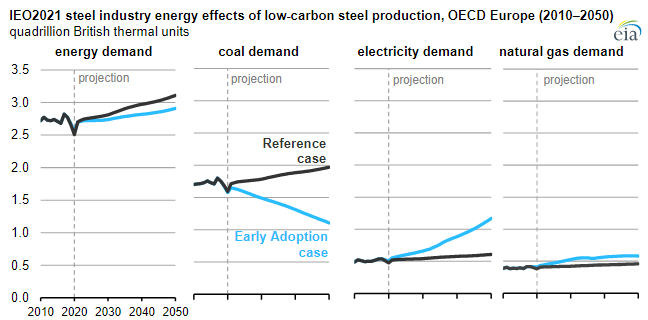

The steel analysis below is interesting because it is likely that a significant bifurcated market will develop for steel as the demand for green steel is likely to be significant, although probably not at any price, while there will also be a few opportunities to make low-cost green steel and the lucky few could make a lot of money. Anecdotally, we are helping a client look for the best use of what could be a substantial tranche of low-cost renewable power in a location that is not heavily populated, and consequently, there is a limited local demand for the power or anything you might make from it, such as hydrogen. Green steel has come up as possibly the best use of the power in a couple of conversations so far. This adds another wrinkle to the question of whether we can build renewable power fast enough – especially to meet some of the green hydrogen expectations. The challenge will be fending off potentially higher bidders for the power, and green steel is a real contender – more so if a reasonable premium can be gained in the market for the steel. See more in today's daily report.

Source: EIA – Today In Energy, March 2022