The Navigator CCS announcement is extraordinary in its boldness and potential lack of any real chance of economic success. The idea of building 1200 miles of high-pressure CO2 pipe (See exhibit below) to collect small volumes from corn-based ethanol producers and potentially have multiple sequestration sites is extremely expensive and would not begin to be covered by the 45Q tax credit, which would easily be consumed by the compression and pipeline costs alone. If some of the ethanol is making it into the LCFS markets, each ethanol producer that has some material heading that way will want a piece of the pie and if each had to jointly file with CARB, with Navigator, for what would be small portions of the overall ethanol output, the administration might be overwhelming, as would be a chain of custody process which satisfies CARB. Navigator is not an altruist fund and consequently, must see a way to make a return on the idea. This may be based on the hope that LCFS or something like it will spread to other states.

Recent Posts

Navigator: A Pipe Dream or Pipe Nightmare?

Jun 3, 2021 9:56:39 AM / by Graham Copley posted in Carbon Capture, CO2, Sequestration, Emissions, Pipeline, carbon dioxide, ethanol, corn based ethanol

Can Big Oil Do Anything To Change It's Image - We Doubt It

Jun 2, 2021 1:29:12 PM / by Graham Copley posted in ESG, Oil Industry, IEA, Oil

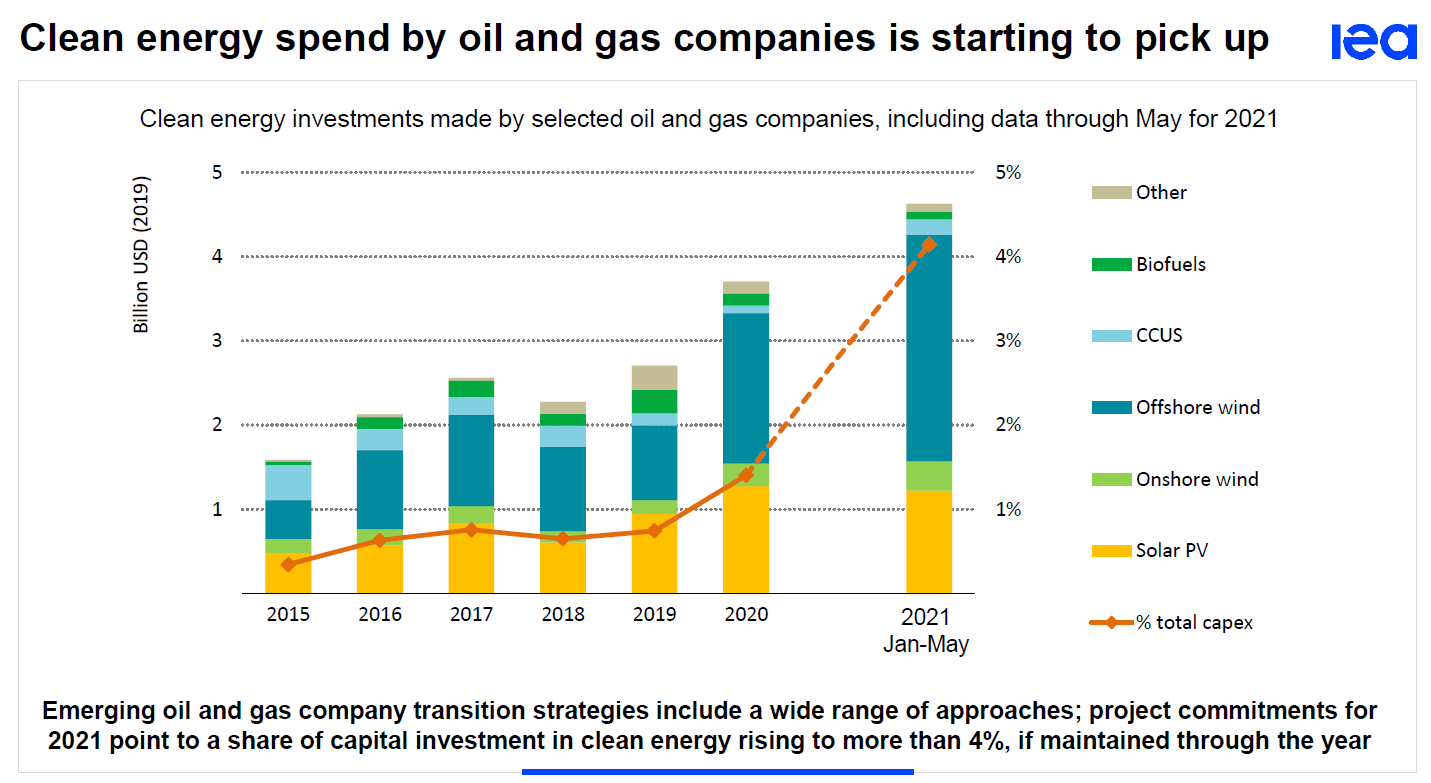

In today's ESG and Climate report we discuss the issues facing the oil industry and present several possible scenarios focused around activist behavior and government behavior – none of the outcomes are pretty and the most likely one is quite concerning. The activists seem to be laser-focused on reducing the production of fossil fuel, but they are arguing for a timeline that is impractical and very inflationary – right now they are winning and they are changing the hearts and minds of investors, both public and in some cases private, but perhaps more important, they are influencing insurers. The fossil fuel industry needs to clean up its act, no doubt, and based on the chart below it is trying harder, but a transition period is necessary to prevent hyper-inflation not just in fossil fuel prices but also in renewables, as they would not be able to keep up with an aggressive cut back in fossil fuel production today – which is what activists are pushing for.

Friday Question: What Is Next For Oil? Help Us Write Our Next Report!

May 28, 2021 1:50:42 PM / by Graham Copley posted in Oil Industry, Energy, Emissions, Shell, Oil

We talked about the Dutch ruling against Shell in yesterday's report and the latest refinery sale in the US is another indication of one of the risks of unilateral court-based decisions. Shell could easily get to lower emissions by divesting assets, as can anyone else with a medium-term emission target on the books. We have written previously about the possibility of an energy equivalent of the “bad bank” structure that was set up during the financial crisis, where emissions challenged assets are divested into either private entities or public holding companies that have mandates to improve excessive emission pools but also have significant cash flows and pay investors to wait.

More Recycling News. Hopefully More Recycling Action

May 27, 2021 1:48:57 PM / by Graham Copley posted in Recycling, Polymers, Polyethylene, Polypropylene, Pyrolysis, Mechanical Recycling, LyondellBasell, Dow, unrecyclable polymer, sorting and cleaning, Nova, Closed Loop Partners, ethylene feed, PE

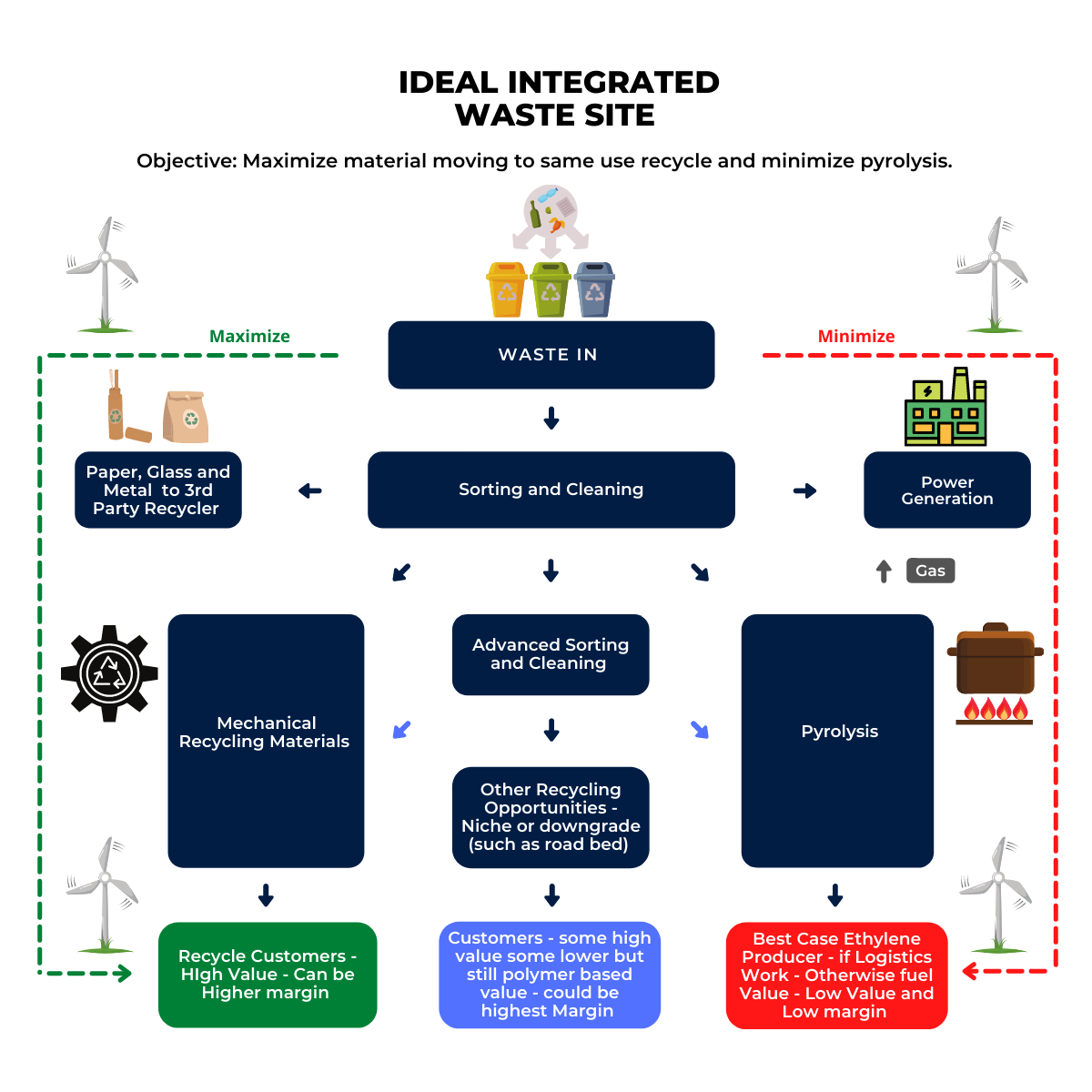

The Dow, LyondellBasell, Nova, Closed Loop Partners announcement yesterday is worth some thoughts. Closed Loop Partners is a PE company focused on funding recycling opportunities, but by its nature, it is relatively risk-averse as it has return goals to meet for its investors – to date its investments have been low-hanging fruit and niche in nature, but steps in the right direction nonetheless. The investment from the majors perhaps gives Closed Loop some wiggle room to look at projects that are less of a sure thing and maybe require a leap of faith on untested technologies or at least technologies untested at scale – primarily in sorting and identifying polymers and cleaning. We would still expect each project to be small, simply because access to the clean and easily sorted polyethylene and polypropylene in the US is limited by very poor standards of recycling and the vast proportion of unrecyclable polymer that ends up in a waste stream. If the group can find locations with significant supply, it might be wise to build pyrolysis at the same site to deal with everything that cannot be recycled. Our hope for this investment is that it is not simply an ESG PR opportunity for the polymer producers and that it does the following:

Will ExxonMobil Activists Change Anything?

May 26, 2021 1:24:39 PM / by Graham Copley posted in ESG, Carbon Capture, Energy, ESG Investing, ExxonMobil, carbon footprint, ESG Fund, bp

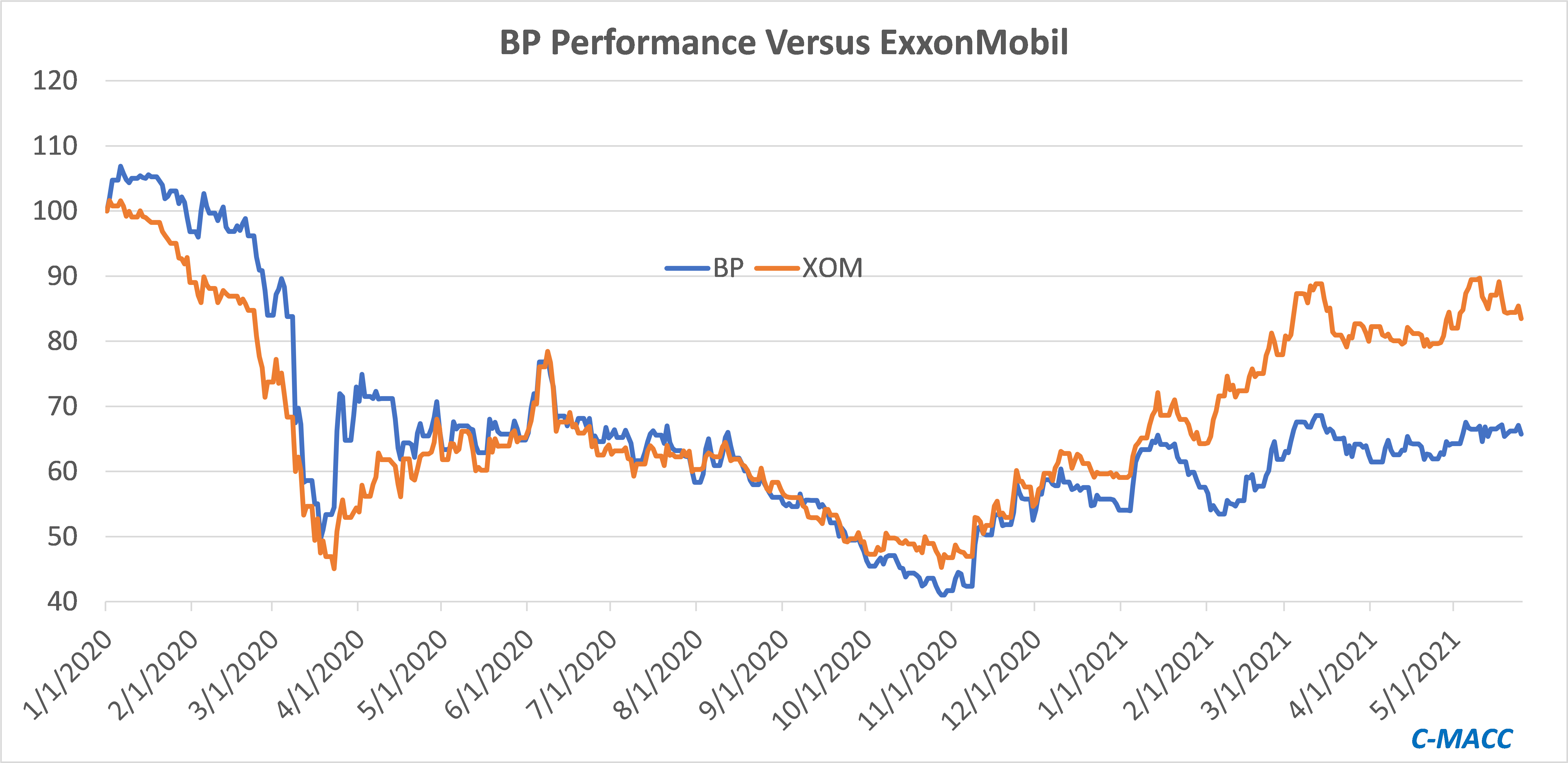

With little chemical corporate news of note, we will focus on ExxonMobil today. The shareholder activism may be high but it is unclear to us what the activists hope to achieve, even if they are successful at the annual meeting. The ESG investment group has largely given up on energy and even if ExxonMobil changes strategy and agrees to spend more on carbon abatement it is unlikely that new investors will show up, especially if the new strategy is more costly. Despite all of its directional change and rhetoric, bp has underperformed ExxonMobil since Mr. Looney took the helm in early 2020. If ExxonMobil were to follow the bp playbook, it is not clear that shareholders would benefit.

ESG Friday Question: Can Technology Keep Pace?

May 21, 2021 1:12:36 PM / by Graham Copley posted in ESG, Carbon Capture, Ethylene, Emissions, Net-Zero, IEA, Dow, propane, Technologies, ethane dehydrogenation, carbon footprint, BASF

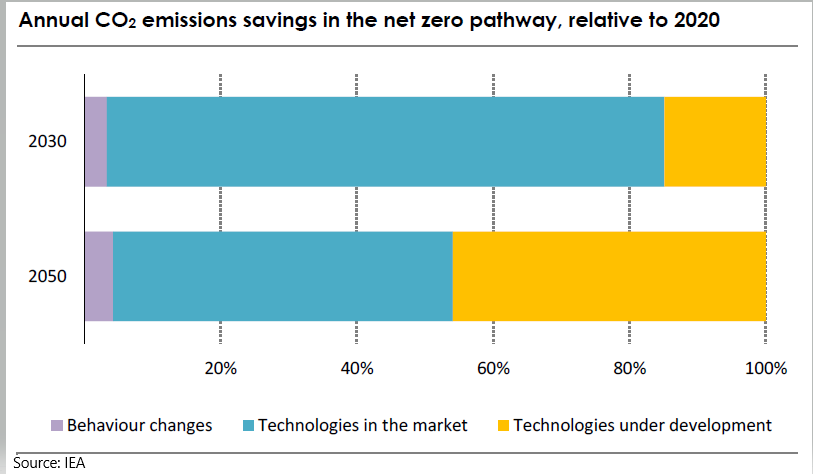

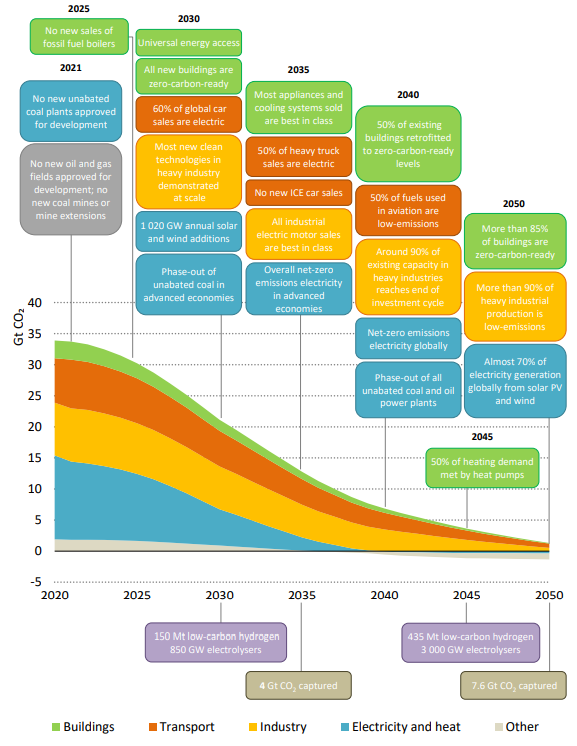

There is a broad technology theme to the articles that we have chosen today, which is in keeping with one of the core conclusions of the IEA report earlier this week. The IEA is estimating that roughly half of the path to net-zero will require technologies still in the test phase, or in some cases still conceptual. The Dow headline around ethane dehydrogenation and electric furnaces is a good example. Both technologies could lower the carbon footprint of making ethylene, but the dehydrogenation route will require some catalyst or other breakthrough as current propane dehydrogenation technologies require a lot of heat. The electric furnace idea is complex and would require extremely high levels of power, all of which would have to be renewable for the carbon footprint to fall – this type of technology is likely implied in the BASF announcement today. The IEA talked about some of the transition moves required to allow the technology advances time to become either commercial or cost effective, or both. Carbon capture features meaningfully in the IEA plans, but the study has carbon capture volume rising through 2050, which we find odd. The idea of carbon capture is to act as a bridge between where we are today and where we could be once new technology is developed – therefore, while companies like Dow should be aiming for technologies that lower the carbon production of its processes, carbon capture should be an almost immediate bridge to lower emissions while both the technology is developed, and its costs are reduced. Carbon capture needs should then decline. View today's Daily Report for more.

Packagers Are Looking At Renewable Sources As Recycle Availability Is Limited

May 20, 2021 2:17:33 PM / by Graham Copley posted in Recycling, Biofuels, Polymers, PET, packaging, Gevo, Supply Chain, Butanol, Coca-Cola, packaging materials, biogradable polymers, Renewable Sources, hydrocarbons

The coverage of the IEA study continues with lots of opinions, which is a good sign as it means that the work is being taken seriously.

More From The IEA; Expensive Hydrogen & Carbon Capture

May 19, 2021 1:44:48 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Green Hydrogen, CCS, Blue Hydrogen, Inflation, IEA, Ammonia

We discussed the IEA report yesterday at some length, but in such a comprehensive report we missed a couple of things that are probably worth noting today. See more in our ESG Report today.

The IEA Sets Out A Plan But Ignores Inflation

May 18, 2021 11:50:10 AM / by Graham Copley posted in ESG, LNG, CCS, Renewable Power, ESG Investing, Materials Inflation, Net-Zero, Industrial Sector, fossil fuel, fuel alternatives, decarbonization

There are too many important topics to choose from today and we will cover many of these in our ESG and Climate report tomorrow. Here we focus on the IEA report published this week, which shows a path to net-zero on a global scale and looks at both the fossil fuel consuming sectors and the rate at which each must change (they are different by sector) and what fuel alternatives will be needed to replace them. Our review of the work would suggest the following:

The Friday Question: What is the Primary Role of an ESG Investor?

May 14, 2021 11:49:05 AM / by Graham Copley posted in ESG, ESG Investing, Corporates, ESG metric, fund manager

We have decided to change up our blogs, at least once a week and each Friday, to pose a question rather than throw out opinions.

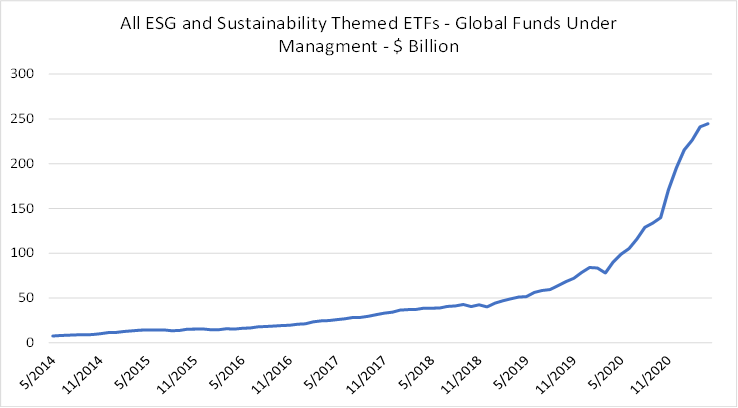

Today we should focus on the very good FT article linked here, which discusses in detail many of the issues facing both ESG investors and corporates concerning the lack of standards in ESG metric providers and the data provided by companies. It is a subject that we have been writing on for a couple of years – before C-MACC – because it is a potential dark stain on ESG investing and has turned (in some cases) a progressive move by the investment community into something that lacks a clear standard empirical base and is currently open to manipulation. The article highlights the ability of corporates to change the ESG metric providers that they use for internal measures and external reporting based on which provider sheds them in a more positive light. It also allows ESG funds to hold stocks that other ESG funds would not because they are not working off the same definitions. The flow of funds into this segment makes oversight critical (see chart below).

We would like thoughts, in the hope of starting an interesting dialogue on what you think the primary role of an ESG fund manager should be – to maximize returns, to promote change, to attract funds, etc.