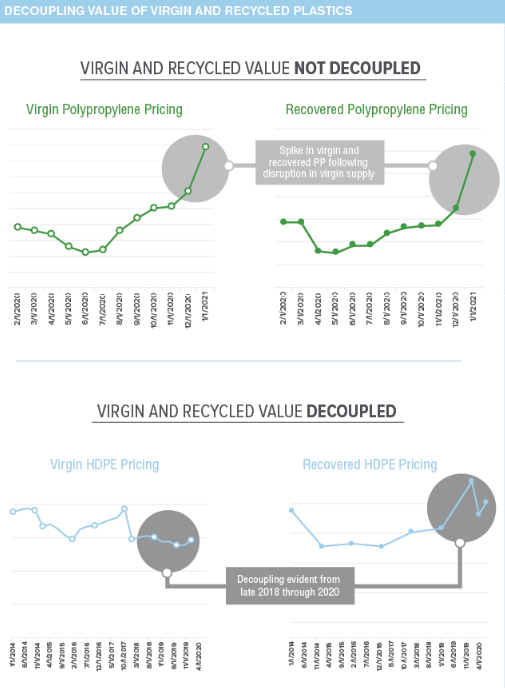

We talked a little about recycled polymer pricing in our ESG and Climate report yesterday. Recycled polymer pricing is rising relative to virgin polymer pricing (see chart below) and is likely to continue to rise unless hydrocarbon prices push virgin resins materially higher. Demand for recycled polymer is growing quickly and more quickly than supply, and we expect this to be reflected in an increased premium, barring more raw material inflation. Recycling is a fixed cost business – each step has a well-understood cost and companies are innovating to try and lower the cost of each step, but as so many different stakeholders are in the chain, it is a complex problem. One of the reasons why see the LyondellBasell/Suez venture works in The Netherlands is because Suez controls the waste in a region where recycling compliance at the household level is high. Despite this, it has taken a couple of years to get to the volumes needed to make the venture adequately profitable – mostly ensuring enough pure recycled polyethylene and polypropylene makes it to the facility. If polymer buyers are willing to cover the full cost of recycling in terms of the prices they are willing to pay, more material will become available – if LyondellBasell/Suez can demonstrate that they can make money when all the stars are aligned, it will likely encourage them to work with other municipalities in other parts of Europe (first) to see if they can replicate what they are doing now. In our view, all of the other advertised recycling programs are very small, very focused on niche applications, and don’t move the needle.

Recent Posts

Consistent Supply Of Recycled Plastics Will Require Consistent & High Enough Pricing

May 13, 2021 1:37:30 PM / by Graham Copley posted in Recycling, Polymers, Polyethylene, Plastics, Polypropylene, recycled polymer, polymer pricing, hydrocarbon prices, virgin resins, supply and demand, raw materials inflation, LyondellBasell, Suez, polymer buyers

If Carbon Prices Don't Rise, The Tax Payer Will Foot The Bill Anyway

May 12, 2021 1:28:52 PM / by Graham Copley posted in Chemicals, CO2, Carbon Price, ESG Investing, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Emission Goals

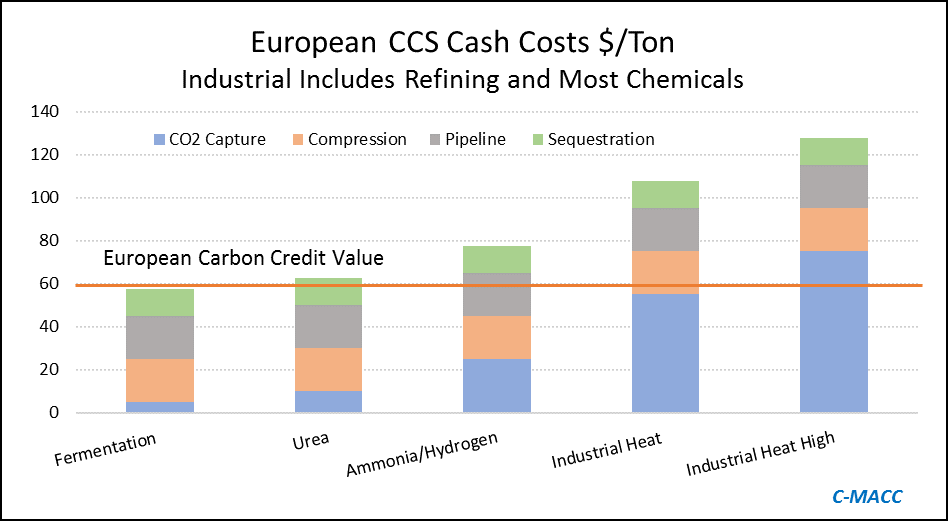

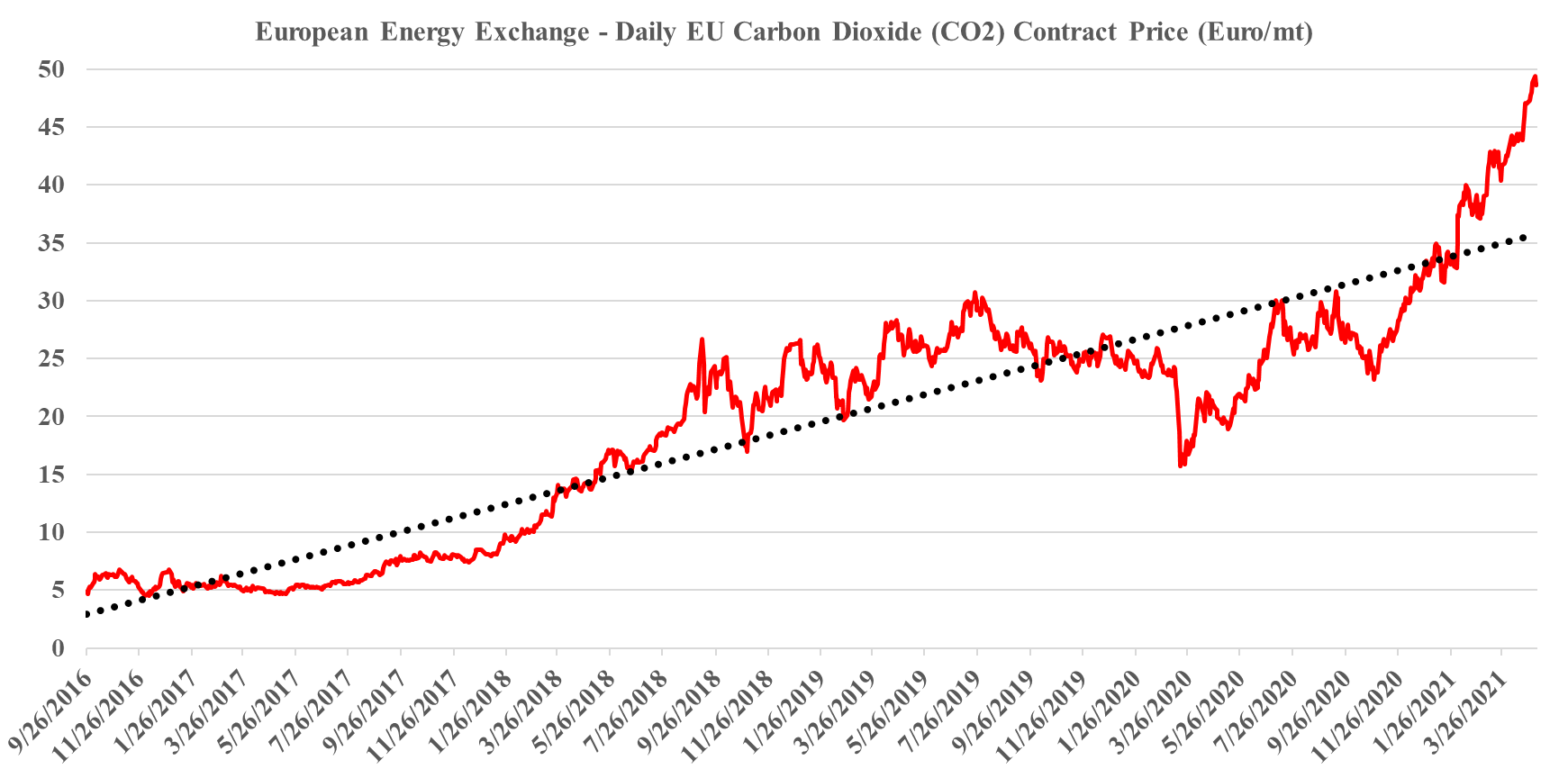

The big news of the week is the massive grant that the Dutch government approved for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be localized within the Port of Rotterdam, where both oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the $2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $65 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs – see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir). For more see today's ESG report.

Source: Global CCS Institute and C-MACC Analysis and Estimates

Another Expensive CCS Project With Limited Capacity

May 11, 2021 11:39:27 AM / by Graham Copley posted in Hydrogen, Chemicals, Carbon Capture, Climate Change, CCS, Emissions, Shell, Air Products, Air Liquide, ExxonMobil, Industrial Gas, Gulf Coast Sequestration, Emission Goals

The big news of the day is the massive grant that the Dutch government approved yesterday for an offshore carbon capture project that will be focused on the operations of Shell, ExxonMobil, Air Products, and Air Liquide. This looks to be focused within the Port of Rotterdam, where both of the oil majors operate large refineries, Shell also operates a large chemical site and the industrial gas companies have significant hydrogen capacity. The Dutch government believes that the country cannot achieve its emission goals without carbon capture as it has one of the largest refining and chemical footprints in Europe and the 2.4 billion grant (likely achieved through a series of subsidies) is an indication that the country is willing to invest to make its emission goals a reality. The grant is likely aimed to help close the gap between the current European carbon price – which is just over $60 per ton today and what is estimated to be the full cost of capture and storage under the North Sea, which the linked article suggests is closer to $100 per ton, but this likely underestimates the capture costs –see chart below - even if the CO2 streams are pooled and treated as one stream. Interestingly, despite the high level of subsidy, this project is estimated to store only 2.5 million tons a year and will only last 15 years (likely because of the capacity of the offshore reservoir).

Source: Global CCS Institute, C-MACC Analysis, 2021

This is another example of a grossly inflated project, in terms of costs and while it may be the best option for the Port of Rotterdam we would make the following observations.

- It will consume a fraction of the CO2 in the local area

- It might give the Dutch operators a competitive edge over other European companies – either because they can produce low carbon fuel or hydrogen or other chemicals (which may get a premium price), or because they avoid paying the carbon prices. This may cause issues within the EU

- It might artificially lower the European carbon price by creating (subsidized) credits – if this project and other government-backed projects (the UK and Scandinavia so far) overwhelm the credit market, they may depress carbon values and discourage other moves to lower CO2 footprints

- Note that we expect a potential fly up in European carbon prices near-to-medium-term, and these mega-projects will not come into operation for a couple of years

- Like the ExxonMobil proposal for Houston, the implied cost per sequestered ton of CO2 is extremely high and while it might reflect problems with land rights, pipeline “right of ways” and other constraints specific to The Netherlands, it is multiples of the cost that we would expect US for on-shore sequestration and we would encourage all to check out the plans (currently with the EPA) that Gulf Coast Sequestration has in Louisiana.

Embracing Different Ways of Achieving Emission Goals

May 7, 2021 1:19:47 PM / by Graham Copley posted in Hydrogen, Carbon Capture, Recycling, CO2, Renewable Power, Emissions, Carbon Neutral

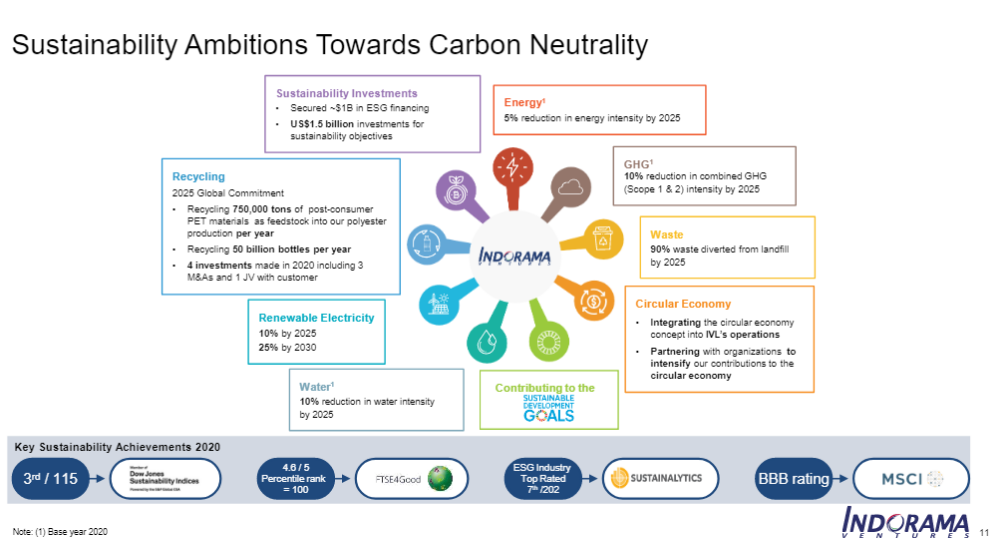

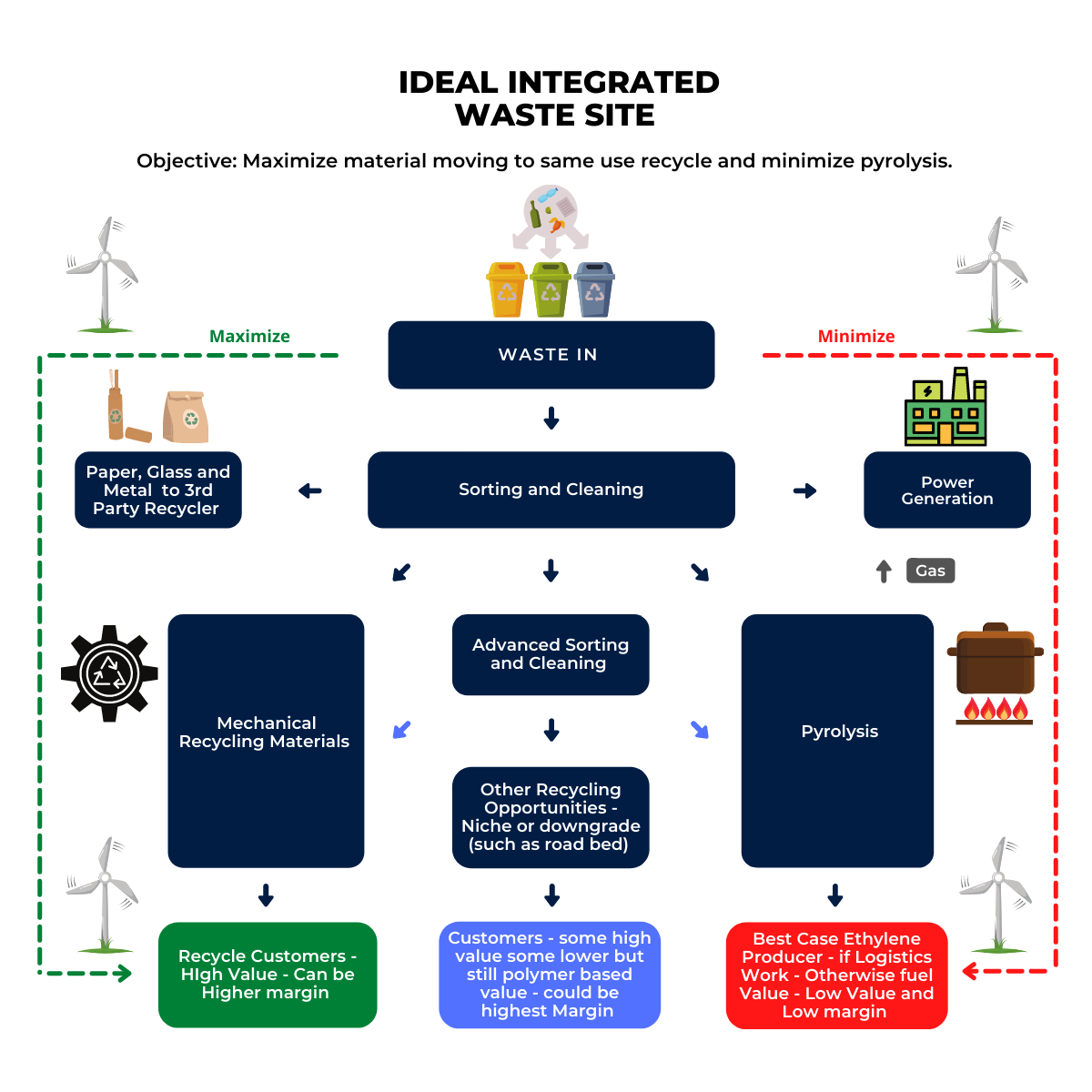

The headlines in today's daily report are interesting as they discuss a large number of different initiatives in recycling, carbon use, and capture, routes to hydrogen, etc. Each initiative is small, but the collective news is encouraging as it suggests that the mood might be changing from one which focuses on only a handful of tools to meet emission goals – which in turn are already helping to driven materials inflation - to a much broader approach that recognizes, or at least beings to recognize, that we need to try everything. We need to experiment with new approaches to recycling; we need more use for CO2 than simply pushing it all underground (but we must still push a lot underground), and we need to try multiple routes to hydrogen, not just those that need to consume vast amounts of renewable power. We need more partnerships – several listed this week - and we need government support where it can be most effective. The headlines today are far more heterogeneous, which is a good sign. One company's view of the solution is show in the chart below.

Raw Materials Inflation Deserves Another Mention

May 6, 2021 1:17:54 PM / by Graham Copley posted in ESG, Renewable Power, Metals, Materials Inflation, Raw Materials

Source: Bloomberg, C-MACC Analysis, May 2021

Without A Carbon Price US Regulations Will Need To Be Tougher & Unpopular

May 5, 2021 12:12:43 PM / by Graham Copley posted in Climate Change, Emissions, Carbon Price, CP Chemical, Carbon Neutral

We doubt that President Biden’s moratorium on new drilling will result in an outright ban. As we discuss in the ESG report today, the lack of unity on the idea of a carbon tax in the US means that the administration has to approach climate change issues in a more piecemeal fashion and one of the easiest triggers to pull, is to limit any new investment that adds to emissions. Our guess is that we will see an EPA-led agenda shortly that will only allow new US energy (and probably industrial) investments that come with a carbon-neutral plan. Drilling will likely be allowed to continue as long as the new wells have zero emissions or have offsets to counter any new emissions. It is unlikely that this will be restricted to oil and gas, and CP Chemical with their 1-Hexene project announced above may be in for a surprise when they apply for a permit.

Not Enough EVs To Make A Difference Yet...

May 4, 2021 1:39:12 PM / by Graham Copley posted in ESG, Electric Vehicles, Fuel Cell, Materials Inflation

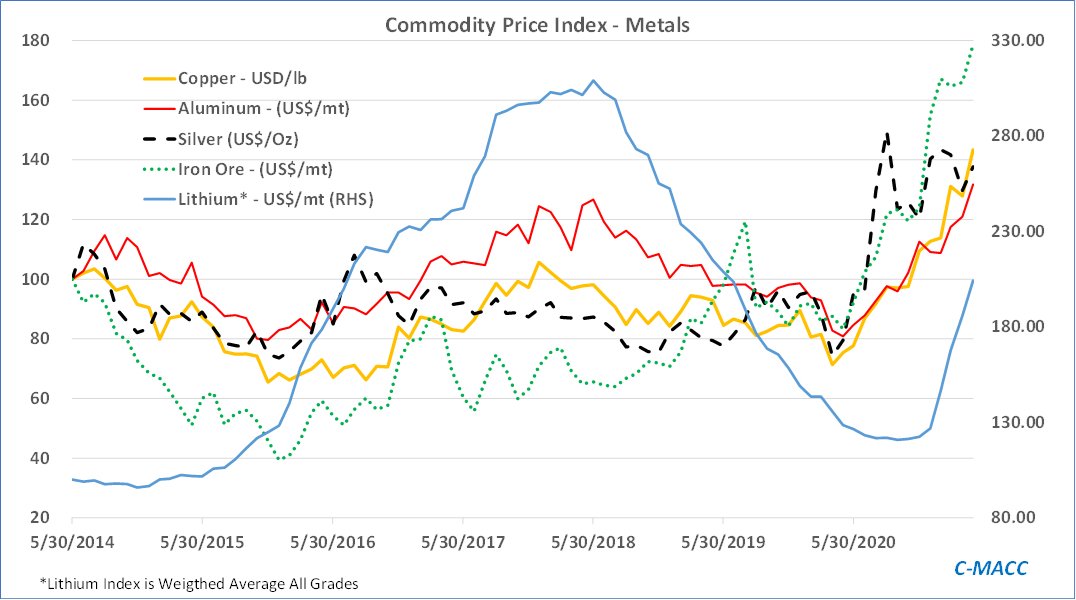

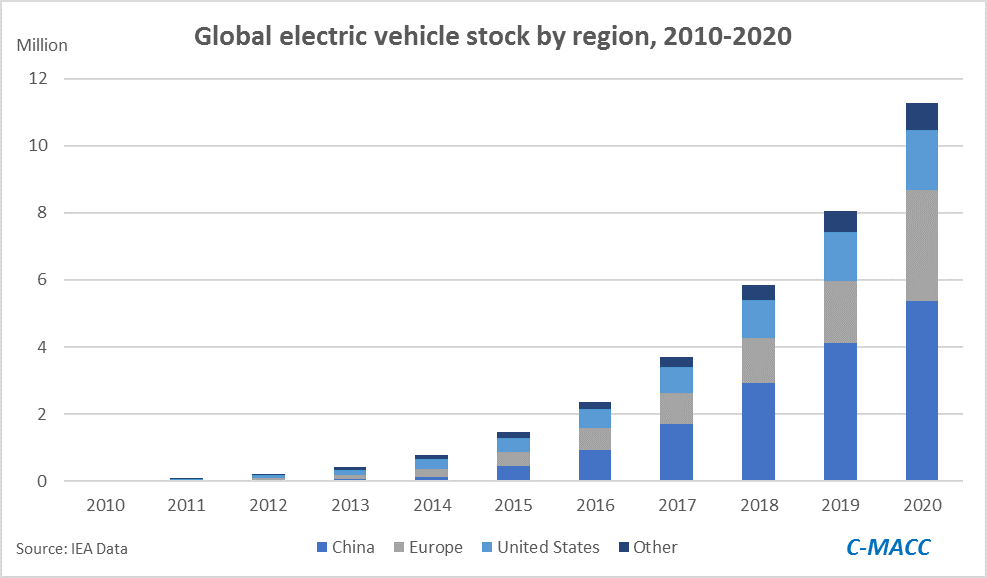

If you read our ESG and climate report which focused on the Biden agenda - The Biden Plan: Taking The Harder Path, Limiting Odds Of Success – you will understand how underwhelming the EV data is in the exhibit below. For the US to reduce its automotive transport carbon footprint to the proposed 2030 goals, the country would need to replace over 130 million ICE vehicles with EV or fuel cell-powered vehicles – 12x the total number of EVs in the world today and more than 100x the number currently in the US. This is a challenge that has almost zero chance of being met unless the benefit of switching is so high or the cost of not switching so high that consumers want to make the change – and – there are enough vehicles to buy. Both of these are remote possibilities today, but likely why we see increased focus on lithium, batteries, and faster roll-out of EVs from the majors as they attempt to do their part to move in the right direction. One unintended consequence that we have discussed at length and will cover in tomorrow's ESG and Climate report is inflation in materials, which will not be helped if the ESG lobby will not support the industries that need to provide the materials and the interlinking infrastructure investment.

Pyrolysis Will Never Win If Consumers Are Willing To Pay For Recycled Plastics

Apr 30, 2021 1:46:22 PM / by Graham Copley posted in Recycling, Polymers, Plastic Waste, Plastics, Pyrolysis, Mechanical Recycling

Recycling is a fixed cost business – it does not vary with the price of oil or the price of natural gas – and the more willing potential customers are to pay on a fixed cost basis, to cover the collection, separation, cleaning, and re-pelletizing costs, the more recycled material will make it back into the cycle and not into landfill or pyrolysis. The pyrolysis technologies being discussed by the major polymer producers are a solution to the plastic WASTE problem, and they allow for a degree of recycling potentially, but they will never be able to bid waste polymer away from a mechanical recycling alternative if the buyer is willing to cover the costs. We have written extensively on these topics in our ESG and Climate reports and we would point readers back to Unwanted: Chemical Recycling – Necessary Now, Less So Later and the second section of True Blue: Not Green but Likely Good Enough.

Don't Dismiss A Good Idea Just Because You Don't Like Who Said It

Apr 29, 2021 1:15:43 PM / by Graham Copley posted in ESG, Metals, ESG Investing

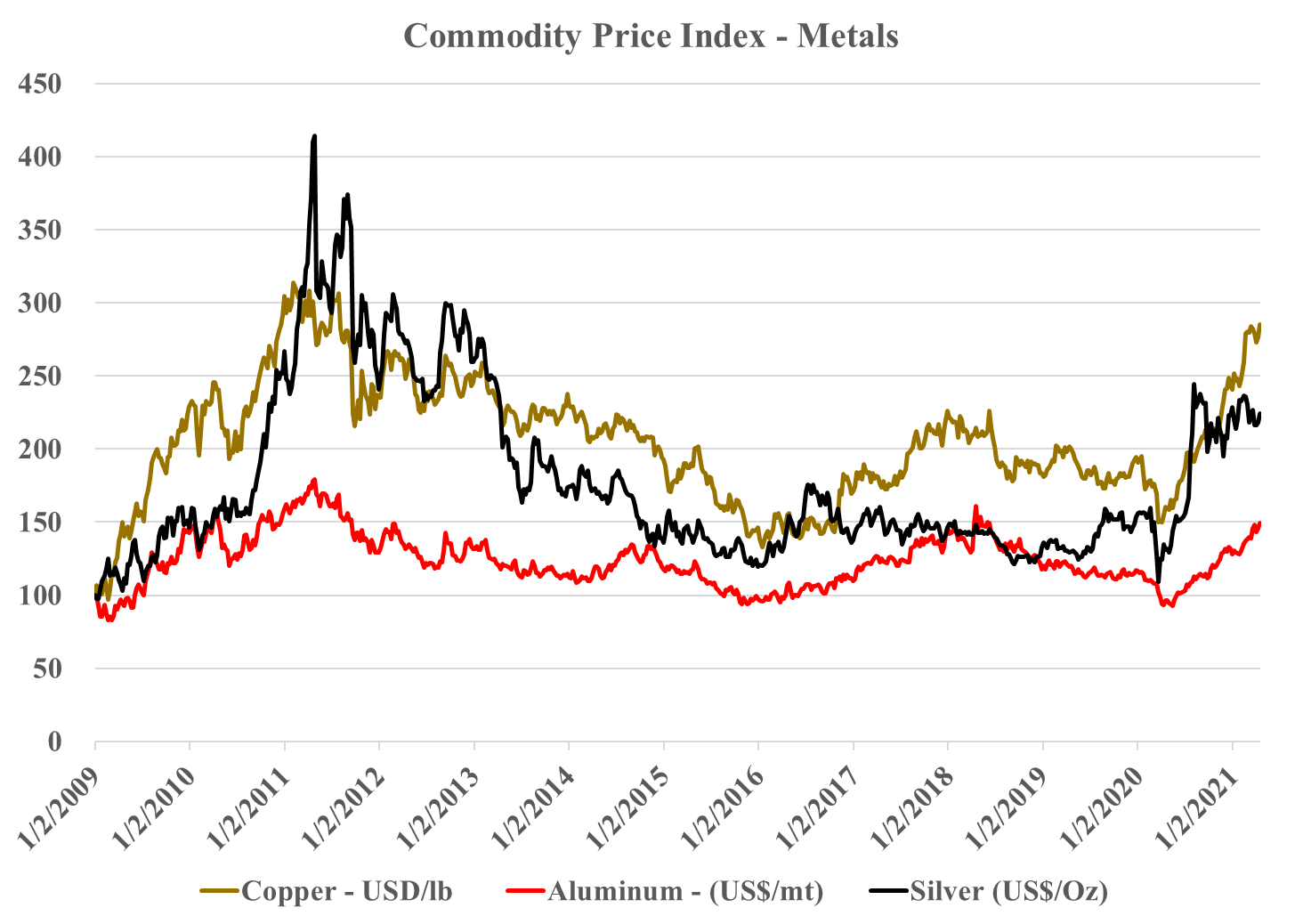

We return to a theme we have covered at length in several prior reports – the idea that the baby gets thrown out with the bathwater as politicians, regulators, and investors make decisions around what is best from a climate perspective and what is best from an ESG investing perspective. In many cases, the short-term noise and politics is masking some of the larger challenges and is likely to result in the wrong decisions, and potentially creating damaging inflation. See metals pricing chart below and today's daily report.

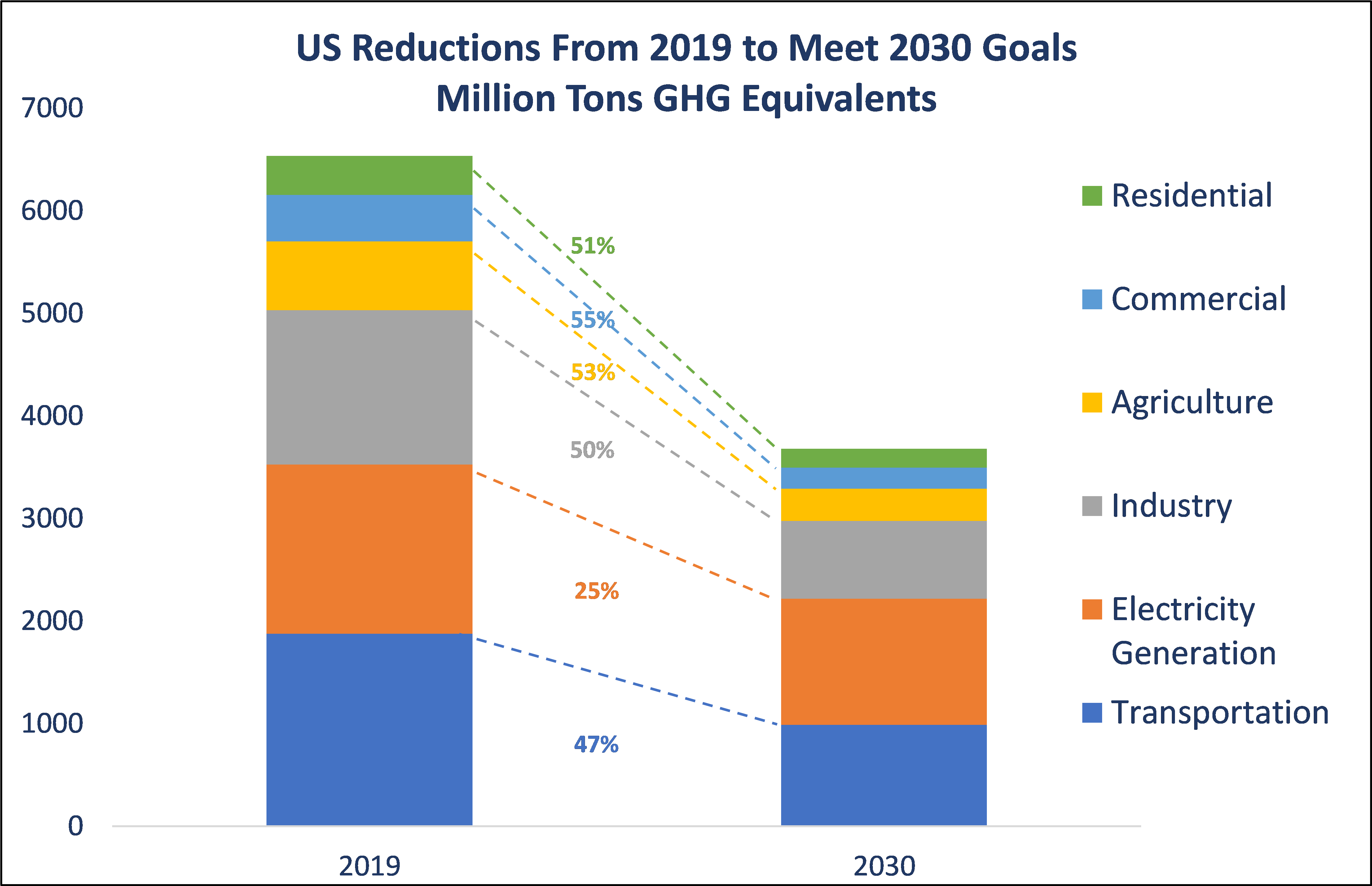

The Hard Math Behind The Biden Agenda

Apr 28, 2021 11:41:54 AM / by Graham Copley posted in ESG, CO2, Emissions

The exhibit below shows in stark terms what would be required. The column on the left is 50% of the sector emissions from 2005 according to the EPA, and this what we need to get to by 2030 to meet the pledge. It is only the Power Generation sector that has seen meaningful reductions since 2005 and consequently a 50% target from 2019 is the average needed from the other segments. We discuss the challenges (which are significant) and some possible solutions in today's ESG & Climate Report