We think that Orion Engineered Polymers and its fellow traditional carbon black producers could be in for a rough ride.

Existing Carbon Black Producers Should Look For Ways to Decarbonize

Oct 6, 2021 2:27:54 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CCS, CO2, Carbon Black, Carbon, Emissions, PET, decarbonization, Origin Materials

Hydrogen Investments: Companies Weighing Alternatives As They Should

Oct 5, 2021 1:36:33 PM / by Graham Copley posted in ESG, Hydrogen, Polymers, Climate Change, Sustainability, CCS, Renewable Power, Emissions, Net-Zero, ethylene producers, Climate Goals

The gaps in the exhibit below are not surprising as 2050 is a long way away and we would not expect all of the needed capacity to be announced or pledged yet, especially as many companies are still weighing alternatives. For example, as an ethylene producer, you have 5 paths – hydrogen as a furnace fuel – electric power as a heating medium – stick with what you have and use CCS – find an alternative route to make the polymers – make alternative polymers.

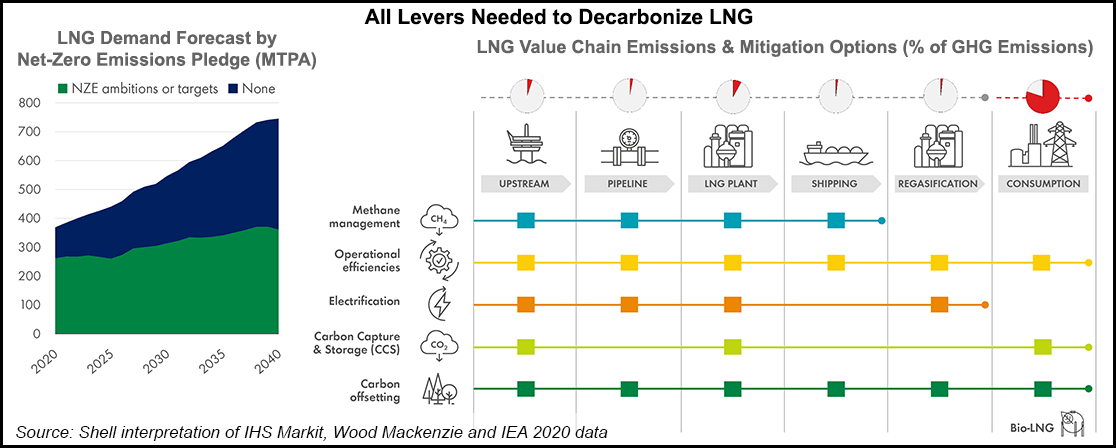

Carbon Capture Supportive Of LNG, But You Need Somewhere To Put The Carbon

Oct 1, 2021 1:46:17 PM / by Graham Copley posted in ESG, Carbon Capture, LNG, CCS, CO2, decarbonization, ethanol, natural gas, 45Q

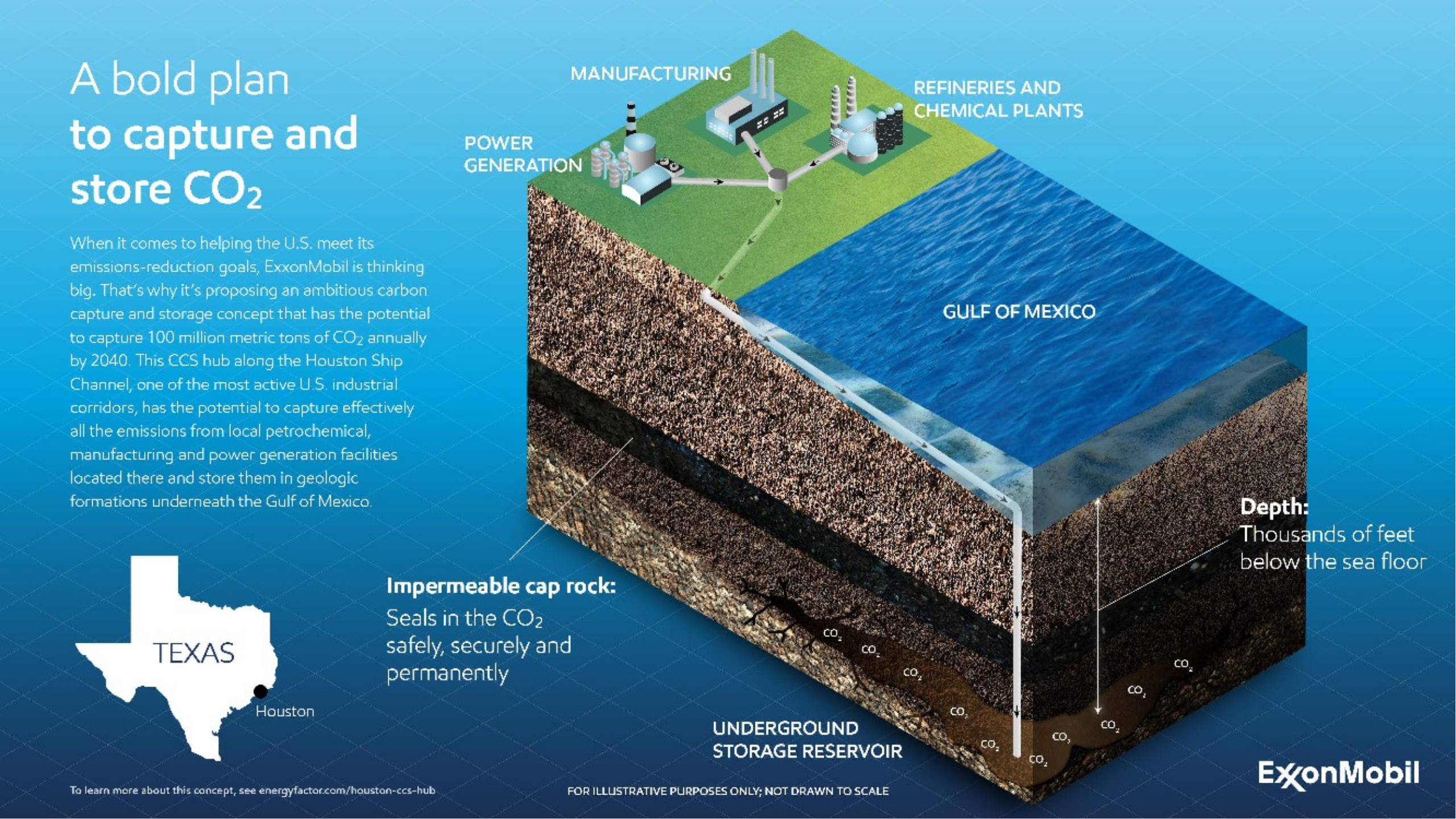

The carbon capture plans lacking a place to put the CO2, suggested in the two connected stories linked here (link 1, link 2), echo something that we have been highlighting for a while. There have been several press releases with respect to CCS – partnerships – plans to accompany new investments – gathering schemes for the ethanol industry, etc. but none have any specificity around where they will put the CO2. The Houston team, discussed in a recent report is talking about offshore Texas, and given both ExxonMobil and Chevron in the partnership, we do not doubt that there is a plan, but in general, the permit activity at the EPA is, we understand, quite limited today. To apply for a class 6 permit, applicants need to have a detailed analysis of the sub-surface that they plan to target, and once you have identified a location, there are likely at least 18 months of work to get into shape to submit the permit. Some of the oil majors may be able to move faster on acreage that they already have seismic models for, but it is a long process – we wrote about the need for 45Q to change in both value and duration in our recent ESG and Climate Piece.

Are We Heading For Fuels/Power Crisis?

Sep 23, 2021 1:25:31 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, Carbon Fuels, CCS, CO2, Renewable Power, fossil fuel, carbon footprint, power, synthetic fuels, aviation fuel

In our ESG and Climate report yesterday we focused on sustainable aviation fuel, discussing a recent report from Shell and Deloitte, which shows some of the challenges with getting the aerospace industry to net zero. The report focused on the need for sustainable aviation fuel now, and in large volumes, as this is the only thread that the industry can pull on today – synthetic fuels (from CO2 and hydrogen will be uneconomic for decades, and neither electric powered or hydrogen-powered aircraft are going to be a solution before 2050). The bp, Delta, and Boeing linked headline is one of many that we expect to see as the need for near-term progress is urgent, given the scale of investment required. See yesterday’s report for more detail.

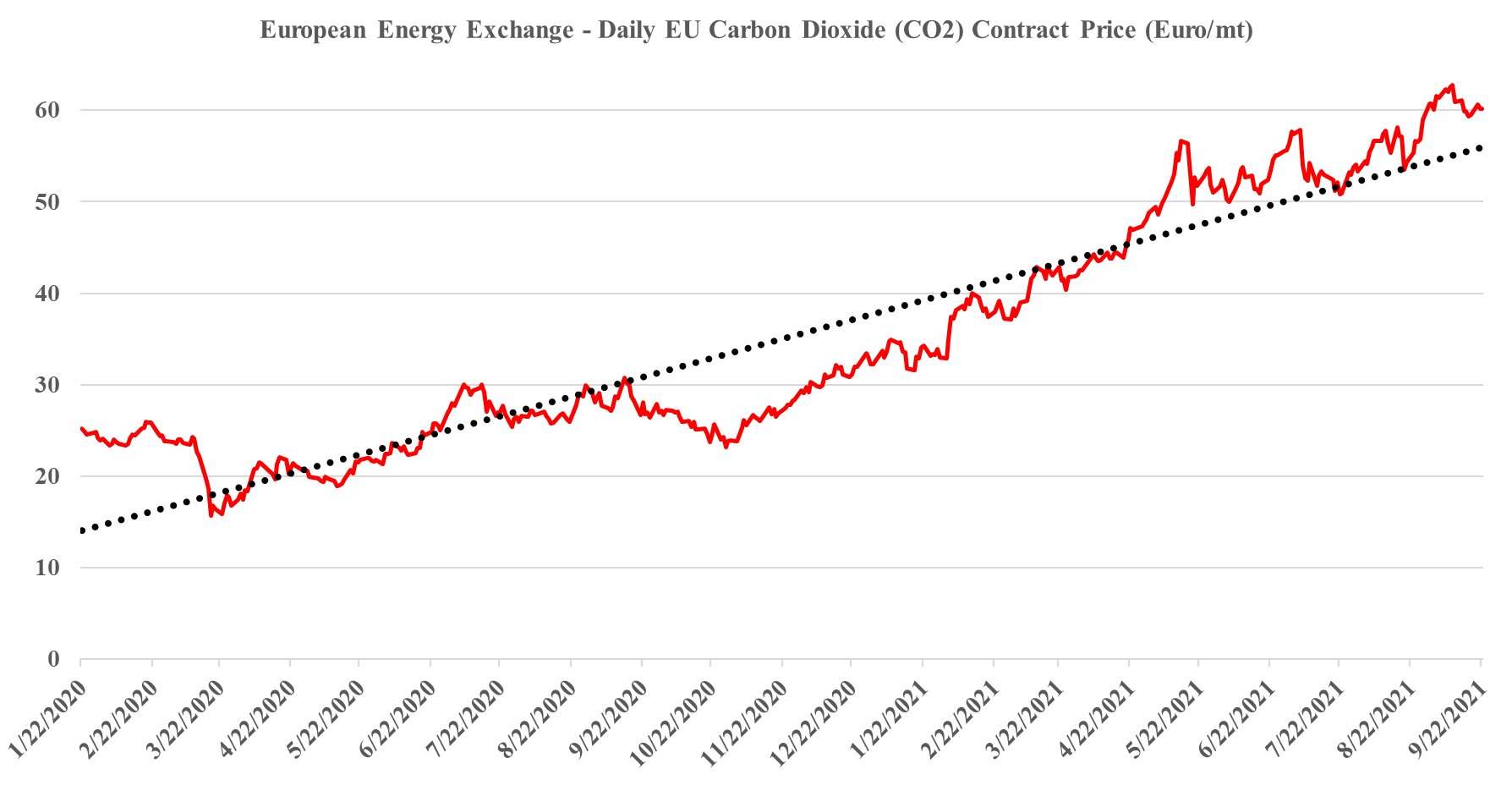

How Can We Have Too Much & Too Little CO2 At The Same Time?

Sep 22, 2021 2:04:48 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Emissions, Carbon Price, Inflation, Ammonia, natural gas, European Carbon price, urea, CF Industries

It is worth a short explanation of what is going on with European CO2, given the mixed signals of shortages in headlines today and then the slight weakness in pricing shown in the image below. These are two very different markets, with the food, beverage, medical and nuclear industries looking for pure streams of CO2 rather than the contaminated streams that make up the bulk of emissions. Historically, the food and beverage industry looked to fermentation – so alcohol production – as its source of a pure CO2 stream, but as demand grew, the next best place became ammonia production, which also has a pure CO2 stream as a by-product. Most ammonia is further converted into urea, which is a consumer of CO2 and there is not enough CO2 produced in a natural gas-based ammonia plant to convert all of the ammonia to urea. You sometimes see urea facilities also selling ammonia, but more frequently they take the carbon monoxide by-product of the syngas reaction and convert that to CO2. The result is enough CO2 to convert all of the ammonia to Urea and surplus CO2 to sell. Because of this more dominant supply of food and beverage grade CO2, and shutdowns caused in this case by runaway natural gas prices, have an immediate impact on the industries that rely on the CO2.

US CCS Clusters Gaining Momentum, As They Should

Sep 17, 2021 12:32:39 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, CCS, CO2, Sequestration, Emissions, ExxonMobil, Emission Goals

News that ExxonMobil has support for its large CCS hub in Houston should not be a surprise. According to the EPA data, for 2019, Harris and Galveston counties combined have more than 50 million tons of CO2 emissions and there are another 20 million tons in Brazoria county, which is close enough to be included. The devil will be in the details as the cost of building a high-pressure pipe network will be high, as will drilling wells with sufficient capacity offshore. We believe that this hub, or cluster (as they are called in Europe), approach will help drive CCS costs down, but we are concerned by the competitive disadvantage that this might cause for those without access to a hub or cluster – see our ESG report - Cluster F***ed: The Dangerous Scale Component of CCS – for more.

Chevron: Working Hard, But Will It Be Enough?

Sep 16, 2021 2:57:56 PM / by Graham Copley posted in ESG, Carbon Capture, CCS, ESG Investing, ESG investment, Chevron, carbon storage

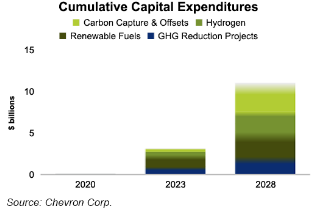

We focused on several aspects of carbon in our ESG and Climate report yesterday and we see several headlines today that focus on carbon and storage, whether it is the blue hydrogen project in France or the Chevron interest in CCS. Chevron has some experience with CCS with the Gorgon natural gas project in Australia and while the company has been criticized recently for falling short of its capture goals for the facility – we believe that all learning experiences are valuable, and what happened in Australia likely leaves Chevron better equipped than many to pursue successful projects going forward. The likely disappointment for Chevron will be the lack of investor appreciation that it may get for the initiatives, as the focus will remain on the scale of fossil fuel exposure – see our Sunday Piece from this week. The barrage of announcements from Chevron is likely in response to the investor pressure that the company (and the industry) is under, but as we discussed on Sunday, it may not make a difference – it did not for Shell in the eyes of the Dutch court.

CCS: US Government Funding Expectations Seem Very Low

Sep 15, 2021 12:15:49 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, ExxonMobil, carbon credit, carbon value, 45Q

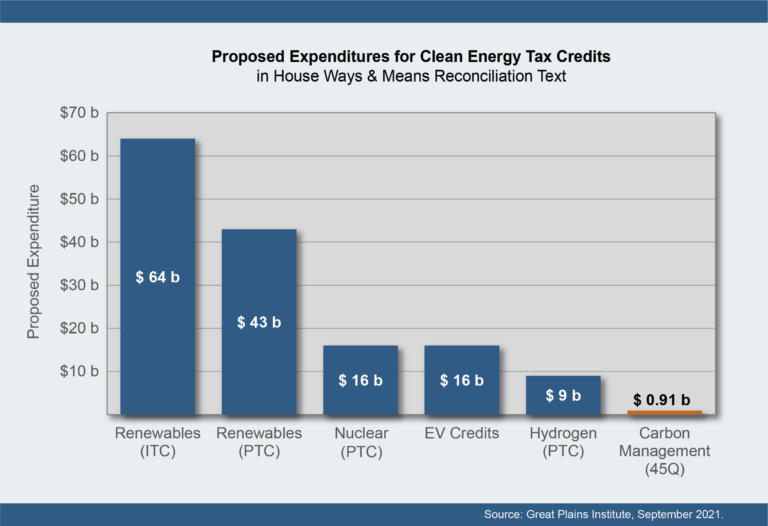

The tax credits suggested for 45Q in the budget reconciliation plan – see Exhibit below – would pay for roughly 18 million tons of CO2 sequestered or used in EOR over the life of the budget, assuming a credit value of $50 per ton of carbon. While this may seem huge in the context of the current levels of CCS in the US, the country had around 2.5 billion tons of emissions in 2019 that could be addressed with CCS (power and industrials), and if we assume 10% of that needs to be dealt with through CCS, the 45Q provisions in the budget reconciliation would cover less than 8% of the volume for one year and the percentage will be even lower if the “CATCH” act is successful in driving the 45Q value to $85 per ton of CO2. So the numbers are either inadequate, or the government is assuming that the levels of CCS in the US will be much lower than the potential – note that the ExxonMobil proposal for a hub in and around Texas talked about the maximum size for the one project being as much as 100 million tons per annum which should equate to $5 billion of tax credits – per annum. See our ESG & Climate report for much more on carbon markets today.

Big Oil Will Struggle To Get Investor Attention With Small ESG Moves

Sep 14, 2021 1:16:08 PM / by Graham Copley posted in ESG, Green Hydrogen, CCS, ESG Investing, ExxonMobil, Gevo, Oil, ESG investment, Chevron, Mitsubishi Power, Engine No1

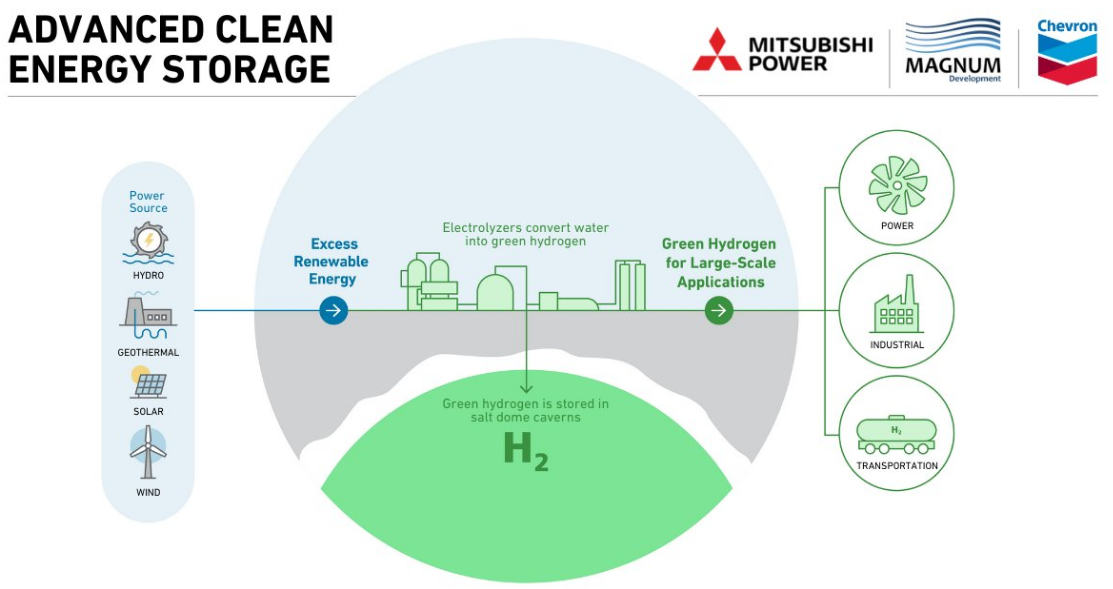

The Engine No1 headline and the Chevron headline are not necessarily the right way to think about the challenges for Chevron and whether or not the challenges are just really beginning for ExxonMobil. The Engine No 1 approach to ExxonMobil was not ESG focused and hit on a larger issue of very poor shareholder returns, with ESG/Climate only one-line item on a list. What Engine No 1 is doing now, is focusing more specifically on climate, and ExxonMobil is likely as large a target as Chevron on this basis. Last week in our Sunday report, we commented on how good the Chevron Gevo deal was for Gevo, but that it did not move the needle for Chevron. Chevron, ExxonMobil, and others are aggressively pursuing renewable fuels, mostly from waste and vegetable oils until the Gevo agreement, and there is another headline today about Chevron pursuing CCS opportunities with Enterprise and the chart below discusses a green hydrogen plan for Chevron. All of these initiatives do not sum to something that investors will take note of for any of these companies yet, and while they might be important building blocks towards a net-zero future, larger tangible investments are probably needed to get any investor buy-in. In the meantime, the activists have a lot of room to work.

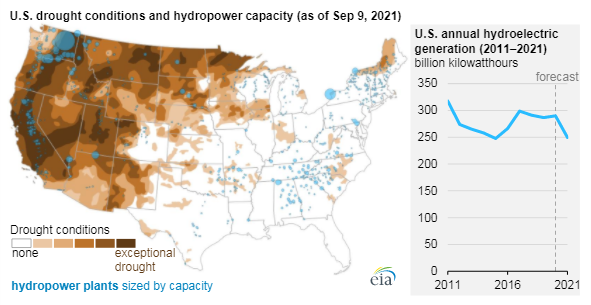

US CO2 Footprint Shrinking, But Not Fast Enough

Sep 9, 2021 1:00:13 PM / by Graham Copley posted in ESG, Sustainability, CCS, CO2, Renewable Power, carbon footprint, climate, EIA, CO2 footprint

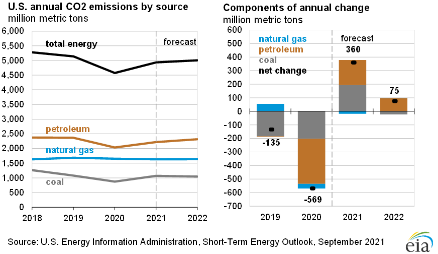

The CO2 emissions chart from the EIA should not be a surprise as the step-up in 2021 and 2022 is a recovery from the economic contraction and habit changes associated with COVID, and the projected increases in 2021 and 2022 are combined lower than the step down in 2020, suggesting that the trend is still negative. The problem is that the trend is not negative enough and as we have written about at length, it will not trend lower fast enough without all corrective opportunities at play – more renewable power, more conservation, and a lot of CCS. See our ESG and Climate work for more.