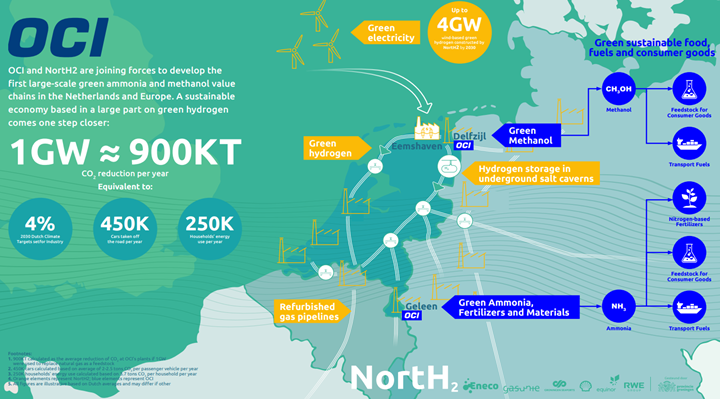

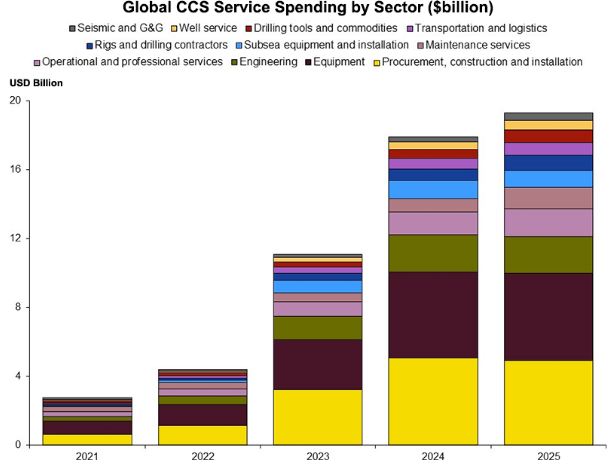

The two charts below today are interesting bedfellows as while one talks about yet more, likely impractical, hydrogen ambitions, the other talks about a possible solution.

Green Hydrogen Ambitions Too Aggressive: CCS Is The Answer

Apr 8, 2022 1:04:23 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, Green Hydrogen, CCS, Blue Hydrogen, Renewable Power, renewable energy

Strong Challenge In Canada And Collaboration In Germany

Mar 31, 2022 2:27:55 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, Green Hydrogen, CCS, Renewable Power, Emissions, BASF, renewables, EV, materials, Shortage, Canada, renewable, materials costs, Germany, Henkel, GHG

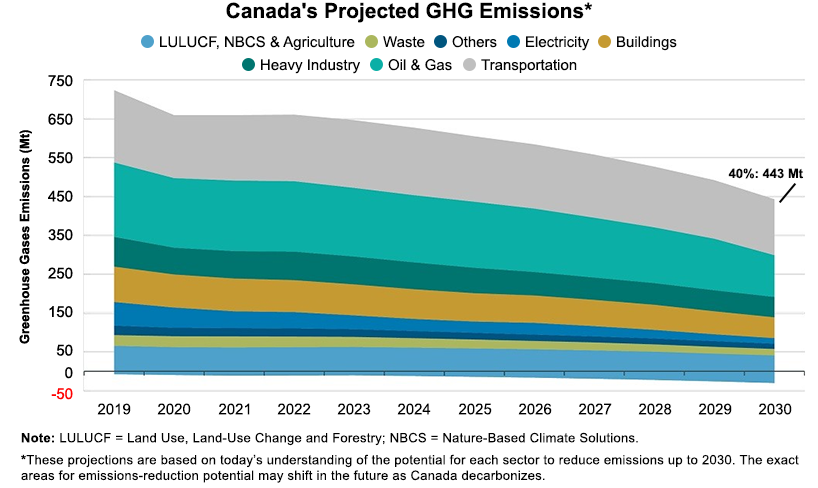

The Canadian targets highlighted below are ambitious and will likely not happen without the significant CCS projects planned for Alberta. The CCS opportunity will drive down energy and chemical (heavy industry) based emissions meaningfully and could also be the basis for new power generation capacity to allow the transport industry reductions that the country is looking for – either through EVs or hydrogen-based transport.

Is Your Recycling Really Green?

Mar 29, 2022 2:19:24 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Recycling, Climate Change, Sustainability, CCS, Emissions, Pyrolysis, carbon footprint, Offshore CCS, gasification

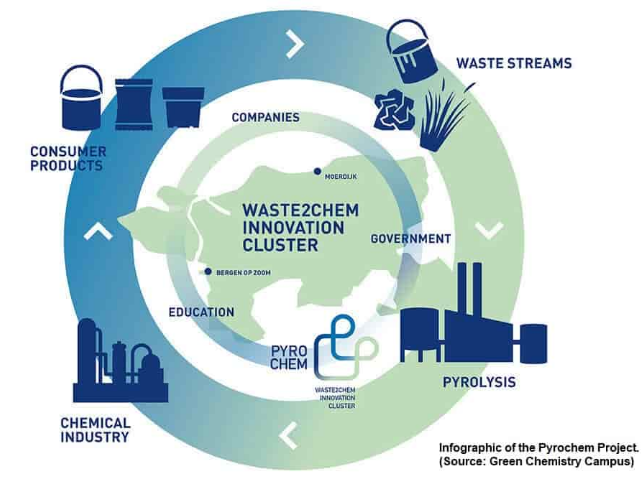

The focus of our ESG and Climate report tomorrow will be on recycling and the challenges associated with each proposed solution. The piece that most chemical recycling projects, like the one highlighted below, fail to mention is that the heat required for pyrolysis is significant, and the carbon footprint is very high unless you can heat through renewable power or you can capture the carbon associated with the heat. Given the location of the facility shown below, it could have access to offshore wind-based power and/or could tie into one of the offshore CCS projects that have been proposed. Both pyrolysis and gasification processes have very high emissions.

Renewable Diesel Will Grow If Other States Adopt LCFS

Mar 25, 2022 2:32:12 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, CCS, CO2, Energy, power, renewable energy, LCFS credit, EIA, renewable diesel, renewable fuels, power capacity, renewable capacity, CO2 pricing, diesel

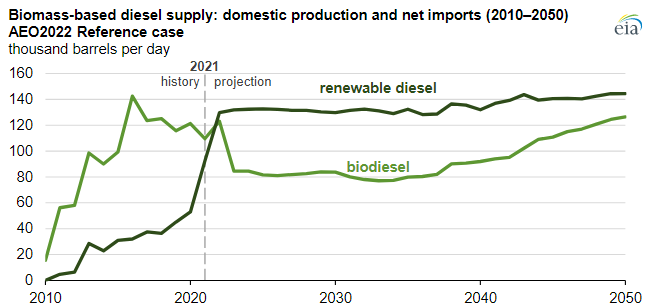

The EIA renewable diesel projections are based on a couple of things – who plans to make it and who will pay for it. All eyes are focused on the California market today as that is where the incentive lies – through the LCFS credit – and production plans plateau associated with that opportunity. As other states in the US adopt similar programs – which seems likely – we would expect to see production plans increase and the EIA will likely adapt its market view model and the chart will change. Note the dominance of renewable diesel over time, and this is where we would expect all future growth to occur. The plug-and-play nature of renewable diesel makes it a far more attractive option for refiners assuming the cost works. See more in today's daily report.

CCS Wont Work Without Policy And Neither Will Energy Conservation

Mar 22, 2022 12:48:43 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Energy, Emissions, IEA, Oil, natural gas, clean energy, renewable, fossil fuels, renewable capacity, EPA

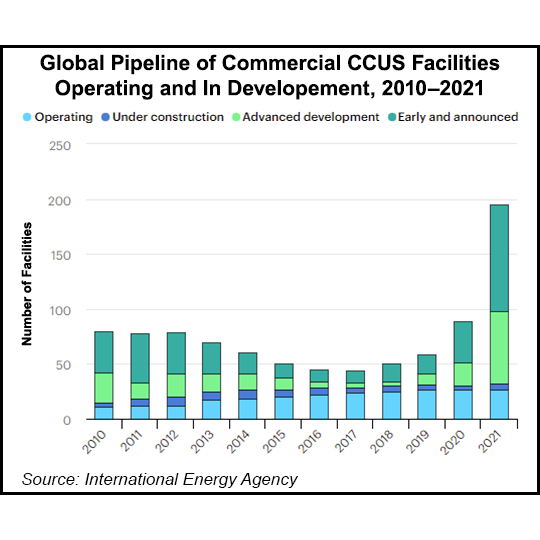

One of the subjects that we will cover at length in the ESG and Climate report tomorrow (to be found here) is the significant need for CCS globally, but especially in the US, as we see more balanced forecasts of energy supply emerging which show more use of fossil fuels for longer – especially, but not limited to natural gas. These forecasts recognize the current energy momentum as well as some of the more practical realities around the rate of construction of renewable capacity relative to energy demand growth. The CCS plans that are appearing all over the place are nothing more than plans right now and if the EPA permit activity is a true barometer – not much has moved beyond planning. This needs to change and we likely need both an increase in CCS incentives – which could take many forms – as well as some streamlining around the permitting process. Simply waiting and hoping for a renewable miracle is not going to work – nor is some sort of CCS cost breakthrough.

Lots Of Needed CCS Waiting For The Right Incentives

Mar 17, 2022 12:23:31 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, IEA, 45Q, CCUS, Denbury

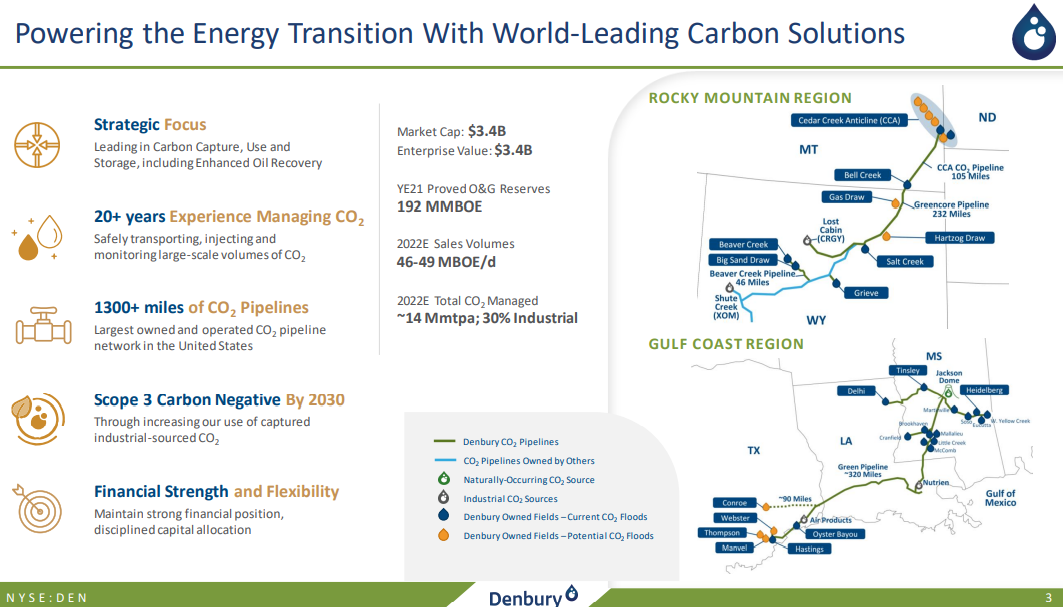

The CCS chart below is one that we have shown before and we make the same observations again as little has changed on the “action” side. The number of facilities under discussion, advanced or otherwise, continues to rise – see the Denbury announcement below, for instance - but very little is moving to the construction phase. While in the US this is in part a permitting issue, with the permit process taking several years, once you have a site plan, we get the sense that everyone is waiting for a more supportive incentive program – either a large CO2 penalty (tax) or an increased incentive – such as increasing the 45Q value. MOUs are being signed with landowners – as is the case with Denbury – and potential offtake partners, but very little cash is going out of the door for any of the US projects yet. Given the EIA analysis above, it would seem critical that something is done to move these projects from planning to action fairly quickly – if the US is going to need CCS at scale in 15-20 years, we need to start down that learning curve now. For more see the energy section of today's daily report.

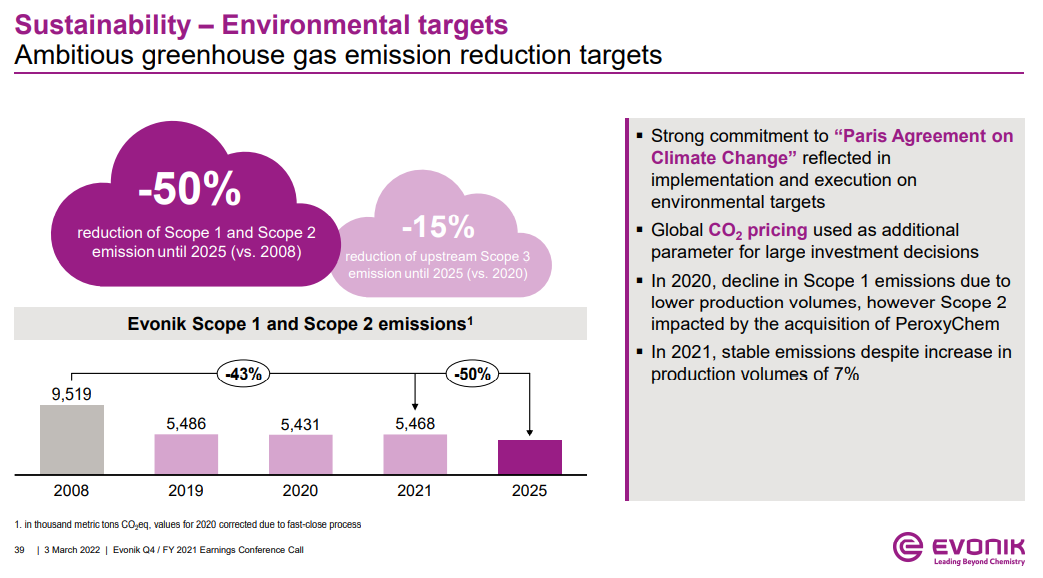

Carbon Pricing Will Be Critical For Investment Decisions, Lack of Clarity Will Cause Delays

Mar 3, 2022 1:35:16 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, CCS, Blue Hydrogen, CO2, Carbon Price, bp, carbon dioxide, carbon abatement, manufacturing, carbon pricing, Evonik, cost curves

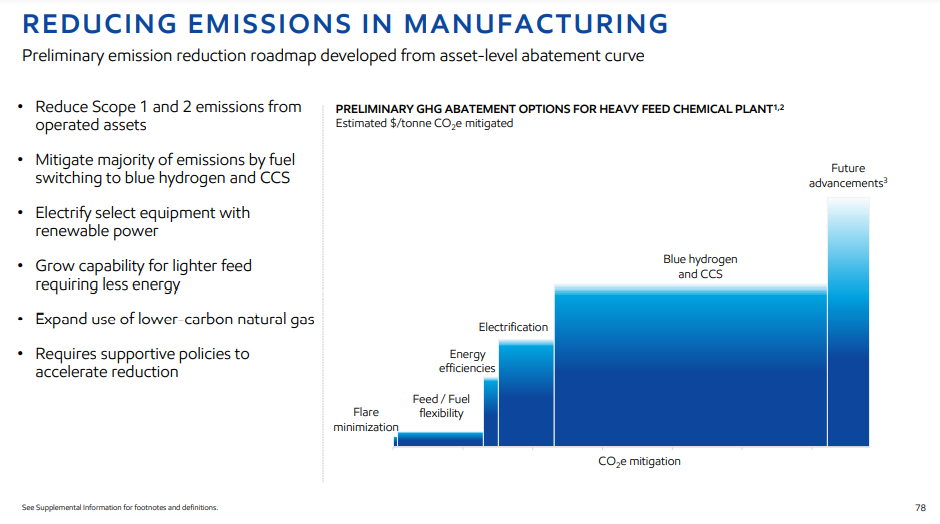

The Evonik discussion around CO2 prices is both relevant and important as CO2 values will be a critical component of investment decisions for many industries going forward. Those waiting for explicit guidance on CO2 prices are likely to be disappointed as we are not seeing much global coordination today and as we discussed yesterday, the European market, which had been the better indicator in our view over the last 18 months, has collapsed in the wake of the Russia/Ukraine conflict as some countries ask for it be suspended, while speculators are assuming that lower gas supplies into Europe will lead to lower emissions and less demand for credits. One of the options here is to take the bp approach and assume a carbon price in investment decisions. Early last year, bp indicated that it would fix on a carbon price of $100 per ton in its longer-term planning. We believe that this is a ballpark steady-state for CO2 pricing but that traded prices could be quite volatile around that level, depending on the mechanisms used. But even if we have a consistent carbon price, we will see significant changes in industry costs and competitive cost curves based on the various costs of carbon abatement. We have written in the past that we could see huge benefits to the US manufacturing base because of the combination of relatively low-cost hydrocarbons and relatively low-cost CCS opportunities. By contrast, we see costs rising steeply in places like central West Europe, where the local CCS opportunity is off the table. Even if Europe can produce cost-effective blue hydrogen on the coast, getting it to central Europe will be an issue. The landscape is less clear in Asia, but we expect to see some competitive edge for countries with low-cost CCS options – Malaysia, Indonesia, Thailand, and parts of China. See more in today's daily.

ExxonMobil: Illustrating That Energy Transition Can Be Done (With The Right Policies)

Mar 2, 2022 1:14:58 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, Blue Hydrogen, CO2, ExxonMobil, Net-Zero, carbon credit, carbon cost, energy transition

Playing right into the central argument of our ESG and Climate report is today’s ExxonMobil investor day, and we include a couple of key slides around the company's proposed path to net-zero below. The first slide shows just how much blue hydrogen (with CCS) the company plans to add to offset its emission-generating fuels – the volumes implied in the chart are high.

Lots Of Carbon Opportunities At The Right Price

Feb 24, 2022 1:42:02 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Energy, energy transition, crude oil, Denbury, EOR, carbon capture and storage

The Denbury release is a great example of something that we discussed in our ESG and Climate piece yesterday. The company is putting stakes in the ground concerning carbon capture and storage but is only really spending on its EOR opportunities, which of course look really interesting today. While the 45Q credit for EOR helps, the main driver is the incremental crude oil volumes that you can pull out of the ground because of the CO2 injection – the higher the price of crude oil the greater the value of EOR. Regardless of the tax credit, the economics of EOR should look very good today and it is not surprising to see several initiatives from Denbury given that it has a lot of existing infrastructure for CO2. The CCS plans are no different than some of the projects we discussed yesterday – they are stakes in the ground – marking territory – but unlikely to move forward without higher incentives. One of the core topics of our report yesterday is whether the conflict in central Europe will turn attention away from energy transition and energy security for tomorrow, because of the acute distraction of both energy and national security today.

CCS In The US: The Potential Is Significant

Feb 17, 2022 12:55:54 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, CO2, decarbonization, carbon value, urea, CF Industries, Climate Goals, oxygen

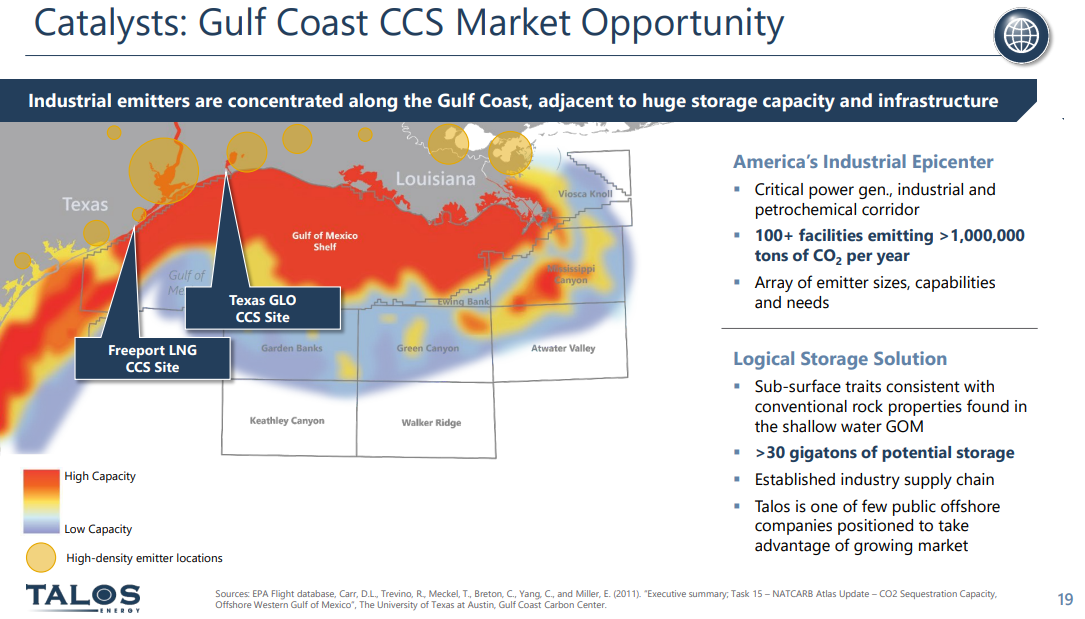

There should be little doubt that the US has a significant opportunity to decarbonize through CCS and if the US has a carbon value close to the level in Europe today we would be seeing investments announced almost weekly. While permitting would cause some significant lead time between announcement and construction/operation, the other uncertainty might be how best to capture the CO2. In its earnings release yesterday, CF talked about purifying CO2 streams at its two large Urea plants on the Gulf Coast, such that the CO2 would be ready to sequester, but the Urea process creates a relatively concentrated stream of CO2 and that makes separation much easier. For others, the better route might be hydrogen investments – driven by the relative ease of capturing the CO2, especially if it is part of the process design. If this route is more economic, the net new investment would be substantial, not just for the SMR, ATR, or fuel cell hydrogen generators, but also for the infrastructure and oxygen capacity for any ATR investment. This seems like a no-brainer bi-partisan opportunity for the US as there is broad support for CCS but incentives need to be higher. For more on this topic see our ESG and Climate research.