We view the hydrogen tax credit discussed in today's daily report as potentially very harmful, as it could give life to projects that will further increase demand on a renewable energy industry that has finite limits to its rate of growth. The credit could encourage inherently uneconomic projects – even with a longer-term “abundant power” view. If the incentives are used to back clean rather than green projects it would make more sense as blue hydrogen could be produced in very large quantities without breaking the bank and would allow constrained renewable power investments to focus on other harder to decarbonize power needs. If the hydrogen subsidy could be added to the 45Q sequestration credit we would likely see a wave of blue hydrogen investments in the US – primarily aimed at decarbonizing industrial applications and refining.

Why A Hydrogen Credit Could Be Harmful & All Change At LyondellBasell

Feb 10, 2022 12:36:00 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Green Hydrogen, Blue Hydrogen, Energy, Emissions, LyondellBasell, decarbonization, renewable energy, tax credit, clean energy, renewable diesel, Neste, fuels, polymer recycling, energy companies

More CCS Plans Than Action Until We Get Proper Carbon Pricing

Nov 26, 2021 12:37:02 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, CCS, Blue Hydrogen, CO2, IEA, carbon footprint, tax credit, blue ammonia, climate, CO2 value, chemical companies, carbon pricing, CCUS, Power companies, oil companies, greenfield investment

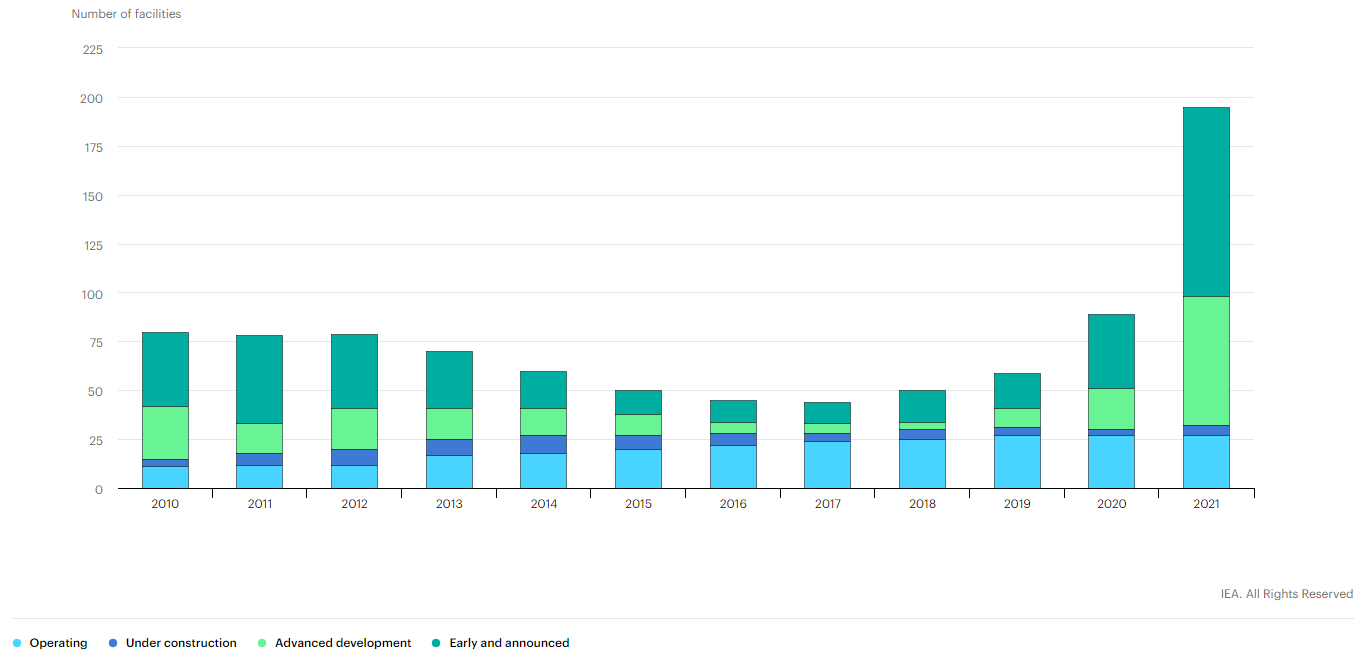

We note the IEA work on CCUS in several charts below and this is good timing relative to our ESG and climate report this week – which focused on carbon pricing, something we believe is necessary to promote more real activity in CCUS. In the Exhibit below, it is important to note how many projects are in “development” rather than operational or under construction. It is also worth noting that the number of projects under construction has not grown since 2019. One of the reasons for this is that increased activity at the planning stage is then followed by a delay associated with permitting, which depending on the region can take 2 plus years. The other constraint is uncertainty, with many of the projects under consideration waiting for something to change, either local values of CO2 or mandates or direct government support. For example, the large project planned for Houston and championed by several oil, power, and chemical companies is unlikely to move forward without a higher tax credit for CO2 sequestration or without some other incentive. The mid-West projects targeting the ethanol industry will also need permits, not just for the wells but also for the many hundreds of miles of proposed pipelines.

Fairness & A Step Change In Investment Could Come From Revised CCS Bill

Jun 25, 2021 1:01:59 PM / by Graham Copley posted in ESG, LNG, Carbon Tax, CCS, Blue Hydrogen, CO2, Sequestration, carbon abatement, US Government, 45Q carbon credits, LCFS credit, tax credit, blue ammonia

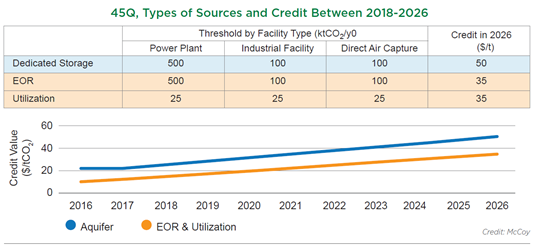

Senator Cramer’s proposed Bill to increase the value of the 45Q carbon credits for sequestration and use as well as remove the annual cap could be a game-changer in many ways. The threshold removal is necessary regardless of the credit value. In our view, the cap creates a potential competitive disadvantage for smaller companies competing with larger ones, especially in the chemical space. Should the Bill increase the tax credit enough to drive real investment in abatement but not remove the threshold we would expect to see litigation from smaller disadvantaged companies. The chart below shows the current expectations for 45Q. To date, the only real investment activity we are seeing is around sequestering CO2 from ethanol production in the US. This is because the CO2 stream is easy to separate in a fermentation process and because some of the ethanol can benefit from the much higher LCFS credit if the fuel is sold into California.