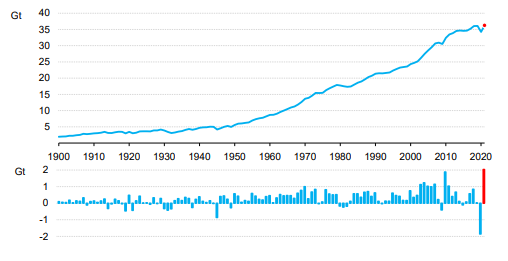

The IEA CO2 emissions data is not a surprise as it has been telegraphed for a while by several commentators that the world went backward in 2021. There were several causes, not least of which was an economy which, with the benefit of hindsight, was overstimulated, pushing up demand for resources in general, including energy. There has also been an overestimation of the rate of investment in renewable power, something which is finally gaining attention more generally, triggered by the energy supply fears that have emerged from the Russia/Ukraine conflict. It will take time to make the very large investments needed to abate the CO2 associated with industrial and consumer activity and there is no overnight fix. Accommodative policies are needed today for investments that will start a decline in emissions several years from now.

2021 CO2 Emissions Levels - The Result Of Too Much Hope

Mar 10, 2022 2:27:05 PM / by Graham Copley posted in ESG, Climate Change, Sustainability, CO2, Renewable Power, Energy, Emissions, carbon dioxide, renewable energy, renewable investment, manufacturing, CO2 emissions, weather, energy supply, energy demand

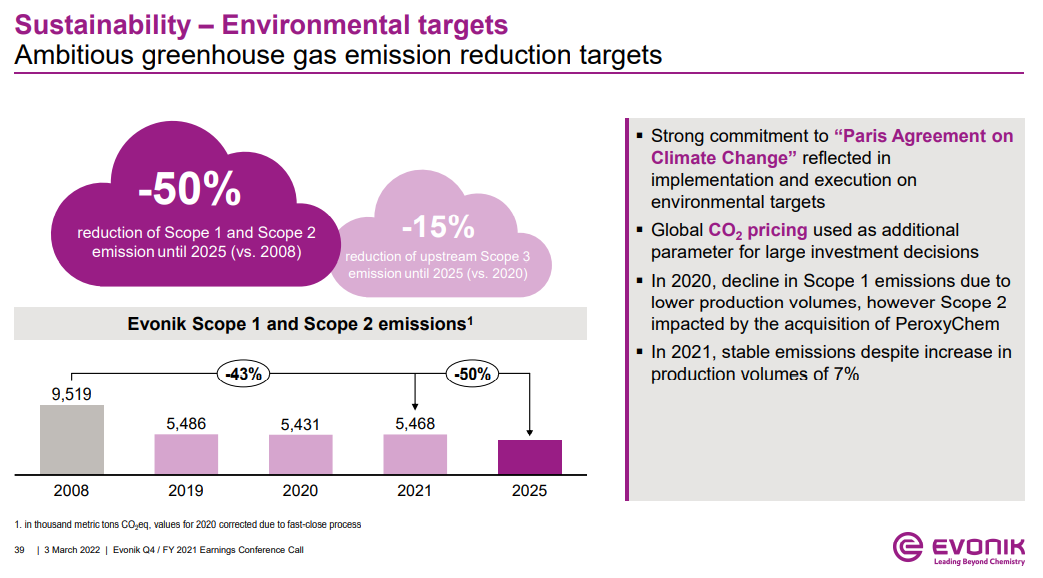

Carbon Pricing Will Be Critical For Investment Decisions, Lack of Clarity Will Cause Delays

Mar 3, 2022 1:35:16 PM / by Graham Copley posted in ESG, Hydrogen, Climate Change, Sustainability, CCS, Blue Hydrogen, CO2, Carbon Price, bp, carbon dioxide, carbon abatement, manufacturing, carbon pricing, Evonik, cost curves

The Evonik discussion around CO2 prices is both relevant and important as CO2 values will be a critical component of investment decisions for many industries going forward. Those waiting for explicit guidance on CO2 prices are likely to be disappointed as we are not seeing much global coordination today and as we discussed yesterday, the European market, which had been the better indicator in our view over the last 18 months, has collapsed in the wake of the Russia/Ukraine conflict as some countries ask for it be suspended, while speculators are assuming that lower gas supplies into Europe will lead to lower emissions and less demand for credits. One of the options here is to take the bp approach and assume a carbon price in investment decisions. Early last year, bp indicated that it would fix on a carbon price of $100 per ton in its longer-term planning. We believe that this is a ballpark steady-state for CO2 pricing but that traded prices could be quite volatile around that level, depending on the mechanisms used. But even if we have a consistent carbon price, we will see significant changes in industry costs and competitive cost curves based on the various costs of carbon abatement. We have written in the past that we could see huge benefits to the US manufacturing base because of the combination of relatively low-cost hydrocarbons and relatively low-cost CCS opportunities. By contrast, we see costs rising steeply in places like central West Europe, where the local CCS opportunity is off the table. Even if Europe can produce cost-effective blue hydrogen on the coast, getting it to central Europe will be an issue. The landscape is less clear in Asia, but we expect to see some competitive edge for countries with low-cost CCS options – Malaysia, Indonesia, Thailand, and parts of China. See more in today's daily.

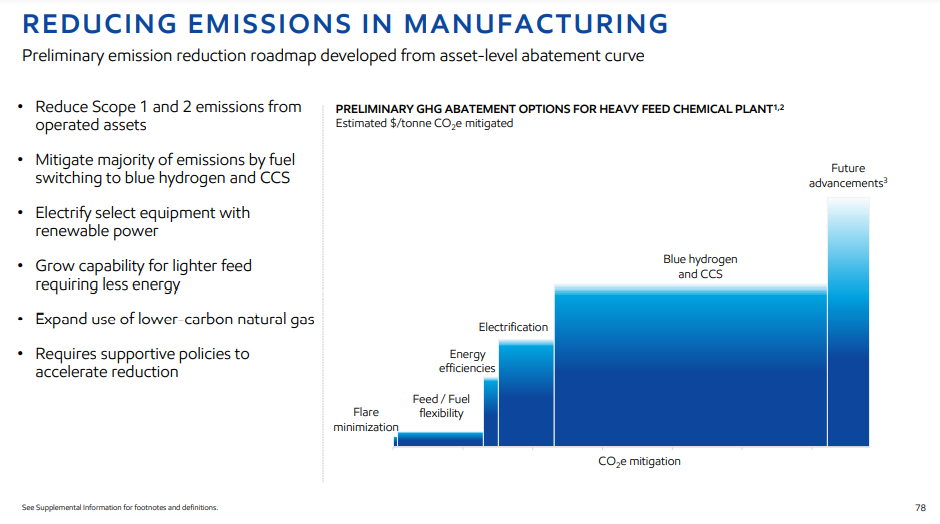

ExxonMobil: Illustrating That Energy Transition Can Be Done (With The Right Policies)

Mar 2, 2022 1:14:58 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, Blue Hydrogen, CO2, ExxonMobil, Net-Zero, carbon credit, carbon cost, energy transition

Playing right into the central argument of our ESG and Climate report is today’s ExxonMobil investor day, and we include a couple of key slides around the company's proposed path to net-zero below. The first slide shows just how much blue hydrogen (with CCS) the company plans to add to offset its emission-generating fuels – the volumes implied in the chart are high.

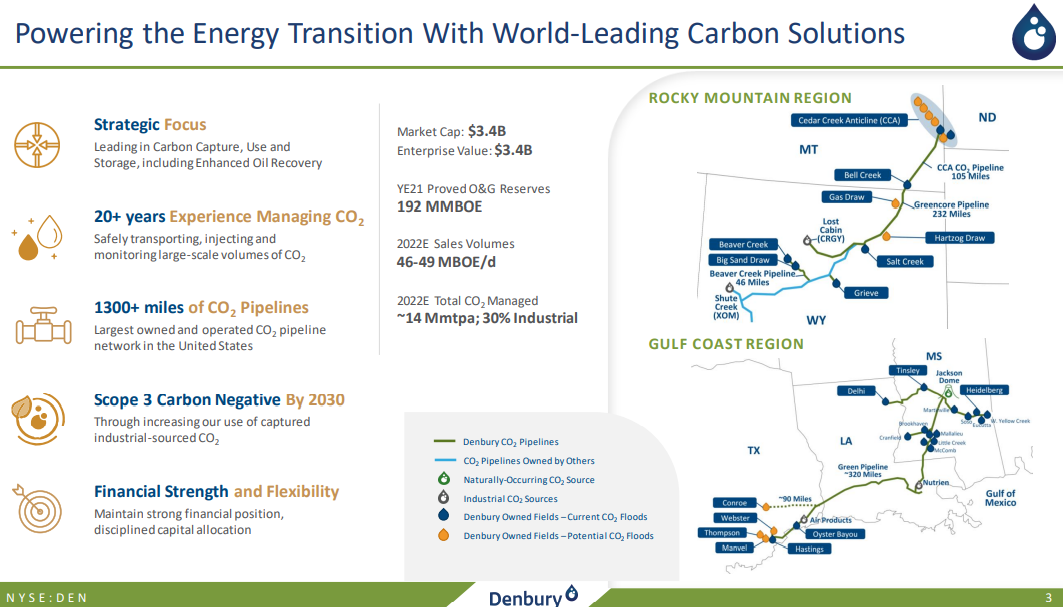

Lots Of Carbon Opportunities At The Right Price

Feb 24, 2022 1:42:02 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, Sustainability, CCS, CO2, Energy, energy transition, crude oil, Denbury, EOR, carbon capture and storage

The Denbury release is a great example of something that we discussed in our ESG and Climate piece yesterday. The company is putting stakes in the ground concerning carbon capture and storage but is only really spending on its EOR opportunities, which of course look really interesting today. While the 45Q credit for EOR helps, the main driver is the incremental crude oil volumes that you can pull out of the ground because of the CO2 injection – the higher the price of crude oil the greater the value of EOR. Regardless of the tax credit, the economics of EOR should look very good today and it is not surprising to see several initiatives from Denbury given that it has a lot of existing infrastructure for CO2. The CCS plans are no different than some of the projects we discussed yesterday – they are stakes in the ground – marking territory – but unlikely to move forward without higher incentives. One of the core topics of our report yesterday is whether the conflict in central Europe will turn attention away from energy transition and energy security for tomorrow, because of the acute distraction of both energy and national security today.

Plenty Of ESG Opportunities In Agriculture

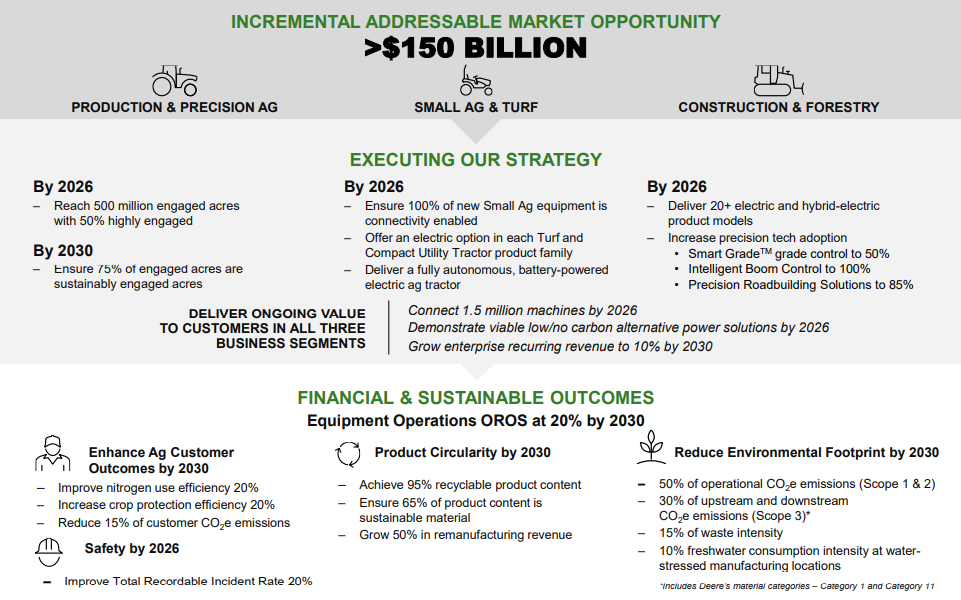

Feb 18, 2022 2:22:18 PM / by Graham Copley posted in ESG, Carbon Capture, Climate Change, CO2, Climate Goals, CO2 emissions, Agriculture, Deere, machinery, CO2 capture, equipment

When we highlighted the Ag equipment names as interesting in our daily report earlier in the week, we had not realized that a Deere earnings announcement was imminent. The high farm profitability in the US is giving farmers some freedom with spending at a time when the equipment makers are hitting the market with some exciting new products – especially autonomous machinery – which can save on labor costs. The ESG angle here is further advances in precision agriculture, which can allow for more output for fewer inputs. There is also a very strong push towards low-till and no-till farming (to lower net CO2 emissions or increase CO2 capture) and this is an opportunity for the equipment makers to sell new equipment.

CCS In The US: The Potential Is Significant

Feb 17, 2022 12:55:54 PM / by Graham Copley posted in ESG, Hydrogen, Carbon Capture, Climate Change, Sustainability, CCS, CO2, decarbonization, carbon value, urea, CF Industries, Climate Goals, oxygen

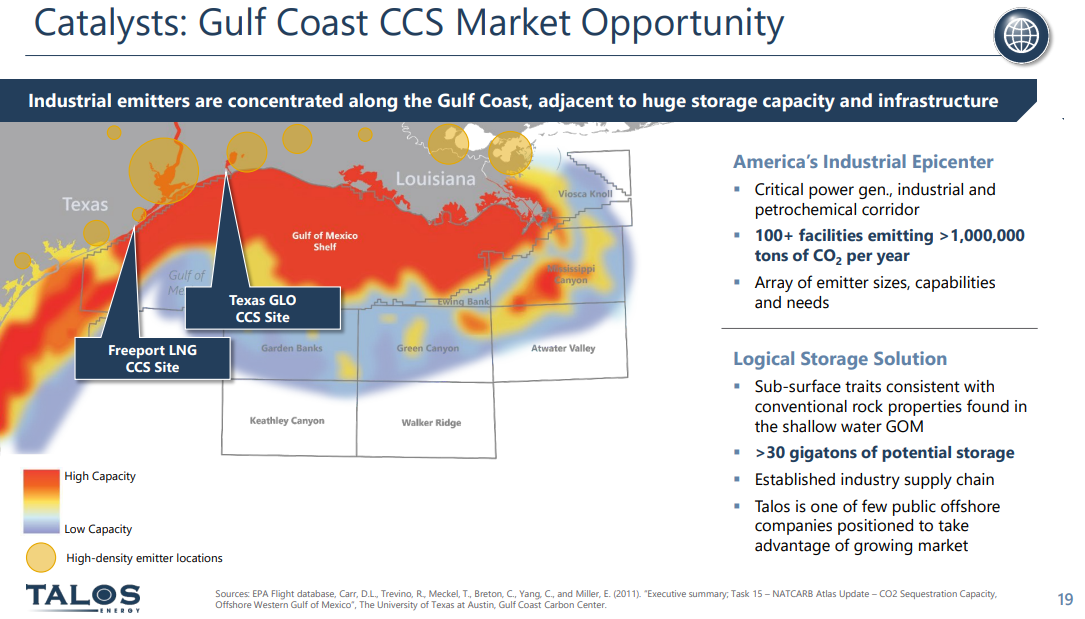

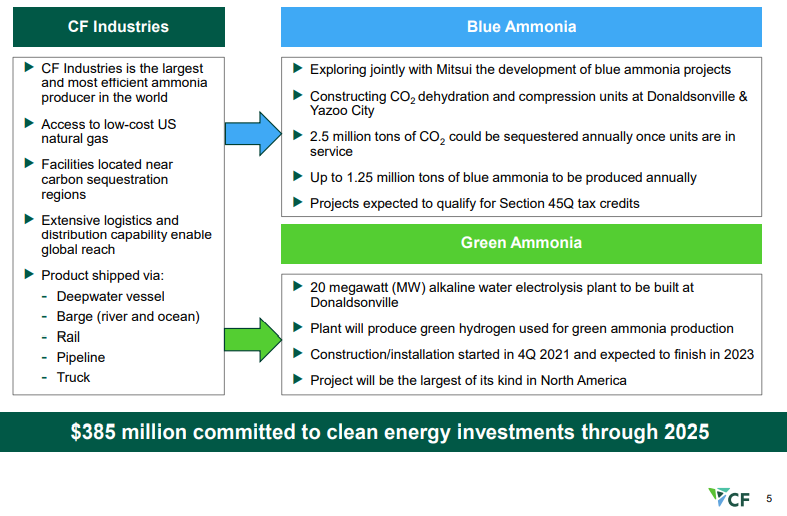

There should be little doubt that the US has a significant opportunity to decarbonize through CCS and if the US has a carbon value close to the level in Europe today we would be seeing investments announced almost weekly. While permitting would cause some significant lead time between announcement and construction/operation, the other uncertainty might be how best to capture the CO2. In its earnings release yesterday, CF talked about purifying CO2 streams at its two large Urea plants on the Gulf Coast, such that the CO2 would be ready to sequester, but the Urea process creates a relatively concentrated stream of CO2 and that makes separation much easier. For others, the better route might be hydrogen investments – driven by the relative ease of capturing the CO2, especially if it is part of the process design. If this route is more economic, the net new investment would be substantial, not just for the SMR, ATR, or fuel cell hydrogen generators, but also for the infrastructure and oxygen capacity for any ATR investment. This seems like a no-brainer bi-partisan opportunity for the US as there is broad support for CCS but incentives need to be higher. For more on this topic see our ESG and Climate research.

Low Cost CCS Could Be A Game Changer For The US

Feb 16, 2022 1:41:38 PM / by Graham Copley posted in ESG, Hydrogen, Chemicals, Carbon Capture, Climate Change, Sustainability, Green Hydrogen, CCS, CO2, Sequestration, Ammonia, blue ammonia, CF Industries, crude oil, low carbon, green ammonia, carbon intensity, carbon market

We continue to believe that the US has a cost advantage in CCS versus many of the other regions of the world and that when coupled with low natural gas prices the US should be able to take a lead in developing low carbon chemicals. CF is pushing the idea of both blue ammonia in the US as well as green ammonia, and while the company has yet to announce sequestration plans for the CO2 it is working to purify – see Exhibit - once dehydrated and compressed the incremental cost of storage should be low.

Effective Global Energy Transition Will Need A Lot More LNG

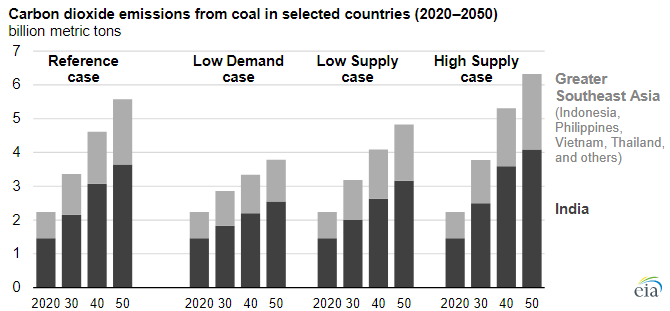

Feb 8, 2022 2:59:48 PM / by Graham Copley posted in ESG, Sustainability, LNG, Coal, CO2, renewables, energy transition, climate, EIA

The coal data in the Exhibit below is likely not popular with the environmental lobby. However, the EIA analysis takes into account the alternatives for the countries involved and the fortunes of coal in these countries will be directly impacted by the help that other countries offer. If the region can be assured of abundant sources of alternative energy, whether renewables or more likely LNG, then the use of coal will fall. This is another example of where some of the global energy policies are coming up short in our view. The better solution is to champion (clean) LNG growth, wherever possible, to bridge the huge gap between the energy the world needs and the rate at which it can be supplied from renewables. See more in today's daily report.

Carbon Capture Plans Advance. US Incentives Remain Inadequate

Feb 2, 2022 12:38:58 PM / by Graham Copley posted in ESG, Carbon Capture, Sustainability, CCS, Blue Hydrogen, CO2, Renewable Power, Emissions, ExxonMobil, Pipeline, natural gas, carbon offsets, direct air capture, carbon offset, climate, DAC, chemical producers, Green Plains Institute

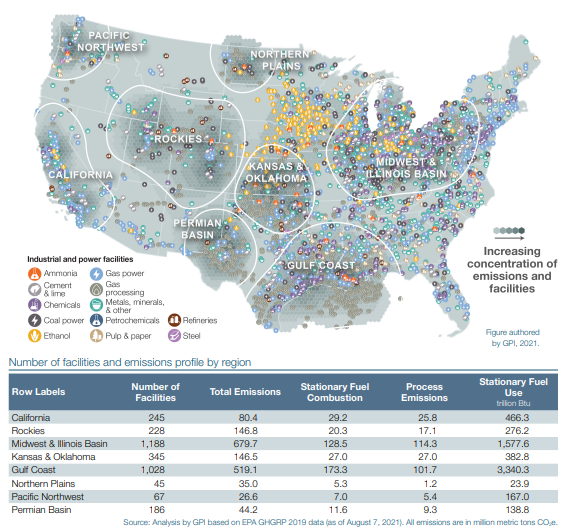

The Green Plains Institute analysis below draws heavily on the EPA emissions data by facility, but correctly, in our view, identifies where CCS makes the most sense in the US. We still struggle with the pipeline distances associated with some of these ideas as CO2 disposal is still a cost for emitters and in any attempt to reduce costs, pipeline distances will be key. We have discussed the opportunity recently for massive blue hydrogen investment (including CCS) to replace industrial heating fuel and this would apply in all of the regions below. Note our conclusions in today’s ESG and Climate report that we expect renewable power installation goals to fall short – requiring more use of natural gas (for power generation or hydrogen production) with accompanying CCS.

The Focus On Renewables Is Intensifying Everywhere

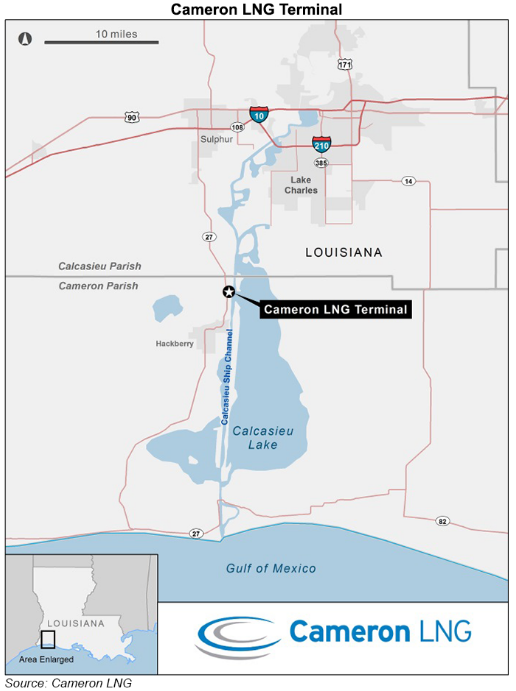

Feb 1, 2022 12:09:01 PM / by Graham Copley posted in ESG, Sustainability, LNG, CO2, Renewable Power, decarbonization, Gevo, carbon footprint, natural gas, power, renewables, climate, Freeport LNG, decarbonize LNG, Cheniere, RNG, RNG projects, natural gas market, Cameron LNG

There are a handful of “renewable” headlines in today's daily report, and it is probably worthwhile discussing the differences. First; the linked Gevo RNG announcement is likely one of several RNG projects that we will see come online in 2022, as there are a number of farm-based RNG projects underway in the US and other parts of the world. The Gevo facility is based on farm manure and is expected to produce 355,000 MMBtu of RNG per year. As such it is not large, and all of the farm-based projects are small in the larger context of the natural gas markets. However, when focused on decarbonizing a specific product or process this RNG can be very important. Our take on the market is that there will likely be more demand for RNG than supply, as several companies are looking for RNG to make proposed investments make sense from a “green” perspective (Monolith would be a good example). This suggests that it will be better to be a seller than a buyer longer-term.