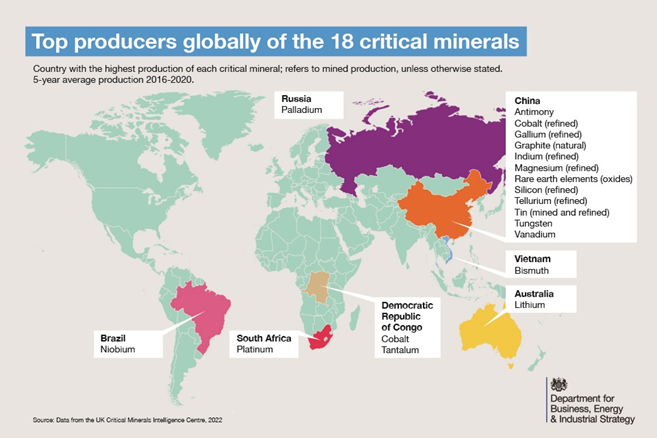

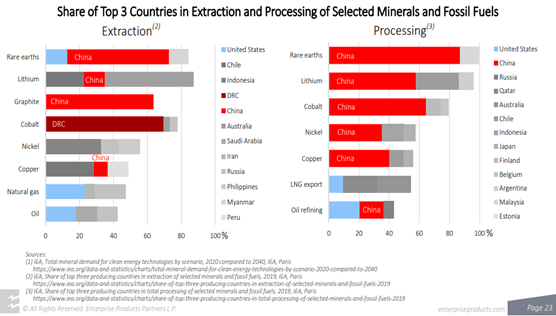

We are seeing more focus on supply chains as they relate to the energy transition. Some European countries are realizing what we have noted in prior research - EU Energy Policy: Swapping A Bad Supplier For Something Worse? - switching to an aggressive focus on renewable energy may reduce your energy exposure to Russia but it currently doubles down on your exposure to China. It is very easy to look at the scale of the problem – the share that China has in critical metals, as shown below – the share that China has of solar modules – etc., and conclude that it is too hard, especially in Europe where you will find an environmental lobby trying to stop you doing anything industrial. But the net effect is severe reliance on China. One advantage that the UK now has with its exit from the EU is more industrial freedom and the country could benefit from the right industrial policies that would attract broader energy transition investment. In our ESG and Climate report this week we talked about the U.S. desire to “friend-shore” rather than re-shore because of local investment challenges in the U.S. as a consequence of some of the political issues. The UK could benefit from becoming an industrial partner with the U.S. for some critical materials.

Energy Transition - Lots at Risk and Funding Harder To Find

Jul 22, 2022 2:14:51 PM / by Graham Copley posted in ESG, Sustainability, Metals, ESG Investing, Supply Chain, renewable energy, energy transition, materials, minerals

Renewable Power Losing Momentum: CCS Rising

May 11, 2022 1:08:55 PM / by Graham Copley posted in CCS, Renewable Power, Energy, Inflation, Supply Chain, EIA, Talos, EPA, raw material

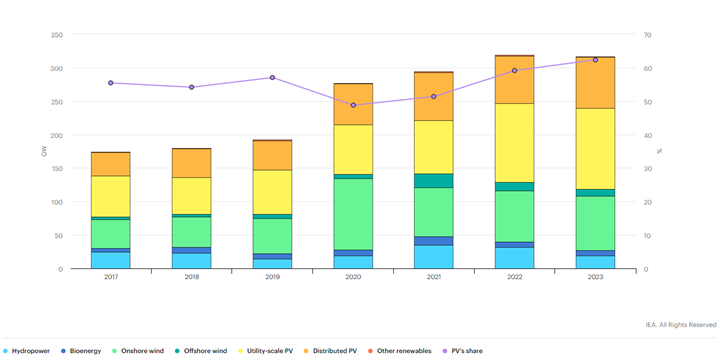

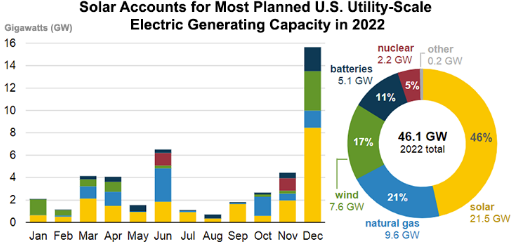

The renewable power space is heading for a very bad year in the US and Europe, as supply chain issues and raw material inflation will impact not only the amount of business that gets completed, but also the margin on that business. The trade issues between the US and China on solar panels have essentially brought the industry to a halt for the moment and suggests that all forecasts of the growth in renewable power contributions in the US in 2022 are too high, and consequently demand estimates for natural gas and coal for power generation are too low – see out comments in the energy section of today's daily report. The EIA forecast below likely fails to take into account the current woes and if governments, at the federal and the state levels act on the information in the chart they may be unprepared for some power shortages later in the year. Overestimation of the rate of renewable power installation as well as its operating rate is responsible for many of the current power shortages that we see in most regions.

More Woes For Wind

May 3, 2022 1:20:32 PM / by Graham Copley posted in ESG, Hydrogen, Wind Power, Climate Change, Sustainability, CCS, Renewable Power, Inflation, Supply Chain, wind, Westlake, renewable, Vestas, Williams, low carbon power

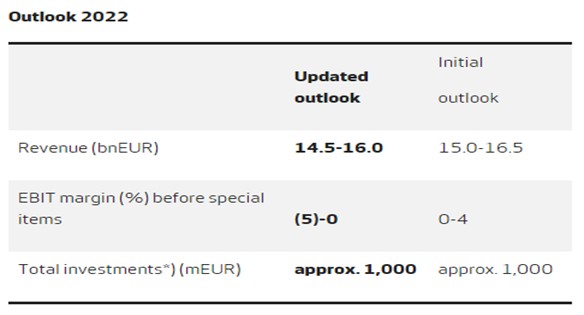

We discussed the woes of the wind power industry at length in a dedicated ESG and Climate piece last week, and the Vestas results below play into the same theme. The company is cutting guidance again for 2022, which is already much lower than estimates would have suggested 6 months ago. While Siemens Gamesa has the added headache of a mismanaged platform change, all of the issues raised by Vestas are shared industry wide, delayed installations because of supply chain issues and material shortages, as well as significant cost inflation. In tomorrow’s ESG and Climate report we discuss some of the increases in European PPAs in 1Q 2022, reversing a multi-year trend of lower installed costs of power. This reversal will likely impact plans for 2022 and 2023, especially for those banking on lower power costs to justify many of the announced hydrogen ventures – particularly in Europe. Those who press ahead despite higher power costs and higher construction costs in general, may stretch both balance sheets and borrowing capacity.

WACKER Is Recognizing Supply Chain Issues Which Threaten Renewable Power Goals

Apr 28, 2022 2:17:23 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, CCS, Renewable Power, Supply Chain, Wacker, raw material

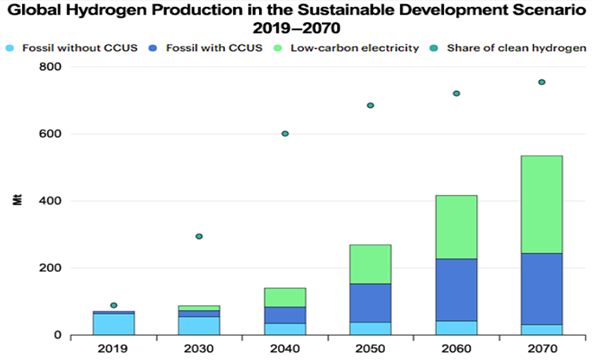

Anyone who read our ESG and Climate reports of the last two weeks will know that we do not believe in the hydrogen projections below as we see renewable power as a potentially scarce resource. Furthermore and also covered yesterday, should the API be successful with its carbon tax proposal in the US and should this be additive to the 45Q incentive for CCS, we could see an explosion of blue hydrogen investments in the US, especially on the Gulf Coast.

Energy Transition Moving Forward; Commodity Availability To Support It In Question

Apr 12, 2022 12:06:03 PM / by Graham Copley posted in LNG, Renewable Power, Raw Materials, Supply Chain, hydrocarbons, Dow, Oil, natural gas, clean energy, Enterprise Products, materials, fossil fuels, material cost inflation, minerals, renewable targets

While longer-term use of oil and gas products is in Enterprise Products' best interest, it is nice to see someone else pushing the point that we have been making for more than a year – that there is not enough material out there, in the right locations, to meet the suggested clean energy goals. It is important that this becomes better understood and accepted by a broader group than just Enterprise and C-MACC, as we will not get the needed tack in strategy, priorities, and incentives if there is a broad reliance on renewable targets that will not be met – we focus on the IPCC report in tomorrow’s ESG and Climate report.

Renewable Capacity: Likely To Dissapoint

Mar 23, 2022 2:19:27 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, Coal, Renewable Power, Energy, Supply Chain, Oil, natural gas, power, solar, renewable energy, solar energy, Gas prices, renewable capacity, supply chain challenges, Utility, materials costs

The back-end loading of the power projects for the US for 2022, as shown in the chart below leaves us somewhat skeptical concerning how much will come online this year. Supply chain problems and materials costs and availability are causing all sorts of problems with renewable power projects and installed capacity expectations for 2021 were too ambitious. We believe that companies are pushing projected start-ups later in the year to give them more of a chance of completion, but this creates the risk that they slip into 2023 or beyond. The most significant issue here is that as these plans get delayed, natural gas demand goes up, as one of the swing suppliers. This is fine as long as the US natural gas industry and shale oil industry is investing so that gas availability rises. Otherwise, we could see gas prices spike in the US next winter and another year where we use more coal than we expected. For more see this week's ESG and Climate report.

Packagers Are Looking At Renewable Sources As Recycle Availability Is Limited

May 20, 2021 2:17:33 PM / by Graham Copley posted in Recycling, Biofuels, Polymers, PET, packaging, Gevo, Supply Chain, Butanol, Coca-Cola, packaging materials, biogradable polymers, Renewable Sources, hydrocarbons

The coverage of the IEA study continues with lots of opinions, which is a good sign as it means that the work is being taken seriously.