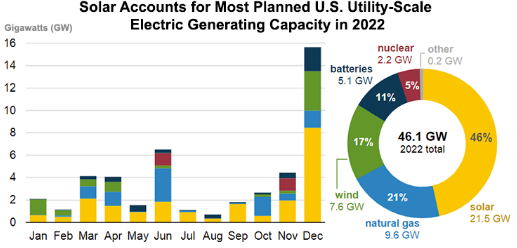

The back-end loading of the power projects for the US for 2022, as shown in the chart below leaves us somewhat skeptical concerning how much will come online this year. Supply chain problems and materials costs and availability are causing all sorts of problems with renewable power projects and installed capacity expectations for 2021 were too ambitious. We believe that companies are pushing projected start-ups later in the year to give them more of a chance of completion, but this creates the risk that they slip into 2023 or beyond. The most significant issue here is that as these plans get delayed, natural gas demand goes up, as one of the swing suppliers. This is fine as long as the US natural gas industry and shale oil industry is investing so that gas availability rises. Otherwise, we could see gas prices spike in the US next winter and another year where we use more coal than we expected. For more see this week's ESG and Climate report.

Renewable Capacity: Likely To Dissapoint

Mar 23, 2022 2:19:27 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Coal, Renewable Power, Energy, Supply Chain, Oil, natural gas, power, solar, renewable energy, solar energy, Gas prices, renewable capacity, supply chain challenges, Utility, materials costs

Investment Constraints On Solar Before We Even Start With Hydrogen

Dec 14, 2021 1:17:04 PM / by Graham Copley posted in ESG, Hydrogen, Sustainability, Green Hydrogen, Renewable Power, ESG Investing, Materials Inflation, Inflation, solar, ESG investment, climate, solar energy, material shortages, product shortages, onshore wind

Much of the core focus of both our chemical industry and ESG and Climate research recently has been on inflation and materials shortages; we would point you to: Inaction, Caused By Inflation Fears, Is Driving More Inflation! and Coming Up Short: Materials Availability To Limit Climate Progress. This linked article suggests that, as we have predicted, cost and availability pressures are taking a toll on solar installation plans for 2022 in the US. While the inflation piece is real and the product shortages highlight some of the capacity constraints for materials and panels, the broader conclusions that can be drawn from the headline are more concerning. These shortages (and higher prices) are coming well before we see any step change in attempts to increase renewable power installations associated with all of the green hydrogen projects that have been announced over the last 6-9 months. All of these investments are relying on the deflationary trends continuing, especially for onshore wind and solar.

Higher Costs Likely To Undermine Some Clean Energy Timetables

Sep 21, 2021 1:37:55 PM / by Graham Copley posted in Hydrogen, Wind Power, Renewable Power, Metals, raw materials inflation, Inflation, renewable energy, solar energy, EVs

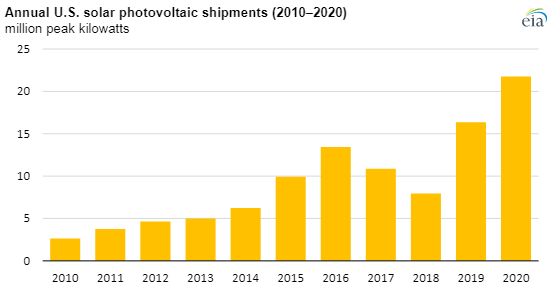

The charts below both support our view that we will see continued inflation in renewable energy costs, rather than the deflation that is baked into all of the forward models. It is easy to forget that some of the early solar installations are coming to the end of their useful lives and are retiring – these are gaps that new solar will need to fill. Wind power has the same issue, as many of the original wind farms need equipment replaced and the introduction of recyclable wind turbine blades has been in recent manufacturers' announcements. When we see analysis of who is going to use which tranche of new renewable power for which new hydrogen project we see major gaps in the power demand analysis, in part related to power demand growth at the domestic consumer – because the more rapid introduction of EVs – and in part because or retirement of facilities and the need to replace them.

Solar Module Raw Material Costs Reversing Long Term Price Declines

Sep 2, 2021 1:57:21 PM / by Graham Copley posted in ESG, Renewable Power, Energy, Raw Materials, raw materials inflation, solar, renewable energy, renewable investment, solar energy, solar module

In our ESG and climate piece yesterday we discussed rising costs of climate-related actions, with a focus on some of the likely inflation in renewable power costs. The optimists are looking at the Exhibit below, and what were falling module costs through 2020, and concluding that solar installations can grow and that costs can still fall. While the module shipment growth in 2020 was impressive at 33%, some of the forecasts of what will be needed call for a much more dramatic rate of module growth than we saw in 2020.

Shipping Hydrogen: Expensive Anyway You Do It

Aug 31, 2021 2:09:19 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, Green Hydrogen, Renewable Power, Air Products, Ammonia, renewable energy, solar energy, shipping, transportation, nitrogen, hydrogen electrolyser, toluene, methylcyclohexane

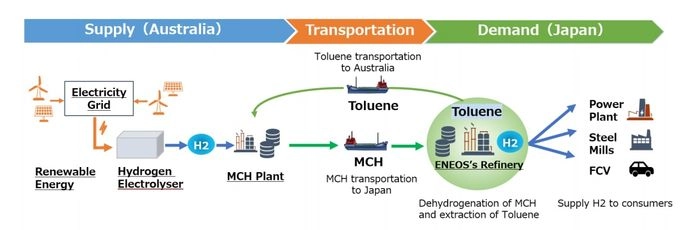

The exhibit below highlights one of the more significant constraints for green hydrogen, which is that the abundant low-cost power opportunities (strong wind and lots of sunshine) are often not where demand for hydrogen exists and the challenge is how to transport it. The problem with reacting it to make something else and then recovering it at the point of use or a distribution hub is that hydrogen is very light and you end up moving a lot of something else to get a little hydrogen. Air Products is looking at making ammonia in Saudi Arabia and shipping the liquid ammonia and the project below is looking at using toluene as a carrier in what appears to be a closed-loop with toluene moving one way and methylcyclohexane moving the other way. The liquid shipping would be cheap, but with the MCH route, only 5% of what you would be moving to Japan would be the green hydrogen. Using ammonia the green hydrogen content is slightly less than 18%, but you have to make the nitrogen on-site. The cost of making the nitrogen would be a function of the local cost of power and these remote locations should have very low-cost renewable power. In the example below, the opportunity is likely unique to the refinery structure and shipping opportunity and we doubt that it is easily replicated in a way that would be more economic than shipping ammonia or shipping compressed hydrogen itself.

Source: H2 Bulletin, August 2021

It's Hard To Bet On Deflation When You Are Dependent On Commodity Pricing

Aug 19, 2021 11:57:02 AM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Renewable Power, Raw Materials, solar, copper, silver, wind, Lithium, solar energy, steel, basic polymers, semiconductors, renewable power goals, aluminum, EV batteries, rare earths

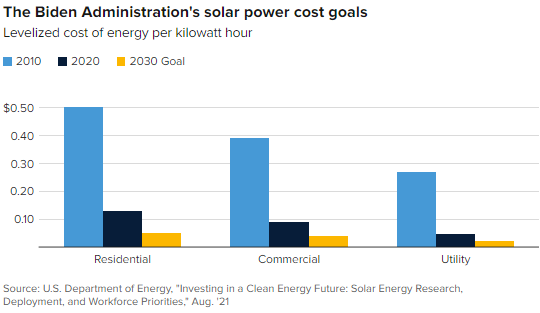

We are back on one of our pet topics today which is the reasonableness around some of the assumptions around the future cost of renewable power. We reference, work done by the US Department of Energy in the Exhibit below, and see two potential pitfalls with the assumptions around continuous improvement in solar, wind, and hydrogen costs, although there is a slight twist for hydrogen. The first is around the dynamics of learning curves. As the exhibit shows, in the early stages of any product development, there are huge leaps in cost improvements, driven by scale, better know-how, more efficient manufacturing, and in the case of solar power, both better processes for installation and some technology improvements. However, as you drive costs lower, the cost of raw materials becomes a much larger component of overall costs, and your ability to lower costs further can be overwhelmed by moves in material costs. Any inability to pass on the costs will result in economics that do not justify additional capital and you find yourselves in a commodity cycle. This is something that we have seen in basic polymers for decades, and no buyer of polyethylene today can claim that they are benefiting from a learning curve improvement. Closer to home for solar, we are seeing the same issue today in semiconductors – not enough margin to invest as everyone has been trying to push costs lower. The expectation in the DOE study and highlighted in the CNBC take on the study below is that annual solar installations in the US need to rise by 3-4X to meet some of the renewable power goals the Biden Administration is looking for by 2030, while similar growth is expected in other markets – the solar panel and other component makers have to be making good money to achieve this.

Here Comes The Sun... But Not Cheaply

Jul 16, 2021 1:50:56 PM / by Graham Copley posted in ESG, Hydrogen, Renewable Power, Raw Materials, carbon abatement, solar, solar energy

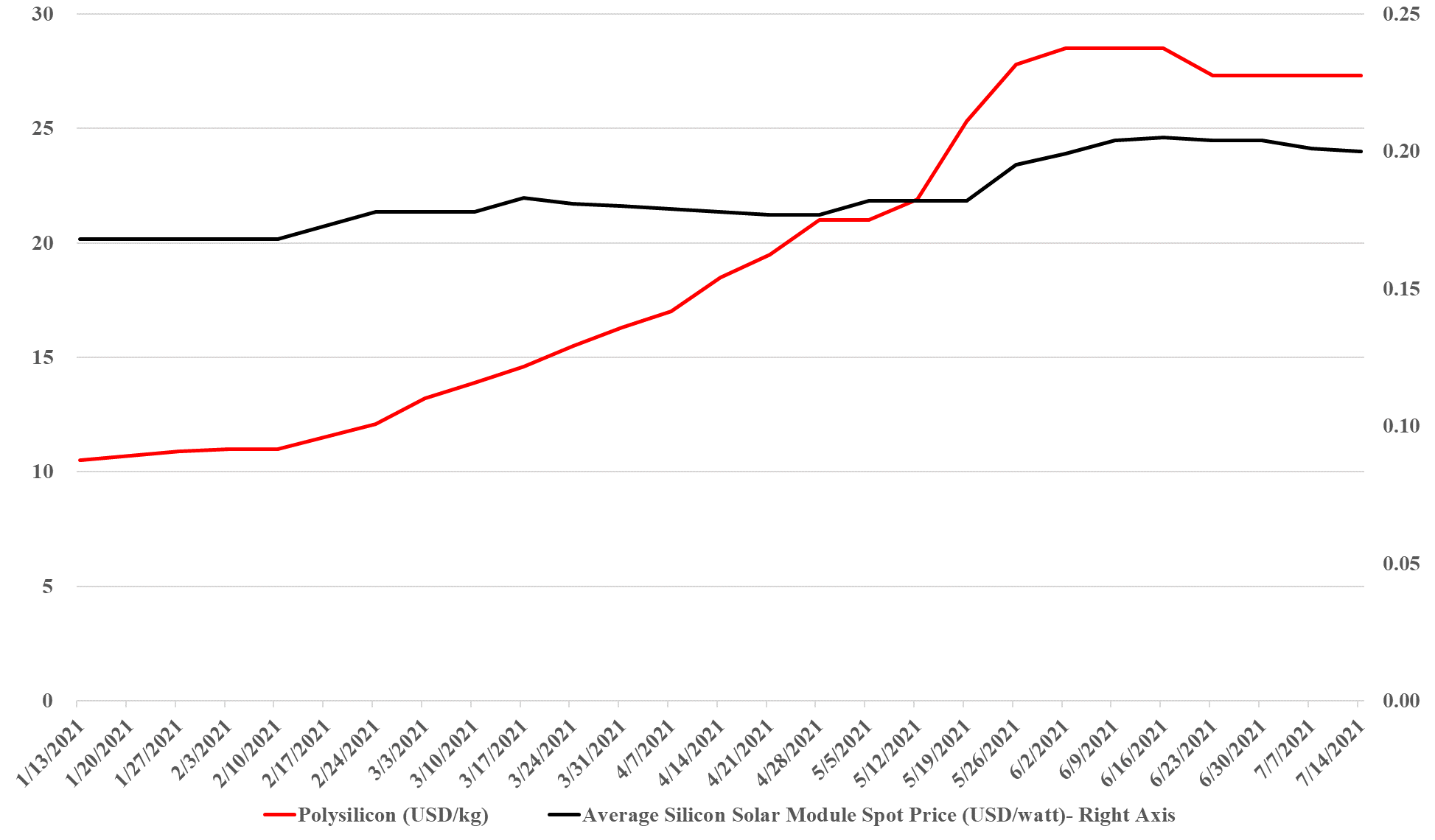

While the escalation in solar panel material costs has plateaued over the last couple of months, the increase has been enough already to reverse the decline in solar module pricing as we have noted previously (see charts below). While the increase in module pricing is not that significant there are three points to note: