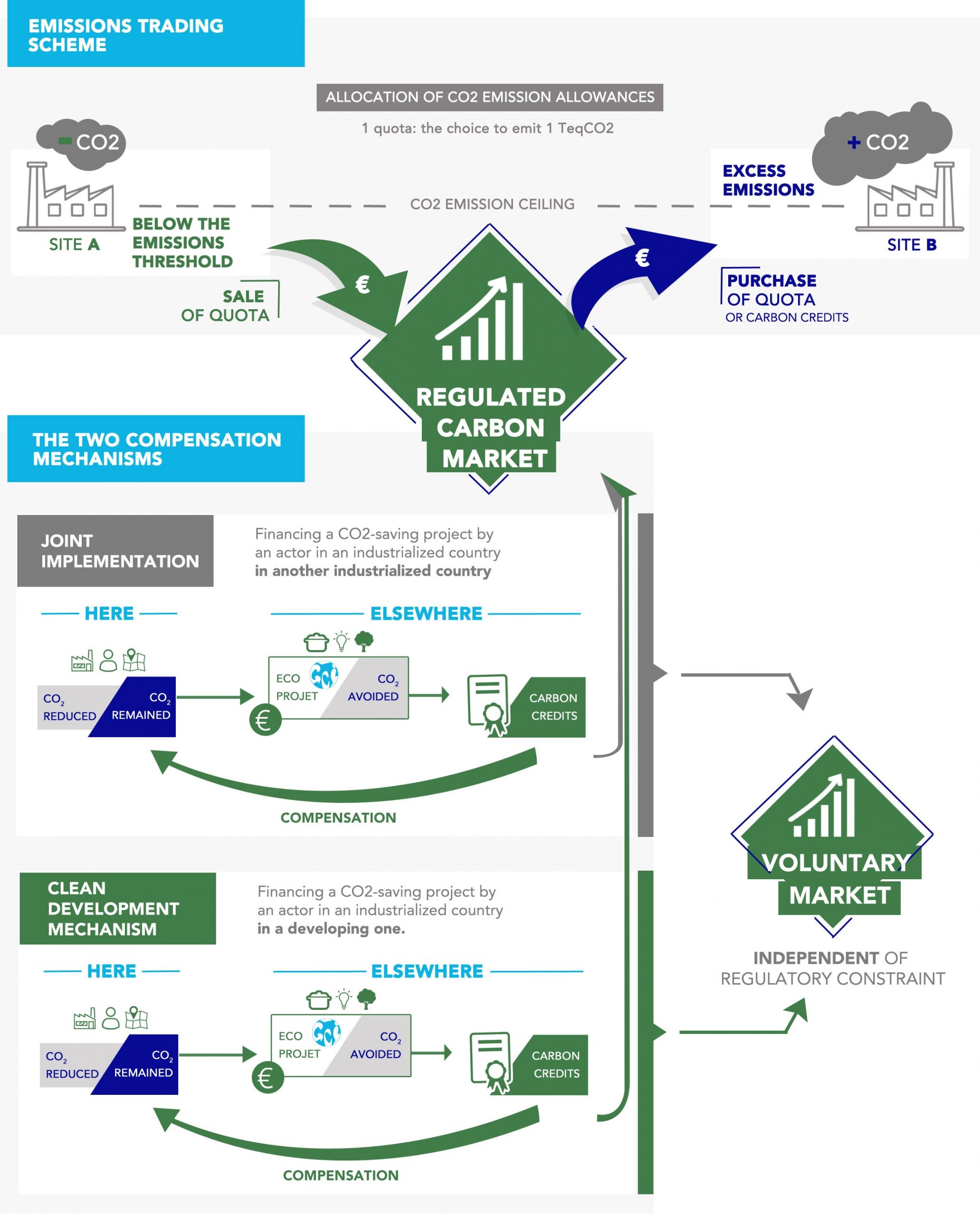

We are skeptical about carbon offsets and we are more skeptical about announcements around carbon-neutral fuel and chemical cargoes. The ESG and climate activists have their radars finely tuned for “greenwashing” and other exaggerated claims, and when we get into offsets, whether as a traded market or as a one-off green cargo we rightly see the skeptics. The cargoes – ethylene below and an LNG cargo earlier this week - are PR stunts in our view and while the accounting may be accurate, the one-off costs are likely high, and the ability to repeat the process for significant volumes is limited. It may be proof that you can create carbon neutrality through offsets, but the supply of offsets will likely never be large enough to create affordable permanent pathways, and offsets should be looked at by all as a way to go the last mile, having exhausted all other options, including carbon avoidance and carbon use or sequestration. We have noted in prior work that we see a risk of too many people banking on a share of the offset market than the likely size of the market – creating price inflation and ultimately lower revenues than could have been achieved through alternate means. Current offset markets are cheap – at least relative to other costs of carbon abatement, but higher levels of oversight, which are both needed and planned, will likely limit availability going forward – also suggesting higher pricing.

Carbon Pricing May See Several Sources Of Volatility

Jul 9, 2021 1:02:30 PM / by Graham Copley posted in ESG, Climate Change, Carbon, Carbon Price, Carbon Neutral, carbon abatement, carbon offsets, offsets, climate, greenwashing

Carbon Abatement – A Multi-client Analysis

Jul 7, 2021 1:01:06 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax, Carbon Fuels, CCS, CO2, Renewable Power, Carbon, Carbon Neutral, Emission Goals, Net-Zero, decarbonization, carbon footprint, ESG Fund, carbon dioxide, carbon credit, carbon value, carbon abatement, power, carbon cost, carbon offset, offsets, ESG investment, carbon emissions, clean energy, climate

A major initiative by C-MACC in collaboration with the Power Research Group

Unrealistic US Green Power Targets May Cause More Harm Than Good

Jul 1, 2021 2:16:28 PM / by Graham Copley posted in Hydrogen, Climate Change, Coal, CCS, raw materials inflation, fossil fuel, natural gas, renewables, batteries, US Green Power, power storage, clean energy, petroleum

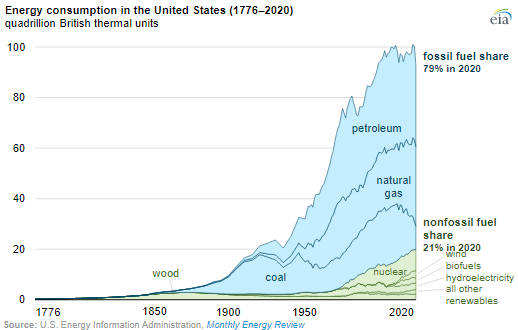

One of the themes that we have focused on in our ESG and Climate work is the lack of realism in the Biden climate plan as it relates to power generation and the same with the plan in California. The more limited reliability factor in renewable power (because of its dependence on cooperation from the weather), means that you have to build a lot more new power capacity than you are replacing and you need to build a storage system for the power – batteries, hydrogen or hydraulic. This gets very expensive and will be more so if the push drives inflation in raw materials – which is already a factor YTD in 2021. Natural gas turbines are a cleaner and reliable source of power and cleaner still if combined with CCS. Politicians in the US are taking a considerable risk by promoting plans that could leave the power grid more vulnerable to some of the issues that we have already seen over the last 12 months (California and Texas). Of course, as the plans call for natural gas phase-outs in 10-12 years, none of those making the decisions today will be in the office to face the consequences!

More Climate Discord Unlikely To Help Necessary Progress

Jun 18, 2021 1:51:45 PM / by Graham Copley posted in ESG, Climate Change, CO2, Carbon, Emissions, ESG Investing, carbon credit, investment managers, US Government, carbon values, carbon offsets, carbon trading

There have been some disappointing headlines out of the UN climate meeting this week, which is intended to pave the way for some of the COP26 discussions and come up with proposals that are likely to be agreed upon at the meeting. Most of the issues are around who is paying for what and whether developed nations are investing enough to help developing nations, using the guidelines put forward when the Paris Agreement was signed. In the US, the climate agenda and the Biden plan are bogged down in Congress and the plan is unlikely to pass in its current form.

It Is Hard To Find Talent When All The Issues Are New

Jun 8, 2021 12:21:03 PM / by Graham Copley posted in Recycling, Climate Change, Sustainability, Net-Zero, fuel alternatives, carbon abatement, renewable polymers, investment managers, investor relations

The article linked that discusses the “Talent War” for ESG spreads well beyond the investment community. Corporations are having to rethink strategy around new variables, and consequently, the experienced talent pool is limited and in some areas such as carbon abatement, recycling versus renewable polymers, and alternate sources of fuel, there is not much history to have created many “experts”.

Another Expensive CCS Project With Limited Capacity

May 11, 2021 11:39:27 AM / by Graham Copley posted in Hydrogen, Chemicals, Carbon Capture, Climate Change, CCS, Emissions, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Gulf Coast Sequestration, Emission Goals

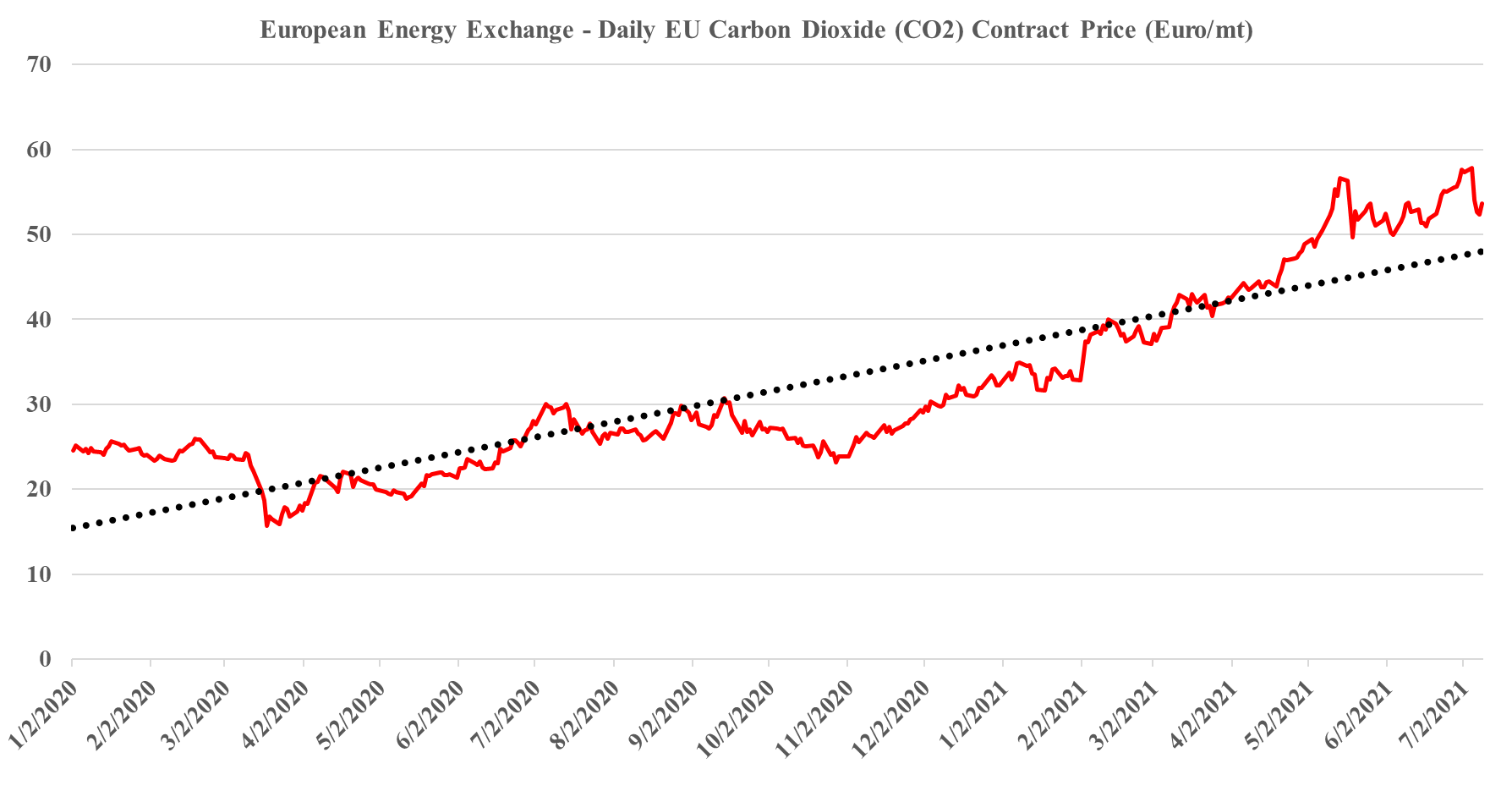

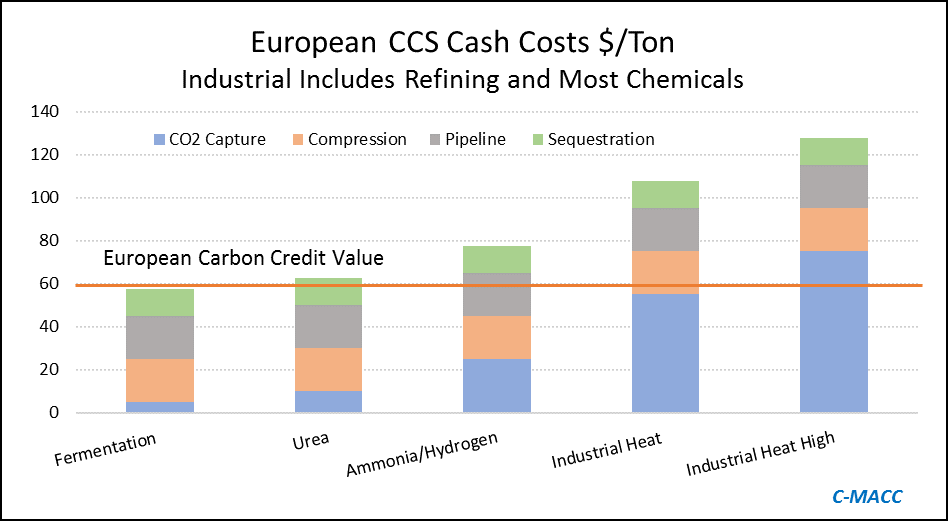

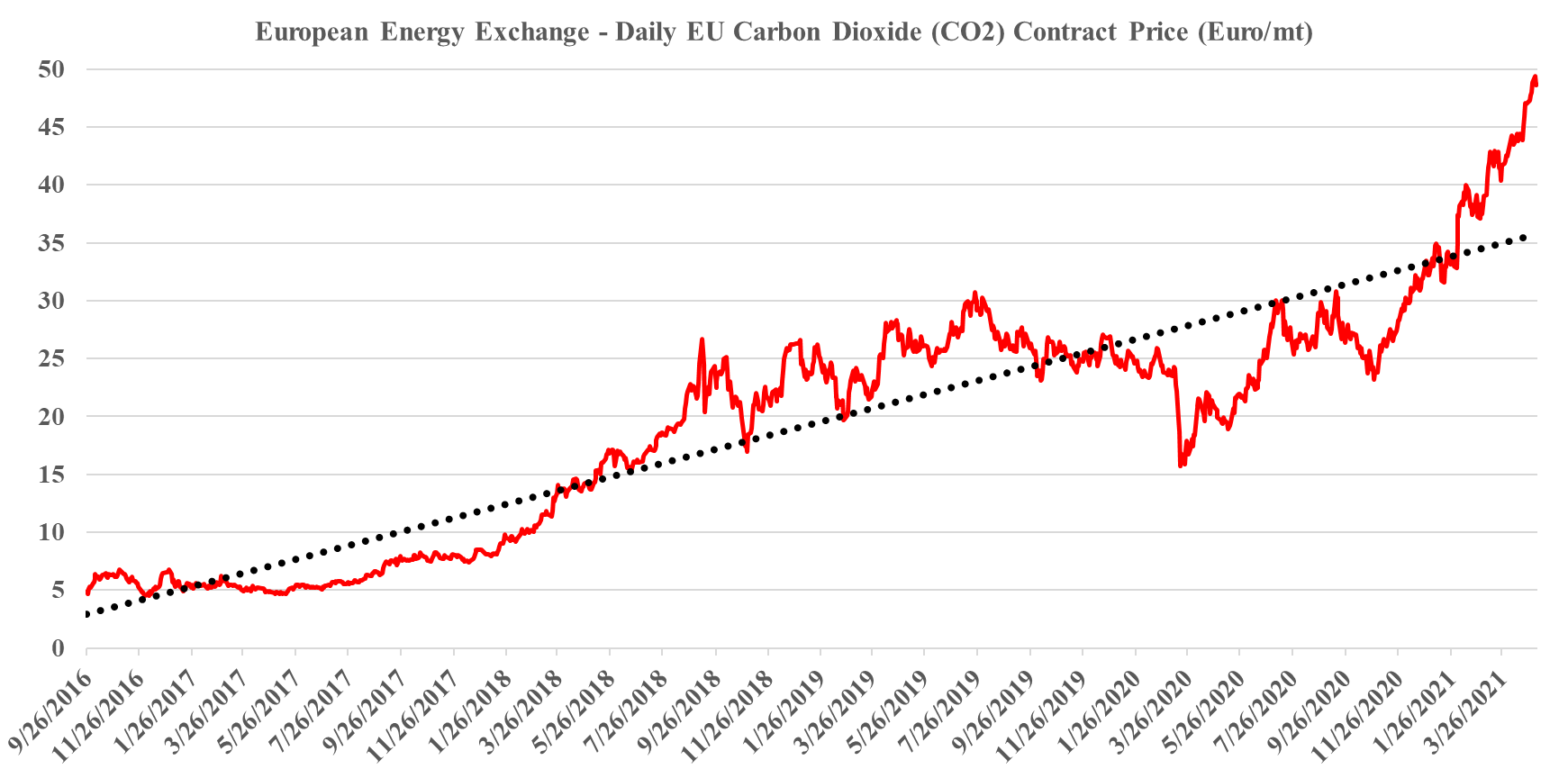

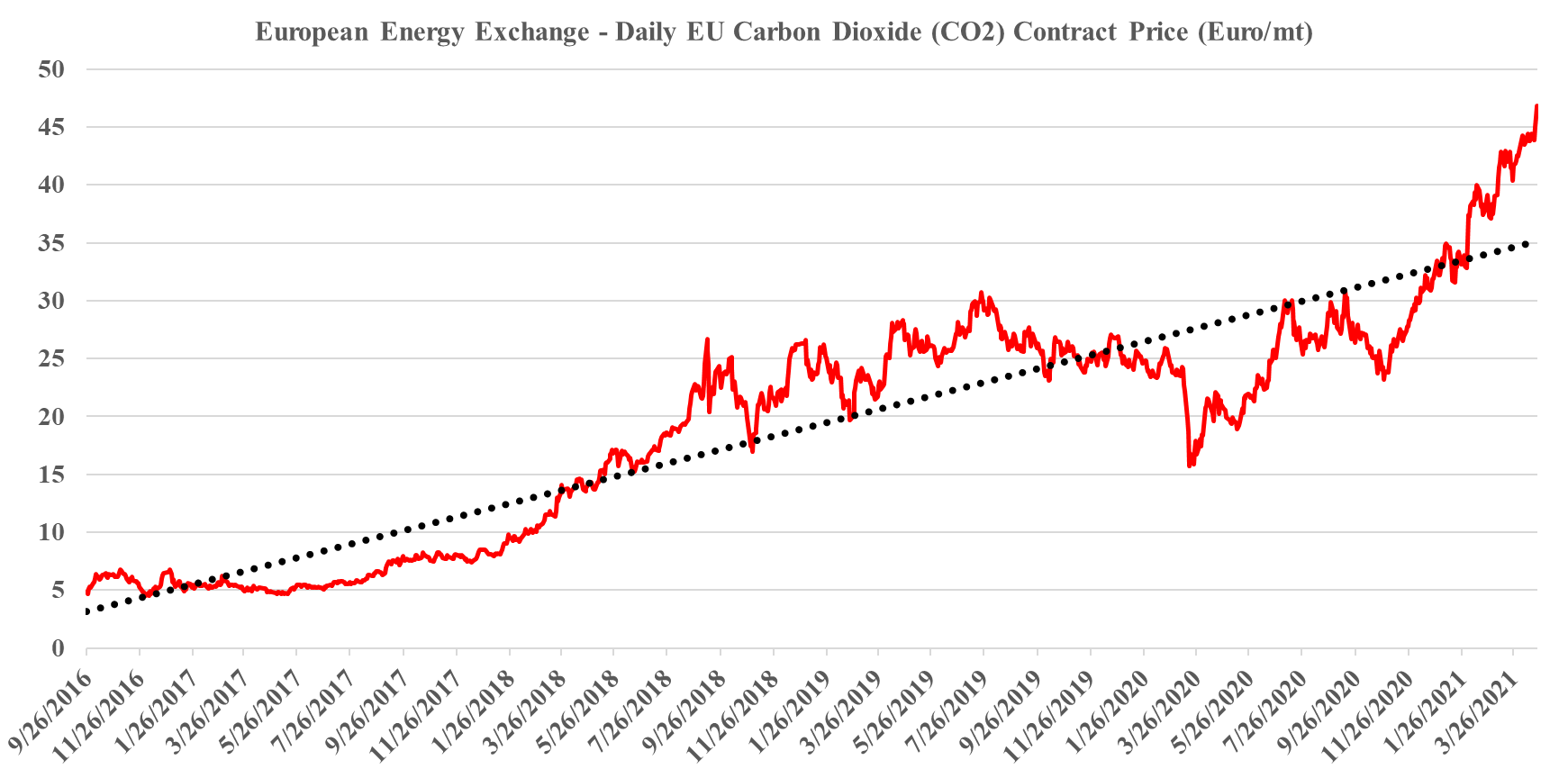

The big news of the day is the massive grant that the Dutch government approved yesterday for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be focused within the Port of Rotterdam, where both of the oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the 2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $60 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs –see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir).

Source: Global CCS Institute, C-MACC Analysis, 2021

This is another example of a grossly inflated project, in terms of costs and while it may be the best option for the Port of Rotterdam we would make the following observations.

- It will consume a fraction of the CO2 in the local area

- It might give the Dutch operators a competitive edge over other European companies – either because they can produce low carbon fuel or hydrogen or other chemicals (which may get a premium price), or because they avoid paying the carbon prices. This may cause issues within the EU

- It might artificially lower the European carbon price by creating (subsidized) credits – if this project and other government-backed projects (the UK and Scandinavia so far) overwhelm the credit market, they may depress carbon values and discourage other moves to lower CO2 footprints

- Note that we expect a potential fly up in European carbon prices near-to-medium-term, and these mega-projects will not come into operation for a couple of years

- Like the ExxonMobil proposal for Houston, the implied cost per sequestered ton of CO2 is extremely high and while it might reflect problems with land rights, pipeline “right of ways” and other constraints specific to The Netherlands, it is multiples of the cost that we would expect US for on-shore sequestration and we would encourage all to check out the plans (currently with the EPA) that Gulf Coast Sequestration has in Louisiana.

Without A Carbon Price US Regulations Will Need To Be Tougher & Unpopular

May 5, 2021 12:12:43 PM / by Graham Copley posted in Climate Change, Emissions, Carbon Price, CP Chemical, Carbon Neutral

We doubt that President Biden’s moratorium on new drilling will result in an outright ban. As we discuss in the ESG report today, the lack of unity on the idea of a carbon tax in the US means that the administration has to approach climate change issues in a more piecemeal fashion and one of the easiest triggers to pull, is to limit any new investment that adds to emissions. Our guess is that we will see an EPA-led agenda shortly that will only allow new US energy (and probably industrial) investments that come with a carbon-neutral plan. Drilling will likely be allowed to continue as long as the new wells have zero emissions or have offsets to counter any new emissions. It is unlikely that this will be restricted to oil and gas, and CP Chemical with their 1-Hexene project announced above may be in for a surprise when they apply for a permit.

A 50% Emissions Reduction In 10 Years; Very Much A Stretch Goal

Apr 22, 2021 11:59:26 AM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Emissions

The focus for today and tomorrow in this section as well as the focus of next week’s ESG and climate piece will be the environmental summit that is being held today and tomorrow and the possible ramifications of pledges that will inevitably come from it. We must start with President Biden’s emissions pledge: “This is the decisive decade,” Biden said at the summit on Thursday morning. “This is the decade that we must make decisions to avoid the worst consequences of the climate crisis.” The administration put forward a goal of reducing US emissions by 50% by 2030. “This is a moral imperative. An economic imperative. A moment of peril, but also a moment of extraordinary possibilities,” the president said.

Climate Dreamers: Big Hats No Cattle

Apr 15, 2021 2:14:18 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change

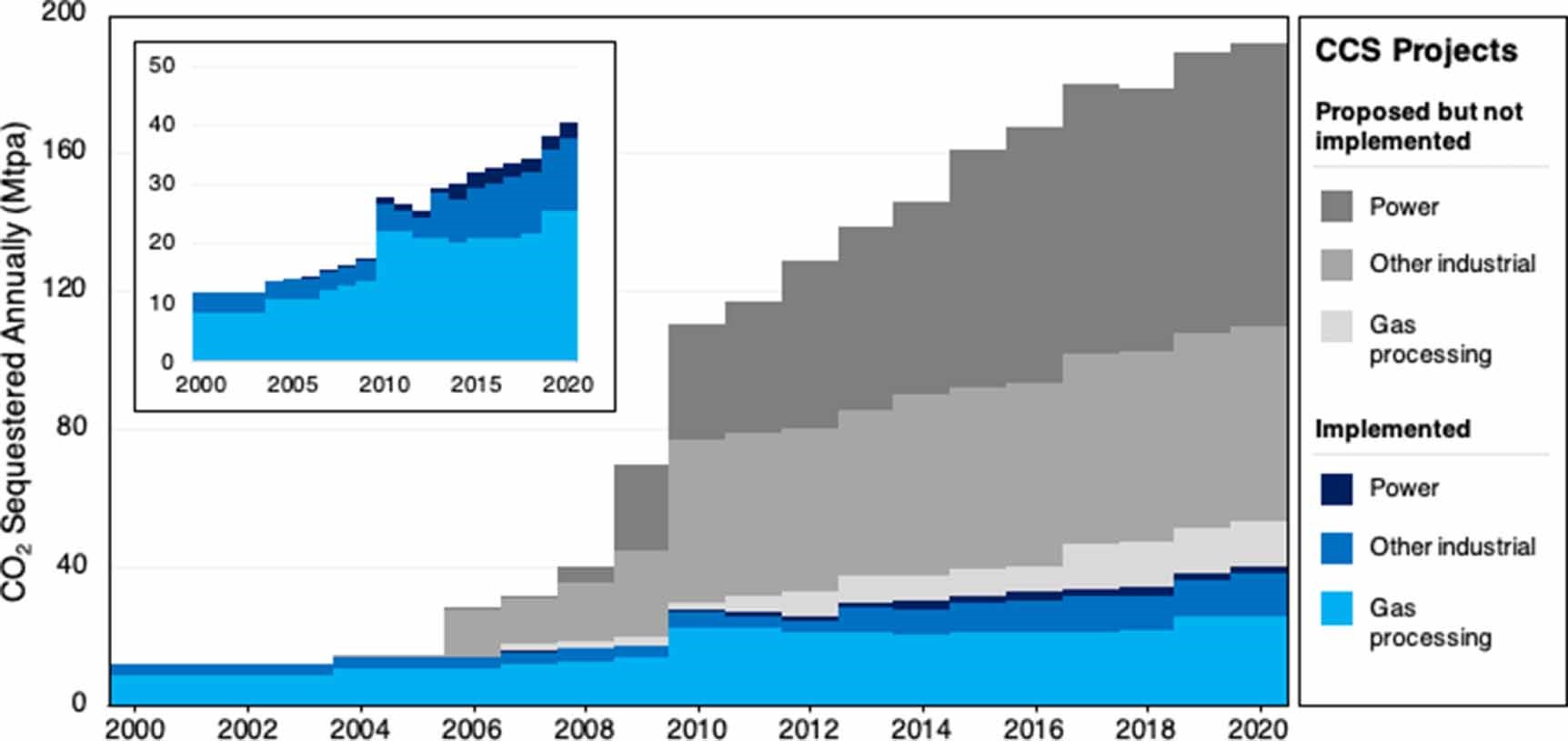

In the UK we have the phrase “all mouth and no trousers”. When moving to Texas I was delighted to find their own phrase “big hat – no cattle”. They mean the same thing – all talk and no action. The chart in the Exhibit below is supposed to be about carbon capture, but it is a much better illustration of “big hat – no cattle”, and we think that it is very relevant today, not just for carbon capture but for many of the other energy transition announcements that we see – especially for hydrogen. In the chart, the carbon capture projects announced by 2020 called for 200 million tons of sequestered carbon, while less than 40 million tons have been implemented (20%), and almost all of that in enhanced oil recovery (EOR).

A US Carbon Tax – How Aligned Would the API be with Something That Worked

Mar 8, 2021 11:19:22 AM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Carbon Tax

The API is suggesting that it would support a carbon tax in the US, but at the same time is suggesting that this would only be supported if it was the only mechanism that regulators used at a Federal level. While both Europe and California have carbon taxes, they have many other regulations and mechanisms to help lower emissions, such as credits for EV use and LCSF in California.