empowered by their win over ExxonMobil and raising more money as a consequence. We have covered this subject at length in our ESG and climate weekly this week: Big Oil’s Big Problem – Hard To Find A Favorable Scenario – maybe Larry read it!

Will ExxonMobil Activists Change Anything?

May 26, 2021 1:24:39 PM / by Graham Copley posted in ESG, Carbon Capture, Energy, ESG Investing, ExxonMobil, carbon footprint, ESG Fund, bp

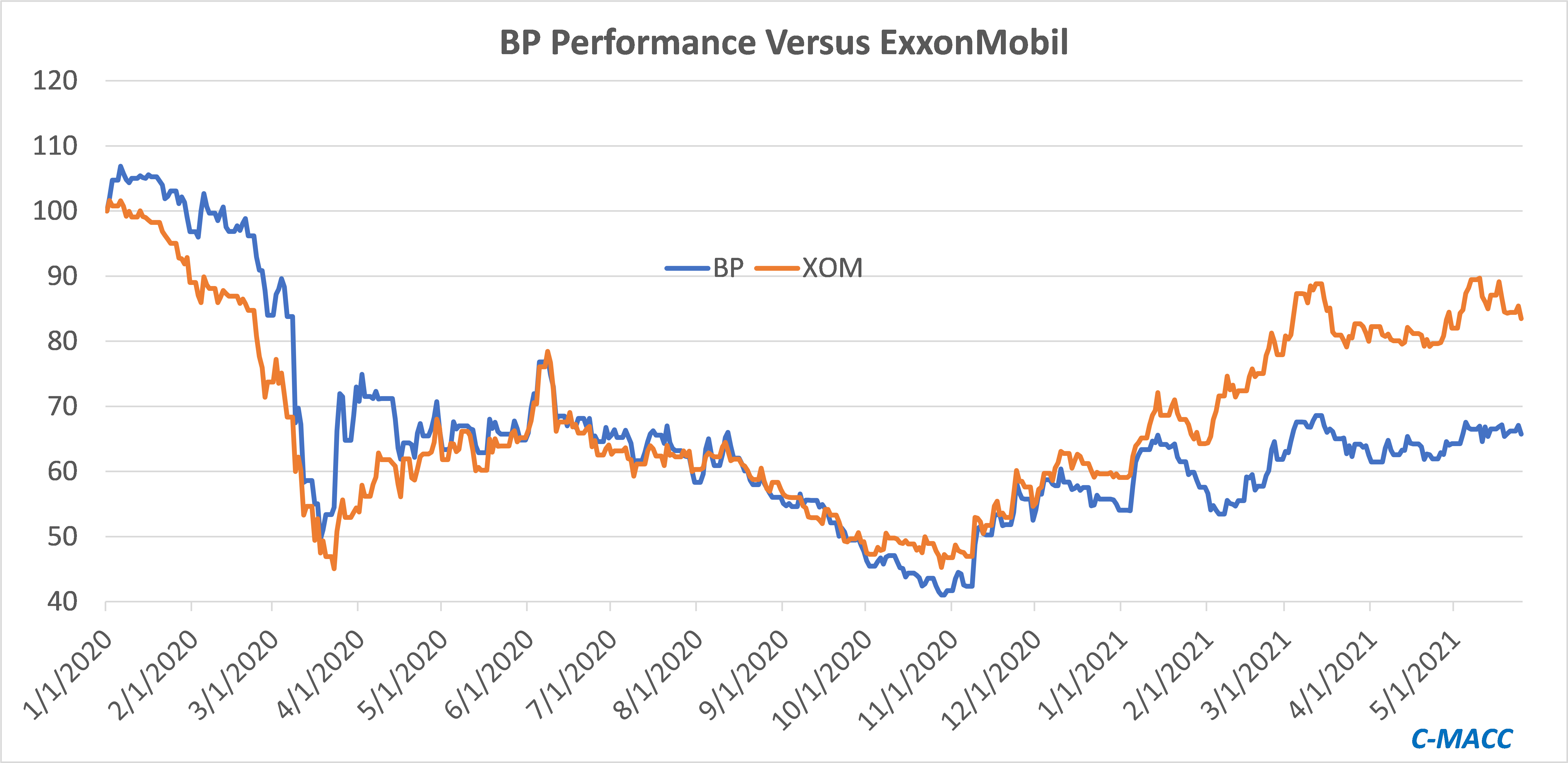

With little chemical corporate news of note, we will focus on ExxonMobil today. The shareholder activism may be high but it is unclear to us what the activists hope to achieve, even if they are successful at the annual meeting. The ESG investment group has largely given up on energy and even if ExxonMobil changes strategy and agrees to spend more on carbon abatement it is unlikely that new investors will show up, especially if the new strategy is more costly. Despite all of its directional change and rhetoric, bp has underperformed ExxonMobil since Mr. Looney took the helm in early 2020. If ExxonMobil were to follow the bp playbook, it is not clear that shareholders would benefit.

ESG Friday Question: Can Technology Keep Pace?

May 21, 2021 1:12:36 PM / by Graham Copley posted in ESG, Carbon Capture, Ethylene, Emissions, Net-Zero, IEA, Dow, propane, Technologies, ethane dehydrogenation, carbon footprint, BASF

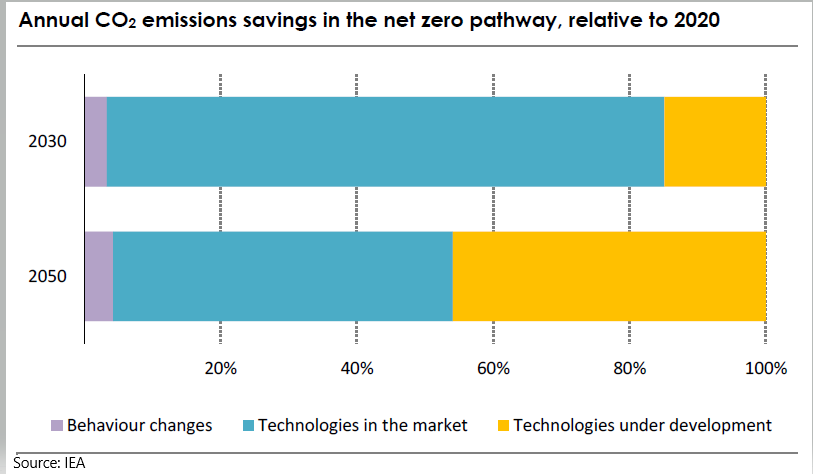

There is a broad technology theme to the articles that we have chosen today, which is in keeping with one of the core conclusions of the IEA report earlier this week. The IEA is estimating that roughly half of the path to net-zero will require technologies still in the test phase, or in some cases still conceptual. The Dow headline around ethane dehydrogenation and electric furnaces is a good example. Both technologies could lower the carbon footprint of making ethylene, but the dehydrogenation route will require some catalyst or other breakthrough as current propane dehydrogenation technologies require a lot of heat. The electric furnace idea is complex and would require extremely high levels of power, all of which would have to be renewable for the carbon footprint to fall – this type of technology is likely implied in the BASF announcement today. The IEA talked about some of the transition moves required to allow the technology advances time to become either commercial or cost effective, or both. Carbon capture features meaningfully in the IEA plans, but the study has carbon capture volume rising through 2050, which we find odd. The idea of carbon capture is to act as a bridge between where we are today and where we could be once new technology is developed – therefore, while companies like Dow should be aiming for technologies that lower the carbon production of its processes, carbon capture should be an almost immediate bridge to lower emissions while both the technology is developed, and its costs are reduced. Carbon capture needs should then decline. View today's Daily Report for more.