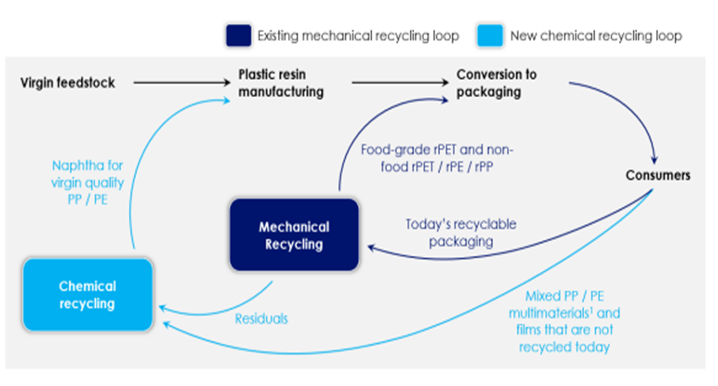

In the first picture below we see another schematic that shows how different options for polymer recycling could work together. We have suggested a more complex site than the one in the chart as there will be opportunities to recycle some polymers into non-like-for-like applications such as roadbed modification and other durable applications. In addition, there may be a better return in waste to energy versus chemical recycling and that may be an alternative or an add-on. This sort of complex site is what we believe LyondellBasell could be looking at for the Houston refinery site. An integrated waste treatment facility that optimizes that use for each tranche of the waste stream could improve the overall investment returns. In the second picture below we show our version of what a comprehensive waste recycling operation should look like. See more on recycling!

Managing Waste To Maximize Value Requires Multiple Processes

May 4, 2022 2:15:03 PM / by Graham Copley posted in ESG, Recycling, Climate Change, Sustainability, LyondellBasell, chemical recycling, waste, polymer recycling, waste recycling

Why A Hydrogen Credit Could Be Harmful & All Change At LyondellBasell

Feb 10, 2022 12:36:00 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Green Hydrogen, Blue Hydrogen, Energy, Emissions, LyondellBasell, decarbonization, renewable energy, tax credit, clean energy, renewable diesel, Neste, fuels, polymer recycling, energy companies

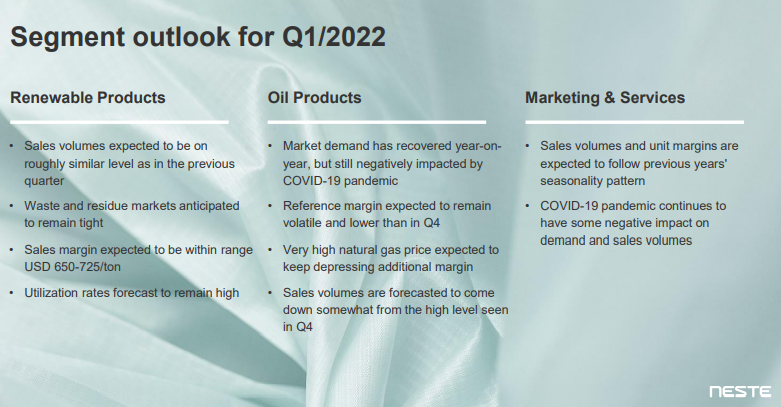

We view the hydrogen tax credit discussed in today's daily report as potentially very harmful, as it could give life to projects that will further increase demand on a renewable energy industry that has finite limits to its rate of growth. The credit could encourage inherently uneconomic projects – even with a longer-term “abundant power” view. If the incentives are used to back clean rather than green projects it would make more sense as blue hydrogen could be produced in very large quantities without breaking the bank and would allow constrained renewable power investments to focus on other harder to decarbonize power needs. If the hydrogen subsidy could be added to the 45Q sequestration credit we would likely see a wave of blue hydrogen investments in the US – primarily aimed at decarbonizing industrial applications and refining.

Packaging Waste Disposal May Not Mean Packaging Waste Recycled

Dec 17, 2021 1:59:37 PM / by Graham Copley posted in ESG, Recycling, Sustainability, Pyrolysis, packaging, chemical recycling, renewables, climate, waste, carbon footprints, polymer recycling, waste disposal, recycled waste

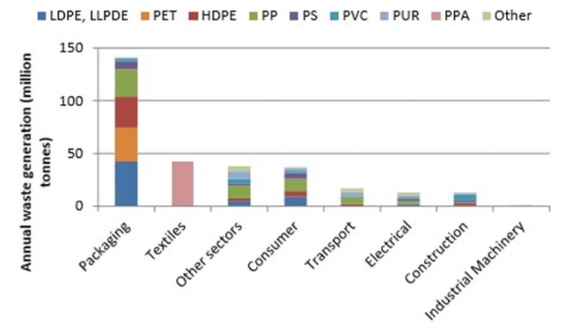

We have spent a lot of time over the last few weeks talking about polymer recycling and renewables and the chart below is another look at where plastic waste is coming from. Packaging is the big piece and it is also the area where customers, i.e. the packagers, are looking for the largest increase in the use of recycled materials quickly. As we noted in our ESG and Climate piece this week, increasing volumes of this packaging waste is moving into different use applications, such as building products and durables, and even more could potentially flow into chemical recycling – note that there are 7 headlines on chemical/advanced recycling in today's daily report. The packagers have little chance of meeting their near-term recycling content goals in our opinion, but they have zero chance if they do not accept chemical recycling as part of the mix. It will be important to accurately audit the chain of custody of chemical recycling to avoid double counting. The separate challenge with chemical recycling is the now increased focus on carbon footprints, as the pyrolysis process is energy-intensive, whether direct heat from burning fossil fuel or electric power-based heat.