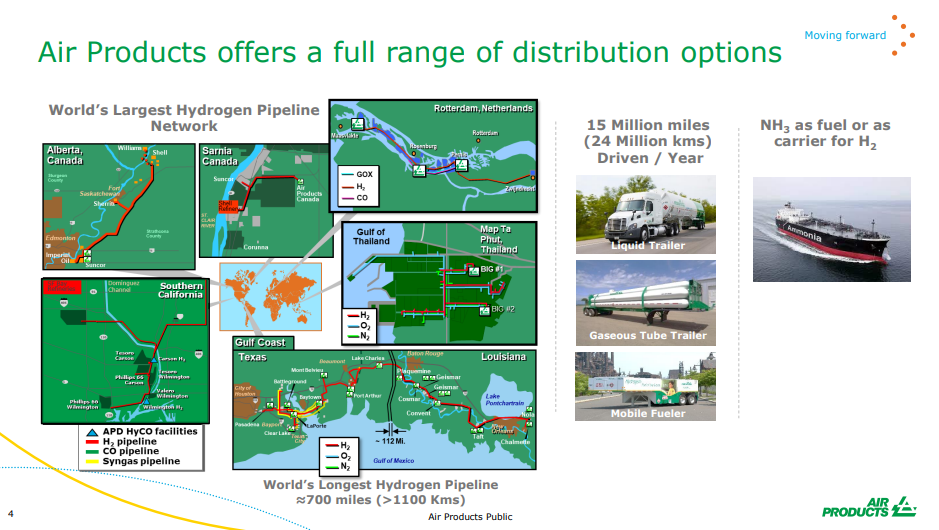

We expect to see a step up in chemical companies parading their green credentials – or plans for more green credentials, not just because COP26 is ahead but because it has now become a competitive issue. Dow’s view that it may be able to sell low carbon polyethylene in the US at a premium to regular polyethylene reflects a fairly rapidly changing narrative with customers, many of whom are also trying to accelerate their green credentials. For a couple of years, we saw packaging companies, for example, talk in broad terms about ambitions around recycled/renewable content, carbon footprints, etc. Now we are seeing the results of them trying to put their ambitions into practice and they are looking for tangible solutions from their suppliers to help them meet the pledges that they have made to consumers. For many of the packagers, the cost of the packaging is a very small component of the product cost and we would expect the packagers to look at more expensive packaging solutions if it gives them a better label. In the Air Products chart below, the company is using the La Porte start-up to remind us that it is already a huge player in hydrogen and hydrogen infrastructure. See our recent ESG and Climate Report.

More Green Credentials On Show; More To Come

Oct 8, 2021 12:25:55 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Climate Change, Sustainability, Air Products, Dow, COP26, chemical companies

Natural Gas Is Not The Focus Of COP26, But It Should Be

Oct 7, 2021 2:35:47 PM / by Graham Copley posted in Methane, Emissions, natural gas, methane emissions, COP26, leakage

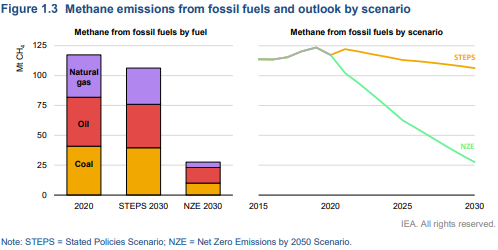

The methane chart below is another reminder of how important it is for governments to increase their demands on methane emitters to find solutions to cut leakage. The current stated policies are grossly inadequate, and while we are seeing some of the majors taking proactive steps to reduce emissions, the problems are more acute among the independents in the West as well as abandoned wells that might have no current ownership and operators outside the US and Europe. We keep talking about the need for COP26 to focus on natural gas, and this would be one of the key issues on which a global agreement would help. See several of our ESG reports for more on this subject.

Existing Carbon Black Producers Should Look For Ways to Decarbonize

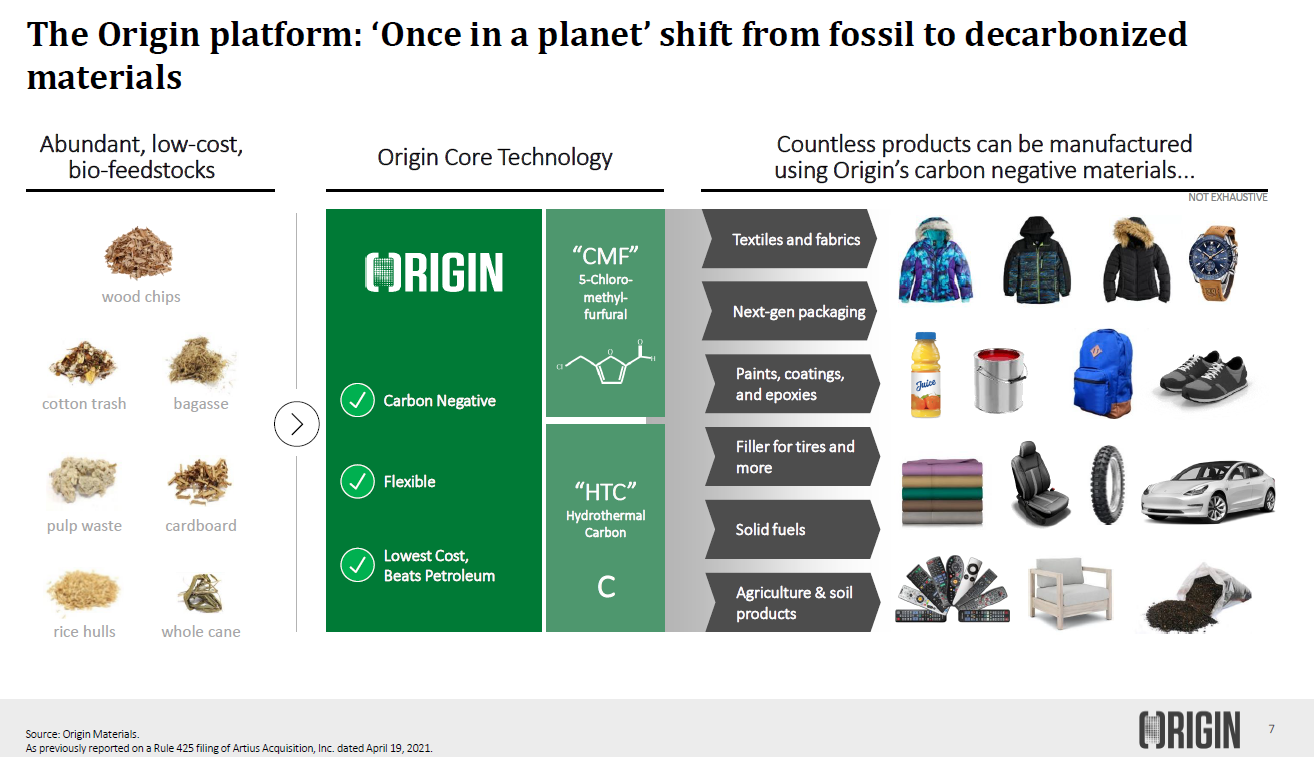

Oct 6, 2021 2:27:54 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CCS, CO2, Carbon Black, Carbon, Emissions, PET, decarbonization, Origin Materials

We think that Orion Engineered Polymers and its fellow traditional carbon black producers could be in for a rough ride.

Hydrogen Investments: Companies Weighing Alternatives As They Should

Oct 5, 2021 1:36:33 PM / by Graham Copley posted in ESG, Hydrogen, Polymers, Climate Change, Sustainability, CCS, Renewable Power, Emissions, Net-Zero, ethylene producers, Climate Goals

The gaps in the exhibit below are not surprising as 2050 is a long way away and we would not expect all of the needed capacity to be announced or pledged yet, especially as many companies are still weighing alternatives. For example, as an ethylene producer, you have 5 paths – hydrogen as a furnace fuel – electric power as a heating medium – stick with what you have and use CCS – find an alternative route to make the polymers – make alternative polymers.

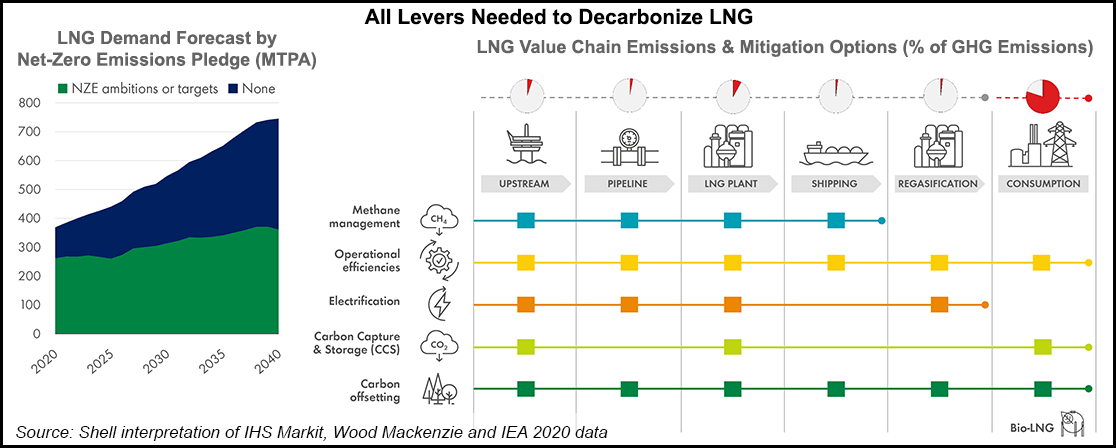

Carbon Capture Supportive Of LNG, But You Need Somewhere To Put The Carbon

Oct 1, 2021 1:46:17 PM / by Graham Copley posted in ESG, Carbon Capture, LNG, CCS, CO2, decarbonization, ethanol, natural gas, 45Q

The carbon capture plans lacking a place to put the CO2, suggested in the two connected stories linked here (link 1, link 2), echo something that we have been highlighting for a while. There have been several press releases with respect to CCS – partnerships – plans to accompany new investments – gathering schemes for the ethanol industry, etc. but none have any specificity around where they will put the CO2. The Houston team, discussed in a recent report is talking about offshore Texas, and given both ExxonMobil and Chevron in the partnership, we do not doubt that there is a plan, but in general, the permit activity at the EPA is, we understand, quite limited today. To apply for a class 6 permit, applicants need to have a detailed analysis of the sub-surface that they plan to target, and once you have identified a location, there are likely at least 18 months of work to get into shape to submit the permit. Some of the oil majors may be able to move faster on acreage that they already have seismic models for, but it is a long process – we wrote about the need for 45Q to change in both value and duration in our recent ESG and Climate Piece.

If We Want Green Hydrogen, We Better Start Now

Sep 30, 2021 2:20:51 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Green Hydrogen, power, solar, batteries, wind, clean energy, battery storage, green investments

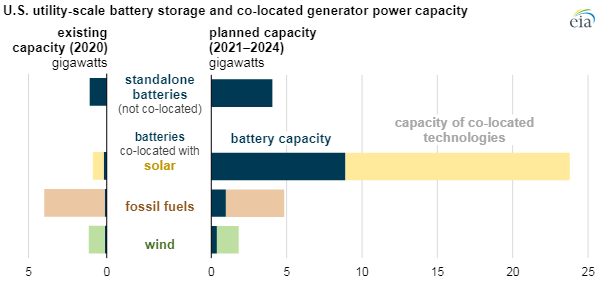

The battery storage investment chart below is interesting in that it shows significant pairing with Solar facilities and less with wind. If we are to meet the green hydrogen goals that many are optimistically predicting over the next 10 years, then the new wind and solar investments need to be paired with hydrogen and hydrogen-based swing power generation capacity. This is the only way that countries will develop effective hydrogen grids. Simply having one or two large hydrogen facilities and/or import facilities will result in very inefficient distribution models either for fuel cell vehicles or for heating and swing power generation. A distributed network for hydrogen makes much more sense and modular electrolyzers coupled with modular hydrogen power generators is a more holistic model, with much more flexibility than adding batteries. Granted, the battery technology is tested and available today, but the broader ambitions for hydrogen will not be met if we do not get out of the blocks soon.

A Climate Plan For China: Ambitious But Late

Sep 29, 2021 2:06:29 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Emissions, Net-Zero, power, clean energy, climate, chemical prices

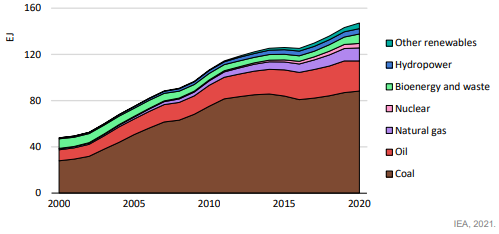

Overnight there has been a very good IEA report on how China could get to net-zero by 2060, and further news of more industries hit by power cuts because of power shortages, some of which are apparently due to tighter emissions standards. These are both important and far-reaching topics and will require some analysis to provide the kind of insight that we believe is necessary, and accordingly, we will push these to next week’s report (all input welcome). In the meantime, we have included a couple of charts that show the way up and the IEA view of the way down. The power outages are interesting as while they may cause some manufacturing cutbacks and we have seen recent news to that effect, China has overbuilt in the last couple of years relative to domestic demand growth, and with port and shipping congestion the country has surpluses of many products sitting around at very low values. The power moves may help correct some of these imbalances and we are already seeing some chemical prices bounce off recent lows because of production cutbacks. We discussed the acetic acid chain in one of our dailies last week – linked here.

Pretty Charts Hide Very Complex ESG Problems

Sep 28, 2021 12:43:15 PM / by Graham Copley posted in ESG, Recycling, Climate Change, Sustainability, Carbon, Emissions, Mechanical Recycling, recycled polymer, Gevo, feedstock, chemical recycling, polymer, biodegradable plastics, Origin, polymer demand, Covestro

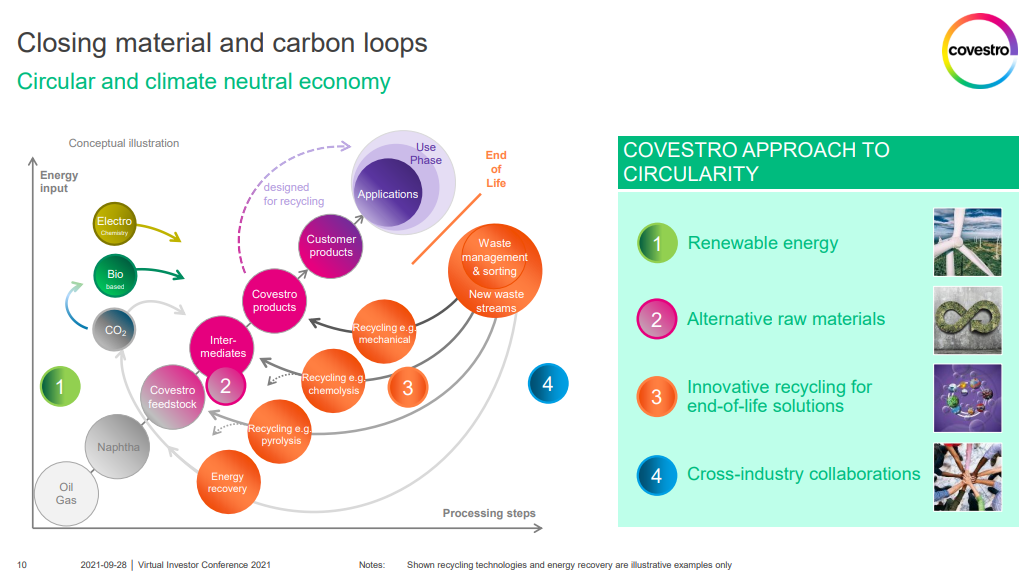

Companies are being encouraged/forced to produce climate plans by ever more focused shareholders many of whom only have a passing understanding of how some of the companies operate and how they might best set a course to lower emissions and otherwise be better stewards of the environment. The pretty graphic by Covestro below likely looks much better than the data and ambition behind it really are. This is not necessarily meant as a criticism of Covestro, but the company like many others is being challenged to explain a very complex, process, and engineering-heavy set of options to an audience not really qualified to understand them – pictures with circles are easier.

Easy To Join The ESG Club, Harder To Stay In

Sep 24, 2021 1:12:50 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Emissions, Net-Zero, ESG investment, NDAs, carbon plan

Our concern with the very encouraging charts below is that it is easy to join the group today, as there is no requirement to have a granular plan as to how you achieve net-zero. Many of the companies on the list may have the best intentions, but to get to their targets many need technology advances that are at best in laboratories today, and many need pricing structures – either incentives or penalties that make the right path forward more obvious. A lot of this does not exist today and the timeline to getting some of it done is being extended by political log-jams and differences of opinions. As time passes, the 100 or so companies that have signed the pledge are going to have to, at a minimum, explain what they are going to do and shortly thereafter, start committing capital.

Are We Heading For Fuels/Power Crisis?

Sep 23, 2021 1:25:31 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Carbon Fuels, CCS, CO2, Renewable Power, fossil fuel, carbon footprint, power, synthetic fuels, aviation fuel

In our ESG and Climate report yesterday we focused on sustainable aviation fuel, discussing a recent report from Shell and Deloitte, which shows some of the challenges with getting the aerospace industry to net zero. The report focused on the need for sustainable aviation fuel now, and in large volumes, as this is the only thread that the industry can pull on today – synthetic fuels (from CO2 and hydrogen will be uneconomic for decades, and neither electric powered or hydrogen-powered aircraft are going to be a solution before 2050). The bp, Delta, and Boeing linked headline is one of many that we expect to see as the need for near-term progress is urgent, given the scale of investment required. See yesterday’s report for more detail.